APPS

APPS

APPS

APPS

APPS

APPS

Tableau Software Inc. saw its stock crash today after reporting earnings that fell short of Wall Street’s expectations.

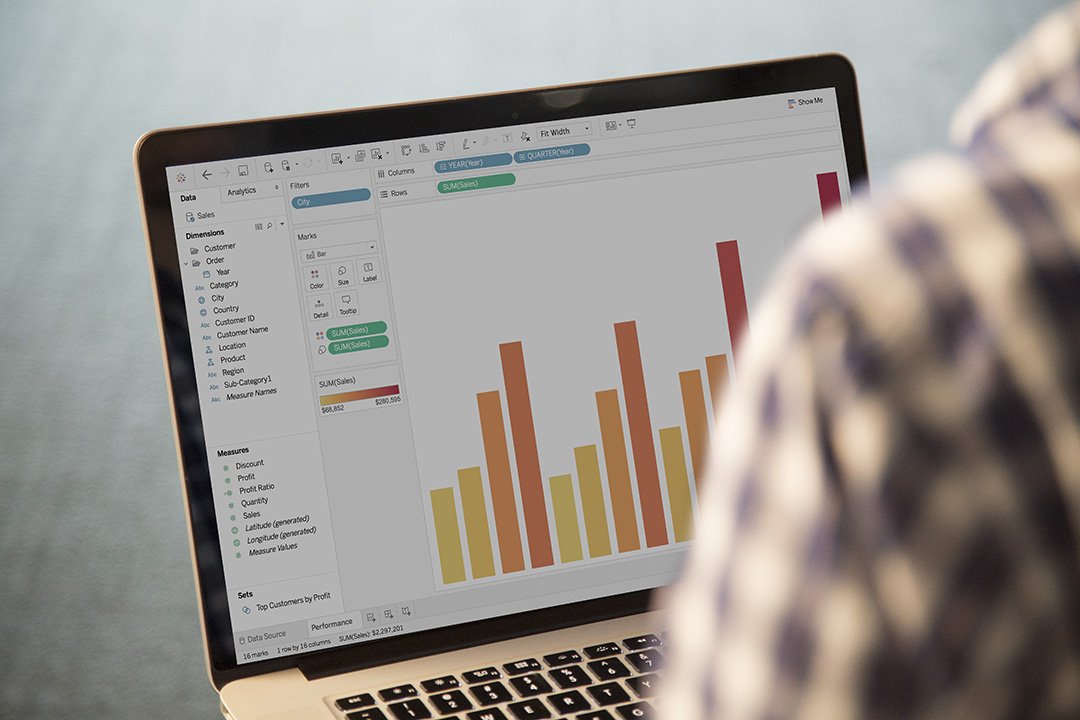

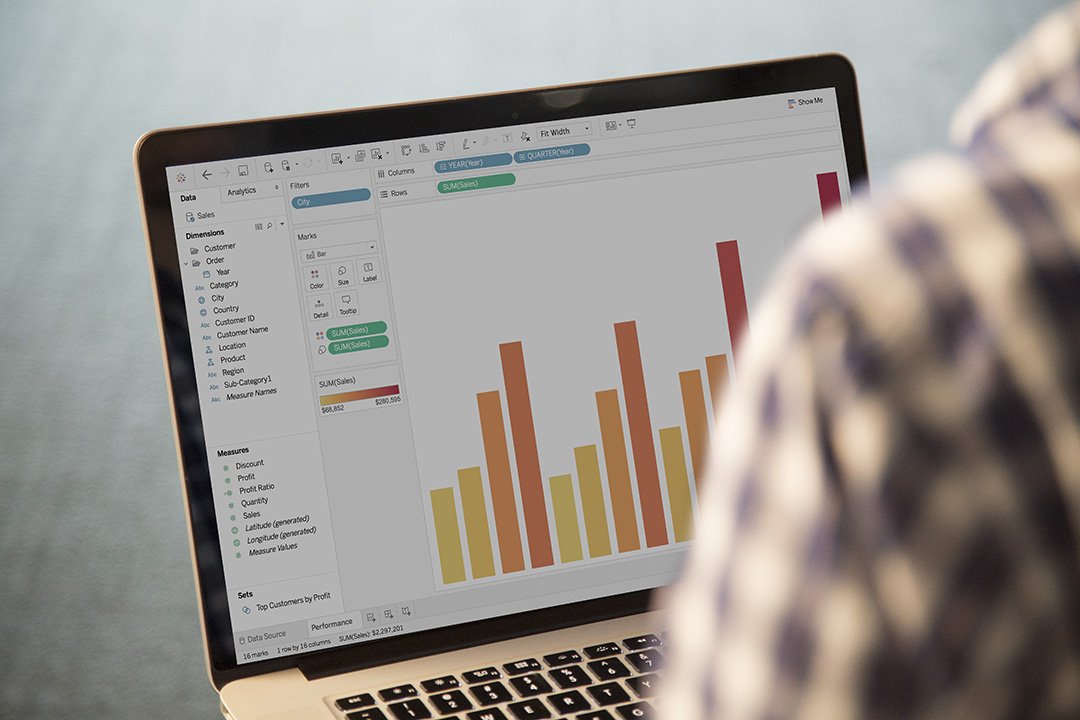

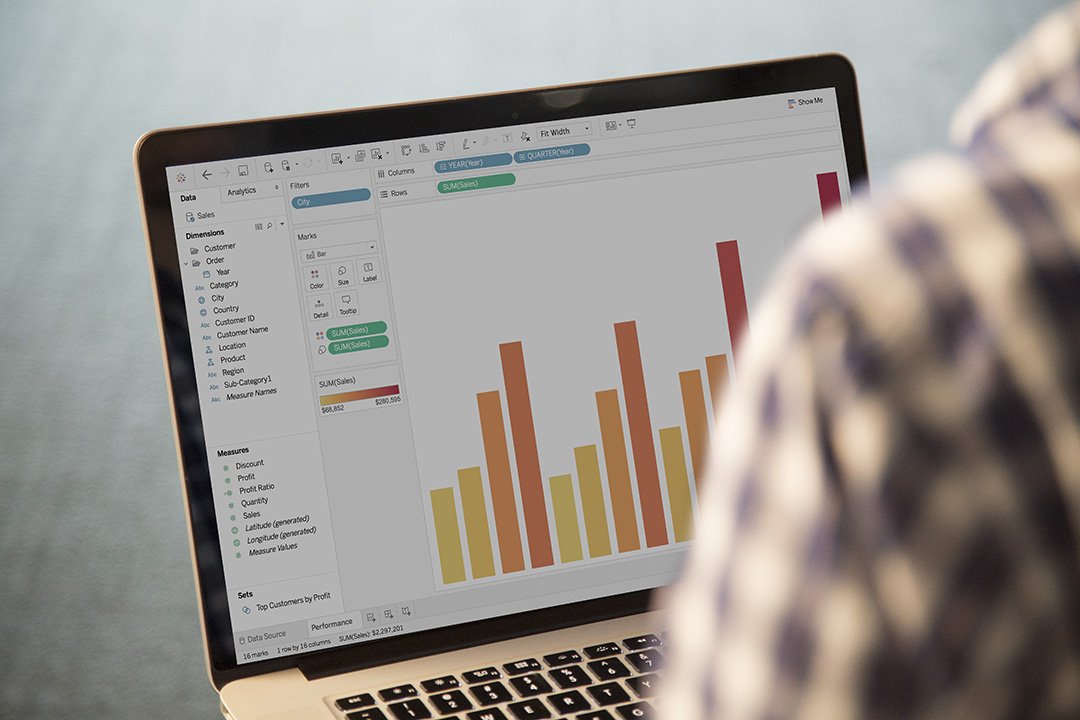

The Seattle-based company, which provides data visualization tools for enterprises, reported a profit of 8 cents per share on revenue of $214.9 million. Wall Street was hoping for 9 cents per share on $219.4 million in revenue. Tableau did have some good news, however, reporting annual recurring revenue from subscriptions of $139.2 million, which is up 204 percent from the same period a year ago.

But that wasn’t enough to assure shareholders, who led a selloff that saw Tableau’s stock plunge more than 11 percent in after-hours trading.

“Customers are embracing our subscription offerings even faster than expected,” Adam Selipsky, president and chief executive officer of Tableau, said in a statement. “Forty-five percent of our license bookings were sold on a subscription basis this quarter, nearly triple the percentage a year ago, as more and more customers turn to subscription to better address their analytics needs with lower upfront cost and reduced risk.”

Selipsky, who took over the reins as the company’s second CEO last year, has overseen Tableau’s transition toward a subscription-based business model with a focus on its Tableau Online product. The belief is that Tableau can make its products available to a wider selection of customers by selling subscriptions, while generating more recurring revenue than its older licensing business model allowed. As part of this strategy, Tableau made all of its data visualization products available on a subscription basis last April.

The company said it increased its total headcount in the last quarter, adding 113 people to bring its staff to 3,418 people worldwide.

Tableau’s stock price has been on a roller-coaster ride the last couple of years, falling from an all-time high of $127 in mid-2015 to a low of $41 in 2016. The stock has slowly but surely recovered since that low, and even with today’s fall, it remains up 84 percent since the start of this year.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.