CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

PayPal Holdings Inc. has kept its wallet wide open this week, announcing yet another acquisition: cloud-based fraud prevention startup Simility, Inc. for $120 million in cash, subject to certain adjustments.

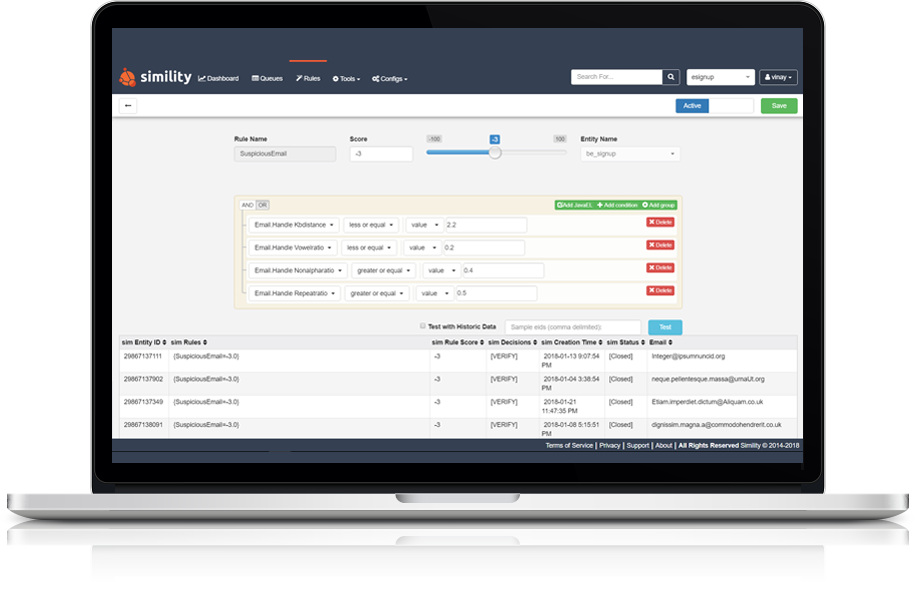

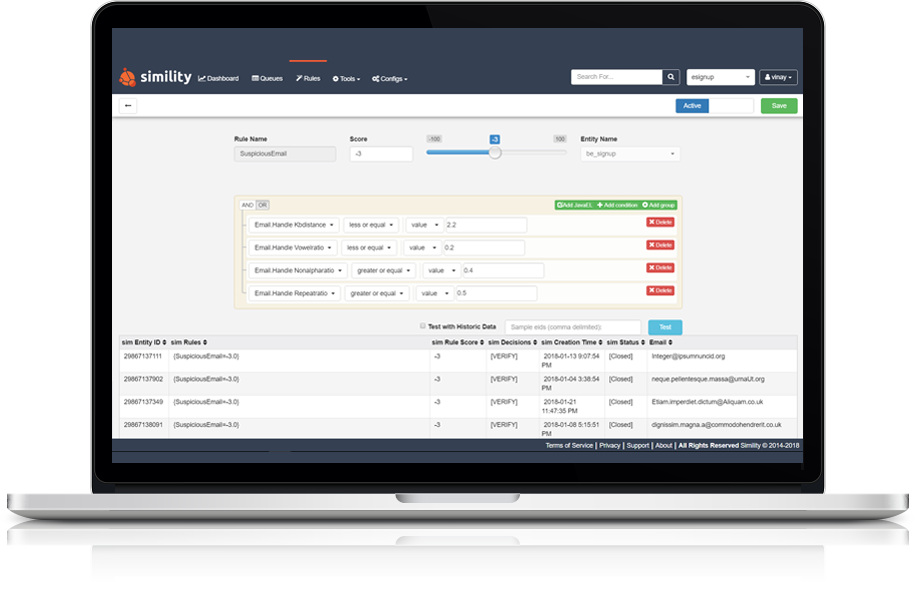

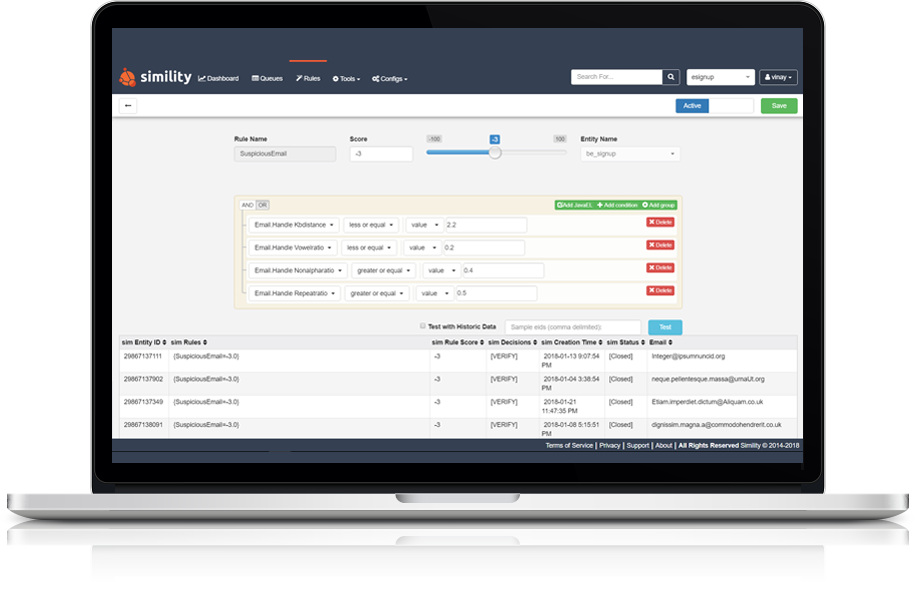

Founded in 2014, Simility offers a cloud-based fraud prevention software solution that combines machine learning with human evaluation to protect small to medium-sized businesses along with enterprise clients from sophisticated types of fraud and abuse attacks. The company’s platform is said to empower fraud analysts to adapt to fraudsters’ evolving tactics quickly without needing to write code.

For PayPal, the acquisition not only strengthens its own in-house fraud detection abilities but adds to a growing list of services it offers customers through its account management dashboard.

“Digital commerce has exploded, and fraudsters have taken note, adapting and developing new methods to carry out their crimes,” Bill Ready, PayPal chief operating officer, said in a statement. With the acquisition of Simility, PayPal merchants will be able to configure security solutions to manage the unique complexities of their businesses “to fight fraud while helping make commerce experiences faster and more secure,” he added.

The announcement of the Simility deal comes two days after PayPal announced it had acquired San Francisco-based funds disbursement firm HyperWallet Systems Inc. for $400 million. It’s the fifth major acquisition for the company this year. From the beginning of the year, PayPal acquired offline bill payments startup TIO Networks Corp. in February 2017 for $233 million followed this May by Swedish mobile payments startup iZettle Inc. for $2.2 billion and artificial intelligence startup Jetlore Inc. for an undisclosed sum.

Simility had raised $24.7 million, most recently via rounds in August 2015 and December 2017. Investors celebrating a solid if unspectacular exit include Accel, Trinity Ventures, Kortschak Investments, L.P. and The Valley Fund. PayPal itself was also an early investor in the company.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.