NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

The Server SAN market is set for explosive growth that will see this new breed of software-led storage quickly overwhelm traditional spinning disk arrays within the next five years and make up 88 percent of the enterprise and hyper-scale storage markets by 2026, according to a new Wikibon report.

Server SAN is built on commodity servers with flash or hybrid flash/disk storage attached directly to the processor bus. In a way, it’s a return to the origins of storage in which disk drives and processors were bundled together. The two went their separate ways during the rise of networked storage over the last 20 years, but flash has brought them back together because of its superior speed and shareability. The speed and capacity demands of Web-scale companies simply don’t permit the latency that disks and networks create.

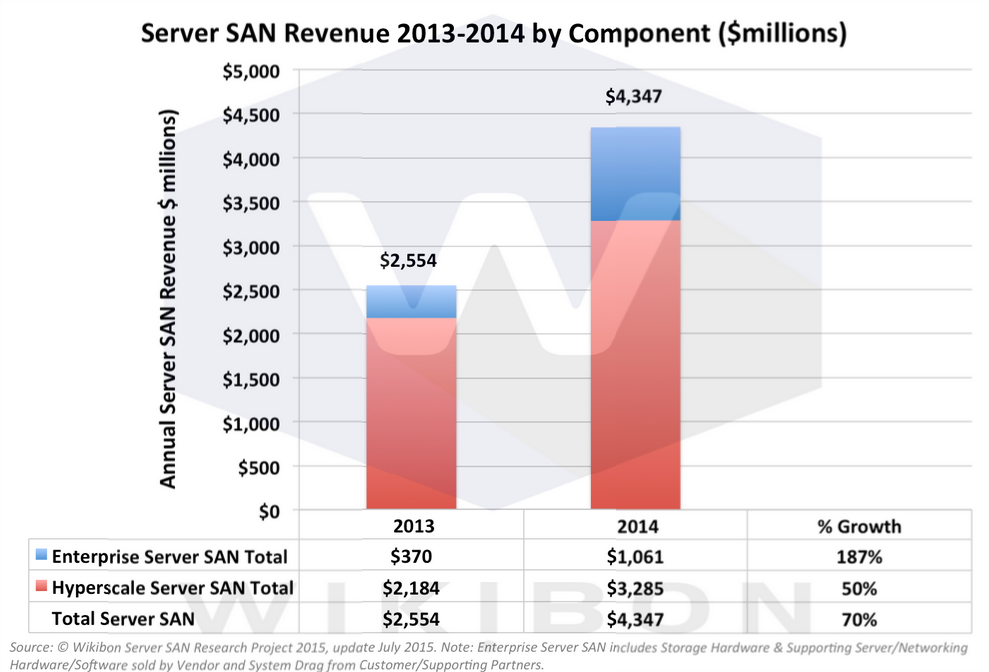

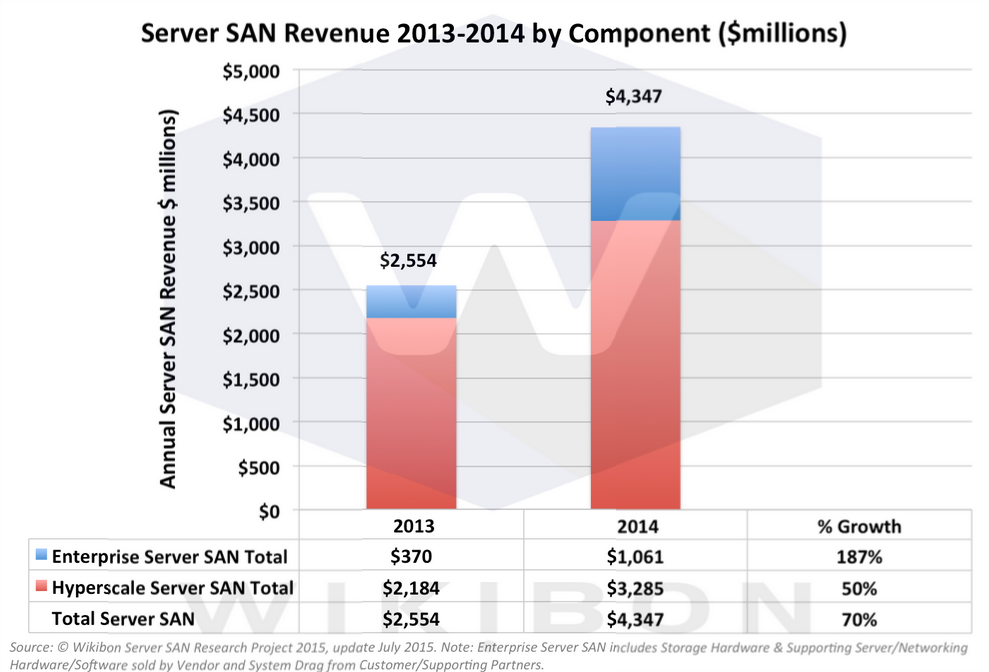

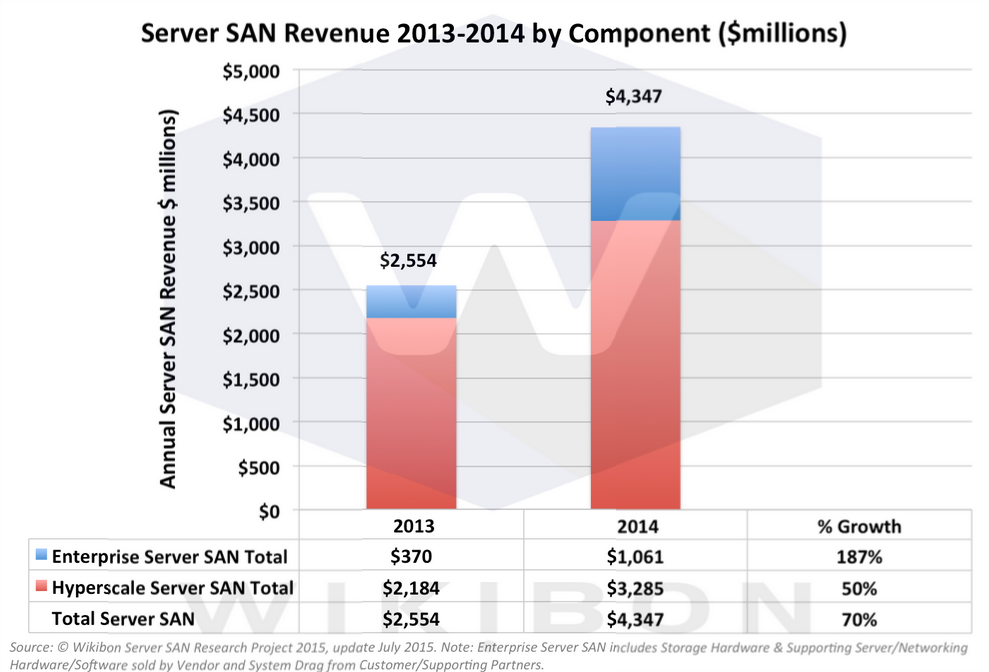

Enter Server SAN, a market that has drawn more than $2 billion in venture capital investment and spawned a host of new players like Nutanix, Inc. and SimpliVity, Inc. The combined Server SAN market grew from $2.4 billion in 2013 to $4.3 billion in 2014 (see chart above). Server SAN spending will be almost evenly split between Web-scale-oriented Hyper-scale Server SANs and more transactional Enterprise Server SANs. Hyper-scale Server SAN grew 50% last year, while Enterprise Server SAN grew at 187% from a smaller base. Both growth rates exceeded earlier Wikibon projections.

Wikibon is now forecasting a 28 percent compound annual growth rate (CAGR) for Enterprise and Hyper-scale Server SAN storage through 2026. At that time, the market is expected to grow to about $48 billion, with the traditional disk-based enterprise disk storage market withering to just $4 billion (a minus-16 percent CAGR). Overall storage spending is expected to grow by three percent annually during that time. .

Nutanix and SimpliVity are among the current market leaders, but that’s likely to remain fluid for the foreseeable future as big players buy in. Investments in Enterprise Server SAN grew 100 percent in 2014 to a total of $2.26 billion, fueled by acquisitions by Citrix Systems, Inc., Red Hat, Inc. and EMC, among others.

Wikibon’s new forecasts incorporate a new factor the analysts call System Drag, which is Server SAN-related software revenue such as VMware, Inc.,’s VSAN. Previous forecasts measured only hardware-related revenue, but Systems Drag accounted for nearly one-third of the overall Server SAN market last year and will be included in future forecasts.

Disk storage still has relevance, the authors write, but mainly for long-term data retention, where it will compete with tape. Given the speed with which the Server SAN market is growing “Wikibon strongly recommends that CTOs and CIOs initiate Server SAN pilot projects in 2015, particularly for applications where either low cost or high performance is required,” the analysts write.

A summary of the research can be found on the Wikibon Premium site. The full research study, Server SAN 2012-2026, requires a Wikibon Premium Membership.

Bert Latamore contributed to this report

THANK YOU