APPS

APPS

APPS

APPS

APPS

APPS

Worried investors hammered shares of Facebook Inc. late today as the social media giant missed second-quarter earnings forecasts and user growth flagged.

Facebook’s stock dropped just over 9 percent during after-hours trading after the earnings report came out. By the end of the earnings call, the drop worsened substantially, to nearly 20 percent, to about $174.20.

Update: Shares fell almost 19 percent Thursday, erasing almost $120 billion from the company’s market value, believed to be the largest absolute one-day drop in stock market history.

During the call, executives revealed that they expect revenue growth to decelerate over the next few quarters because of increased attention on business challenges such as customer security, community growth and long-term investment strategies that don’t make money.

“Deceleration such as management guided towards suggests that while the company is still growing at a fast clip, the days of 30 percent+ growth are numbered,” Pivotal Research Group analyst Brian Wieser wrote in a note to clients.

Facebook reported a second-quarter net income of $5.12 billion, at $1.74 share, up from $3.89 billion, at $1.32 a share, a year ago. Revenue came to $13.04 billion, up from $9.16 billion last year. However, analysts surveyed by FactSet predicted $13.34 billion, at $1.71 a share.

The earnings report also shows that the company missed user acquisition predictions by about 1 percent, but that’s an especially closely watched metric. Facebook came in at 1.47 billion daily active users, while analysts predicted 1.49 billion Facebook also reported 2.23 billion monthly active users, with analysts expecting 2.25 billion. This shows usage growth to be about 11 percent from last year, missing the prediction of 12 percent.

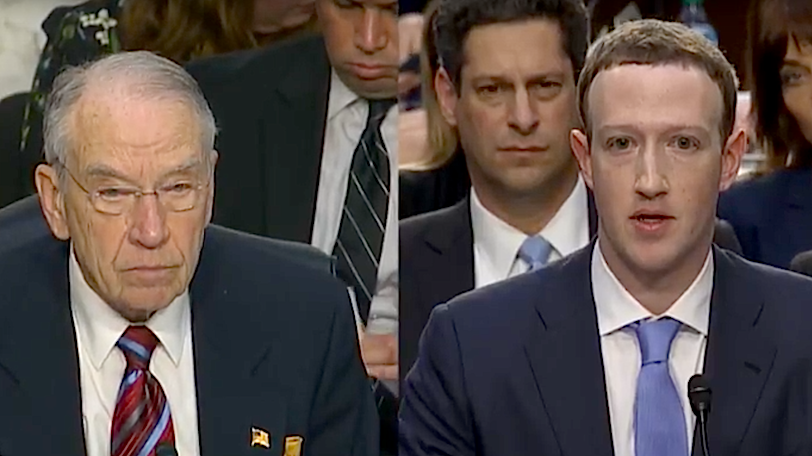

Trials and foibles by the social media company during 2017 led many to predict a reduction in the domestic usage of Facebook’s core services in the U.S. Then news of private data leakage during the Cambridge Analytica scandal caused widespread concern and Chief Executive Officer Mark Zuckerberg (pictured, right) proceeded with an apology tour and vowed increased privacy standards.

Facebook executives also commented that the new General Data Protection Regulation law in Europe contributed to the suppression of some user engagement in that region. The GDPR puts the onus for data privacy and security for users onto online services that collect private data, which includes social media sites such as Facebook.

Although the implementation of GDPR did not affect ad revenue this quarter, since it has only just gone into effect, it is expected that some privacy control changes may have a modest effect on revenue in the coming quarters.

Mobile advertising revenue represented approximately 91 percent of Facebook’s advertising revenue for the second quarter, up from 87 percent of advertising in the same period of 2017. The company reported $13 billion in advertising revenue, up from $9 billion last year.

Zuckerberg spoke to what the company has done to increase transparency, privacy and security for users. Advertisements are now labeled and archived, and advertisement transparency will show what publishers have paid and if they are related to political events. This would allow users, and businesses, to better understand the history and nature of advertisements appearing in their feeds and on their pages.

He said Facebook is making progress against the spread of misinformation and making it harder for people to create fake accounts and discourage spammers who use Facebook to spread bad information with an economic interest.

“We are taking a broader view of our responsibility and investing to make sure our services are used for good,” said Zuckerberg. “But we also need to keep building new tools to help people connect, strengthen our communities and bring the world closer together.”

Zuckerberg vowed to continue to invest heavily in security and privacy with an interest to keep people safe. He also mentioned that because Facebook is investing so heavily in security, it would impact the company’s revenue and that this was apparent already this quarter.

Revenue growth is expected to slow down over the next few quarters thanks to a greater focus on user security and the impact of GDPR. Executives also believe that by putting more focus on products such as Facebook Stories, a feature similar to Snapchat where photos and videos vanish in 24 hours, which doesn’t generate as much money as other parts of the site, will be a long-term goal but affect short-term revenue.

All this clearly spooked investors, but some analysts welcomed the move. “We believe that management comments were born of recent internal long-term planning/budgeting and that FB is potentially planning structural changes to shore up its ecosystem for the LT,” Macquarie Research analyst Ben Schachter wrote in a note to clients. “This should be welcomed, because in our view, the LT trajectory is not on solid ground, as growing privacy issues, ramping government regulation and ever-evolving user habits present LT existential threats to FB’s health.”

In the realm of virtual reality and augmented reality, Zuckerberg said the company intends to keep investing and has shown its roadmap with the Oculus Go headset. The hardware is “off to a good start,” he said, commenting that at a price tag of $199, it will become the way that many consumers experience virtual reality for the first time.

Chief Financial Officer Dave Wehner said he expects that Facebook’s investments in AR and VR will be a long-term view and look to change the future of computing. Although those investments will not bring in short-term revenue, he said it’s an important part of Facebook’s roadmap for eventual growth.

With reporting by Robert Hof

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.