INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

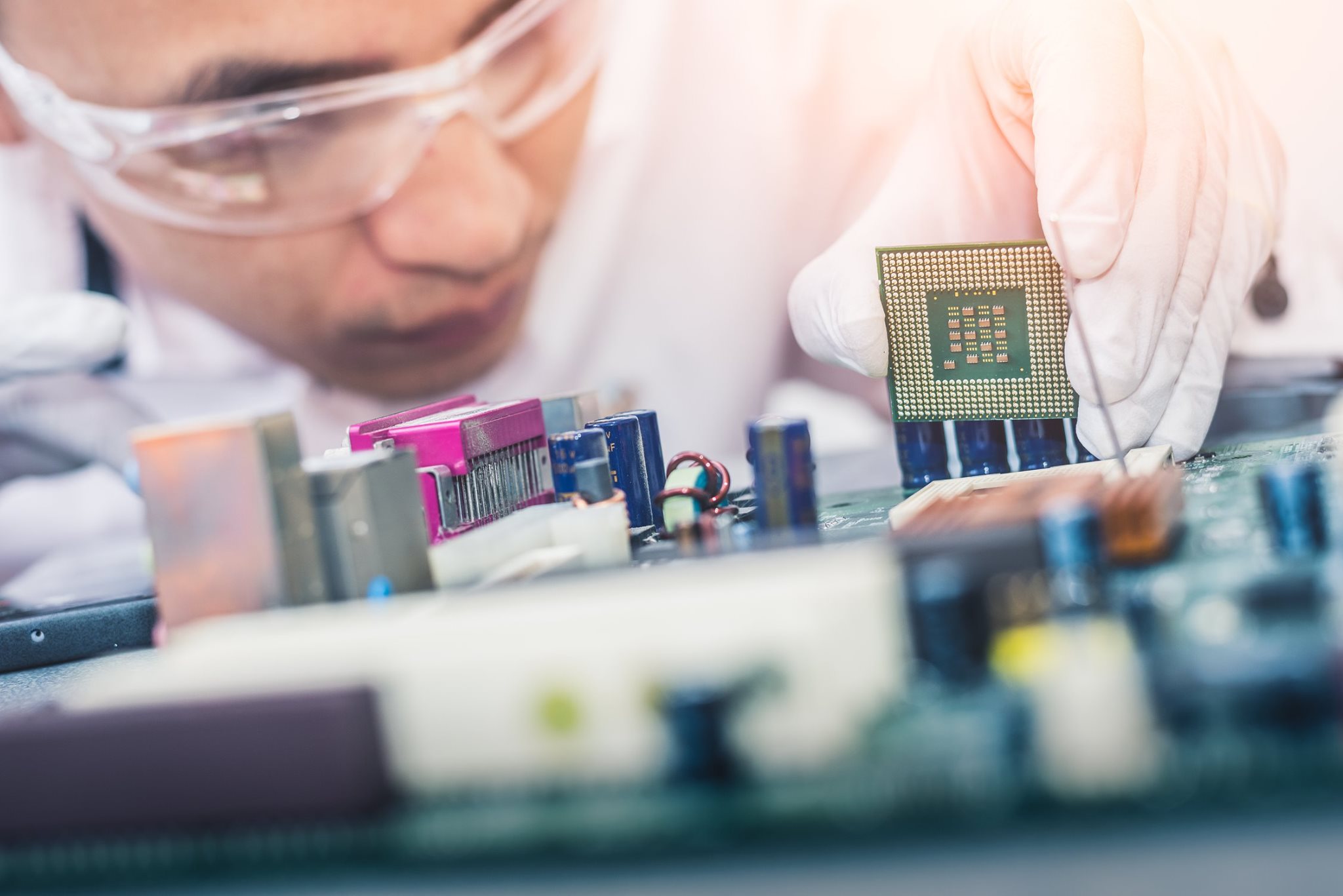

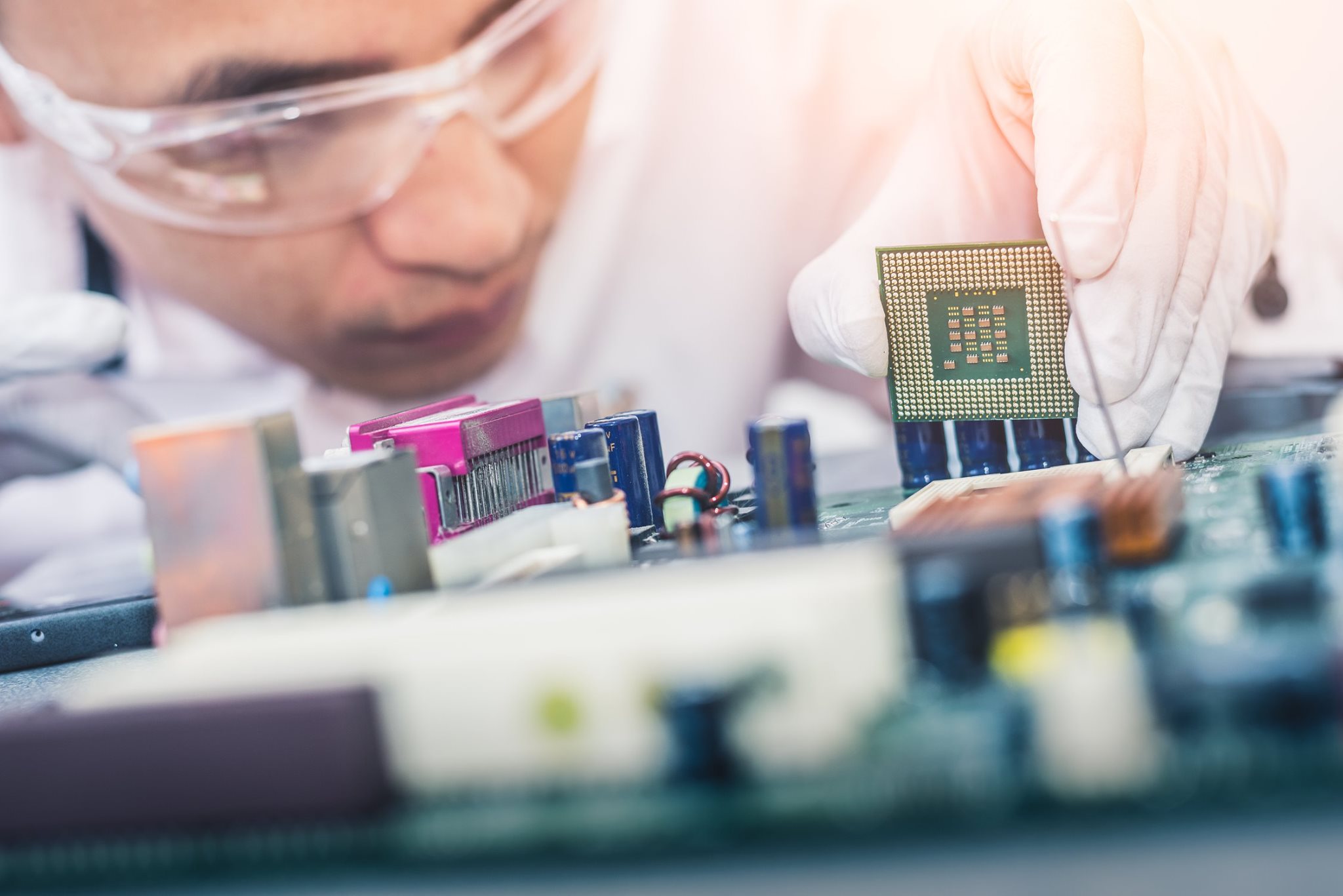

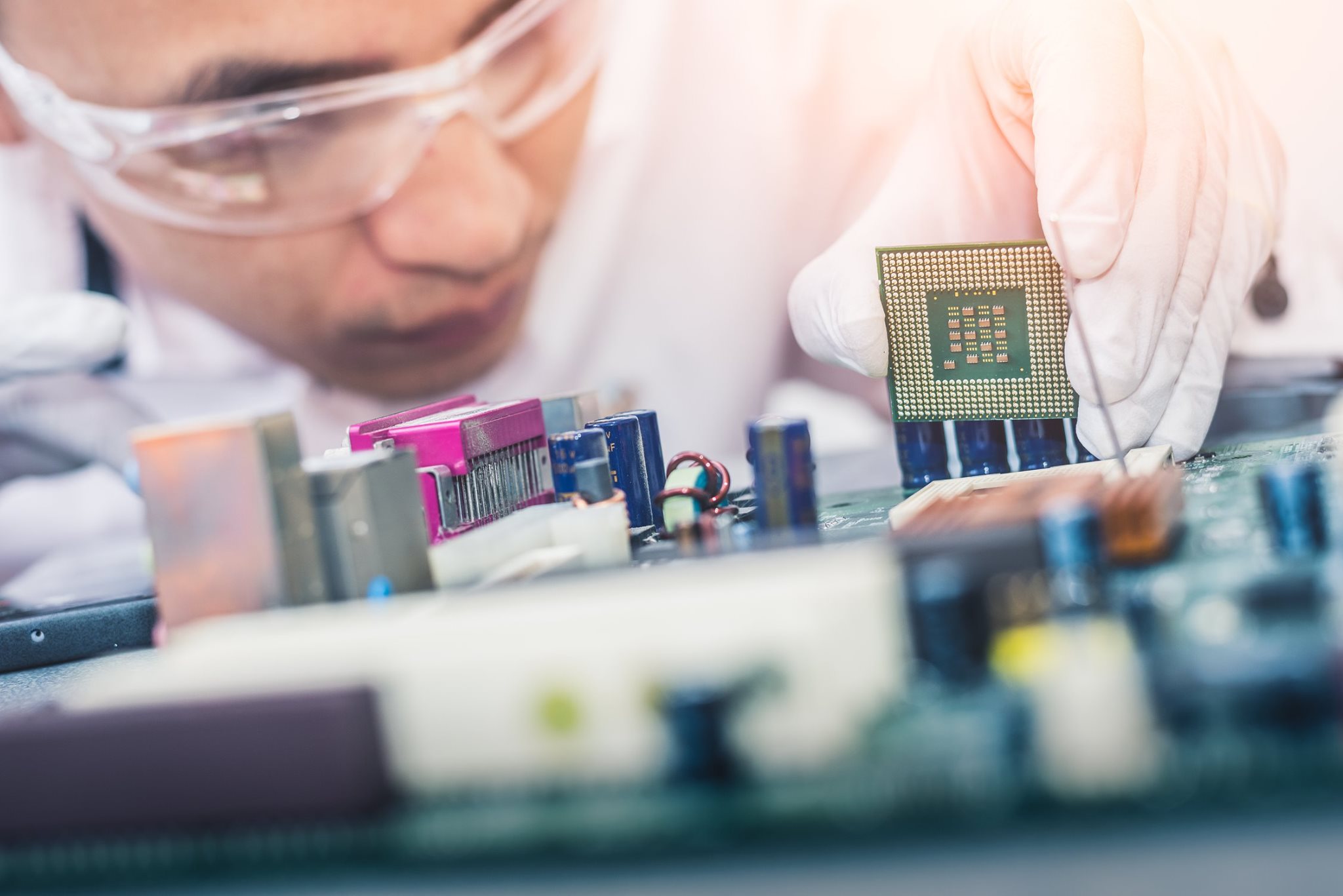

Computer chipmaker NXP Semiconductors NV said today it’s buying Marvell Technology Group Ltd.’s wireless connectivity business unit for $1.76 billion as it steps up its bid to grab more market share in the automotive industry.

The transaction is expected to close by the first quarter of 2020, subject to regulatory approvals.

Netherlands-based NXP plans to use Marvell’s Wi-Fi and Bluetooth connectivity products to enhance its edge computing platforms, which it sells to clients in the automotive, communication infrastructure and industrial markets.

The chipmaker said there’s a big opportunity here, as Marvell’s wireless business pulled in $300 million in revenue in fiscal 2019 ended in February, and that number is likely to double by 2022.

The acquisition appears to have been a kind of “Plan B” for NXP, which had expected to be acquired itself by rival chipmaker Qualcomm Technologies Inc. for $44 billion. That deal was announced in 2016, only to be canceled by Qualcomm after Chinese regulatory authorities declined to give their approval.

PiperJaffray analyst Harsh Kumar told Reuters that NXP had been “underinvesting” in Wi-Fi as it assumed it would be able to access Qualcomm’s own technology. But with the cancellation of that deal, Qualcomm remains one of NXP’s main competitors, forcing the Dutch company to do its own thing.

“NXP has a weak Wi-Fi portfolio compared to Qualcomm and needs Marvell’s assets to fill in the gaps to better go after the automotive market,” said Patrick Moorhead, an analyst with Moor Insights & Strategy.

NXP said it intends to cross-sell Marvell’s products to its own customers once the acquisition has been completed.

The deal makes sense for Marvell too, since it has been more focused on selling networking equipment since its $6 billion acquisition of Cavium Inc. in 2017.

Holger Mueller, an analyst with Constellation Research Inc., told SiliconANGLE that acquisitions, including failed ones, tend to shape the semiconductor industry in a way that’s felt more keenly than in other technology industry segments.

“The Wi-Fi business was too big to stop but too small to thrive, and so voila, we have a non-acquisition and a real acquisition that leads to another acquisition,” Mueller said. “The chip industry monopoly game is in fill swing.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.