INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Worldwide server shipments slumped again in the fourth quarter of 2016, according to new data from market watchers International Data Corp. and Gartner Inc.

Both analyst firms reported declining revenues in the final quarter of the year. IDC said that revenues plummeted by 4.6 percent, to $14.6 billion, while Gartner saw a more modest 1.9 percent decline, to $14.8 billion. In both cases, the analysts said the decline was due to a lack of activity from enterprises.

“The server market suffered another difficult quarter as most segments declined, including hyperscale deployments, suggesting that the weakness previously seen is more systemic,” said Kuba Stolarski, research director of computing platforms at IDC.

Stolarski said that IDC isn’t forecasting an improvement anytime soon. He expects to see long-term secular declines in high-end system revenues. In addition, he said there were signs that the overall levels of deployment and refresh appears to be slowing in hyperscalers — large Internet companies such as Google Inc. and Microsoft Corp. — and also large enterprises. As such, the only way is down, IDC appears to think.

“Some public cloud datacentre deployments are being delayed and there are indications that overall levels of deployment and refresh may slow down even through the long term as hyperscalers continue to evaluate their hardware provisioning criteria,” Stolarski wrote. “On the enterprise side, we are seeing ongoing weakness as companies struggle to decide whether to deploy workloads on premises or off, and continue to consolidate existing workloads on fewer servers.”

In contrast, though, Gartner said that hyperscalers such as Google and Facebook Inc. had actually stepped up their server purchases in the last quarter, driving “significant server replacements.”

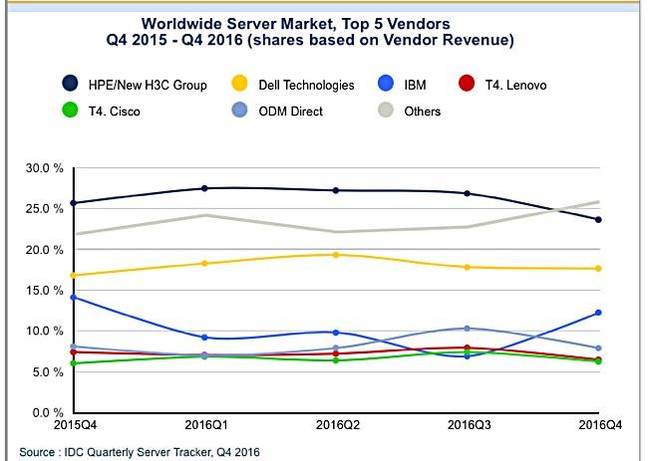

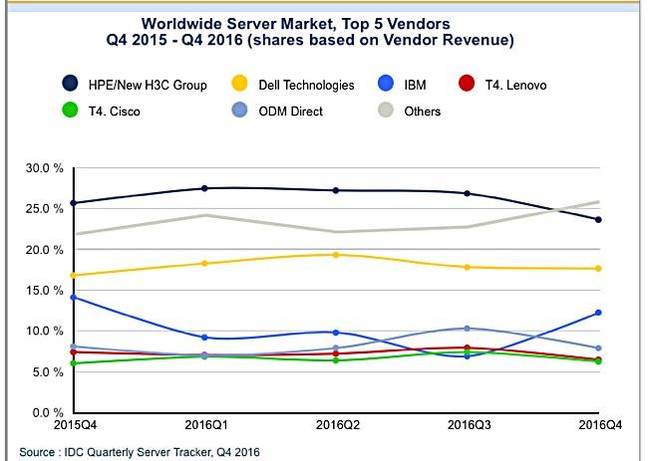

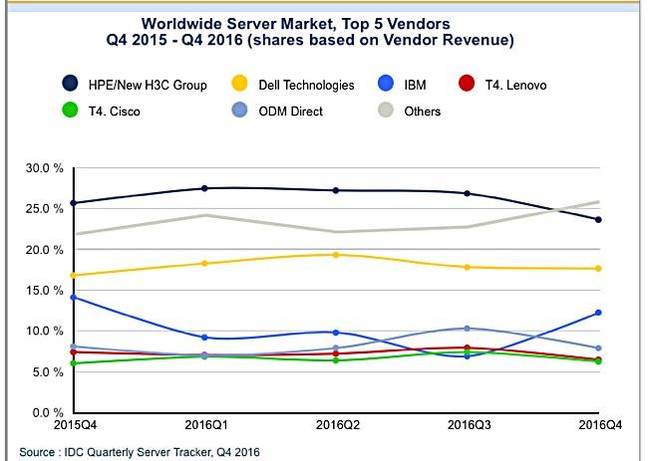

Regarding vendors, Hewlett-Packard Enterprise Co. retained its position as the No. 1 manufacturer in terms of revenue, according to both IDC and Gartner, though both analyst firms said it was overtaken by the “others” category. HPE amassed total revenues of $3.45 billion, down 11 percent from a year ago, according to IDC.

Things were just as glum for IBM Corp. and Lenovo Group Ltd., which both saw big declines in server revenues. Dell Technologies Inc. was the only major vendor to see any growth, with revenues barely rising, by 0.1 percent according to IDC, or 1.8 percent according to Gartner.

“Other than Dell, which remained relatively flat, all top worldwide vendors experienced global revenue declines year over year,” said Lloyd Cohen, research director of computing platforms at IDC. “Just outside the top five, Huawei, ranked number six, grew 73.6 per cent year over year. On a positive note for the overall market, average system values increased 9 per cent.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.