INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Nvidia Corp. has been flying high for years thanks to big demand for its graphics chips in gaming, high-performance computing and artificial intelligence, but that means even a small dip in altitude can upset investors.

That’s what happened today, when the Santa Clara, California-based company reported its fiscal second-quarter results and said revenue from cryptomining systems dropped to almost zero.

Nvidia reported a net profit of $1.1 billion, or $1.76 a share, on $3.12 billion in revenue, up 40 percent from a year ago but down 3 percent from the first quarter. Adjusting for items such as stock compensation, the profit was $1.2 billion or $1.94 a share, up 92 percent from a year ago but down 5 percent from the first quarter.

Both revenue and profit easily beat Wall Street estimates. Analysts had expected $1.67 a share, or $1.85 on an adjusted basis, on $3.1 billion in revenue, according to FactSet.

Where shares apparently got tripped up, though, was on Nvidia’s guidance for $3.25 billion in revenue, plus or minus 2 percent, in the current quarter. That fell short of analysts’ forecast of $3.34 billion.

As a result, shares were falling about 4 percent in after-hours trading after closing down 0.6 percent, to $257.44 a share, in regular trading. Nvidia’s shares are up more than 50 percent in the last year, so any hint of a slowdown in momentum can have a big impact on investor sentiment. That happened in the first quarter as well, though that was mostly profit-taking as results and forecast both beat estimates.

Two factors seems likely for the muted outlook. For one, Nvidia just this week debuted a new chip architecture that could cause some customers to pause their buying of existing systems until new graphics processing unit chips ship in the fourth quarter. But more immediately, revenue from cryptocurrency mining systems, which had been $289 million in the first quarter, dropped even more than expected, and likely will have “negligible” revenue impact from now on.

Still, the second quarter continued Nvidia’s steady strong growth in earnings across most of its markets, including AI, gaming, self-driving cars and visualization.

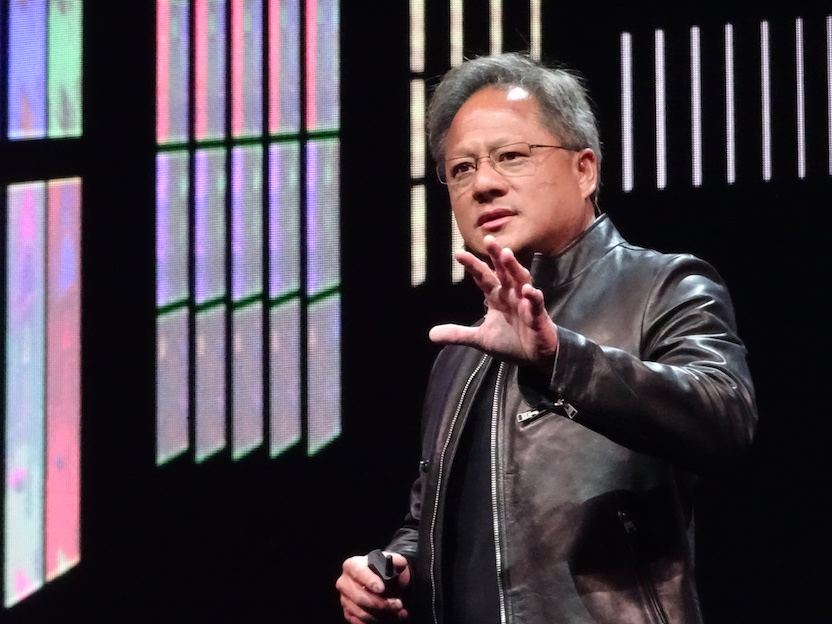

“Fueling our growth is the widening gap between demand for computing across every industry and the limits reached by traditional computing,” Nvidia Chief Executive Jensen Huang (pictured) said in prepared remarks. “Developers are jumping on the GPU-accelerated computing model that we pioneered for the boost they need.”

At least one analyst agreed. Trip Chowdhry of Global Equities Research said in a note to clients that the “secular growth trends” in data centers remains, and it’s “not stopping anytime soon.”

The growth star again was data center revenue, which jumped 83 percent, to $760 million, beating forecasts. That’s thanks to everyone from AI researchers to cloud giants such as Google LLC and Amazon Web Services Inc. using Nvidia graphics chips for deep learning, a branch of AI that enables computers to learn on their own. That has led to breakthroughs in fields such as image and speech recognition and self-driving cars.

Revenue from gaming, still by far Nvidia’s largest business, grew 52 percent from a year ago, to $1.8 billion, a bit over analysts’ forecasts. Professional visualization revenues rose 20 percent, to $281 million.

Automotive remained marginal, with revenue up only 13 percent, to $161 million. Recently Tesla Inc. said it would no longer use Nvidia chips in its self-driving cars though Daimler AG and Bosch Ltd. announced that they would use Nvidia Drive for their robotaxi fleets.

Revenue from systems used for cryptocurrency mining dropped precipitously, to just $18 million. Chief Financial Officer Colette Kress said last quarter that cryptomining revenue in the second quarter would be only $100 million, so the more precipitous decline means it will be nearly nil in the future.

The impact of cryptocurrency mining, which uses computers with GPUs in them, has been a source of continuing concern to investors, who doubt how long the crypto boom will last, so Nvidia has downplayed the impact on its results.

The results and outlook suggest that Nvidia’s long run of positive results won’t end anytime soon. Still, it’s likely to face more competition later this year and next.

More companies, for instance, are looking to use specialized silicon for deep learning. Intel Corp. has been pitching both its own mainstream central processing units for at least some machine learning workloads, and it has picked up a number of chip companies in recent years to do more specialized AI work such as computer vision. Google has its own Tensor Processing Unit for AI that it doesn’t sell but uses in its cloud data centers.

Nvidia itself has been angling to offer broader solutions itself. In late May, it introduced a new cloud server platform, the HGX-2, with which it aims to combine both AI and high-performance computing, as more applications are doing. And in June, it announced Jetson Xavier, a new AI chip developed with robots and drones in mind.

The company continues to press its advantage in high-performance computing particularly for artificial intelligence and its original computer graphics focus too. Late Monday, it introduced its newest chip architecture, dubbed Turing, that it said will allow for much more realistic graphics rendering in real time.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.