AI

AI

AI

AI

AI

AI

Artificial intelligence model risk management startup ValidMind Inc. said today it has closed on an $8.1 million seed funding round that will be used to advance its go-to-market plans.

Today’s round was led by Point72 Ventures and saw participation from Third Prime Ventures, New York Life Ventures, AI Fund, Notion Capital, FJ Labs, Angel Invest and Gaingels.

ValidMind has created an AI model risk management platform for financial services organizations to automate tasks such as AI model testing, documentation and model risk governance. By automating these tasks, the startup says it’s uniquely able to increase developer’s productivity, reduce the time to market for new AI models and improve outcomes for model risk management teams.

Existing model risk management processes are notoriously inefficient, the startup says. The bulk of AI model documentation tasks are done manually, meaning more than 100 hours of manual writing per model.

What’s more, model validation is a reactive process that occurs at the end of the development process, which means any potential issues usually aren’t discovered until several months into a project. In addition, organizational silos between developers and model validators result in slow and inefficient communications and information sharing that further hampers progress and extends time to market.

ValidMind reckons it can vastly improve the efficiency of AI model risk management operations, with its automated documentation capabilities eliminating much of the manual work in this process, saving hours of time. It also provides insight into any potential risk issues much earlier in the development process, enabling development teams to be proactive instead of reactive. Finally, it streamlines communications and information exchange, enhancing collaboration between developers and model validators.

According to the startup, there’s likely to be big demand for its automated model risk management tools, as financial services providers are desperate to get their hands on advanced AI, yet their ability to do so is severely restricted by the need to ensure trust and safety. For example, the Consumer Financial Protection Bureau reports that banks using chatbots run the risk of providing customers with inaccurate information that isn’t compliant with consumer finance protection laws.

Financial firms are also under pressure to comply with banking regulations such as SR 11-7 in the U.S. and SS1-23 in the U.K., as well as new regulatory challenges such as Europe’s AI Act and the recently announced AI Bill of Rights in the U.S.

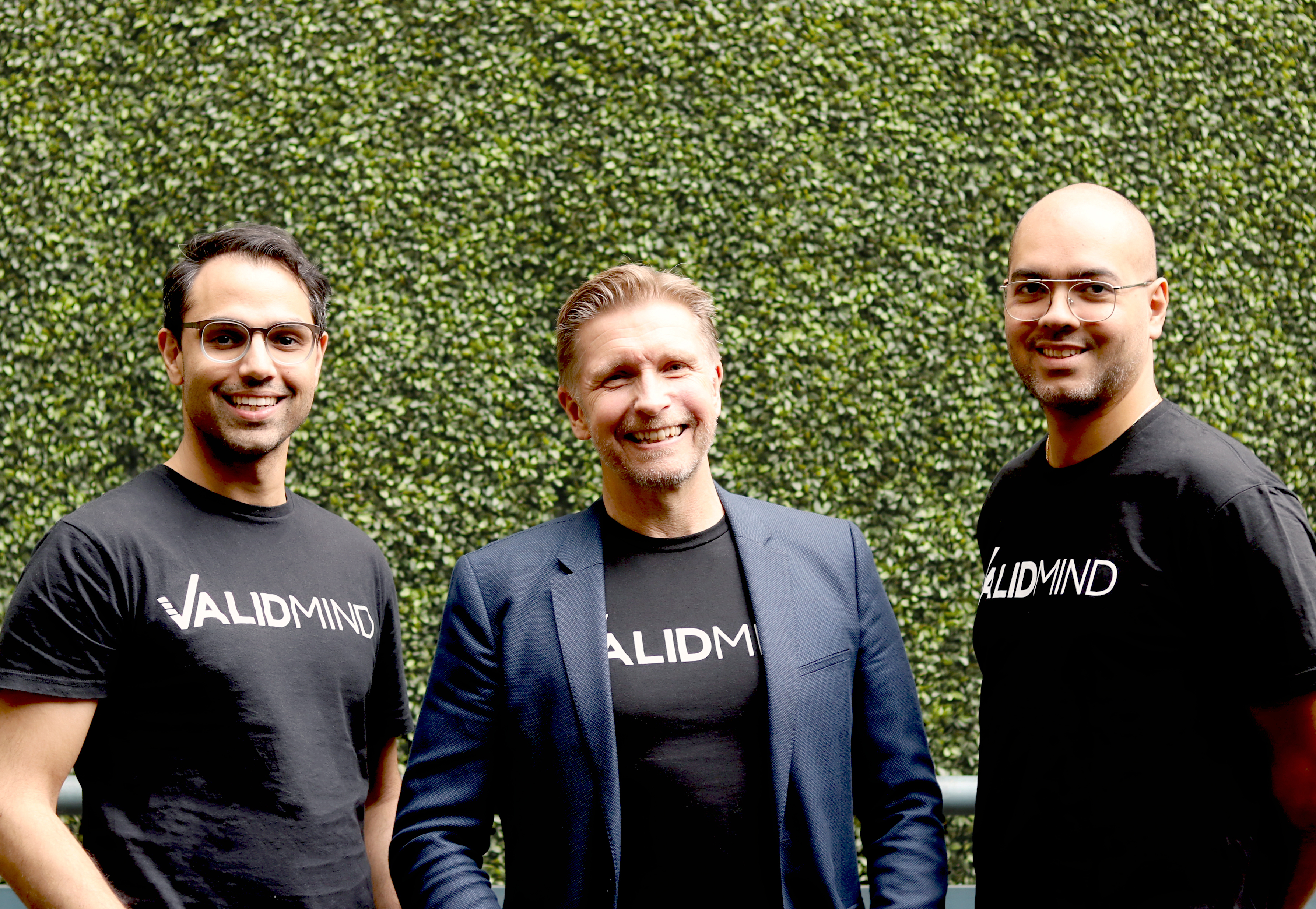

ValidMind co-founder and Chief Executive Jonas Jacobi (pictured, center, with co-founder and Chief Product Officer Mehdi Esmail, left, and co-founder and Chief Technology Officer Andres Rodriguez) said these concerns mean that financial institutions struggle to keep pace with the advances in AI, at a time when they’re under pressure to deploy the technology much faster. They’re hampered by outdated and time-consuming risk management processes. “This funding strengthens our commitment to helping customers increase the speed and efficiency of their model risk management processes, reduce time-to-market and ensure compliance with global AI and model risk regulations,” he said.

Constellation Research Inc. analyst Holger Mueller said ValidMind is targeting a lucrative sector in the AI market, as financial services firms are among the most obvious and richest beneficiaries of generative AI. “The AI transformation is moving fast and this kind of funding for vertical AI markets is proof of that,” he said. “In light of the increasing regulation around AI, financial organizations definitely need an easier way to document and validate their models. ValidMind simply has to show it can deliver on its promise.”

Point72 Ventures Managing Partner Tripp Shriner said AI has the potential to transform financial services. “We believe ValidMind is in a strong position to ensure these models comply with current and future regulations,” he added.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.