CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Amazon Web Services is in the midst of its biggest reinvention since its founding and the look in Chief Executive Andy Jassy’s eyes is that of a CEO who isn’t resting on his laurels.

Last week, I interviewed Jassy for an exclusive preview of AWS re:Invent, and he revealed new insights into his vision and direction of AWS, candidly talking about the impact on the cloud computing industry, changing customer requirements and the recent surge in competition.

In short, AWS is changing the game in cloud computing and in the process reinventing itself. Amazon has enjoyed, and continues to dominate, the developer and startup information technology landscape, and it has become the standard by which everyone else is measured in the rest of the world including, small and medium-sized businesses, large enterprises and the public sector.

More than 13 years after its founding, AWS has been a thundering machine of growth, industry disruption and success. AWS accounts for 71% of all of Amazon’s operating profit, but now it’s seeing competition approaching in its rearview mirror, while controversies unfold in front of it.

I, along with others from SiliconANGLE and our livestreaming studio theCUBE, have been commenting that AWS, as a fairly new entrant in a multitrillion-dollar, entrenched enterprise IT market, will be challenged and in order to sustain their leadership must continue to innovate. As the cloud market changes industry structures, it is our view that many of the next-generation leaders will be new companies either born in the cloud or existing enterprises reborn in the cloud.

But too much of the discussion is still around which cloud company is winning and which one is losing or who’s eating whom, as opposed to the real business and technological shifts happening in the cloud industry, and who will best enable them.

“We have, by far, the largest enterprise business in this space…. [If anything], the functionality gap is widening,” said Jassy.

Even though AWS has had financial and technical success, Jassy doesn’t think that’s the most important conversation around AWS and the industry. It’s really about how the cloud enables organizations to transform themselves in big ways, no matter their current size.

“I think some of the leaders are going to reinvent themselves and be the solutions of the future,” he said. “And then some of them are going to be brand new startups. Some of whom exist today in a very early stage and many of them don’t exist today.”

Today’s successful company leaders are all investing in cloud technologies as a core foundation for reimagined business models, as shown by market share gains, blockbuster initial public offerings and financial performance. The new business and technology models are much different than those of traditional industry leaders. More and more businesses are delivering their value as software-as-a-service or SaaS applications on the cloud – from financial services to the public sector.

These cloud-enabled companies that are built on the cloud are flipping the script on established industry segments. Stripe, for example, has changed the payments industry. Robinhood is doing the same in the financial services market. Doordash and many more are examples of companies born in the cloud that have taken over markets from older, slower incumbents that haven’t leveraged the cloud.

These and other success stories have led to a cloud computing market that is booming and should top $214 billion in 2019, according to Gartner. Within that market, it has become commonplace by industry analysts to lump together “the big three” cloud providers, as if they’re running at roughly equal speeds.

They’re not.

Microsoft Azure and Google Cloud Platform have carved out reasonable positions for themselves, but they’re investing heavily, trying to keep AWS in sight. Hybrid, for example, is real, but Microsoft and Google seem to push a hybrid approach to try to slow the pace of innovation to meet their speed. AWS has and continues to embrace hybrid, last year announcing AWS Outposts, which gives companies a way of distributing AWS on-premises. “Customers are quite eager to see the general availability of Outposts to aid their migration plans to the cloud,” says Jassy.

This is exactly what Jassy predicted in my 2015 interview. “Our point of view is that in the future, very few companies will own their own data centers, and those still in operation will cover a small footprint,” he said. “The vast majority of workloads will go to the cloud. We’re just at the beginning — there’s so much more to happen.” That’s consistent with what is happening in the cloud market today.

Although the cloud is changing everything, it still only represents just 5.6% of total IT spending, which Gartner projects will hit $3.8 trillion this year. And this is just the beginning, since only 20% of enterprise workloads have moved to the cloud, so there is massive growth to more business moving to the cloud-enabled model.

For enterprises that want to fast-forward to the cloud future, it’s time to think big, and much bigger than they have. It’s not about transitioning to the cloud. Transitions are small, incremental things. For organizations that hope to capture the explosive potential of the cloud, it’s time to think about transformation.

It’s time to embrace the next cloud wave or get crushed by it. That was a key takeaway from Jassy when we spoke at length about what makes cloud so important — and historic. Although he has been saying for years that the cloud will impact all businesses, it’s clear now that his vision for the cloud and AWS’ technical and business models are well beyond what the public cloud is today. Jassy’s vision is an AWS cloud that extends everywhere, there is the need for compute, storage, networking and artificial intelligence that are accessible from anywhere.

Simply put, it’s an “Amazon anywhere” strategy. In the cloud. At the edge. Even in your data center.

But somehow Jassy seems different now. More emphatic. More certain. He’s seen companies dance around transformation, ultimately settling for more piecemeal transitions. One problem with this approach, however, is that the world doesn’t stand still while companies with incremental improvements. The taxi industry, for example, spent years ignoring things that made consumers’ lives easier, like accepting credit card payments or even making it easier to find a cab when needed. While they dithered, Uber, Lyft, Ola, myTaxi and others stepped in and completely changed how ride-hailing works.

Or take Peloton and what it has done for the fitness industry. Or Pinterest and visual search. Or Airbnb and the hospitality industry. Or any number of innovations that came out of nowhere and are in the process of upending established, slow-moving industries that thought “incremental” was good enough.

The cloud has completely “flipped the business and startup model on its head,” Jassy declared. “Enterprises and startups are much more willing to take risks on new business ideas because the cost of trying a bunch of different iterations of it is so much lower in AWS and the cloud.”

For enterprises, this is a new business mode, one that can help them to operate more like the startup – lower costs to start a project, faster product/market fit, agility and low headcount.

“If you’re an existing enterprise and you’re just seeing your world through the lens of your current market segment share, and you’re not thinking that there’s a chance that a startup you’ve never heard of, or maybe doesn’t even exist today, might disrupt your business with a better idea, and you’re not already experimenting and iterating quickly, you’re going to find yourself on the wrong end of that equation,” said Jassy.

It’s not about taking baby steps to the cloud, Jassy said. “Enterprises realize that if they want to be successful, sustainable companies over time, they can’t just make small, incremental changes,” he said. “They (enterprises) have to think about what do their customers want and what’s the customer experience that’s going to be the one that’s demanded over time. And, usually, that requires a pretty big change or transformation.”

Not piecemeal. Not a transition. A transformation.

That’s easy to say, but how do mainstream enterprises get there? They’re still fumbling with decades of legacy infrastructure, praying that no one changes the infrastructure or the entire thing will collapse. I put the question to Jassy: For companies that want to truly transform themselves, what are the few things that matter?

“Most of the big initial challenges of transforming the cloud are not technical,” he responded. “They’re about leadership — executive leadership. You have to get the senior leadership team aligned and convinced that you’re going to make the change. Once that team is aligned, you have to set an aggressive top-down goal that forces the org to move faster than it organically otherwise would.”

CEOs taking charge of cloud transformation is one of the big changes in the cloud industry, according to Jassy. “Today CEOs are much more involved than they used to be,” he said. “In the first 10 years of AWS, a lot of the movement, a lot of the experimentation, a lot of the migrations were driven by frustrated developers, frustrated engineering managers, architects, line of business managers. Those still happen today, with the CIO getting involved a little bit later, but before, the CEO wasn’t that involved in the decision.” This is no longer the case, he added: “Today this is being driven much more top-down than it was before, and they’re big strategic decisions.”

According to Jassy, it’s important that senior leaders, when told, “We’re doing a lot with the cloud,” need to inspect it and say, “Well, show me.” They need to hold their teams accountable.

Competition is heating up for AWS, yet Jassy and AWS seem unflappable. “Having a lot more functionality and capability is a huge deal to customers,” he said. “It’s why we’re successful in the vast majority of head-to-head battles that we have … [and] the partner community around AWS is much more significant than other providers, giving organizations much more choice (and capability) when they elect to build on AWS.”

Amazon’s scale is enabling a lot of people to do things that they couldn’t do before. And now a new era is beginning in which it’s not just about the compute and scale, but rather what happens on top of the cloud. This is what Jassy sees that his competitors don’t seem to appreciate. They’re running as fast as they can to catch up, but they’re mostly failing.

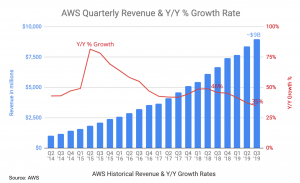

We can bandy around relative growth percentages, but as Jassy pointed out at the company’s re:Invent 2018 conference, “AWS is growing revenue more than twice as fast as Microsoft, its next-nearest competitor in the cloud.”  Or, as Jassy said in our interview, “We’re growing at a meaningfully more significant absolute dollar rate than anybody else, even at a much larger absolute size.”

Or, as Jassy said in our interview, “We’re growing at a meaningfully more significant absolute dollar rate than anybody else, even at a much larger absolute size.”

“If you look carefully at the capabilities that different platforms have and the features with the most capabilities, I think the functionality gap is widening and we’re about 24 months ahead of the next largest provider, and the next largest provider is meaningfully ahead of the third-largest provider,” he added.

Jassy continues with an Amazon aphorism. “There’s no compression algorithm for experience. And it turns out it’s different to run infr astructure for millions of other active customers all over the world and every imaginable industry who can use you without any warning. With a business that’s several times larger than the next few providers combined, you just learn certain lessons in operational experience because you get to different levels of the growth curve and at scale.”

astructure for millions of other active customers all over the world and every imaginable industry who can use you without any warning. With a business that’s several times larger than the next few providers combined, you just learn certain lessons in operational experience because you get to different levels of the growth curve and at scale.”

That’s undoubtedly true, but it’s also true that the industry increasingly talks about multicould, which could slow AWS’ growth even as it allows would-be competitors to catch up.

Is it just media hype or is it real? The answer, it turns out, is: “It’s both.”

Jassy acknowledged that: “We have a large number of companies who have gone all-in on AWS, and that number continues to grow, but there’s going to be other companies who decide that they’re going to use multiple clouds for different reasons.”

It’s not hard to find those reasons: M&A activity, for one, often introduces different clouds into a more homogeneous IT stack. And then there’s the fact that developers will often bring in cloud services of their preference. In either case, this isn’t multicloud by design or some big strategy. It’s just more of the same enterprise IT mishmash that we’ve seen for decades.

What’s different in multicloud, Jassy says, is how it rolls out in real life. “When you look at companies that decide to have a multicloud strategy, they don’t typically split it up 50/50 or evenly across a few providers, mostly because, if you do, you have to standardize on the lowest common denominator [in terms of feature set], and these platforms are in pretty radically different spots right now in terms of capabilities and the ecosystem and maturity,” he explained. “You also end up taking your development teams and asking them to not just make the big shift from on-premises to the cloud, but then force them to be fluent across multiple providers, which development teams hate.”

As a result, he says, the “vast majority” of organizations pursuing a multicloud strategy tend to pick a predominant provider and then, if they feel like they want another one, either because there’s a group that really is passionate about them or they want to know they can use a second cloud provider in case they fall out of sorts with the initial cloud provider, they will. Jassy went on to say that for customers implementing multiple clouds the workloads are split between a primary and secondary cloud more like 70/30 or 80/20 or 90/10, not 50/50.

So multicloud is real (though not how most people think, and certainly not as a deterrent on AWS’ growth), but some clouds’ attempts to woo away workloads may be backfiring. Not surprisingly, in an attempt to close the gap with AWS, other cloud vendors, who may have longstanding relationships with the enterprise, competing clouds will offer free cloud credits to coax those customers into trying out their cloud (and thereby keep them away from AWS).

I asked Jassy if he thinks it’s working. Quite the opposite, he contended. “In many ways, the pretty dramatic acceleration in our enterprise business over the last few years was, in part, aided by the fact that there were a lot of enterprises that were activated by older relationships where they were given free credits to try it, and they also explored us [as part of due diligence], when they were thinking about really exploring the cloud,” he said.

The bottom line on multiple clouds for enterprises is if you are trying to transform your organization with the cloud, he said, it would be irresponsible not to evaluate the clear cloud leader. And anyone worth their salt in the cloud would attest that the clear cloud leader is AWS.

At the heart of the cloud is the next generation of business differentiation and competitive advantage: data. Data is also where different clouds’ capabilities are most cruelly exposed. On the one hand, it’s hard for companies to figure out how to build the right access control and policies for modern applications.

And then there’s the problem of how enterprises need to move data for these applications: Most organizations simply don’t have networks that can handle the scale of data that needs to be transferred over the wire. Add in proliferating edge points and compound it with greater storage needs and organizations must come up with a completely different strategy to address their emerging analytics and other needs.

A transitional approach won’t do it. Transformation is required, with new architectures for the new realities of data.

As Jassy sees it, organizations need to take a twofold approach: “One is they’re going to have to think about how to take the data that’s close to the analytics or that’s close to the compute resource and be able to intelligently and automatically figure out what needs to stay hot or warm and what needs to go back to something cold,” he said.

If they can’t figure that out, they’ll either have costs skyrocket, by keeping too much data hot, or performance will plummet, by keeping too much data cold. In this situation, Jassy points out, it’s important to have a leader such as AWS that can apply machine learning and experience to figure out how to move data automatically.

Fine. But what really got me wondering was something Jassy said about upcoming capabilities: “You can expect, over the coming few weeks and months, that we will introduce some additional capabilities that are really aimed to try and address what we see as some of the big challenges in having that much more data, scale more than ever before, and try to make it increasingly easier for people to manage with more performance,” he said. A few minutes later, he said that “companies are going to want to eliminate network hops and find a way to have the compute and the storage much more local to the 5G network edge.”

Hmm. As useful as it is for AWS to introduce new capabilities, what is AWS doing to help organizations make more sense and better use of their data? What, in short, is AWS doing to advance machine learning?

“Most other cloud providers are trying to funnel all of the machine-learning work through just one framework, which is TensorFlow,” he said. “We have a lot of TensorFlow. Roughly 85% of the TensorFlow running in the cloud runs on top of AWS. [Also] we have very broad support and very strong performance in every major framework for customers, including PyTorch and Apache MxNet, so they have the right tool for the right job.”

Machine learning would still be a big deal if it focused only on Ph.D.-toting data scientists, but what makes AWS’ approach different is how it’s trying to democratize data science. “If you want machine learning to be as expansive as we believe it can be, you’ve got to make it easier for everyday developers and data scientists,” Jassy says.

That’s the sort of broad-scale approach to machine learning that makes it a truly transformative force in the enterprise, rather than just a transitional half-step.

Even in established areas such as compute, however, AWS keeps innovating. I pushed Jassy on the need to not rest on his laurels when it comes to Amazon EC2. “It’s going to be a long time before people aren’t using [EC2] instances to a very substantial extent,” he responded, so it’s important to continue to innovate there.

“We have a meaningfully broader selection of instances than anybody else,” he said. “We’ve got the most powerful machine-learning-training instance, the most powerful GPU graphics-rendering instances. We have FPGA instances. We’re the only ones that have 100 gigabits per second in networking. And we’re not close to being done.”

This same focus on going deep and broad is evident in the company’s approach to containers. Yes, AWS offers a managed Kubernetes service, like other cloud providers. But it also has its container orchestration engine — Elastic Container Service or ECS — which Jassy says is continuing to grow fast because some customers care most that their container service is deeply integrated with other AWS cloud services.

Still, other customers want a managed Kubernetes service called Amazon EKS, and AWS offers it. Finally, AWS Fargate, its serverless container option, manages at the task layer for those that don’t want to be bothered with servers and clusters at all.

It’s about giving customers the tools they need to truly transform themselves. Could it include quantum computing? Said Jassy: “We are serious on quantum.”

Legacy IT providers aren’t happy about Amazon’s seemingly overnight success in the public sector and defense market. How could they be? Trillions of dollars are at stake in this big transformation effort. The old guard get paid by blocking any enterprise transformation while AWS gets paid to enable them.

There was always bound to be a fight when a newcomer, like AWS, walks into a wall of opposition from generations of beltway bandits with entrenched lobbying and relationships based upon the old way of doing things. The result: controversy and smear around, and at, AWS.

Perhaps the most tangible, or at least the most recent, example of this conflict coming to a head is JEDI, for Joint Enterprise Defense Infrastructure. AWS has long done business with the U.S. Department of Defense, but when it could have been awarded a contract with JEDI that could be valued at $10 billion, the legacy empire struck back.

Specifically, Oracle went to some extreme lengths to try to keep JEDI in play for itself, even though its cloud couldn’t come close to meeting the federal requirements, as I’ve reported. Ultimately, after a bunch of pretty sleazy politicking from insiders like Oracle — including from President Trump — Microsoft was awarded the contract, despite not having the requisite certifications at the time of the award. Not surprisingly, AWS has filed suit to protest the awarding of the contract.

For Jassy, the issue isn’t the $10 billion at stake. It’s about the U.S. and, ultimately, global security: “It’s very risky for the country,” he insisted. “It’s risky for democracy. It’s risky for making the right decisions for the country. Our national defense is critical for this country but not just for this country. It’s critical for the world. So when you need very significant modernization where the ramifications are high, the decision must be made in a completely objective way that’s clear from political interference.”

I’ve been covering JEDI long before the rest of the media picked up the story, and it’s clear that AWS had the best capabilities — by far — for what the DOD needed. In the world of transformations, workloads decide the cloud selection. It’s not a matter of some chief information officer saying, “I’ve got this cloud, now app developers, build what you can on it.”

The script has been flipped, and in the case of JEDI, I believe that politics, not government transformation, was the script. The Pentagon initially had a well-intended, good transformation plan that it allowed to be derailed by political interference.

Which brings us back to where we started: transformation. Cloud computing started the world down this cloud path and keeps offering more services to ensure that path is a superhighway for any organization willing to go big. It is this willingness that separates the wheat from the chaff, as it were — the cloud natives from the cloud naïve. AWS, Jassy says, isn’t struggling to find organizations willing to go big.

“More enterprises are deciding to mass migrate and bet on the cloud,” he said. “When they make that decision, all bets are off. [At that point] everybody they’ve been using before, everything they’ve been using before, everything is on the table to be reconsidered, which is interesting because it throws the world upside down. And it’s a great opportunity, not just for us, but for really the entire ecosystem.”

It’s not necessarily a full reset on everything but rather a willingness to reconsider everything.

That “everything” includes mainframes, of course. “We spend a surprising amount of time with enterprises helping them move away from their mainframes,” he said. “It also includes legacy, proprietary relational databases. It’s Windows-to-Linux migrations, with Linux growing at nearly 20% CAGR and Windows declining at 4% CAGR. Next year roughly 82% of all new workloads will run Linux.

It includes all of that and more. Everything is on the table.

“Our goal is to be the infrastructure technology platform underneath all of these enterprises in their transformation strategies and to enable them to be able to invent and to build better customer experience and to help them grow,” said Jassy.

It’s a big dream, one that will shake up the next decade not just of software, but of how organizations across the planet put software to use in creating entirely new, previously impossible applications. It’s an exciting new era, one that legacy providers are right to fear, and one that would-be cloud contenders need to figure out fast because AWS is already there, helping enterprises transform themselves with the cloud.

The high stakes of modern business come down to survive or die. To survive is to transform to new business models, and to die is to make a mere transition with the same old stuff.

Check out the full interview with Jassy in three installments over the next few days as the AWS re:Invent conference gets into full swing Monday, with full coverage all week by SiliconANGLE and theCUBE.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.