INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Capping a years-long return to form, computer chipmaker Advanced Micro Devices Inc. today reported its highest quarterly revenue since 2005.

It came after its first full quarter of seven-nanometer-process Epyc, Ryzen and Radeon processor sales, but the company’s shares fell slightly in after-hours trading after its guidance for the next quarter came up short.

AMD posted third-quarter earnings before certain costs such as stock compensation of 18 cents per share on revenue of $1.8 billion, up 9% from a year ago. The numbers were more or less in line with Wall Street’s expected earnings of 18 cents per share on revenue of $1.81 billion.

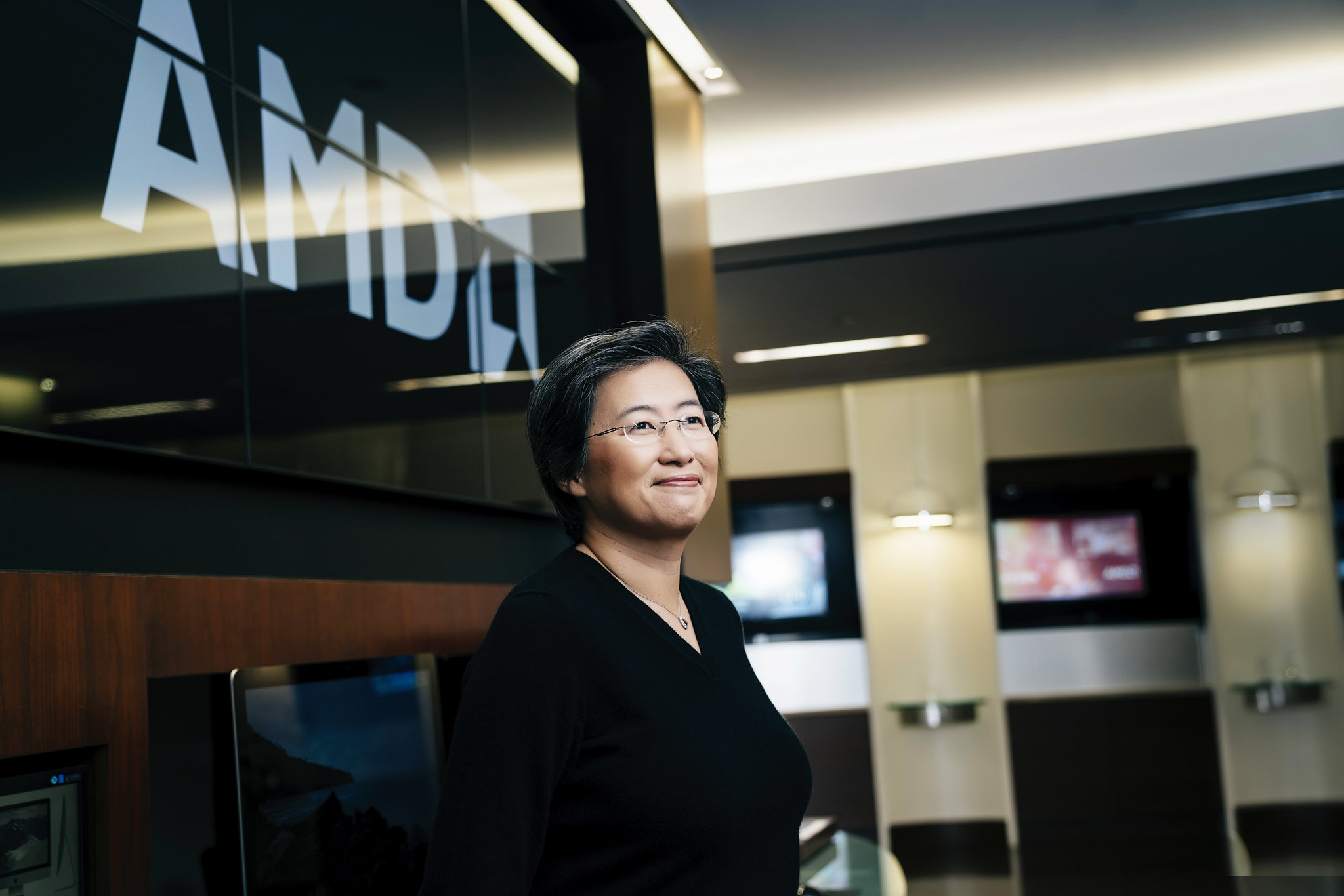

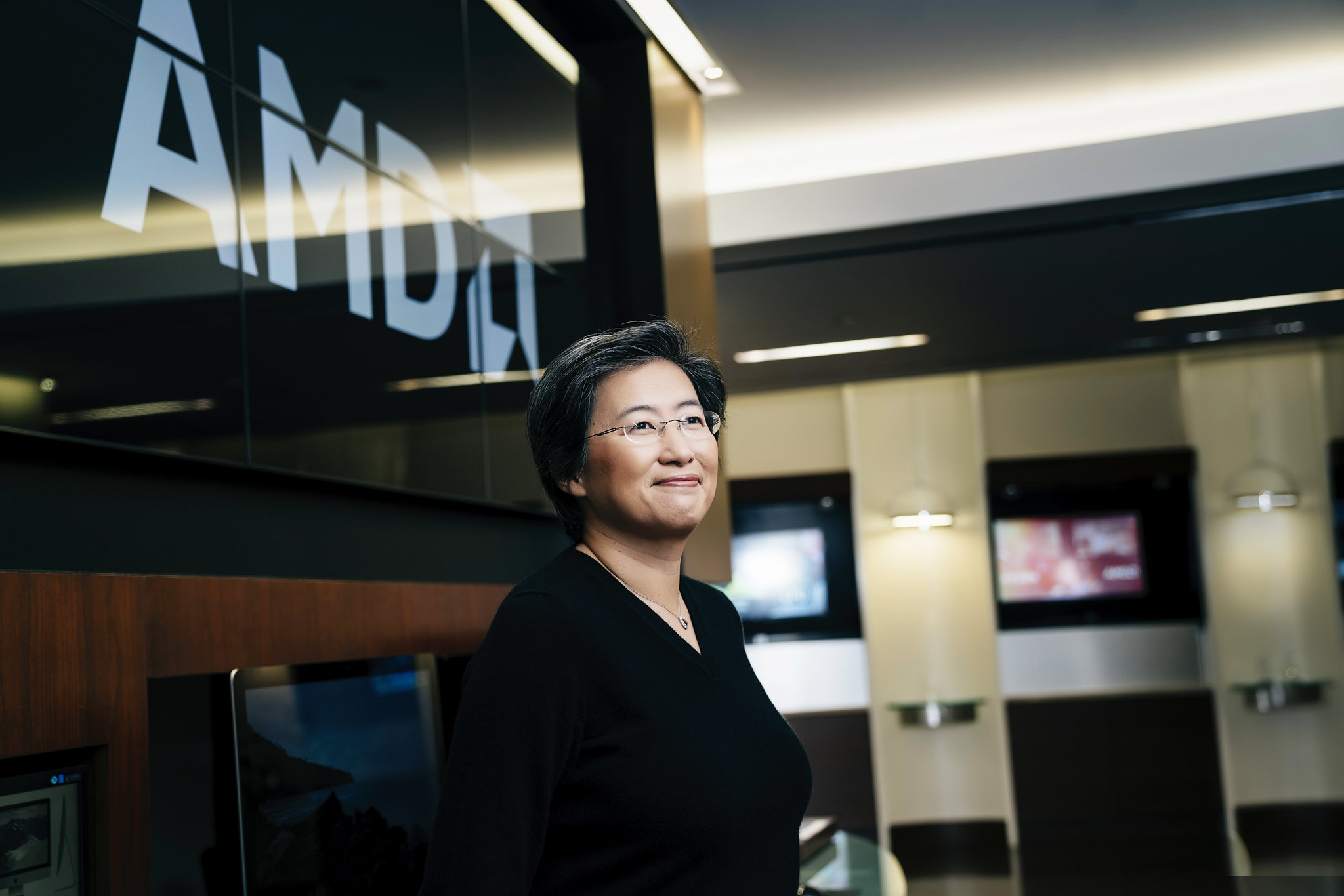

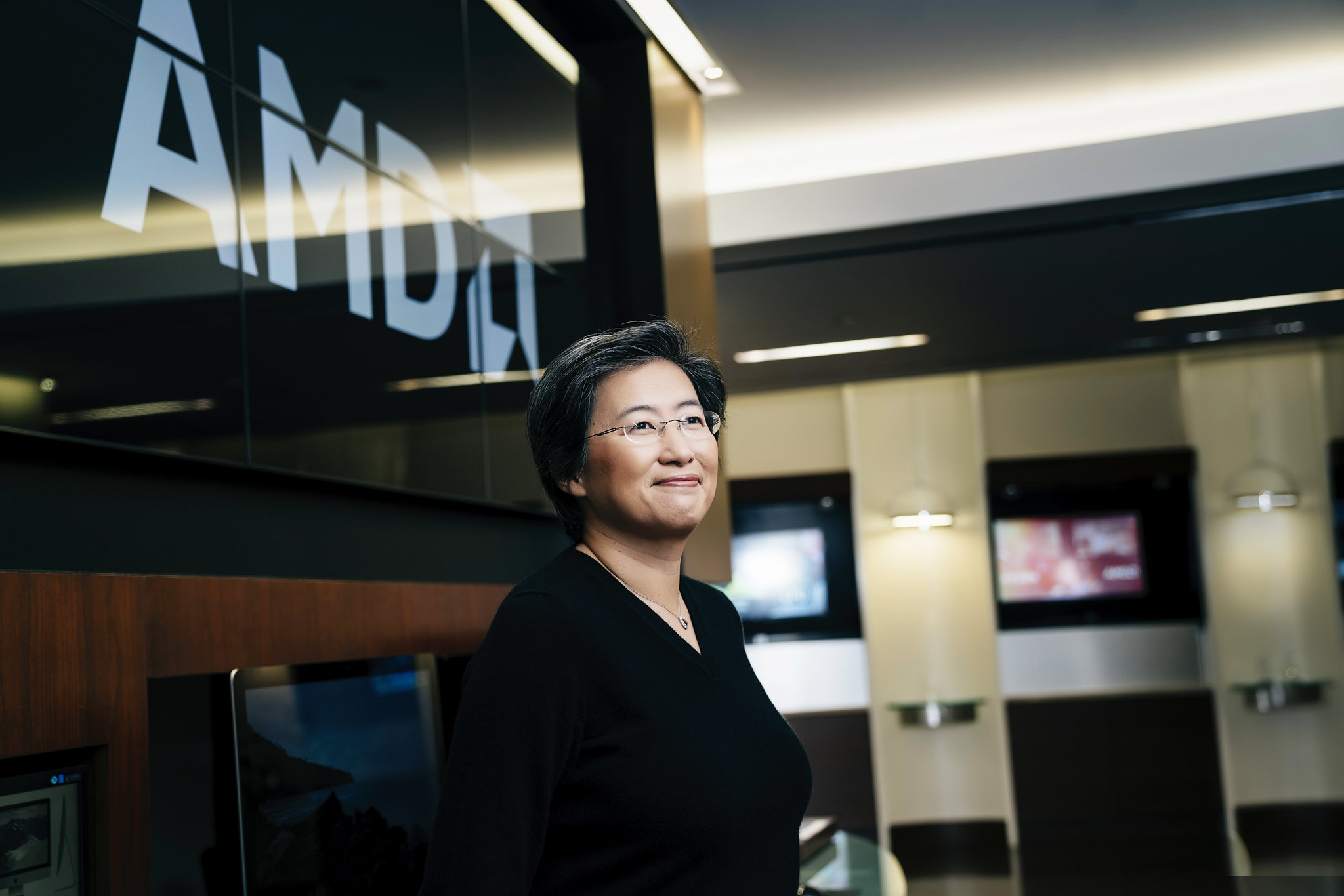

“I am extremely pleased with our progress as we have the strongest product portfolio in our history, significant customer momentum and a leadership product roadmap for 2020 and beyond,” AMD Chief Executive Officer Lisa Su (pictured) said in a statement.

AMD finds itself in somewhat unfamiliar territory as it’s widely perceived to have a strong advantage over its biggest rival Intel Corp. The latter company has struggled come up with processors that can match AMD’s current generation of silicon, which includes its new 7nm Epyc chips for data centers.

AMD launched its second-generation Epyc chips in August, and at the time Su proclaimed they’re the “world’s fastest x86 processors” and would be put to use in data centers operated by both Google LLC and Twitter Inc., among other marquee customers.

The Epyc chips followed the May launch of AMD’s new Ryzen central processing units for personal computers, which are also built using a 7nm process that enables more transistors to be squeezed onto the chip. More transistors means faster calculations and consequently, a much more powerful chip overall.

The new chip have been selling like hot cakes, if AMD’s figures are anything to go by. That much is evident from the performance of the company’s Computing and Graphics business unit, its largest, which saw revenue of $1.28 billion in the quarter just gone, up 36% from a year ago. Ryzen processor sales were the main driver, AMD said.

“We saw particularly strong demand for our top-end Ryzen processors and believe we gained client processor unit share for the eighth straight quarter,” Su said.

AMD’s Enterprise, Embedded and Semi-Custom business unit, which includes the Epyc chip sales, reported revenue of $525 million, down 27% from a year ago. AMD blamed the decline on lower than expected semicustom revenue.

The numbers would have been much worse, however, without the impact of Epyc sales. AMD said Epyc revenue and unit shipments grew more than 50% from the last quarter following the launch of the new chips in August.

Analyst Patrick Moorhead of Moor Insights & Strategy said the results show that AMD is thriving.

“These numbers were driven by the first full quarter for its new 7nm parts, including Ryzen, Radeon and Epyc,” Moorhead said. “Its PC group comprised of Ryzen processors and Radeon graphics led the charge with an eye-popping 36% growth.”

Charles King of Pund-IT Inc. agreed that AMD had a terrific quarter, but said he was more impressed by the company’s growing competitiveness when compared to rivals such as Intel.

“For many years the company focused on creating products that were nearly as good as its competitors’ chips, but sold them at far lower prices,” King said. “Under CEO Lisa Su, AMD has proven that it can take on its competitors head-to-head and often beat them on both innovation and performance points.”

The only real blot on AMD’s sheet was its guidance for the next three-month period, which came in below estimates. For the fourth quarter, AMD said it’s expecting revenue of around $2.1 billion, just shy of Wall Street’s forecast of $2.15 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.