INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

In a sign of rising investor worries about how long the technology bull market can run, shares of Advanced Micro Devices Inc. plunged more than 20 percent in extended trading after the chipmaker reported disappointing quarterly results and an even more disappointing outlook.

AMD’s shares had already fallen 9 percent, to $22.79 a share, in the regular trading session on worries about the Sunnyvale, California-based company’s third-quarter results. Update: Shares fell a slightly more modest 15 percent Thursday.

Indeed, concern about AMD and other chipmakers’ prospects helped take the entire Nasdaq index down 4.4 percent in its worst day in more than seven years. The downdraft took the tech-heavy Nasdaq into correction territory, a decline of more than 10 percent from a recent high.

The fall spread to the overall stock market as well, as the Dow Jones Industrial Average declined 2.4 percent, or 608 points. As a result, all of the gains in the Dow and also the S&P 500 so far this year have vanished.

AMD reported a third-quarter profit of $102 million, or 9 cents a share, up from $61 million or 6 cents a year ago. Earnings adjusted for items such as stock compensation came in at 13 cents a share. Revenue rose a bit to $1.65 billion from $1.58 billion a year ago. Analysts had expected a 12-cent profit on $1.7 billion in revenues.

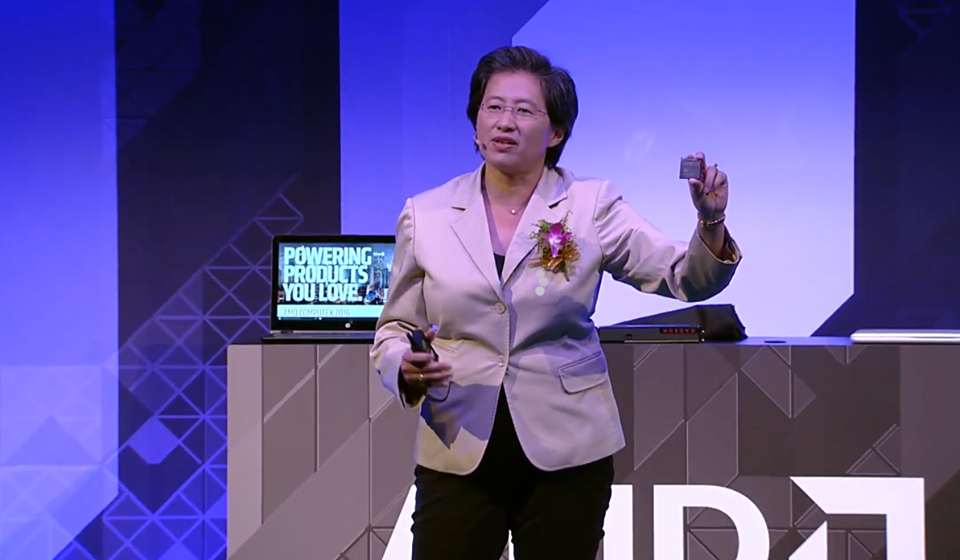

“Client and server processor sales increased significantly although graphics channel sales were lower in the quarter,” AMD Chief Executive Lisa Su (pictured) said in a statement. Specifically, computing and graphics chip sales were $938 million for the quarter, while analysts had forecast $1.05 billion.

The shortfall was the result of weaker-than-expected graphics processing unit chip sales. In particular, chips intended for blockchain applications saw slower channel sales than expected, resulting in a buildup of inventory, Su said on an earnings conference call. She added that she expects graphics chip revenue to rise in the fourth quarter, though flat in the channel.

Despite the stock drop, some analysts said their main concern wasn’t the GPU channel inventory Su referenced.

“I wasn’t expecting much from the graphics division in the quarter anyway,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy. “I am not expecting any major change in GPU market dynamics until the seven-nanometer Navi launches, which I believe will improve its position, particularly in the enterprise market.”

AMD’s outlook didn’t inspire confidence either. It called for fourth-quarter revenue of $1.4 billion to $1.5 billion, up 8 percent at the midpoint and a tad below Wall Street’s forecast of $1.6 billion. It also forecast adjusted gross margin to rise to about 41 percent on sales growth of Ryzen, EPYC and data center GPU processors.

Moorhead said he was surprised not to see a bigger upside in processor volumes given that rival Intel Corp. recently has scaled back its expectations, but he believes AMD is being conservative in its outlook. “In my discussions with PC and servers manufacturers, I am seeing increased interest in AMD’s roadmap,” he said.

For her part, Su noted on the call that AMD’s second half of the year is usually stronger than the first half. Moreover, she said, “We believe our competitive position gets stronger as we go into 2019.”

The company’s adjusted gross profit margin rose to 40 percent in the fourth quarter, up 4 percentage points from a year ago, mostly thanks to new products such as its Ryzen and EPYC processors. After adding back in intellectual property-related revenue and adjustments for memory and inventory, the company said, gross margin would have been 2 percentage points lower.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.