AI

AI

AI

AI

AI

AI

UiPath Inc. is going public this coming week to become the next hot software company to stage an initial public offering. But it has had a long, strange trip to its IPO.

How so? Well, the robotic process automation company, whose software mimics human interactions using software scripts or robots that execute human tasks in discrete steps, was started way back in 2005. But its culture is akin to a frenetic startup. The firm shunned conventions and, instead of focusing on a narrow geographic area to prove its product/market fit before it started to grow, it aggressively launched international operations well prior to reaching unicorn status.

Today, more than 60% of UiPath’s business is outside of the United States, despite its New York headquarters. And there’s more. According to recent Securities and Exchange Commission filings, UiPath’s total revenues grew 81% last year — but its free cash flow is modestly positive. That’s rare.

Wait, there’s even more. The company raised $750 million in a Series F funding round in early February at a whopping $35 billion valuation. Yet the implied valuation based on the most recent SEC filings yields a valuation of just under $26 billion. It’s a good bet that artificial ceiling will be shattered.

In this week’s Breaking Analysis, we’ll share our learnings from sifting through hundreds of pages of UiPath’s S-1 and convey our thoughts on its market, competitive position and outlook. And, as is our model, we’ll back up these observations with data from Enterprise Technology Research.

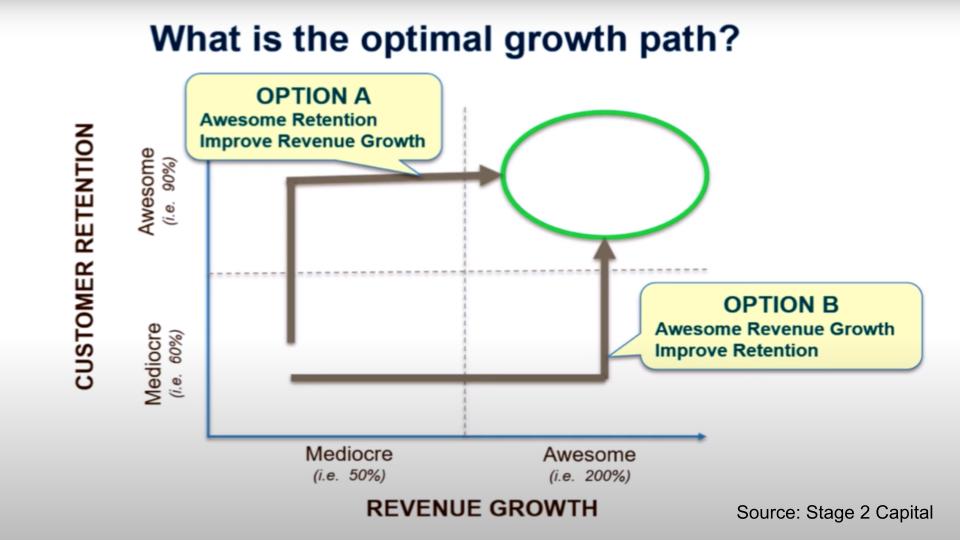

Mark Roberge is a managing director at Stage 2 Capital, a small but very hands-on venture capital firm. He also teaches at the Harvard Business School and one of his favorite questions is: What’s the best way to grow a company?

He uses the above chart to answer that question. On the vertical axis is customer retention and on the horizontal axis is growth. You of course want to be in the green circle – awesome retention of more than 90% and awesome growth. But what’s the best way to get there? Should you “blitzscale” and go for the double-double-triple-triple blowout with your go to market team, or should you be more careful and focus on nailing retention and then and only then go for growth?

What do you think most VCs would say? What would you say?

What would UiPath Chief Executive Daniel Dines say?

As we shared at the top, UiPath shunned conventions and expanded internationally, very rapidly, well before it hit a $1 billion valuation. And then it grew like crazy, got out of control and had to rein in and plug some holes – but the growth didn’t stop. Go go go. And very clearly based on its performance and reading through the S-1, the company has great retention – it uses a metric called gross retention rate, which is more than 96% – very high.

So maybe that’s the right formula – go for growth, grow fast, “Let chaos reign, then rein chaos” as Intel Corp.’s Andy Grove would say. Go fast horizontally and then go vertical in the above chart, right?

You need to try to do the impossible, to anticipate the unexpected. And when the unexpected happens, you should double the efforts to make order from the disorder it creates in your life. The motto I’m advocating is — Let chaos reign, then rein chaos. – Andy Grove

Here’s what Professor Roberge would probably say, something like: You can do that. But churn is the silent killer of software-as-a-service companies. And the better path is perhaps to nail product/market fit and the retention metrics before you go for hyperbolic growth. Figure out the customer success model and key performance indicators that give you clarity for retention, then scale.

There’s a science behind this which may be antithetical to the way many investors want to roll the dice and go for a “grow fast or die” strategy. Well, you say, it worked for UiPath, right?

Not necessarily — and this is where the path to IPO gets long and strange for UiPath. As we shared earlier, UiPath was founded in 2005 – out of Bucharest, Romania. The company actually started as a software outsourcing startup called Deskover. It built automation libraries and software development kits for companies such as Microsoft Corp., IBM Corp. and Google LLC. It also built automation scripts and developed computer vision technology, which became part of its secret sauce.

In 2015, Deskover changed its name to UiPath, became a Delaware corporation and moved its headquarters to New York City a couple years later. So our premise here is that UiPath actually took the preferred path espoused by Mark Roberge. Five ticks north, then five more east. It slow-cooked for the better part of 10 years, trying to figure out a market to serve. It spent a decade figuring out product/market fit and then threw gas on the fire. Boom!

Pretty crazy.

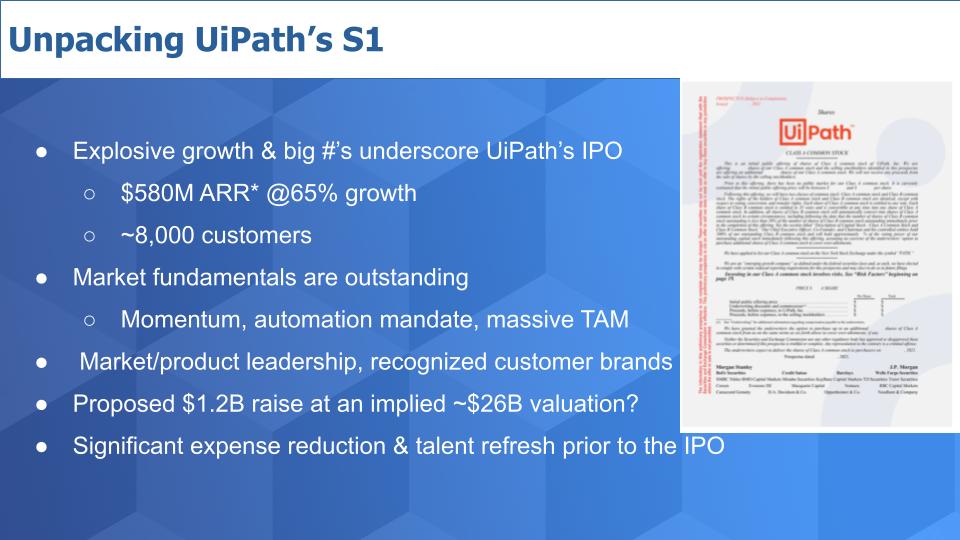

The numbers are impressive, as shown below. It shows $580 million in “ARR” with 65% growth. The asterisk is there because – like you – we thought ARR stood for Annual Recurring Revenue. It really stands for Annualized Renewal Run Rate.

Annualized Renewal Run-Rate is a metric that is one of UiPath’s internal KPIs and it will likely communicate that publicly. We’ll explain that further in a moment.

UiPath has a solid customer base of nearly 8,000 with good penetration into the Fortune 500; about 63% buy from UiPath. Most of UiPath’s business – about 70%, comes from existing customers. Its mantra of land-and-expand reminds us of the early days of Tableau Software. Like UiPath, Tableau started out as a point tool, it had passionate customers and it solved the problem that analytics were too cumbersome, complicated and slow. Tableau would land, embed into a company and grow the account.

The market fundamentals for UiPath are very good – automation is super-hot right now and the pandemic has created an automation mandate. UiPath is a leader, ranking high in Gartner Inc.’s Magic Quadrant for robotic process automation. UiPath pegs its total addressable market at $60 billion based on some bottom-up calculations and some data from Bain. Pre-pandemic, we had it at more than $30 billion and we felt that was conservative. Post-pandemic, the TAM is definitely higher.

According to the S-1, UiPath will raise about $1.2 billion at, as we said, an implied valuation that is lower than its Series F round. We suspected at one point that perhaps the Series F investors have a ratchet to accommodate any reduction in price, but most of the Series F investors are early investors too – so it’s not likely the late investors got special treatment.

It’s more likely UiPath wanted to beef up its balance sheet with the $750 million from its Series F investors — its balance sheet numbers in the S-1 show $474 million in cash and equivalents at the end of January — and it saw an opportunity. It took in the $750 million in early February when the market was hot. Notable comps Datadog Inc., CrowdStrike Holdings Inc. and even Okta Inc. were elevated at the time, and they’ve pulled back. So this is likely a case of UiPath just being conservative. It wouldn’t be a shock if that implied price is simply a placeholder for a much higher number.

UiPath has had significant expense reductions and we’ll show you some detail on that. It has brought in fresh talent to provide some adult supervision. About 70% of its executive leadership team and outside directors came to the company after 2019. In the company’s S-1, it disclosed that its independent accounting firm identified what it called “a material weakness in our internal controls over financial reporting related to revenue recognition for the FY ending 2018… caused by a lack of oversight and technical competence within the finance department.”

The company outlined steps it took to remediate the problem, including hiring new talent. However, as we said last year, we felt that UiPath wasn’t quite ready to go public. It was not, as we said at the time, the well-oiled machine that was Snowflake Inc. under Chief Financial Officer Mike Scarpelli’s firm operating guidance.

But it’s pretty clear UiPath wants to take advantage of this hot stock market. It needs the cash to bolster its balance sheet even more to prepare for the massive opportunity it faces. The public offering will give it a cache and stronger competitive posture relative to Automation Anywhere Inc. and the big whales such as Microsoft.

One other important note from the S-1: Dines owns 100% of the Class B shares of the company and has 35-1 voting power relative to Class A shares. So the chairman and CEO controls the company, subject of course to his fiduciary responsibilities. He has more latitude to do things that Wall Street might not like without having to worry as much about activist shareholders taking over his company.

There are lots of detail in the S-1 and we want to give you some of the highlights. Below are the impressive graphics. As we said ARR or annualized renewal run rate just annualizes the invoice amount from the subscription and maintenance portion of revenue – that is, the parts that are recurring. It excludes revenue from support, perpetual licenses (onetime licenses) and services. So it’s pretty similar to the ARR that you’re familiar with.

UiPath has the advantage of a sizable and growing customer base with a growing number of six and seven figure accounts. It has a dollar based net retention of 145%. This figure represents the rate of net expansion of UiPath’s ARR, from existing customers over a 12-month period. So this says UiPath’s existing customers are spending more with the company: Land and expand.

And you can see the 86% compound annual growth rate over the past nine quarters on the right.

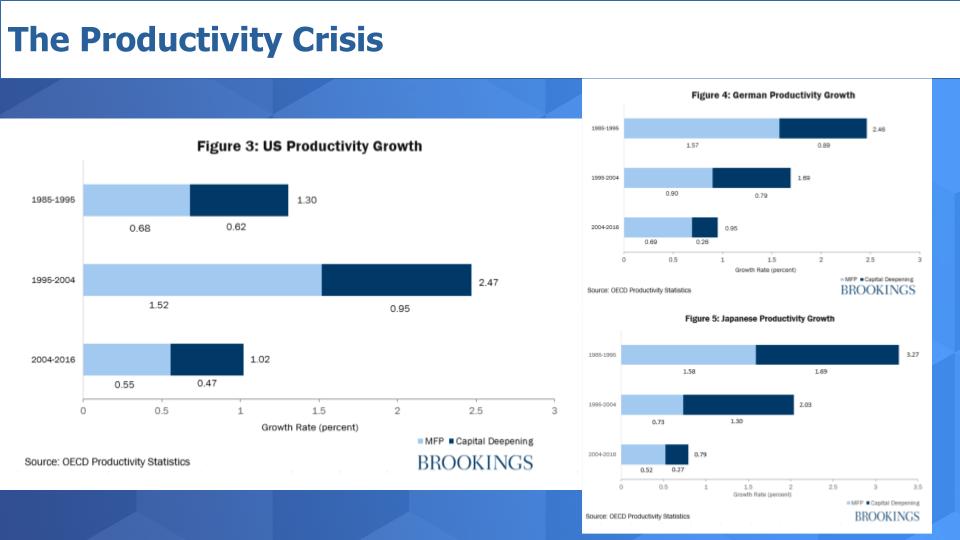

Below we show some data from the Brookings Institution and the Organization for Economic Co-Development that depicts productivity statistics for the U.S. The smaller charts on the right are for Germany and Japan.

The U.S. showed productivity improvements with the personal productivity boom in the mid- to late 1990s and early 2000s but since then has dropped quite significantly. Germany and Japan are also under pressure, as are most developed countries. China’s labor productivity will show declines, but it’s at levels significantly higher than these countries.

The point is that we’re reaching the limits of what humans can do alone to solve some of the world’s most pressing challenges. And automation is one key to shifting labor away from the more mundane tasks toward more productive and important activities that can deliver lasting benefits. This, according to UiPath, is its stated purpose – to accelerate human achievement. And the market is ready to be automated, for the most part. The post-isolation economy will increasingly focus on automation to drive productivity.

Here’s a snapshot of the RPA magic quadrant from Gartner. Nearly everyone’s a winner in these reports, and even just getting on the chart is a win for some companies.

We’ve reported extensively on the two-horse race between UiPath and Automation Anywhere. We would shuffle this deck a bit, however. We would more clearly separate those two from the others. And from our vantage point, UiPath’s IPO is going to either force Automation Anywhere to respond or UiPath will extend its lead – that would be our prediction.

We would have Pegasystems Inc. higher on the vertical, since we think they’re executing well, although they are not an RPA specialist and that probably hurts them in the positioning. And we probably would drop Blue Prism Ltd. down a bit. One major difference is that we would definitely have Microsoft looming large as a challenger more than as a visionary. But Gartner does good work and its analysts are very deep into this stuff, so we don’t want to discount that.

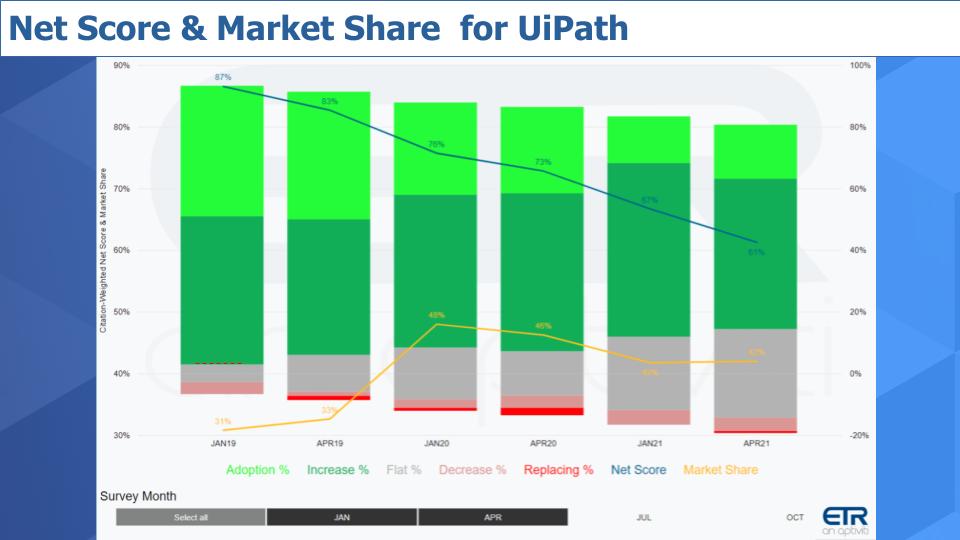

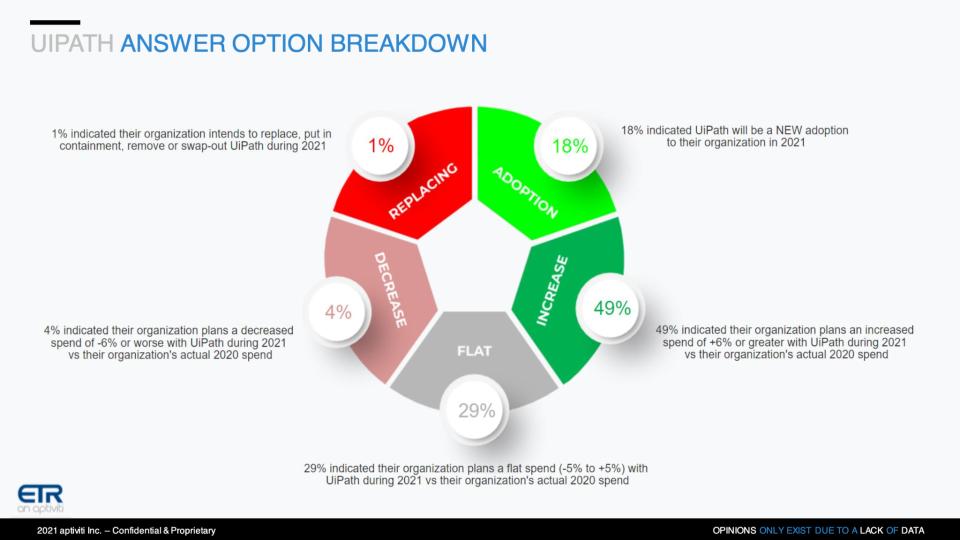

Below is a candlestick chart from ETR that shows the components of Net Score or spending momentum – that’s the the blue line. Market Share, or pervasiveness in the survey, is the yellow line. The greens represents the percent of customers spending more and the reds are spending less or replacing. The gray is flat spending.

And even though UiPath’s Net Score is declining, at 61%, it’s a very elevated score. Anything over 40% in our view is impressive, so holding in the 60s and 70s over the several quarters is very good for UiPath. While the yellow line, Market Share, dips a bit, it’s only because Microsoft is so pervasive in the data that it tends to overwhelm somewhat and skew the curves.

Below is another way to look at this data. It’s a wheel chart that shows the components of Net Score. What’s happening here is the bright red is defections — very small. That’s churn. It’s tiny. And the forest green is existing customers spending more at 49%. That’s big. The lime green is new customers — and again from the S-1, 70% of UiPath’s revenue comes from existing customers.

This data backs up and extends our earlier discussion. The optimal path for growth is to get product market fit right, nail the retention metrics, codify the sales process and conditions for great customer outcomes, add cohort sales, scale and build a moat. This is the path UiPath has taken and though at times the company appears to have been redlining, it’s pretty impressive performance.

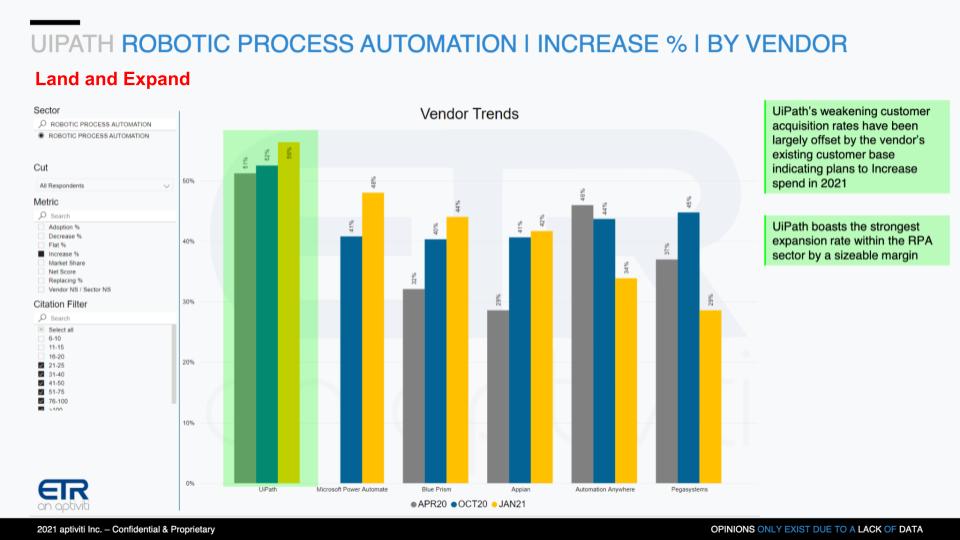

The graphic below is a snapshot from the January ETR survey and it lines up UiPath next to its competitors. It cuts the data only on those customers increasing spending. So what we saw in the first quarter was the pace of new customer acquisition for UiPath was decelerating from previous highs, but UiPath shows here that it’s outpacing the competition in terms of increased spending momentum from existing customers.

More evidence of land-and-expand.

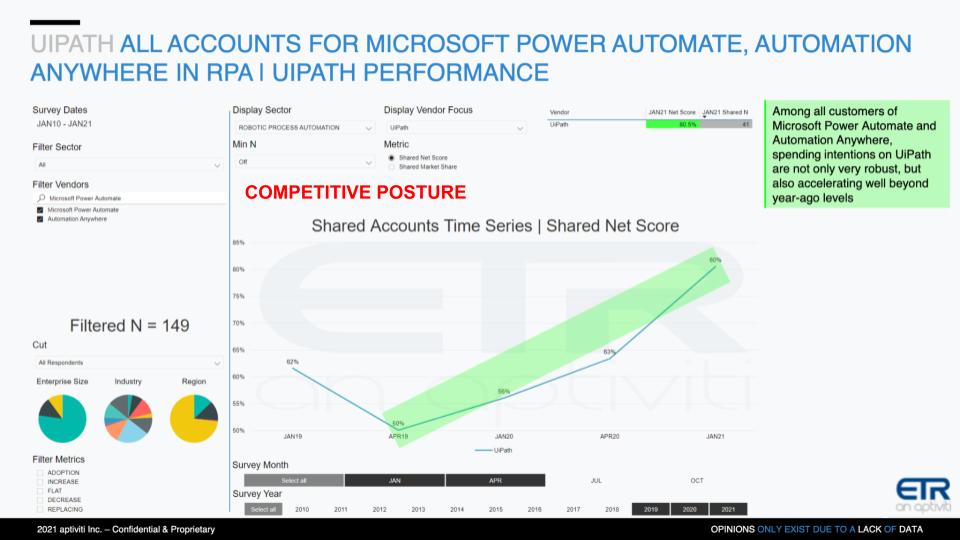

The graph below provides further evidence that UiPath has a strong account presence, even in accounts where its competitors are present.

In the 149 shared accounts from the first-quarter survey where UiPath, Automation Anywhere and Microsoft have a presence, UiPath’s Net Score or spending velocity is not only highly elevated, its relative momentum is accelerating from last year.

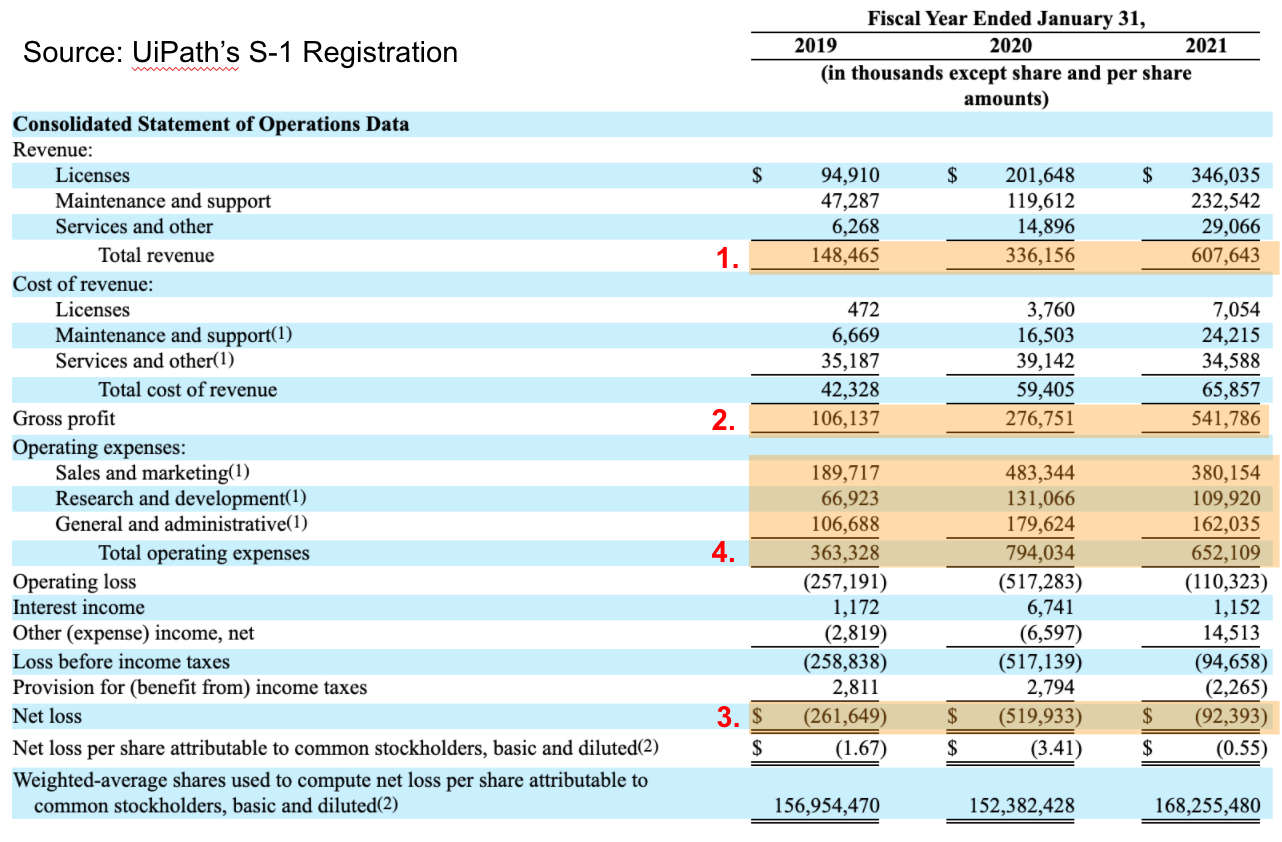

So there’s some good news in the numbers, but some other things stood out in the S-1 that are worth more attention. Below is a picture of UiPath’s income statement. First, look at the growth. The company was doing something like a million dollars in revenue back in 2015 and it surpassed $600 million last year. Amazing. Second, look at the gross profit. Gross margin is almost 90% because revenue grew so rapidly and last year its costs went down in some areas such as service; less travel was part of that.

Third, now jump down to the Net Loss line. Normally you would expect a company growing at this rate to show a loss — the Street wants growth – and UiPath is losing money. But its net loss went from $519 million to only $92 million.

Fourth, that’s because the operating expenses went way down. Typically, a company growing at this rate would show corresponding (directional, not proportional) increases in sales and marketing expenses, research and development and even general and administrative expenses.

But all three declined in the past 12 months. Now, reading the notes, there were definitely some meaningful savings from no travel and cancelled events; UiPath invests in holding great events around the world. But to drop that precipitously with such high growth is surprising.

As a point of reference, look at CrowdStrike’s income statement. It shows hypergrowth but its sales, marketing, R&D and G&A expense lines are all growing in absolute terms as revenue grows — perhaps at a slower rate, but they’re not shrinking in absolute dollar terms.

So either UiPath has applied some magic automation process to its business and it has found the Holy Grail of operating leverage, or the company was running way too hot on the expense side and had to cut to clean up its income statement for the IPO and conserve its cash.

With the recent $750 million funding plus the injection of cash from the IPO, we’ll be watching these line items. We would expect UiPath will continue to invest heavily – especially in R&D and go-to-market efforts.

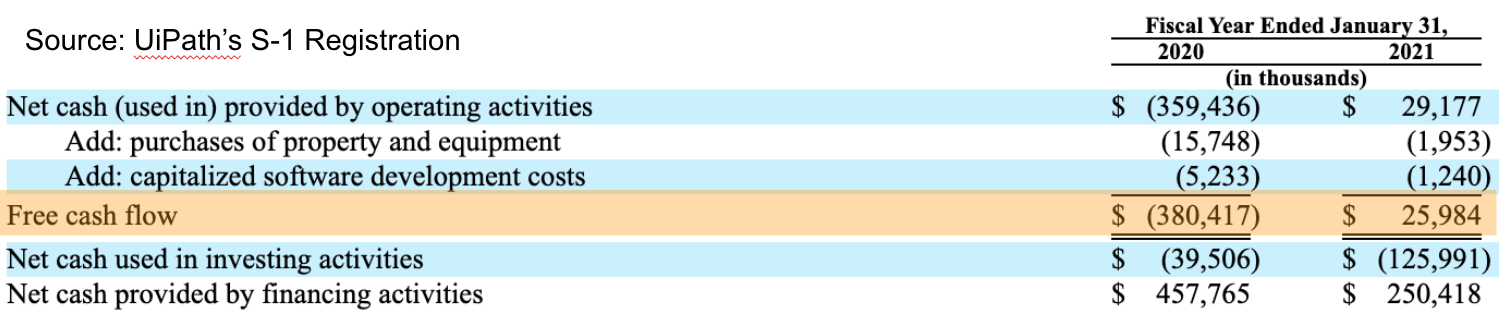

And just to add a bit more to this unconventional journey: When have you seen an explosive growth company in tech or software, just about to go public, show positive cash flow? It’s rare. Again – go look at companies such as Snowflake. It’s not showing positive cash flow. Not yet – they’re growing and trying to run the table and outsprint the competition.

CrowdStrike, on the other hand, was cash flow negative when it went public, but within months it flipped to cash flow positive. So perhaps CrowdStrike is a better compare than Snowflake.

So you have to ask: Why is UiPath operating this way? In part because it was running so hot that it had to reel things in to get ready to IPO. But Dines is an unconventional CEO and maybe this is planned. Perhaps all along, he has had a strategy to put the pedal to the metal and grab a lead, get to the public markets and then steady the ship, for a while, get some muscle memory as a public company and step on the gas again.

Either way, it’s going to be really interesting to see how this stock reacts when it IPOs. Our prediction is the current market momentum will carry UiPath. The tech rotation seems to have been a buying opportunity. Combined with the froth from the recent Coinbase Global Inc. IPO and an appetite for high-growth tech names, we think these mean good things for UiPath.

We must ask: Is this IPO window dressing or did UiPath uncover a new productivity and operating leverage model? The obvious answer is this company doesn’t want to miss the market window. It wants the cash now to compete and we think it’s using the IPO as a forcing function to get its house in order and begin a new chapter as a public company.

Will the automation mandate sustain? We think it will. The forced march to digital, however unpleasant, was an effective wakeup call to get digital “right.” And even a downturn, we think, will confer advantage to automation providers, especially UiPath because of its simpler adoption model, great training, strong community and product roadmap.

Then there’s pricing. UiPath has dramatically expanded its portfolio and had to reprice everything. We’re not so worried about that. It will figure out the right pricing for the portfolio in the near term. Our bigger concern is SaaS pricing in general. We think it’s flawed and very unfairly weighted toward the vendors. We’d rather see cloudlike consumption pricing move to the SaaS market more broadly.

This is the reason we put cloud on the chart. We think cloud pricing is the right way to price: Pay by the drink. Cancel any time. Datadog, Snowflake, Stripe Inc., Twilio Inc. — modern SaaS startups have moved to a consumption/usage pricing model.

We think over time the term lock-in model will give way to true consumption-based pricing. And although UiPath’s cloud revenue today is minimal, over time it must continue to grow that and we think that will force a rethink in pricing and revenue recognition. So watch that.

How will the street react to Dines having control? Generally we feel that solid execution will outweigh those concerns, but we’ll see. Generally we admire a CEO or chairman who has enough confidence to secure control in this way.

We saw what happened to EMC Corp. with activist investors and it eliminated a once-great company. We saw how Michael Dell responded and will never allow that to happen to his company. Reasonable people can debate this issue, but we feel that if you’re willing to deal with the consequences and have a strong enough company, why wouldn’t you maintain control?

The bottom line is that UiPath has really favorable market momentum and fundamentals. While it is signing up for the 90-day shot clock, the fact that the CEO has control means they can look to the long term and invest accordingly. That’s often easier said than done, but Dines has that option.

We like the automation market; it’s a large market and UiPath, as we’ve been reporting, is well-positioned for continued growth. Frankly, we would be surprised if the stock doesn’t rocket on day one of trading. As we always stress, it’s rare that you won’t find a better buying opportunity after the first day. But like we said with Snowflake, if you just want to get in and get it over with, hold your nose and dive in. Good luck.

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU