NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Strong sales of graphics chips for gaming, artificial intelligence and autos helped Nvidia Corp. nearly double earnings in its third quarter, driving shares up almost 16 percent in after-hours trading Thursday.

The Santa Clara, Calif.-based maker of graphics processing unit chips said revenues rose 54 percent, to $2 billion. Net profit jumped to $542 million, or 83 cents per share, in the quarter ended Oct. 30, up from $246 million, or 44 cents per share, a year ago.

The results easily beat Wall Street expectations. A dozen analysts surveyed by Zacks Investment Research had expected a profit of 57 cents per share. Nvidia’s shares have more than doubled since the start of the year, far outpacing the Standard & Poor’s 500 index’s 6 percent rise. In today’s session, a down day for technology stocks, shares had fallen about 3 percent, to $67.77 a share. Update: In Friday morning trading, shares jumped even more, by about 24 percent.

For the current quarter that ends in January, Nvidia said it expects revenues of about $2.1 billion, way above analysts’ forecasts of $1.69 billion.

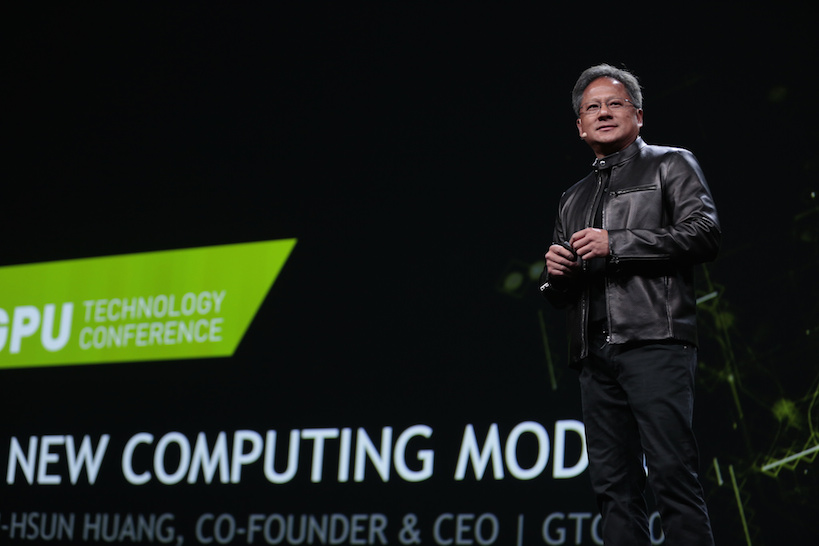

Jen-Hsun Huang (above), Nvidia’s founder and chief executive, said the quarter was driven by all its product lines. The chipmaker’s new Pascal GPUs are “fully ramped” and “enjoying great success” in gaming, VR, self-driving cars and datacenter AI computing, he added.

Chips for video games, the largest segment, saw revenues rise by 63 percent over a year ago, to $1.24 billion. Revenues from the data center business nearly tripled, to $240 million.

As in recent quarters, Huang emphasized the rising role of Nvidia’s GPUs in computer servers used for deep learning, a branch of AI that has led to big advances in speech and image recognition in products from Google Inc., Microsoft Corp. and others. “GPU deep learning has really ignited this wave of the AI revolution,” he said in comments during the earnings conference call, thanks to investing “billions of dollars” to advance deep learning in recent years.

Nvidia has made deep learning neural networks a focus of development and marketing efforts in the past few years. Nvidia’s chips have proved especially useful for the parallel processing needed for deep learning. In May, the company introduced new graphics processors that Huang said were 10 times faster than the previous generation. Apple Inc., Facebook Inc., Microsoft and other companies have been building GPU-based systems for their data centers, driving a large part of the upside in Nvidia’s results in the last few quarters.

Huang said during the conference call that its chips are getting used in applications across a wide range of large industries. “The GPU has really reached a tipping point,” he said, finding its way into a wide range of products from game machines and autonomous cars to personal computers and data center computers. “The GPU is no longer a niche product. We’re now a computing platform company.”

That view was backed by Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, who said Nvidia has invested in the software, services and hardware to support its chips.

“The company is hitting on all cylinders,” said Moorhead. “It’s hard to spot a hole now in their lineup.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.