INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

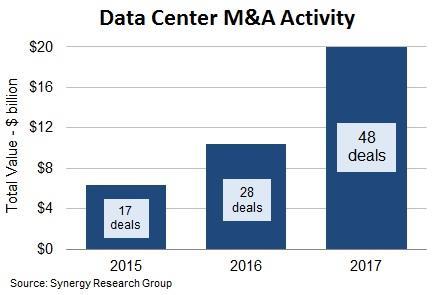

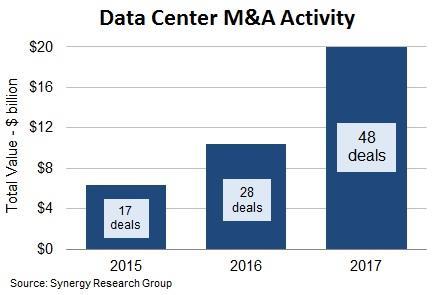

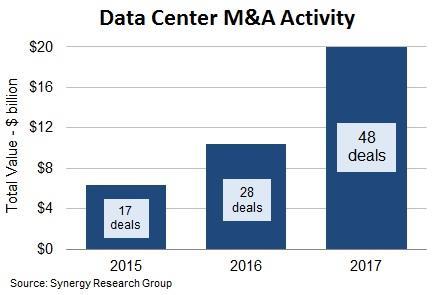

Merger and acquisition activity in the data center space accelerated last year, with the total value of transactions in 2017 topping $20 billion, according to new data from Synergy Research Group.

That total far exceeds the combined transaction amount in the preceding two years, Synergy said. What’s more, four additional deals in the space, valued at more than $2.6 billion, have been agreed upon but not yet closed.

“What is driving the data center M&A activity is enterprises focusing more on improving IT capabilities and less on owning data center assets,” said John Dinsdale, chief analyst and research director at Synergy. “That shift is driving huge growth in outsourcing, whether it is via cloud services, or use of co-location facilities, or sale and leaseback of data centers.”

Synergy said that 2017 saw an average of one significant M&A deal in the data center space per week. Digital Realty Trust Inc.’s $7.6 billion takeover of DuPont Fabros Technology Inc. was the largest data center acquisition of the year, but four other deals also surpassed the $1 billion figure, including notable buys from Equinix Inc., Cyxtera Technologies Inc., Peak 10 Inc. and Digital Bridge LLC.

The remainder of 2017’s M&A activity saw 12 deals valued in the region of $100 million to $1 billion and 31 smaller deals of $100 million or less, bringing the year’s total to 48 deals overall. That compares with just 45 deals spread throughout 2015 and 2016, of which only three were worth more than $1 billion.

Digital Realty and Equinix were the biggest spenders over the three-year period by some distance, spending a combined $19 billion on acquisitions. Equinix’s acquisitions have been on a global scale, while Digital Realty’s efforts have been focused on the U.S. and Europe only.

Synergy said it believes this increased M&A activity is being driven by the rise in public cloud adoption among enterprises, a trend that’s likely to continue. “We expect to see much more data center M&A over the next five years,” Dinsdale said.

THANK YOU