CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Oracle Corp. today showed more progress in its drive to become a leading player in cloud computing, but it fell short of analysts’ expectations for its fiscal second-quarter revenues.

As a result, in trading after the market close, Oracle’s shares were falling about 2 percent. In regular trading today, shares declined a small fraction of 1 percent, to $40.86.

Oracle reported $2 billion in net income for the second quarter that ended Nov. 30. Profit before certain costs such as stock compensation came in at $2.6 billion, or 61 cents a share. The company, which still depends mainly on sales of licenses for business software such as databases, said that if not for the impact of the U.S. dollar strengthening against foreign currencies and an unexpected Egyptian currency exchange loss, its profit would have been 2 cents higher.

Oracle has been focused for the past year or so on boosting cloud revenues, which Oracle co-Chief Executive Mark Hurd a few months ago predicted would constitute 80 percent of information technology budgets by 2025. Slowing revenues of licenses for its core database software market have stunted the Redwood Shores, CA-based business software giant’s revenue growth. That’s why revenues were flat from a year ago at $9 billion, or up 1 percent in constant currency.

Still, Oracle’s ascent to the cloud moved ahead. Revenues from cloud software as a service, or software delivered over the Web, and platform as a service, which enable the creation of Web software, jumped 81 percent in U.S. dollars, or 83 percent in constant currency, to $878 million.

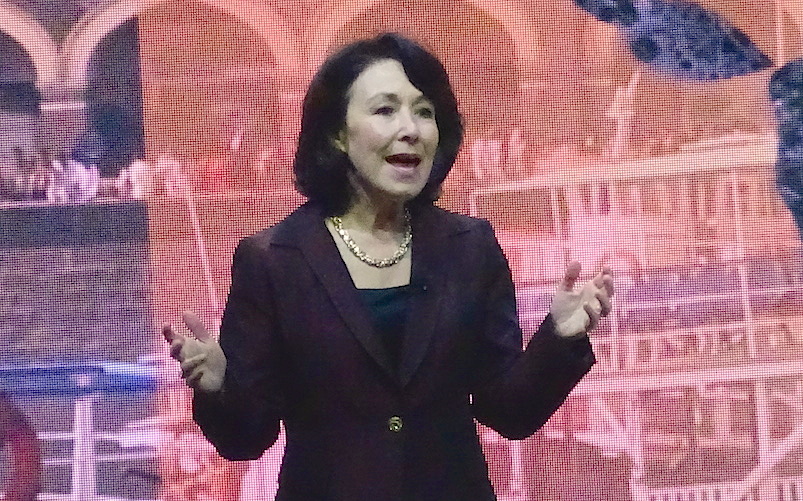

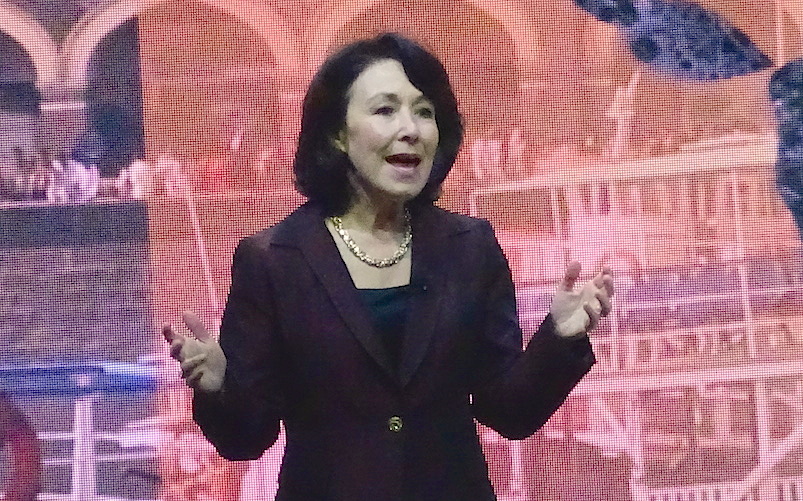

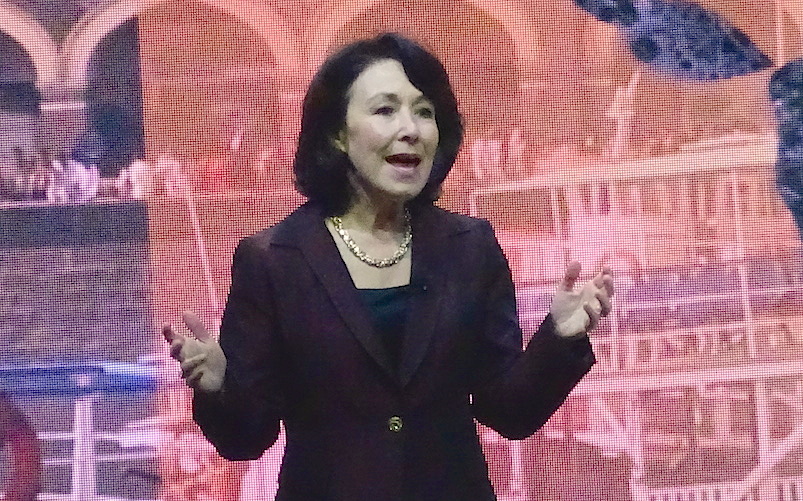

“We continue to see accelerating growth rates in our cloud business while our competitors slow down,” co-CEO Safra Catz (above) said in comments during the earnings conference call. What’s more, she said, “The combination of our cloud and new software license business together are growing.”

Total cloud revenues, including infrastructure as a Service such as that provided by leader Amazon Web Services and Microsoft Azure, rose 62 percent in U.S. dollars and 64 percent in constant currency, to $1.1 billion. A category Oracle calls “cloud plus on-premise software revenues” rose 2 percent in dollars and 3 percent in constant currency, to $7.2 billion.

“We are clearly the fastest-growing cloud company at scale,” Oracle Chairman and Chief Technology Officer Larry Ellison said in comments on the call.

Analysts on average had expected Oracle to post adjusted earnings of 60 cents per share on total revenue of $9.11 billion, according to FactSet. Cloud revenue was expected to be $1.05 billion, with on-premises software revenues of $6.27 billion.

Catz said the company expects SaaS and PaaS revenues to growth 82 percent to 86 percent in the current quarter. Combined software and cloud revenues will be up 4 percent to 6 percent, she said, with total revenues up 3 percent to 5 percent in the third quarter.

For fiscal year 2017, she said the company has increased its growth estimate for SaaS and PaaS from 67 percent to 80 percent thanks to the $9.3 billion acquisition of NetSuite that closed Nov. 5. Gross margins will be higher than the current 61 percent, she added. Not least, she forecast double-digit profit growth in fiscal 2018.

Oracle’s cloud computing efforts are costing the company big bucks in research and development, sales and marketing. R&D alone grew to $5.1 billion in fiscal 2016, up $2 billion from six years ago, and Hurd has said much of the increase is from rewriting software for the cloud and creating new cloud services. “This makes me popular with customers and not so popular with investors,” Hurd said in September.

What’s more, cloud computing puts Oracle in competition with a raft of entirely new competitors, from Amazon.com Inc. to Salesforce.com Inc., in place of IBM Corp. and SAP SE. The company sought to demonstrate its ability to compete with cloud leaders such as Amazon Web Services and Salesforce.

Hurd said Oracle has now passed Salesforce to become No. 1 in SaaS cloud application sales, Hurd noted. “We expect to book over $2 billion in new annually recurring cloud business this year alone,” he said in prepared comments. “And, with the acquisition of NetSuite, we plan on being the #1 cloud applications service provider for companies with less than 1,000 employees as well.”

Not least, Ellison noted that the cloud version of its dominant database software is taking off, reaching $100 million in the quarter. He expects that business, as well as its IaaS business, to grow faster than the SaaS business. “Stay tuned. More surprises coming,” Ellison said.

Oracle also announced that Catz will become a member of President-elect Donald Trump’s transition team but will remain at Oracle.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.