BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Securitize Inc., a compliance platform for digital securities using blockchain technology, today announced it has raised $12.75 million in new funding.

Using digital ledger blockchain technology, it’s possible to ensure secure representation of securities, such as stocks and bonds, and tokens, including digital currencies such as bitcoin. As a result, companies looking to use blockchain to provide securities or tokens need some way to stay in compliance with local laws and regulations.

Securitize provides a platform designed to code compliance for exchanging digital securities and enables investors and issuers to worry less when it comes to audits. The platform also provides a protocol for issuing, managing, tracking and storing the securities in a manner that can be trusted by customers and third parties – including regulatory agencies.

The Series A funding round was led by Blockchain Capital LLC. Also joining the round were Coinbase Ventures, Global Brain, NXTP, OK Blockchain Capital and the Xpring fund at Ripple Labs.

This funding comes in advance of upcoming plans to launch what the company calls a “Digital Security Offering” in 2019. With the DSO process, companies will be able to issue and distribute their own securities as tokens on the blockchain to raise funds.

Securitize itself is not involved in the trading and does not run an exchange. Iinstead, it supplies the platform and underlying protocols needed to assist with regulatory management and administration for security tokenization. With the platform, a company can rapidly “digitize itself” and start issuing its own securities.

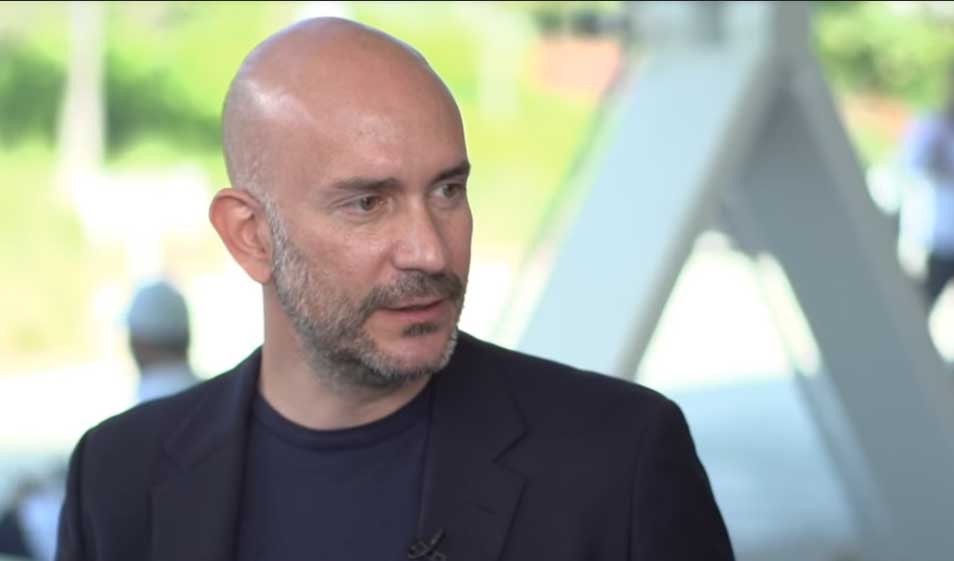

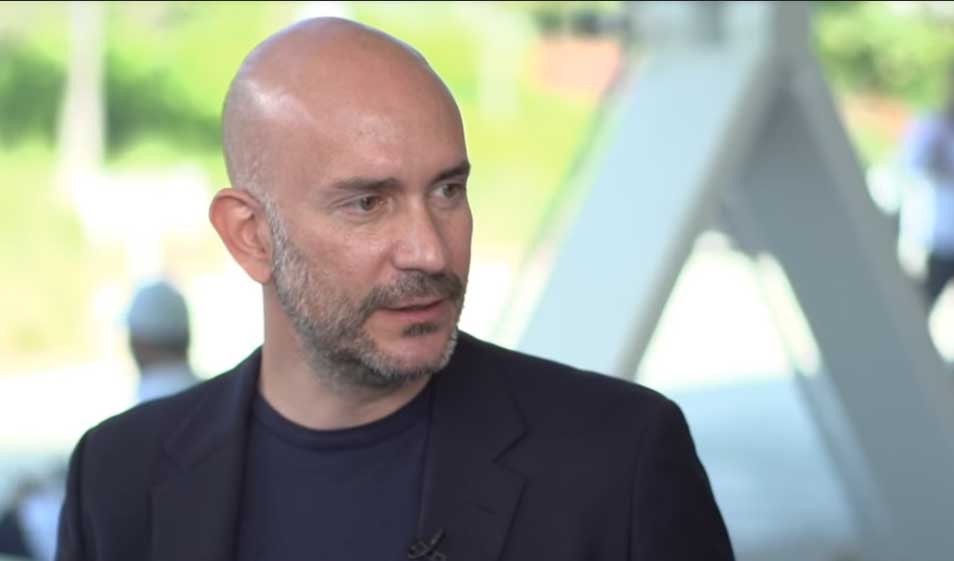

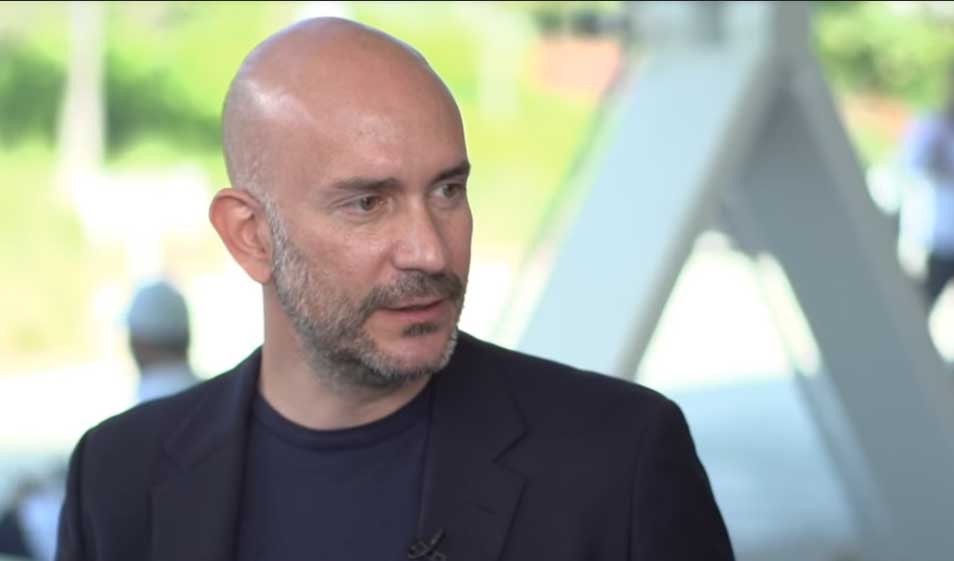

“The burden is on us in the industry to develop products and services that ensure regulatory compliance both here in the USA and in countries where investors are investing in, and trading digital securities,” said Carlos Domingo (pictured), Securitize’s co-founder and chief executive, referring to a recent Securities Exchange Commission statement on the nature of digital asset securities regulation.

According to the Securitize whitepaper, the platform is designed to “consider the full lifecycle of digital securities ownership, beyond issuance, as well as the goals of the different stakeholders: issuers, investors and exchanges.”

To make the platform accessible, Securitize also intends to provide a reference implementation of its protocol on its own “DS Issuance” platform. The system uses programmable smart contracts to allow distributed app, or DApp, development that will support tokens on the Ethereum blockchain.

The Ethereum blockchain is the second most popular blockchain in the world, right behind bitcoin, and is focused more on business and application development. As a result, Ethereum is sought after by a lot of app developers looking to provide tokenized services.

According to Securitize, the securities and token industry exceeds $7 trillion in market share, and, as a worldwide industry, there’s a lot of room to grow. Using this funding round, the company intends to expand its reach as far as it can go and offer its platform to any company intent on issuing its own securities.

“We believe the tokenization of legacy securities industry is taking place right now on a global scale,” Domingo told CoinDesk. “To take advantage of this emerging market opportunity, we plan to grow our engineering team and geographic coverage from Latin America to the Asia Pacific Region and other parts of the world for business development.”

“In our view, Securitize’s end-to-end digital securities issuance and compliance platform will play a key role in the development of the security token market,” said Yasuhiko Yurimoto, chief executive of Global Brain. “We [shall] work with Securitize to set up a presence in Japan and leverage its network to assist the company in penetrating the Japan/Asia market.”

The company introduced the system it calls the Digital Securities protocol in June and also offers examples for developers and businesses to build apps or digitize themselves rapidly.

Domingo spoke with John Furrier, host of theCUBE, SiliconANGLE Media’s mobile livestreaming studio, during the Polycon18 event in The Bahamas in March. They discussed how Securitize is streamlining the process of raising a security-backed token:

THANK YOU