INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

In the winter of 1984, four executives from California, wearing suits and ties, presented to a group of market analysts in a smoke-filled boardroom in Framingham, Massachusetts. From a startup called Teradata Corp., the executives were unveiling under a nondisclosure agreement a new “Database Computer” that connected to the backend of an IBM Corp. mainframe and offered better performance than conventional databases.

The system was modern for its time. Everything was integrated, including several Intel Corp. microprocessors with access to a farm of 475-megabyte Winchester disk drives. There was a dedicated, high-speed internal switching network with a homegrown file system, a database management service and a SQL query language. The system could manage databases up to a whopping 1 terabyte. This was the first successful instantiation of a highly specialized, integrated, converged or engineered system and it marked the early signs of a future trend.

Years later, Acadia was announced as a joint venture between EMC Corp., Cisco Systems Inc. and VMware Inc. The group used the term “Converged Infrastructure,” claiming to be the first to combine compute, storage and networking into a single managed unit. In reality, this had been done 25 years ago by Teradata and, notably, the previous year by Oracle Corp.

At the 2008 Oracle OpenWorld conference, Oracle announced the HP Oracle Database Machine. It marked the first version of Exadata (pictured), built specifically to run Oracle’s iconic database. Almost exactly one year later, after Oracle announced the acquisition of Sun Microsystems Inc., Oracle unveiled the Sun Oracle Database Machine.

It was technically Version 2.0 of Exadata but marked the end of the tight Oracle-HP partnership and the beginning of a new strategy architected by Oracle founder Larry Ellison, now chairman and chief technology officer. He called it Engineered Systems.

Oracle’s acquisition of Sun completely changed the dynamic in the company’s ecosystem. No longer was Oracle a friendly face to any hardware platform that could make its software run faster. Oracle was now a competitor to the infrastructure companies that for decades were partners with Oracle.

And not just casual competitors who talked about co-opetition. Oracle aimed to dominate completely across the entire hardware and software stack and squeeze its former hardware partners out of its core markets. Hewlett Packard Inc., EMC, Dell, IBM and any other player wanting a piece of the Oracle “Red Stack” was now on the outs.

Oracle last week announced the Oracle Exadata Database Machine X8, on the occasion of Exadata’s 10th anniversary. Technically Exadata is 11 years old, but if you start the clock at Exadata V2, the timing works.

Oracle said the X8 system includes new hardware and software enhancements. On the hardware side, these include new Intel Xeon processors and PCIe NVME flash components that increase performance by not only speeding up compute, but eliminating many of the bottlenecks associated with traditional storage I/O protocols.

On the software front, the company is touting the Oracle Autonomous Database as the “first self-driving database.” Oracle is highlighting its machine learning capabilities such as Automatic Indexing that “continuously learns and tunes the database as usage patterns change.” Oracle claims these additions improve performance and eliminate manual tuning.

Not least, Exadata played a role in the upside reported Wednesday in Oracle’s fourth-quarter earnings.

SiliconANGLE secured two exclusive interviews with key Oracle executives involved in Exadata development and go-to-market strategies to get their perspectives on the evolution of Exadata, its performance in the market and impact on the industry, including the competition.

One is Juan Loaiza, executive vice president of mission-critical database technologies at Oracle, reporting to Ellison. Loaiza leads product strategy, product development and product management. He left the MIT doctoral program to join the Oracle Database engineering team in 1988 and has an in-depth understanding of the history of Oracle and the industry at large.

The other is David Donatelli, executive vice president for worldwide sales and marketing strategy for Oracle Cloud solutions and the company’s on-premises infrastructure portfolio, reporting to Chief Executive Mark Hurd. Donatelli, spent 22 years at EMC and became the president of the company’s largest division. He also ran Hewlett Packard’s server, storage and networking business under Hurd before coming to Oracle. Donatelli actually coined and popularized the term “converged infrastructure.” He has deep product and industry knowledge spanning parts of four decades.

We also tapped the research team at SiliconANGLE Media Inc.’s sister market research firm Wikibon to get input from their analysts and the many Exadata customers they’ve interviewed over the past decade.

According to Loaiza, 77% of Global 100 companies run Exadata and that number is really 85% if you exclude the companies that compete with Oracle, such as Hewlett Packard Enterprise Co., Dell and Google LLC. One might argue that firms like Google wouldn’t ever build its platform on top of Exadata, but it’s clear that Oracle’s strength is in serving the world’s largest customers.

The interview kicked off from what Donatelli told SiliconANGLE about the newest Exadata: “In terms of our technical gap, as it relates to what we’re doing to save people money and offer better performance and move them to the cloud, we probably have our greatest product and technical differentiation in the history of Exadata.”

Q: People don’t typically associate Oracle with saving money.

Donatelli: Don’t take my word for it. Talk to our customers. They’re seeing dramatic improvements in total cost of operations. For me, having the experience of starting this way back in the early 2000s, just bolting together a bunch of hardware, it’s nice but it doesn’t do nearly as much for your operational costs as Exadata does.

Q: How is that translating to business results? Many people are saying that Exadata has run its course and its momentum is slowing.

Oracle’s David Donatelli (Photo: SiliconANGLE)

Donatelli: That’s just not accurate. If you look at the data we’ve set all-time selling records for Exadata. There are companies with over 100 Exadatas now. And when I say all-time record, that’s for the on-premises version. If you add in Exadata Cloud at Customer and the Cloud version, that’s incremental on top of that.

Q: Juan, where did Exadata start?

Loaiza: The initial concepts started more than 15 years ago. Originally we were focused on solving data warehouse problems to improve the performance and economics of storing and analyzing large volumes of data. We’ve evolved that vision over the past decade and now are running complex business applications like SAP and Oracle Fusion apps on Exadata. So we’ve evolved from the early days and now are running a variety of workloads on premises, in the public cloud as a service and also Exadata Cloud at Customer. So we’ve advanced rapidly and have been very successful.

Q: How successful is cloud? Many people point to the lead that hyperscalers such as Amazon Web Services Inc. and Microsoft Corp. have in cloud. How has the adoption been for Exadata in the cloud and what’s blocking and/or driving adoption?

Loaiza: Twenty-five percent of the Global 100 has adopted Exadata in the cloud over the last two years. What’s driving that is the customers are comfortable with Exadata and the fact that they can get the exact same technology on-premises or in the cloud. Exadata on-prem is proven and it naturally will take some time for people to move to the cloud. We’ve had a 50-year run of on-prem with a large installed base of storage, switches and servers, so it will take time.

Q: Given the inertia, how would you describe Oracle’s strategy?

Loaiza: Well it’s sort of self-evident, but we want to build the highest performance, the most available and most reliable products and services for our customers. And we want them to be able to consume these services on-prem, in the cloud or in a hybrid approach. Our strategy is not an “either-or.” Many workloads are applicable for the cloud and many are applicable on-prem. We want to serve both.

Q: Dave, can you add anything to the pace of adoption, specifically as it relates to Exadata?

Donatelli: In the early days, a customer would install a system or maybe two. But what’s really happening is a transformation where customers are taking in tens or dozens of units that are helping their entire Oracle Database environments. And the reason is they’re smart business people: They like the technology, they like the ease-of-use, they like the ability to patch everything at once and they like the path we give them to the cloud.

Q: Is the adoption primarily existing customers or are you able to attract new logos?

Donatelli: It’s actually a tremendous number of new logos, which is great, but in terms of volumes, customers who might have just had Exadata for a particular application or department are really starting to expand across their environments. Multiple lines of business are investing in Exadata in a single organization. And what’s powerful is it’s given us the ability to help customers grow into a cloud strategy because of our Same:Same approach.

Plus Oracle Exadata is the one technology that has proven itself both in the cloud at scale and in large-scale enterprise on-premises environments. No other system from any vendor has successfully made the leap to the cloud or is powering a major public cloud at scale.

Q: Can we come back to the points on differentiation? Your competitors would argue that Oracle is narrowly serving its own goals by locking customers in to its technology; but the world is heterogenous and you’re not serving the needs of those customers who require multivendor support.

Donatelli: Exadata is specifically designed for an Oracle environment. I think what you’re really asking about is the tradeoff of horizontal versus specialized. The argument on the other side of the fence is, “Hey, I’m going to run slower, it will be harder to patch and everything else, but you can run multiple applications on top of us.” That’s their argument.

Q: That’s not quite how your competitors would tell the story.

Donatelli: Well, that’s the reality. Customers find that Exadata doesn’t lose performance comparisons when it comes to Oracle Database. Running Oracle Database on any other hardware means you’ve made the decision to live with degraded performance, higher costs, reduced security and far less scalability.

Q: Juan, can you validate this from a technical and development perspective? What is the secret sauce and can you give an example?

Oracle’s Juan Loaiza (Photo: SiliconANGLE)

Loaiza: The magic is in the integration. We own everything. We understand the database needs and can optimize everything from the compute, storage and networking. We re-designed all the interfaces and the software — not just reading and writing blocks. One example is RDMA, which allows much faster communications with low latency. Another huge differentiator for us is Autonomous.

Q: Explain that please, Juan. With all the AI hype out there, can you give some detail and give us confidence this is real innovation resulting from R&D? For example, is this a capability that Oracle has built or are you using industry machine intelligence and bolting it on?

Loaiza: We build the whole stack in-house, including the AI and ML. Autonomous is like a self-driving car. If you make cars, you better be working on self-driving. It’s the same with database. Automation frees up talent, it drives better availability, performance, lower cost, improves security and availability. We are automating everything, the database, the storage, the servers the network and everything underneath. This gives customers a huge advantage.

Q: Talk more about the machine learning capabilities. What specifically are you doing and how are you applying ML?

Loaiza: There are two parts to that. First is the ML that Oracle uses to make the database autonomous — the indexing, the tuning, diagnostics, predictions…. They’re all autonomous. Second is how we’re applying the machine learning algorithms. They’re specifically focused on solving problems that enterprises care about rather than consumers.

Q: OK, but AWS, Google and Microsoft have very strong AI capabilities, they are much larger in the cloud than Oracle and they all develop their own database technologies. What’s different and why do you think you can sustain your lead relative to the hyperscale companies?

Loaiza: Exadata is different. It’s customized for the database software. We do special things like push the database query processing into storage. We optimize the entire stack from the processor, persistent memory, flash storage, the network, RDMA — again, the magic is in the integration. The cloud vendors just look at database as another app running on top of servers.

Q: OK, but the cloud guys would say their underlying infrastructure is superior and that would offset the advantages that you claim to have.

Loaiza: We’re seeing adoption across virtually every industry — banks, telecomm, you name it. Plus we’re giving customers the option to run on-prem, in the cloud or a combination of both with Exadata Cloud at Customer.

Q: What about Amazon Outposts? That’s a clear move to offer customers more choice along the lines of what you’re proposing.

Donatelli: I think imitation is the sincerest form of flattery. And we’ll wait for what actually gets shipped to see.

Q: Dave, any last thoughts that you’d care to share?

Donatelli: Our vision is to offer the most complete cloud in the industry. We think simplifying the customer experience and giving them the ability to run their entire business on-prem or in the cloud — or both — with the same hardware and software is unique to Oracle and we believe this is very important to customers. And the technological gap we’ve created relative to our competitors has never been bigger.

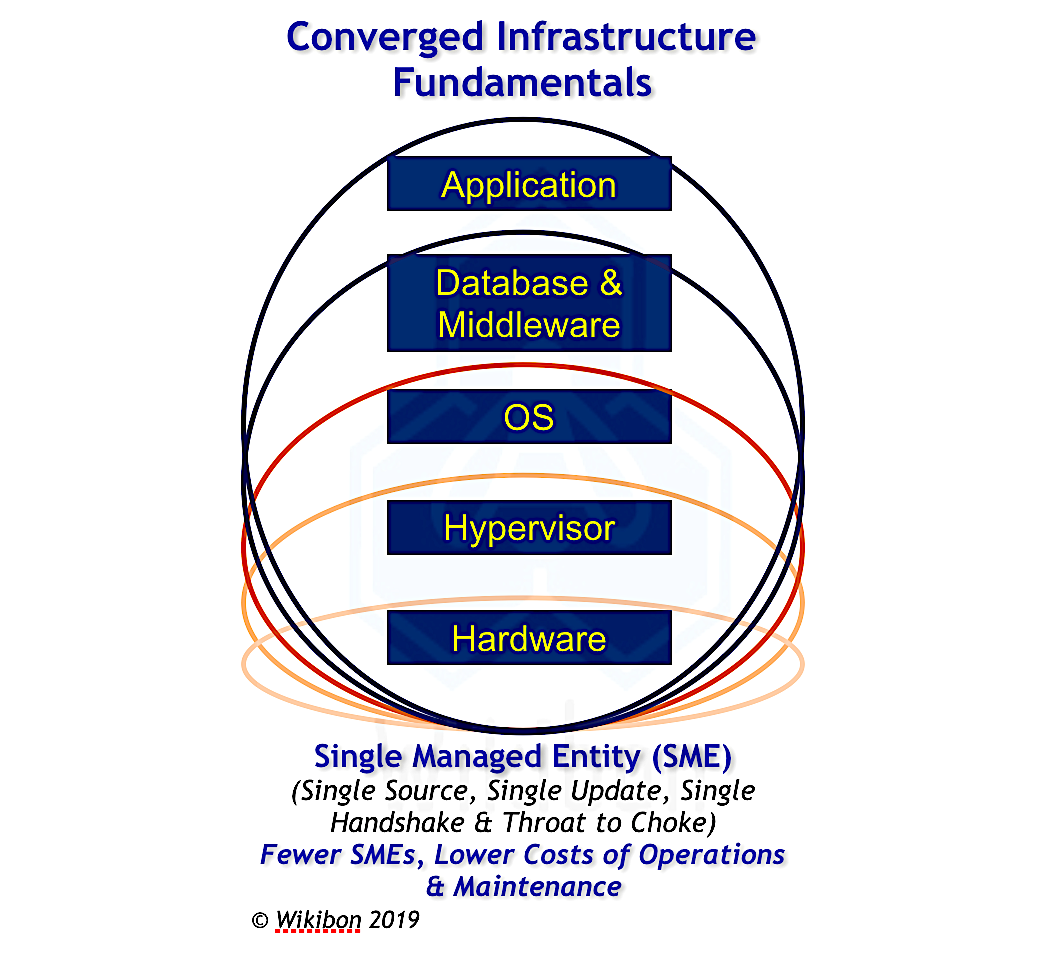

Wikibon has consulted with many hundreds of Exadata customers in its community and has done extensive research with Oracle practitioners since the early days of Exadata. These customer conversations confirm research produced in Wikibon’s economic models and are highlighted in the chart below. The ellipses show the potential for value capture.

A key takeaway is that the further up the stack you integrate, the more value a customer can potentially extract. Although the risk of lock-in grows, over 90% of customers interviewed suggest that the value created from Exadata offsets the exposure of lock-in.

As one Exadata customer in the Wikibon community said, with Exadata, “we are coming out of a reactive model. We have more time to be proactive and stay ahead of the curve. We are able to provide more value to our developers and application teams. Putting the database on Exadata sometimes we’ve seen 16-20 times better performance on the same process–without touching anything. This frees up a lot of time spent tuning and patching. Prior to Exadata the only reason we upgraded is because our maintenance was running out. But now we’re able to take advantage of new features that add value to our business and it’s a much better experience.”

Oracle’s strategy of building its own public cloud puts it in a unique position in the industry. Of the traditional enterprise players, only IBM and Oracle have a cloud strategy that has survived the early panic and missteps within the vendor community. Two notables: Hewlett Packard launched and quickly killed its public cloud. VMware had several starts and stops and finally capitulated and formed a widely publicized deal with AWS around cloud.

Oracle is not likely ever to achieve the infrastructure cost structure of AWS or Google. The hyperscalers spend more on capital spending to build out data center infrastructure in a single quarter than Oracle does over many years. Oracle’s advantage is that it can subsidize its underlying hardware costs with margins from its database and applications businesses.

From a business model perspective, Oracle is a low-growth cash machine. Its operating margins are among the industry’s best, in the mid- to high 30% range. Its cloud business, however, is not growing fast enough to offset the decline in its legacy business.

In addition, as it shifts to more of a subscription model, the income statement will see the effects in the form of lower revenue relative to a perpetual license model. As result, until Wall Street values cash more than growth, observers should expect Oracle to continue to allocate significant capital toward stock buybacks and dividends.

This strategy is viable to the extent the stock is undervalued. The risk is that generally the Street’s sentiment flip occurs after a downturn. In other words, it’s likely that market sentiment won’t change until stocks enter a bear market — suggesting that would be the best time to buy the stock, rather than today when the market has run up over the past 10 years, fueled significantly by growth companies.

Finally, from a customer perspective, especially for on-prem environments, Wikibon research shows that as much as Oracle markets the “plug-and-play” aspects of Exadata, practitioners tell us they still need to keep their infrastructure teams in the loop. The database team can’t just set it and forget it. Datacenter operations and networking teams still need to be involved.

There is significant work around how, for example, connections are made, top of rack switches connect into networks and more. At the end of the day, it’s still an Oracle database and it’s up to the customer to figure out the best way to apply it to their business. Database analysts remain critical and aren’t going away.

With regard to the cloud, Wikibon research shows that Oracle customers generally indicate it waited too long to adopt and enact a cloud strategy. Part of this is because Oracle’s cloud has evolved more slowly than the hyperscalers. Nonetheless, the sentiment of “there’s no security in the cloud” has given way to “security in the cloud is better than security in our backyard.”

Most customers believe that long-term, the number of data centers that they build will moderate and decline. Solutions such as Oracle Cloud at Customer are a stepping stone and offer a logical path for customers to move.

There are uncertainties. Oracle’s recent announcement to team up with Microsoft appears to be an attempt to slow down AWS’ momentum, hewing to the saying, “The enemy of my enemy is my friend.” And the database wars between Amazon and Oracle will not end soon. Wikibon believes that high-value traditional applications running on Oracle will likely remain on Oracle because the business case to move is not compelling and very risky.

When Oracle acquired Sun Microsystems, most of the world expected Larry to sell it off. He had other designs in mind — namely to take Steve Jobs’ vision of an integrated hardware and software design into the enterprise. The alternative would have been to sell Sun and take a partner ecosystem approach. It’s hard to imagine that the latter strategy would have put Oracle in a better position than it is today.

THANK YOU