NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Wikibon has just released its latest 2015 Big Data Market Shares report, highlighting the hardware, software, and services vendors that are likely to lead a Big Data market that’s set to hit $92.2 billion by 2026, according to the research firm’s latest projections.

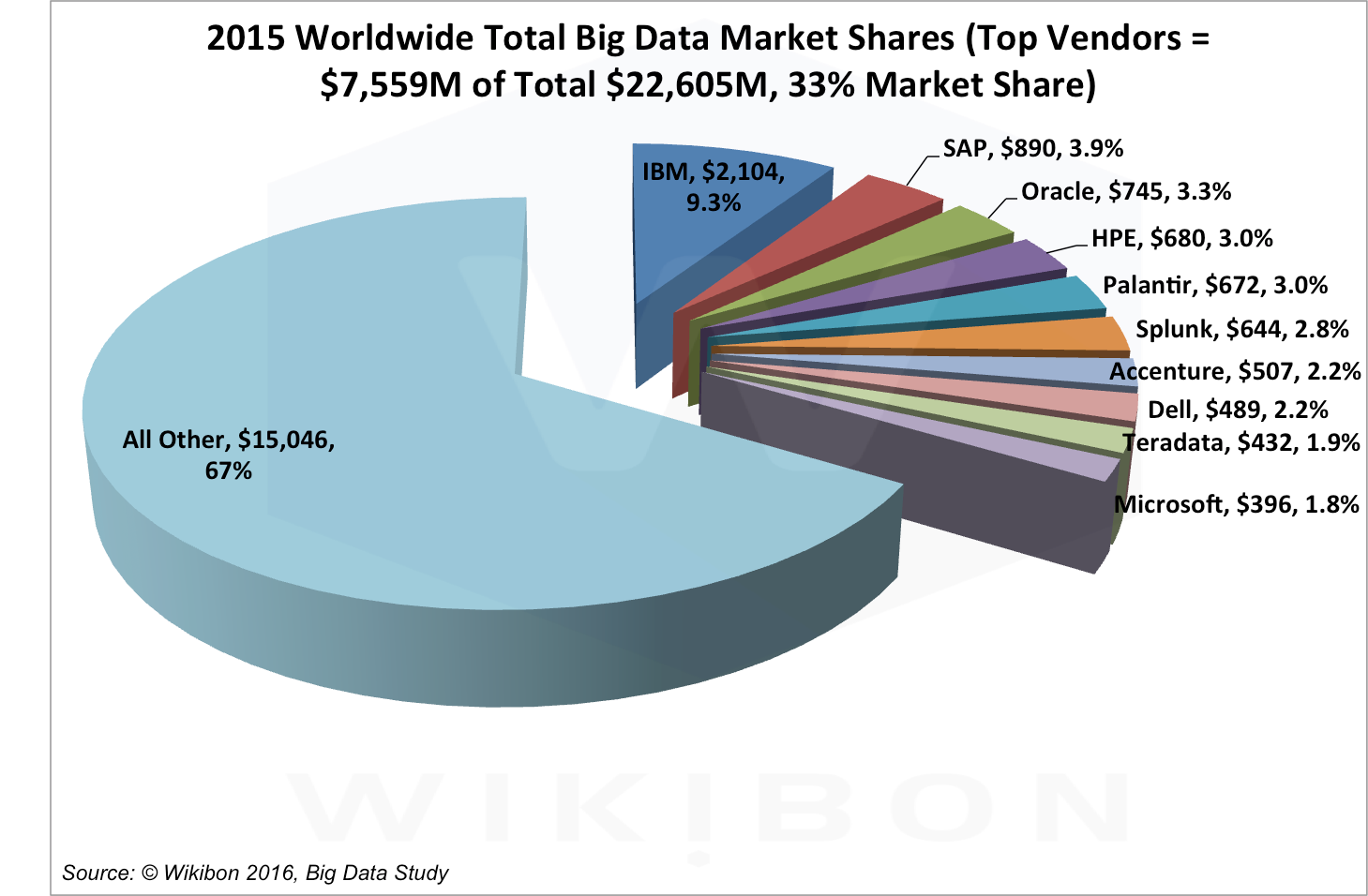

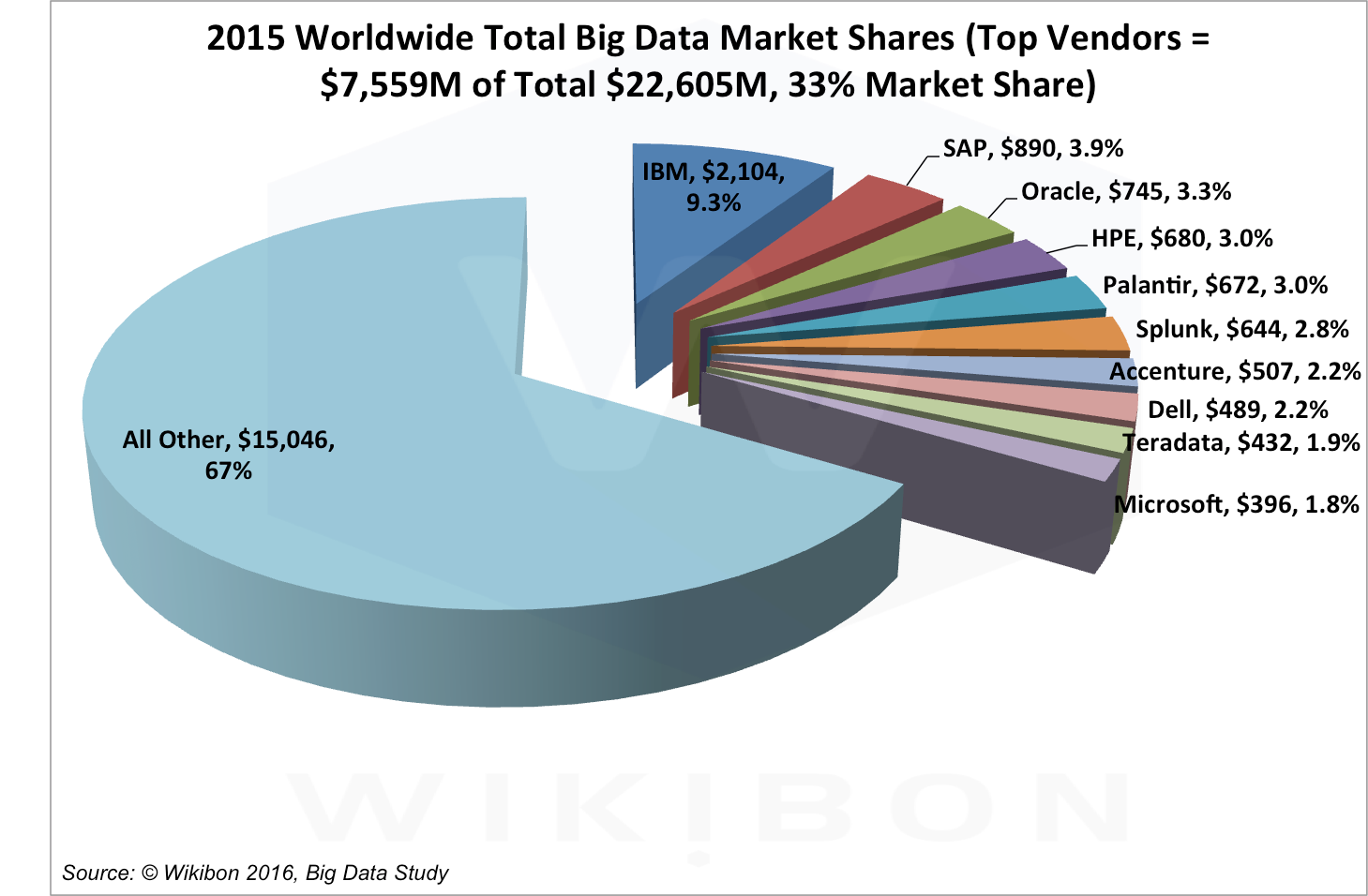

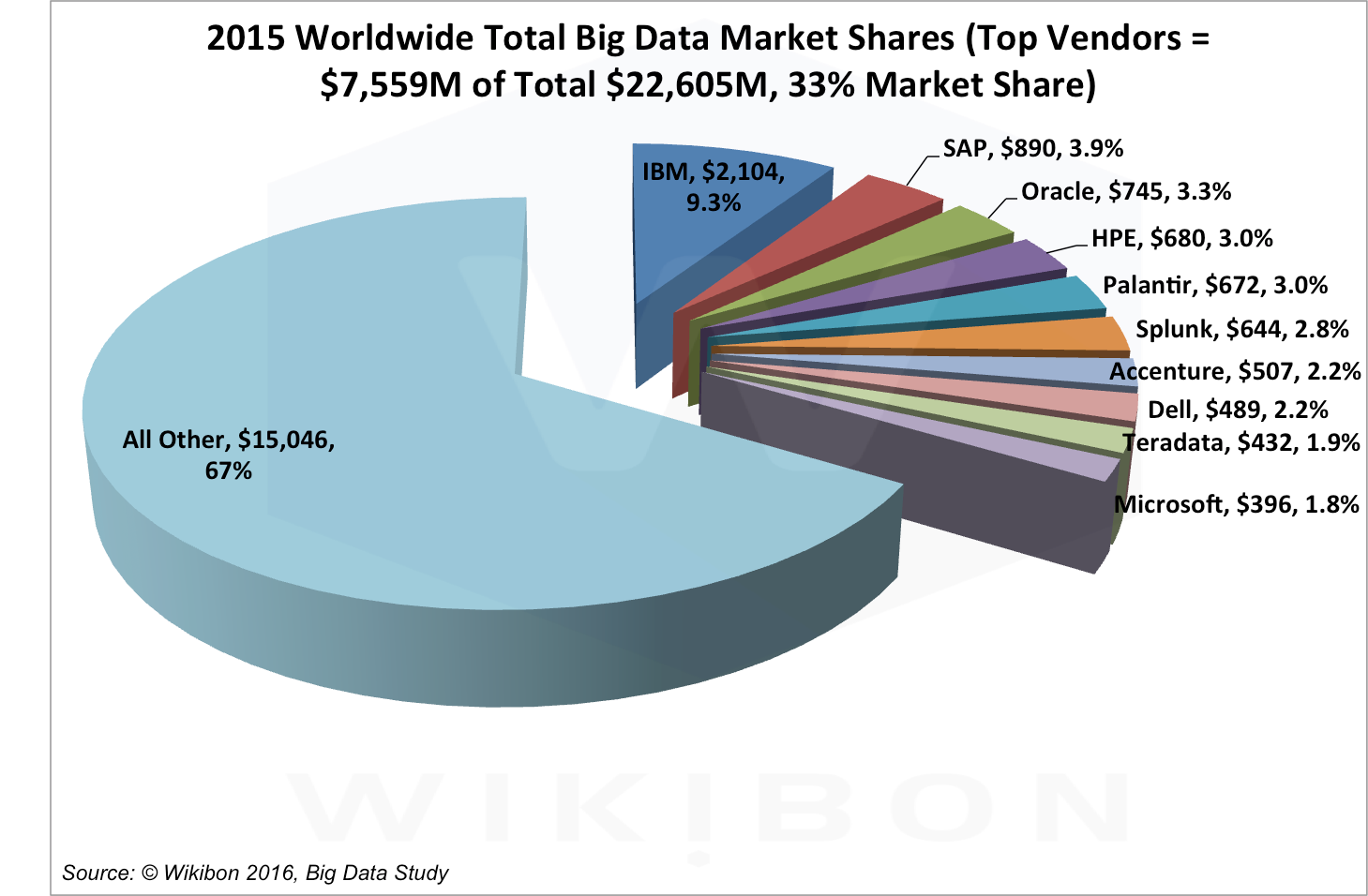

Wikibon’s latest figures show the overall Big Data market grew from $18.3 billion in 2014 to $22.6 billion in 2015, representing a growth rate of 22 percent. The overall growth rate of the top 10 vendors was 24 percent year over year, while the remaining vendors grew slightly slower at 21 percent.

As far as individual vendors go, IBM once again leads the way with a 9 percent share of the overall market in 2015, with revenues of $2.04 billion. Big Blue is followed by Germany’s SAP SE in second place with $890 million in revenues and a 4 percent market share, Oracle in third with $745 million in revenues (3 percent market share) and Hewlett-Packard Enterprise (HPE), which pulled in $680 million in revenues (3 percent).

Wikibon also identified the fastest growing Big Data vendors by revenue in its report. Original Design Manufacturers (ODMs) displayed the most rapid growth, with revenues increasing by $553 million year over year. They were followed by IBM, which saw revenues grow by $333 million, and Splunk Inc. with $193 million. Wikibon also gives a nod to Amazon Web Services (AWS), whose revenues grew by a stunning 166 percent to $149 million, as well as Hadoop vendors Hortonworks Inc., which grew by 151 percent to $118 million, and Cloudera Inc., which grew by 100 percent to $182 million.

Wikibon breaks down its Big Data numbers into three distinct segments, namely Hardware, Software and Professional Services. It notes that while a handful of market leaders are strong in all three segments with offerings across the board, the majority of Big Data vendors participate meaningfully in just one of those segments.

The hardware segment, like the other segments, is dominated by original design manufacturers (ODMs), which command 40 percent of all revenues. As far as branded hardware goes, the recently-split HPE leads the field with its assortment of server, storage and network offerings. HPE pulled in $456 million revenues in 2015, giving it a 7 percent share of the market. Its followed by IBM in second place with $378 million in revenues and a 5 percent market share, with Dell Inc. Cisco Systems Ltd., EMC Corp., Oracle and NetApp Inc. all performing strongly. Amazon Web Services is also included in the top ten, because Wikibon defines its IaaS offerings as hardware since they serve the same function as on-premises hardware services.

The Big Data software market is dominated by database and application software providers SAP SE, Oracle, and IBM, which make up three of the top four vendors due to their widespread software offerings that, according to Wikibon, address every segment of the market.

Splunk Inc. comes in at second place due to its expertise in the IT operations segment, while the top ten is rounded out by companies that focus on product strengths derived from the analytic capabilities of their tools and big data professional service skills, such as Microsoft, SAS Institue, Palantir Technologies and Hadoop vendor Cloudera Inc.

The largest market segment is comprised of the following types of vendors:

Of these, IBM comes out on top with $1.234 billion in revenues and a 13 percent market share. It’s followed by Accenture, Palantir, Teradata and Mu Sigma, which round out the top five professional BiG Data services vendors.

Read the full 2015 Big Data Market Shares report over at Wikibon.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.