INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Gaming and deep learning continue to drive graphics chip maker Nvidia Corp., which today released its best quarterly earnings ever, beating fourth-quarter expectations and hitting a record $2.17 billion in revenues.

The maker of graphics processing unit chips, or GPUs, saw revenues jump 55 percent from a year ago. Nvidia also posted an impressive gross margin of 60 percent. This marks the seventh consecutive quarter Nvidia beat earnings expectations.

Still, investors may have wanted a bit more, especially in the company’s first-quarter outlook, which also beat forecasts but perhaps not as much as hoped. Nvidia, whose stock performed best among S&P 500 companies last year with a return of 227 percent, saw its shares vacillate up and down a fraction in after-hours trading, after falling nearly 2 percent in regular trading, to $116.38.

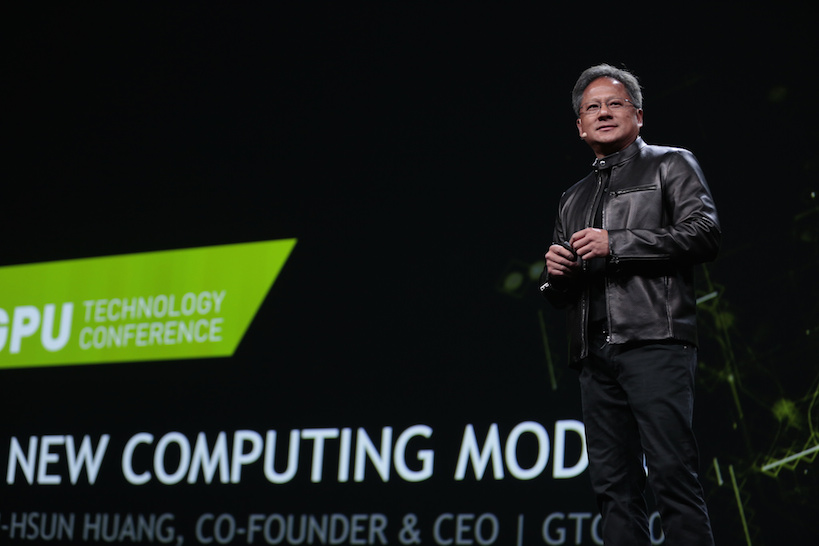

Nvidia called out strong adoption of its Pascal GPU chip architecture, which hit the market last year. Nvidia’s gaming GPU business alone brought in over $1.34 billion in the fourth quarter, and during today’s earnings call, Chief Executive Jen-Hsun Huang said that the personal computer gaming market is still going strong and continues to be one of the company’s core businesses. Huang credited the rise of esports, which is projected to become a $1.4 billion industry by 2019, with the continued growth of gaming, calling it “a dynamic that nobody ever expected 20 years ago.”

Perhaps even more impressive, the company’s data center segment more than tripled in 2016. Nvidia’s data center business brought in $296 million in the fourth quarter, roughly $200 million higher than the fourth quarter of 2015. This segment includes a range of Nvidia products and services, including its virtualized GPU business, its DGX-1 AI supercomputer appliance, its graphics-accelerated virtual desktop service and others. Nvidia noted in its report that its data center growth demonstrates the increased demand for virtualized computing and training deep learning systems for image and speech recognition services.

“If they keep growing at this pace, and it could, it will be a $2 billion-a-year business that has gone from nothing to something in short order,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy.

Nvidia’s professional visualization and automotive segments also saw modest growth, but its original equipment manufacturer and intellectual property segment was down by 11 percent year-over-year.

The same insane speed and processing power that makes Nvidia’s GPUs popular with gamers have also made them popular with deep learning engineers. During the earnings call, Huang said that Nvidia expects deep learning to continue growing in importance across every industry.

“Everybody knows now that every hyper-scaler in the world is investing very heavily in deep learning,” Huang said. “And so my expectation is that over the next coming years, deep learning and AI will become the essential tools by which they do their computing.”

He later added, “Enterprise has all woken to the power of AI, and everybody understands that they have a treasure trove of data that they would like to discover insights from.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.