INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Cisco Systems Inc. broke a six-quarter streak of declining revenue, showing a 3 percent uptick in sales driven by its new products as well as strength in applications and security products.

The revenue rise in the networking giant’s fiscal second quarter wasn’t entirely a surprise, since it had forecast a 1 to 3 percent improvement three months ago, but it was at the top end of that estimate. The question, still to be answered for certain, is whether Cisco has finally turned the corner in its long quest to transition its business from a dependence on declining hardware to more of a software and subscription-based services company.

But today’s results indicate solid progress on that front, and Cisco’s new forecast calls for even stronger growth this year of 3 to 5 percent. What’s more, recurring revenues from software and subscriptions jumped 36 percent, accounting for a third of overall revenues. “While the company has more to show quarter after quarter, it appears the turnaround is happening and Cisco CEO Chuck Robbins and team deserve a lot of credit,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy.

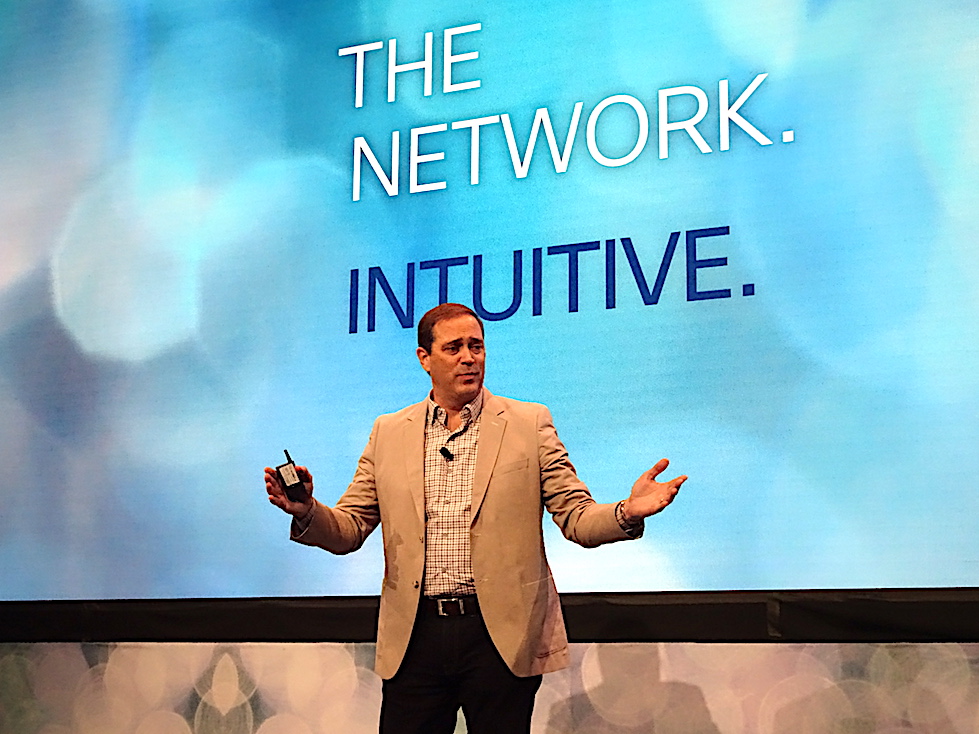

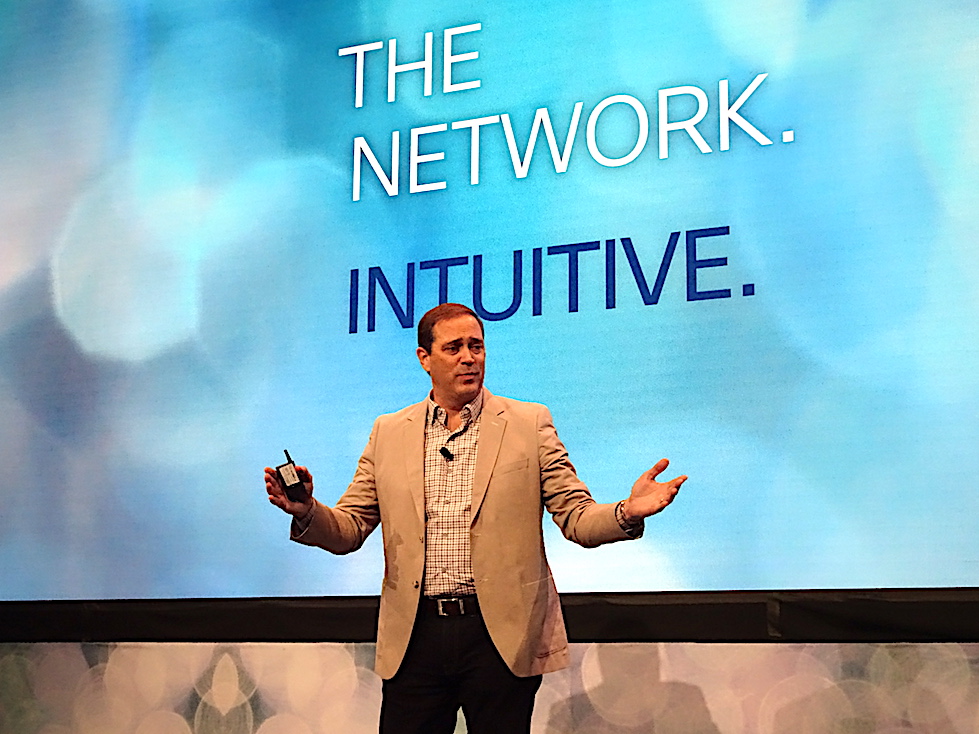

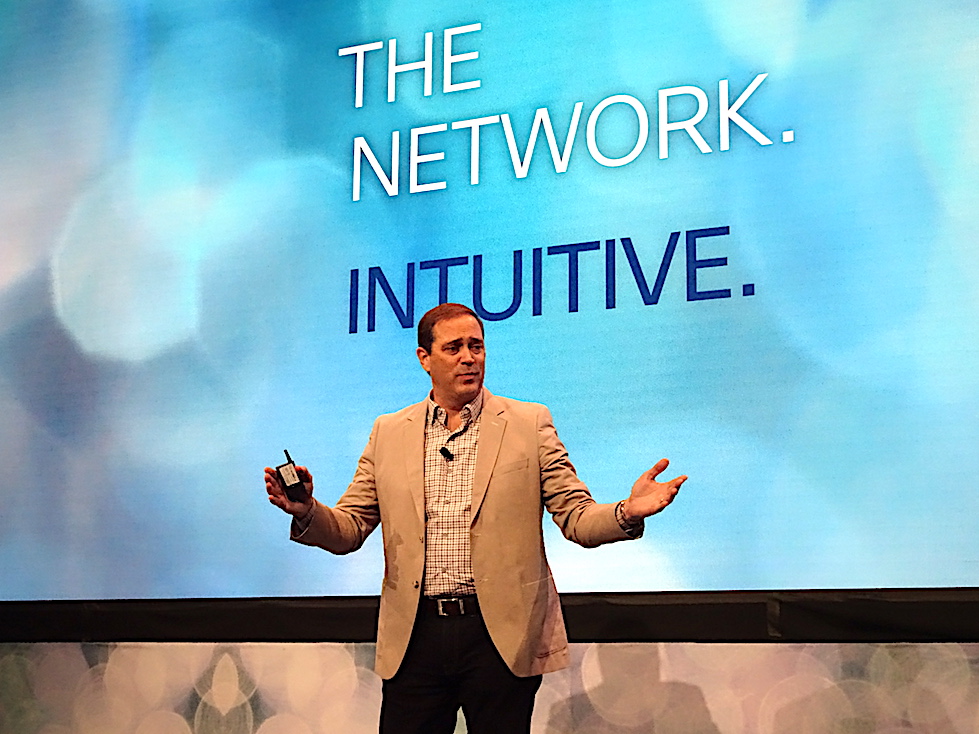

Robbins (pictured) said in comments during the earnings conference call that the results reflected both the company’s fastest-ever ramp-up of a new network switch, the Catalyst 9000 introduced last June, and its software and cloud efforts. “We made continued progress in shifting more of our business to software and subscriptions,” he said.

Cisco, which is the world’s largest maker of network switches and routers for moving data over the internet and large corporate networks, reported today that its second-quarter profit before certain costs such as stock compensation and the impact of the tax bill rose to $3.1 billion, or 63 cents a share, from a year ago. Revenue rose 3 percent, to $11.9 billion.

That beat analysts’ projections of an adjusted profit of 59 cents, up 2 cents from a year ago, on 2 percent revenue growth, to $11.81 billion, according to a FactSet survey. On a net basis, Cisco lost $8.8 billion, or $1.78 a share thanks to an $11.1 billion charge on repatriation of $67 billion in overseas cash related to the new tax act, among the most announced by a company to date.

It appears that Cisco will spend a big chunk of the repatriated cash on shareholders. It announced a 14 percent increase in its quarterly dividend to 33 cents a share. It also said it will buy back an additional $25 billion in shares, bringing the total buyback amount to $31 billion over the next 18 to 24 months.

That won’t make skeptics of the new tax law happy, since some had predicted the money wouldn’t go toward hiring more people and doing research and development, as proponents of the measure had promised.

But investors liked everything they heard, at least judging from after-hours trading, which saw Cisco shares rise almost 7 percent. On an up day for the market, Cisco’s shares had already closed up about 2 percent in regular trading, to $42.09. Shares had risen 20 percent since it reported fiscal first-quarter earnings in November. Update: In trading Thursday, shares rose almost 5 percent.

Cisco’s core infrastructure platforms, which include its networking hardware, saw only a 2 percent rise in revenue, to $6.7 billion, but applications and security each rose 6 percent. “That’s very positive given the investments the company has been making,” Moorhead said.

Investors are especially interested in deferred revenue, which includes subscription-based and software revenue. That rose 10 percent from a year ago, but the portion from recurring software and subscriptions jumped 36 percent.

Cisco has made some small inroads with large cloud computing providers such as Microsoft Corp., Google LLC and China’s Alibaba Group Holding Ltd., most of which have typically built their own networking hardware. The prospect of more business from so-called “hyperscale” companies prompted Nomura Instinet analyst Jeffrey Kvaal today to slap a buy rating on Cisco stock and raise his target price from $33 to $45 a share.

Still, Cisco has a long way to go before it can declare victory. “Cisco is still in its transformation to software and services, and gaining two percentage points more in that category is hardly a substantial shift year over year,” noted Holger Mueller, vice president and principal analyst at Constellation Research Inc. “But all good things take time and the Cisco transformation is moving along.”

The company also has made a series of moves and acquisitions to embrace newer businesses it’s betting on, from the cloud to security. In late January, it bought Skyport Systems Inc., which makes a specialized appliance combining compute, storage and networking components that’s designed to run companies’ most sensitive applications. Also in January, Cisco launched its own distribution of Kubernetes, widely used software to manage software containers that allow applications to run unchanged across a range of environments.

In October, Cisco spent $1.7 billion to purchase cloud business communications firm BroadSoft Inc., which provides more subscription-based recurring revenue. The same month, Cisco acquired machine learning-driven data analysis startup Perspica Inc. and signed a deal with Google to help corporate enterprises more easily develop software that spans private data centers and public cloud computing.

There could be even more or larger acquisitions to come. “Cisco could use extra cash coming onshore to make a transformative acquisition related to security, data analytics or as-a-service, which we think investors would applaud,” Barclays analyst Mark Moskowitz wrote in a note to clients.

THANK YOU