EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

In what could be described as a case of venture capital funding going full circle, a technology growth fund has in effect undertaken an initial coin offering that has sold tokens to invest in tech firms, a contrast to recent examples of investments in ICO-issuing startups.

The Andra Capital LLC “Silicon Valley Coin” is a security-tied token that aims to “democratize venture capital by allowing global investors to participate in top-tier Silicon Valley investments.” By contrast, the firm said, “traditional investments have previously been restricted to closed VC networks and large investment firms.”

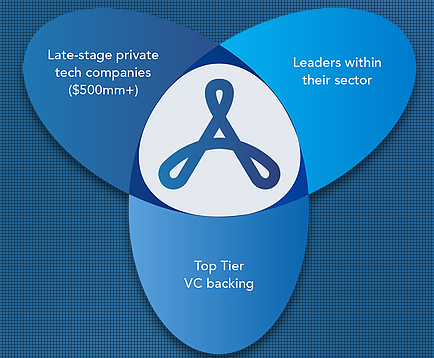

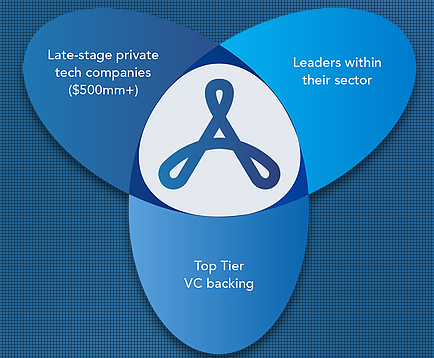

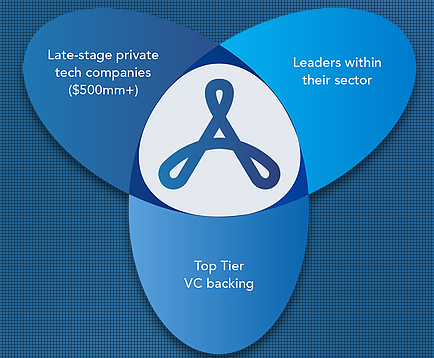

Built on top of the Ethereum blockchain, the token has already raised $500 million in a presale. The fund is investing primarily in late-stage, high-growth pre-initial public offering technology companies that are each worth at least $500 million. The company cited Lyft Inc., WeWork Inc., AirBnB Inc., SpaceX Inc. and Palantir Inc. as potential investment examples. Twenty percent of the funds raised will be invested in early-stage startups.

“Andra Capital is democratizing venture capital with the ‘Silicon Valley Coin,’ a security token built on the Blockchain,” Haydar Haba, managing partner at Andra Capital, said in a statement. “We combine our innovative investment strategy with technology, world-class partners and a fund structure with tradable interests to achieve higher returns and lower risks — comparable to top-tier venture capital firms.”

The offering does vary from a typical ICO, despite its issuing tokens. Since the fundraising is tied to securities, therefore legally registered and allowable under U.S. Securities and Exchange Commission rules, investments are strictly limited, at least in the U.S., to accredited investors or those with a net worth of $1 million. Those outside the U.S. have no such restrictions on participating.

Having already raised $500 million from undisclosed investors in the presale, there is more to come. Andra Capital is seeking another $500 million via a initial coin offering of the tokens in the summer, according to Reuters. One billion tokens will be issued in total, with 500 million offered in the ICO at $1 per token.

Andra Capital said it hopes investors will see significant capital appreciation over 30 to 60 months and that it was aiming over a 10-year period of delivering an internal rate of return of 30 percent.

In an age where ICOs are so common now that most are ignored, this one stands out in tying a token to tangible investments in real-world startups that have a potential of delivering a return. The whole idea of “democratizing” VC is clearly a sales pitch, but there’s actually a decent amount of truth in it.

There are two outstanding questions though in relation to the offering. The first is what the minimum buy-in for the ICO will be. Although U.S. investors will be limited by status, it’s unlikely to be a small minimum buy-in, meaning that the “democratization” is really only spreading access to those who already have wealth.

The second question is whether the tokens themselves will be tradable. Presumably, given that they’re being sold as tokens, they will be. If so, there may finally be a decent ICO-issued token that can be traded in a similar fashion to the way shares are today: tied to tangible investments as opposed to a white paper with nothing more than a prayer that something of value may emerge in the future.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.