INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

High-end servers saw strong revenue growth in the third quarter of 2016, in stark contrast to the rest of the server market.

International Data Corp., in its latest “Worldwide High-Performance Technical Server QView” report, said high-performance computing, or HPC, server revenues grew by 3.9 percent in the third quarter, to $2.8 billion. In contrast, third-quarter revenues in the overall worldwide server market fell by 7 percent to $12.5 billion.

The HPC server market is split into four segments: supercomputers ($500,000 or more), divisional systems ($250,000 to $499,999), departmental systems ($100,000 to $249,999) and workgroup systems (below $100,000). The first two segments saw revenue growth of about 22 percent each, while the latter saw declines of 14 percent and almost 9 percent, respectively.

“Higher-priced systems led the way with year-over-year growth exceeding 22 percent, while lower-priced system revenue declined,” explained Earl Joseph, IDC’s program vice president for technical computing. He added that declines in the latter segments were likely to be only a temporary blip.

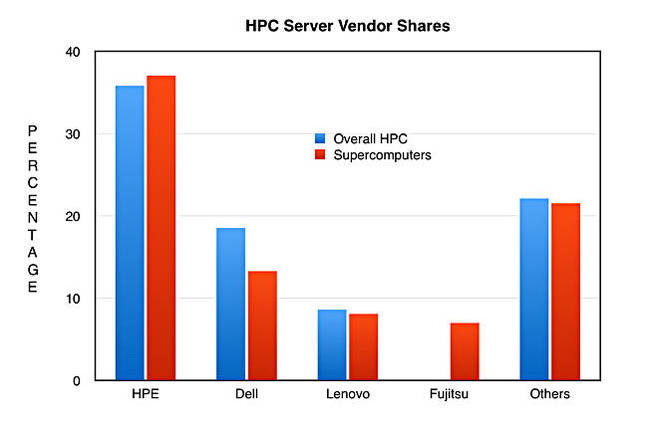

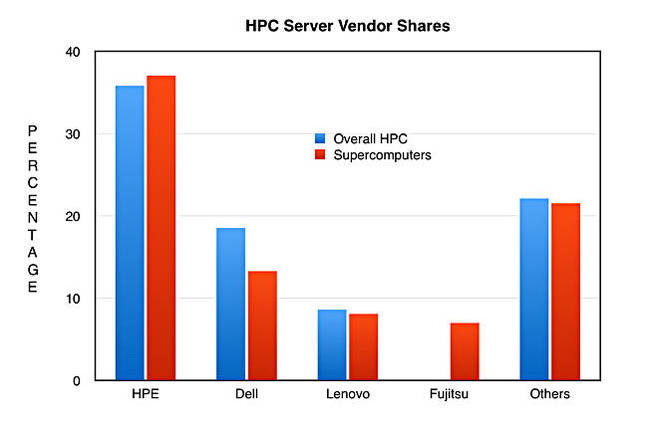

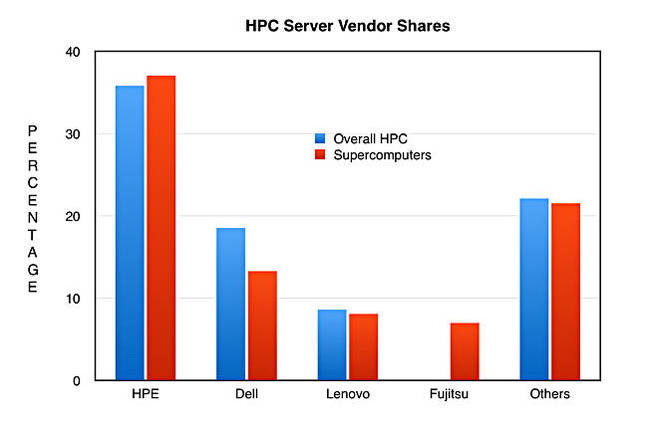

As for the suppliers, Hewlett-Packard Enterprise Co. came out on top with a 36 percent share of the HPC server market and 37 percent in the supercomputer segment. Dell Technologies Inc. came in second with an almost 19 percent share of the overall market, and 13 percent in supercomputers.

Third was China’s Lenovo Group Ltd., which grabbed 9 percent and 8 percent respectively, while Japan’s Fujitsu Ltd. grabbed 7 percent of the supercomputer segment, without being featured in the overall HPC server market. Meanwhile, there was a strong showing by the “others” category, which refers to non-major-brand “white-box” vendors, which grabbed 22 percent of the overall HPC market and close to the same percentage of the supercomputer segment.

These figures don’t add up to 100 percent in either category, which means IDC is holding back some numbers for the eyes of its paying customers.

Total revenues for the first three quarters in 2016 add up to $8.1 billion, which represents growth of 3.4 percent compared with the first three quarters of 2015. That suggests steady growth in the market overall.

Support our open free content by sharing and engaging with our content and community.

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.