SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Palo Alto Networks Inc. is moving into the fast-growing connected device security market with the acquisition of Zingbox Inc., a startup hatched at Stanford University that uses machine learning to detect hacking attempts.

The deal, announced Wednesday afternoon, is worth $75 million. It follows Palo Alto Networks’ announcement of two other startup acquisitions in May that were together worth more than $410 million. Earlier, the network protection provider bought Demisto Inc. for $560 million.

With Zingbox, Palo Alto Networks is gaining a suite of tools called IoT Guardian that allows companies to put up multiple layers of security for their connected devices. The suite is built around a threat detection engine that uses machine learning to spot suspicious activity. It learns how a company’s systems behave and raises the alarm whenever an endpoint starts exhibiting unusual activity patterns that may be the result of a breach.

The other tools in the suite serve complementary roles. IoT Guardian includes, among others, a service called Vigil that alerts a company if other Zingbox customers with similar devices are being targeted by hackers. There’s also a microsegmentation tool that allows administrators to limit communications between systems, which helps contain the damage in case hackers somehow breach the network.

Zingbox claims it’s protecting more than 11 million devices for organizations in sectors such as healthcare and manufacturing. Those customers will now move over to Palo Alto Networks as part of the acquisition, though it appears the company is mainly interested in the startup’s technology.

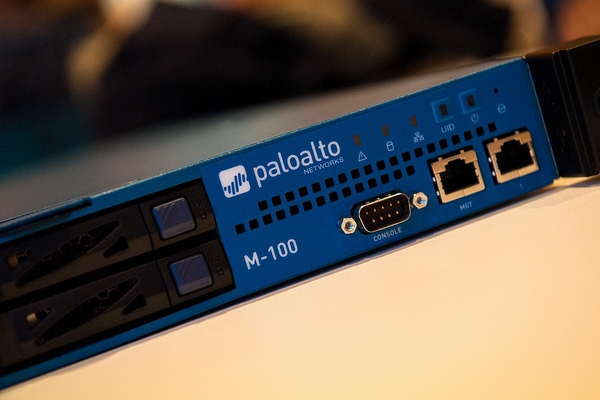

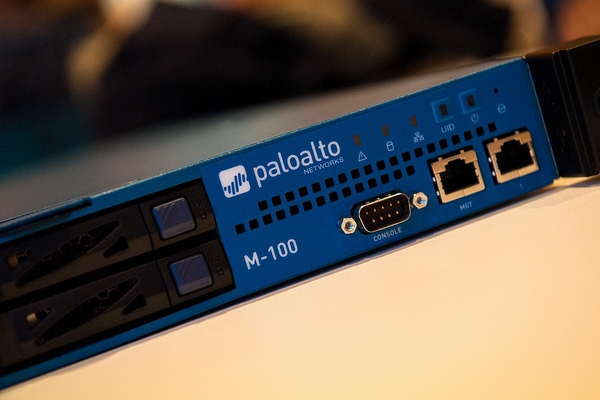

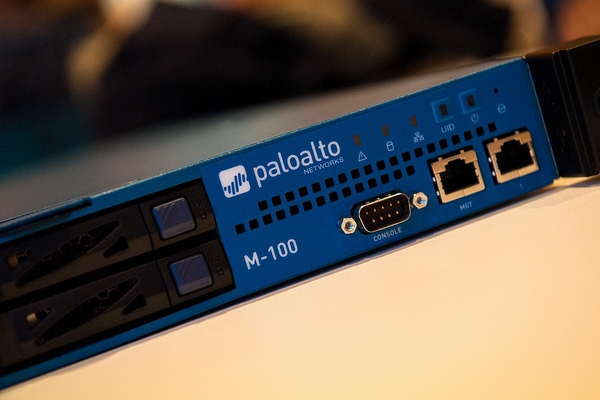

Palo Alto Networks plans to integrate IoT Guardian with its Next-Generation Firewall and Cortex threat detection service. Zingbox’s tools will continue to be available on a standalone basis after the deal completes, which will happen later this quarter if all goes according to plan.

“With the proposed acquisition of Zingbox, we will provide a first-of-its-kind subscription for our Next-Generation Firewall and Cortex platforms that gives customers the ability to gain control, visibility, and security of their connected devices at scale,” Palo Alto Networks Chief Executive Officer Nikesh Arora said in a statement.

The company announced the deal shortly after posting better-than-expected earnings for its fiscal fourth quarter. Palo Alto Networks generated a $20.8 million loss on revenue of $805.8 million, up from $658.5 million the prior year and slightly above what analysts had anticipated. Adjusting for nonrecurring items, earnings per share also beat projections, coming in at $1.47 per share compared with the Zacks consensus estimate of $1.42.

Palo Alto Networks’ shares rose about 6% this morning on the strong results as well as a significant rise in the overall stock market.

THANK YOU