CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Oracle Corp. may still be the biggest provider of databases, one of the foundations of today’s data-driven businesses, but Amazon.com Inc. wants the world to know there’s more to databases than the venerable giant’s brand.

In a blog post today, Amazon Chief Technology Officer Werner Vogels made a detailed case that the half-dozen kinds of databases it offers on the Amazon Web Services cloud service offer more of what modern companies need to compete than mainstream commercial databases.

Many in the tech world already know that, and there’s no significant news in the post. But in an exclusive interview with SiliconANGLE, Vogels said he aims to explain why today’s applications can no longer depend solely on the “relational” databases that have dominated the field for decades.

“The days of the one-size-fits-all monolithic database are behind us,” he said. “Our customers are changing how they develop applications and they need particular databases to do that.”

If there’s a unifying theme to AWS’s disparate set of databases, he said, it’s that they’re all aimed at supporting cloud-native methods of creating applications that aren’t driven by the way the data needs to be stored in a single kind of database. Instead, the cloud application, often composed of smaller bits of code widely distributed in multiple data centers and the cloud, drives the way the data needs to be accessed and used. That, Vogels contends, requires different kinds of databases for different kinds of applications.

“The world of application development is changing,” he added. “If you want to target your customers with the right tools, you need a variety of databases.”

At first glance, the post would appear to be another shot at Oracle by AWS, whose Chief Executive Andy Jassy hasn’t been shy about throwing darts at the database giant, and there were reports earlier this year that AWS, an Oracle customer, was gradually moving to its own databases. Those critiques have come as Oracle itself has increasingly targeted AWS with its cloud efforts. Most recently, Oracle has touted its “autonomous” database capability, hoping to slow down a wholesale move by many companies to clouds run by Amazon, Microsoft Corp., Google LLC and others.

But Oracle’s push doesn’t appear to have had much impact on AWS, whose revenue rose 49 percent in the latest quarter, to $5.4 billion — even faster than the previous quarter. Moreover, Vogels noted that AWS has seen 75,000 migrations from other databases to its own in the cloud since the migration service launched in early 2016, up from 20,000 in early 2017.

That said, Oracle has felt the heat and started to respond with its own service to migrate its on-premises customers to its cloud. James Kobielus, an analyst with SiliconANGLE sister company Wikibon, said recently that he thinks Oracle fast-tracked that service.

Still, Oracle may not be the prime target here. Kobielus said he thinks Vogels’ post is directed more at the dozens of independent providers of specialized databases.

“The reason why AWS is pushing this line now is simply because they have successfully reinvented the wheels, in terms of building or acquiring specific fit-for-purpose database products in all the same segments that IBM and Oracle assembled over many years,” he said. “They’re declaring, with considerable justification, that they can address any data/analytics requirement that any customer may have without having to bring non-AWS databases, such as from partners, into the engagement.”

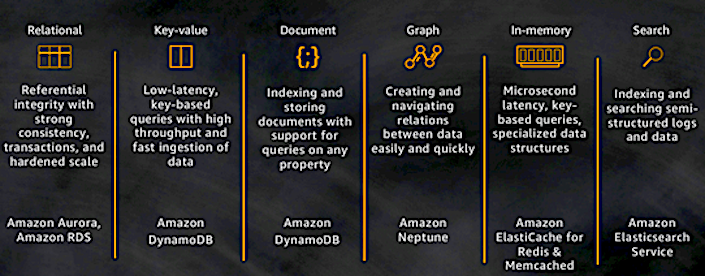

In any case, Vogels explained how Amazon itself came to the conclusion that it couldn’t depend anymore only on relational databases, which are collections of data with predefined relationships between them, organized as a set of tables with columns and rows.

Amazon built its own DynamoDB “key value” database when it ran into scaling issues during the 2004 holiday season that resulted in some high-profile outages. It realized that about 70 percent of its operations were so-called key-value lookups that didn’t require looking up lots of data in rows. This simpler kind of database, which stores data in a way more like a dictionary or map than rows and columns, allowed for more scaling-up of operations with faster access for applications such as gaming, digital ad serving and the “internet of things.”

Since then, Amazon, often building on the rise of alternative open-source databases, has started offering more flavors of data stores. They include an in-memory database called Amazon ElastiCache that enables very fast response times for applications such as real-time analytics and leaderboards and an Elasticsearch Service that is built for near-real-time visualizations for software troubleshooting and price optimization. Expedia Inc., for instance, uses more than 150 ES “domains” involving 30 terabytes of data and 30 billion documents for these purposes.

And a graph database called Neptune that was introduced last fall at AWS’ re:Invent conference was made generally available on May 30. Thomson Reuters Corp., for one, uses Neptune to help companies navigate the thicket of complex global tax policies, while others use it for fraud detection, in-game offer recommendations and other applications.

Not least, Amazon has its own cloud relational database called Aurora, since it’s clear they still have enormous utility for many applications. Indeed, in April, AWS said Aurora is the fastest-growing service in AWS history, doubling the number of active customers in the past year.

More generally, Vogels contended, AWS’ own enterprise customers were looking for alternatives. “With many of our enterprise customers migrating from on-premises into the cloud, there’s a desire to move away from commercial databases, mostly because of the licensing restrictions and the lack of control over the cost.”

Now, he noted, a lot of companies are using multiple Amazon databases for various parts of their business. “What we’re seeing in AWS customers is they’re using a multiplicity of databases,” he said. “They’re looking for the best tool for each application, or maybe multiple tools.”

For instance, Airbnb Inc. uses DynamoDB for storing users’ search history, ElastiCache for storing site sessions for faster site rendering, and MySQL on another AWS relational database, RDS, as its main transactional database. Besides Elasticsearch, Expedia also uses Aurora, ElastiCache and Amazon’s Redshift data warehouse.

Still, AWS may have a bit of a selling job for companies looking to move more jobs into the cloud. Jonathan Lacefield, director of customer experience and graph solutions at graph database firm DataStax Inc., told SiliconANGLE late last year that the new databases do require applications to be rebuilt, and in a different way from those that use relational databases.

“The biggest challenge is education; there is another way, but it means learning something new,” Jim Webber, chief scientist at the graph database maker Neo4j Inc., also told SiliconANGLE. “If all I’ve got is a hammer, then every problem is a nail. Relational is a beautiful hammer.”

Vogels said he thinks there will be more kinds of databases developing in the future to accommodate further innovation in information technologies.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.