Pageonce CEO on the Wallet of the Future: “Transaction is the Next Step”

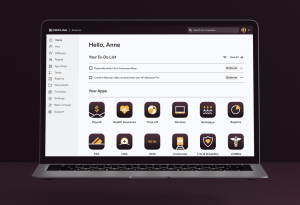

![]() The role of the mobile app has become a very personal matter, aiding us in everyday tasks on a whole new level. Pageonce has seen the evolution of the mobile app as a personal assistant, riding a wave of service-oriented developments that have spanned Netflix queues to centralized bill pay. Founder and CEO Guy Goldstein has lead the company through the mobile revolution so far, changing with the needs of the user and finding innovative ways to anticipate their demands. In today’s profile snapshot, Goldstein discusses the importance of accessible consumer data, the impact of the mobile industry, and some surprising differences between his hometown of Israel and the U.S.

The role of the mobile app has become a very personal matter, aiding us in everyday tasks on a whole new level. Pageonce has seen the evolution of the mobile app as a personal assistant, riding a wave of service-oriented developments that have spanned Netflix queues to centralized bill pay. Founder and CEO Guy Goldstein has lead the company through the mobile revolution so far, changing with the needs of the user and finding innovative ways to anticipate their demands. In today’s profile snapshot, Goldstein discusses the importance of accessible consumer data, the impact of the mobile industry, and some surprising differences between his hometown of Israel and the U.S.

What role does data play in empowering the consumer?

Consumers want to be in control of their daily finances. They have a lot of stress around managing so many different accounts and not knowing their financial situation. Data gives them comfort, a sense of security, and the confidence that they are in control.

Oftentimes data overload makes the problem even worse, making finances confusing and even intimidating to the average American. The key is to deliver the right data at the right time and in the right way.

Consumers want digested data that is understood quickly and easily. They also want the information to come to them when they need it. This is when alerts come into play. For example, a consumer doesn’t want to know that a bill is due several weeks in advance, but that it’s due in 5 days; and now they can actually take care of it right from the smartphone. This protects them from making mistakes and incurring overdraft or late fees. Pageonce strives to make data as useful as possible, delivering it in a simple yet effective way that saves time and money.

What’s the biggest impact mobile has had in the direction Pageonce has taken over the years?

![]() Mobile actually made Pageonce: it’s the vehicle to our success. We started out as a web company, then we identified mobile as the future of how people will receive and interact with information. We believe the mobile device is the most personal device, and as such personal finance is a perfect fit for mobile. Before the widespread adoption of smartphones, we made a bet on mobile in 2007, the same year the iPhone launched. We were one of first 500 apps on iPhone and were in the iTunes store on day 1.

Mobile actually made Pageonce: it’s the vehicle to our success. We started out as a web company, then we identified mobile as the future of how people will receive and interact with information. We believe the mobile device is the most personal device, and as such personal finance is a perfect fit for mobile. Before the widespread adoption of smartphones, we made a bet on mobile in 2007, the same year the iPhone launched. We were one of first 500 apps on iPhone and were in the iTunes store on day 1.

Once we shifted our business strategy from the web to the mobile platform, we had to rethink our service. It forced us to think about simplicity – how to give the most concise, useful information on small screen that could be consumed at a stoplight.

Now, we see the next wave is mobile payments. We’re creating The Wallet of the Future for the second wave of mobile, which is moving from consuming information to doing things. Transaction is the next step for the mobile device.

What’s the most surprising difference you found between your home country of Israel and America?

I noticed a difference in attitude. People here are more optimistic. Israelis tend to see issues or obstacles, while Americans are more positive. Also, I found that Silicon Valley is an amazing place that is extremely collaborative and supportive. The amount of networking, events, and willingness to share and help reflects that optimistic American attitude.

What do you like to collect?

Daughters – I have four of them. Other than that, I don’t really have time to collect anything.

Creating a personal management app means anticipating the needs of the average consumer. What does balancing the future mean to you?

Balancing the future means projecting into the future to create a better way of doing something. Traditionally, for last 100 years or so, consumers worked with the banks on their finances, but now they can work with technology. Companies like Amazon, Apple, PayPal, and Pageonce are investing in technology that can offer a better customer experience. The companies that deliver great customer experience will win.

Now the smartphone is becoming The Wallet of the Future. Consumers earn rewards when they pay, and have the freedom to pay how and when they want. It’s simpler and safer, and gives consumers the convenience and control of their money that they want.

A message from John Furrier, co-founder of SiliconANGLE:

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU