NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

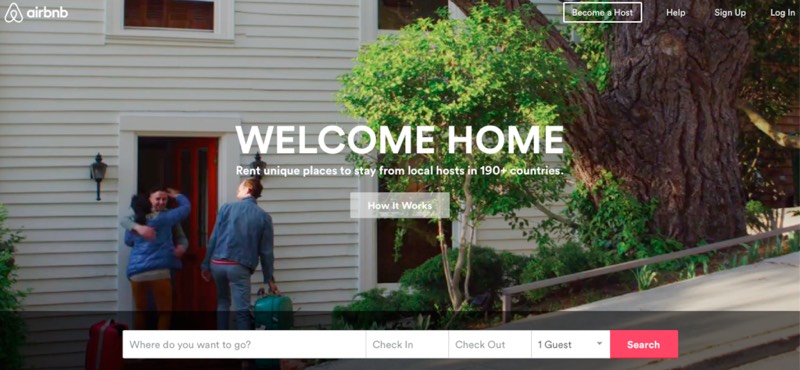

Online accommodation marketplace Airbnb, Inc. has raised even more money, this time in the form of $1 billion in debt financing.

JPMorgan, Citigroup Inc, Morgan Stanley and Bank of America Corp are said to have led the deal.

The debt raising follows confirmation in December that Airbnb had raised $1.5 billion earlier in 2015.

According to Bloomberg, the financing gives Airbnb more money to spend on global growth strategies and expansion beyond home-sharing, including building add-on travel services, although what those services entailed was not made clear.

The same report also notes that the debt financing may be a prelude to plans for an initial public offering (IPO) as “investment banks often arrange debt facilities for successful private companies in hopes of building relationships to win future business like underwriting an IPO.”

Airbnb has not confirmed the debt raising, although numerous outlets have confirmed it via sources and “people familiar with the matter.”

The company itself had previously projected $900 million in revenue in 2015, and had predicted it would be profitable in 2016, while at the same time predicting, be it ambitiously, that they were projecting revenue of $10 billion in 2020; in perspective to get to that figure Airbnb would need to increase its share of global lodging market from 1 percent to as much as 10 percent over the next five years in order to reach its goal.

Airbnb is often compared to ride-sharing service Uber, Inc., as both were established at around the same time and both are chasing what is often referred to as the “sharing economy.”

Both also share another trait other than both being unicorns: they absolutely love raising large sums of money.

Uber’s model does differ from Airbnb in that the former uses its funds to subsidize drivers as it enters new markets and seeks to expand, whereas Airbnb does not spend directly with accommodation providers but instead does things like television advertising in an attempt to acquire customers.

The difference aside, the question remains: how much money do these companies require to get to the point where they are either profitable or can slow down on their excessive spending?

Airbnb’s prospects do appear to be solid, but no company can keep going on raising money for ever and a day.

Including the new debt financing, Airbnb has raised $3.39 billion to date; previous investors include SherpaCapital, TPG Growth, T. Rowe Price, Dragoneer Investment Group, Founders Fund, CrunchFund, Sequoia Capital, Ashton Kutcher, Andreessen Horowitz and others.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.