NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Real estate investing site Realty Mogul Co. has raised a $35 million Series B in a round led by Sorenson Capital that also included previous investor Canaan Partners.

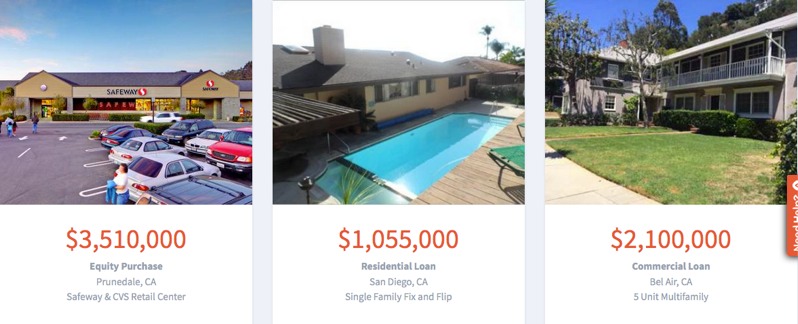

Founded in 2013, Realty Mogul is a marketplace for accredited investors to pool money online and buy shares of pre-vetted investment properties, with an object to make it easy for investors to invest in real estate, in particular connecting clients to previously inaccessible investment opportunities and capital.

Along with institutional investors looking to diversify their portfolio, the service also caters to borrowers in search of flexible debt or a real estate sponsor looking for joint venture equity.

The company claims to be the fastest-growing real estate crowdfunding site online and has already helped fund 240 properties totaling more than $500 million in value.

“We’re seeing online marketplaces massively transforming other industries, and Realty Mogul’s growth path clearly shows they’re poised to be the key disruptor in the huge asset class of real estate investing,” head of Sorenson Capital’s Technology Practice and new Realty Mogul board member Rob Rueckert said in a statement sent to SiliconANGLE.

Although not traditionally what most people would consider to be crowdfunding versus more a pooled investment service, it’s nonetheless an interesting concept that does truly introduce 21st century concepts into a marketplace that is still very wedded to 20th century norms.

The concept, of course, is limited to qualified investors, but tap into the 20 somethings making millions in Silicon Valley and San Francisco alone, who might not traditionally be interested in investing in real estate, and you’ve got a willing and ready market right there.

Including the new round, Realty Mogul has raised $45.1 million to date. Previous investors who did not invest in the new round include VoiVoda Ventures, Microsoft Accelerator – Tel Aviv, David S. Rose, Gordon Stephenson, Jilliene Helman and Tibor Nagygyörgy

The company said it would use the new round to add to its headcount to strengthen its “robust technology platform, which uses Big Data to get smarter about risk profiling in real estate,” as well as further expanding itsgeographic presence in the United States.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.