INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Nvidia Corp. today posted fourth-quarter financial results that easily beat Wall Street’s expectations, though it was forced to lower its guidance for the next quarter thanks to uncertainties over the coronavirus.

Despite that lower forecast, investors overall still liked what they saw. Shares in the maker of computer graphics and artificial intelligence chips rose more than 5% in after-hours trading. Update: Shares rose more than 7% in Friday trading.

Nvidia reported a profit before certain costs of $1.89 per share on revenue of $3.11 billion, up a massive 41% from a year ago.

In contrast, Wall Street was looking for earnings of just $1.67 per share on revenue of $2.97 billion.

Nvidia’s success in the quarter was a result of some massive gains in its data center business, which reported record sales of $968 million for the quarter, up 43% from a year ago and well above the analysts’ consensus of $825.8 million. That made up for the slightly disappointing performance of Nvidia’s gaming unit, which pulled in $1.49 billion in revenue, up 43% from a year ago but below the $1.52 billion estimate.

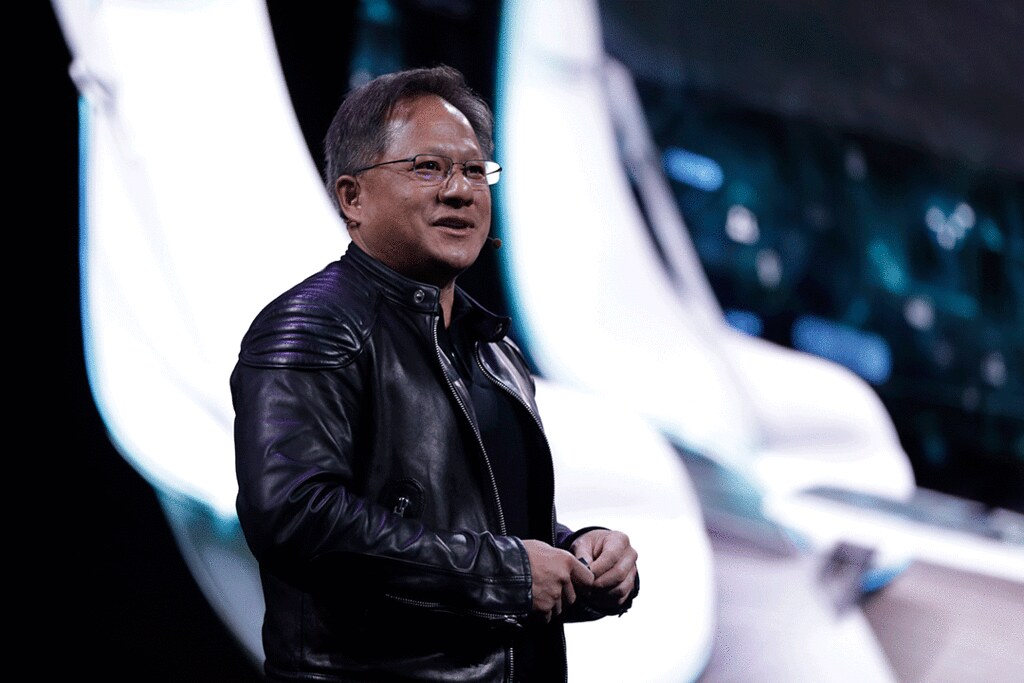

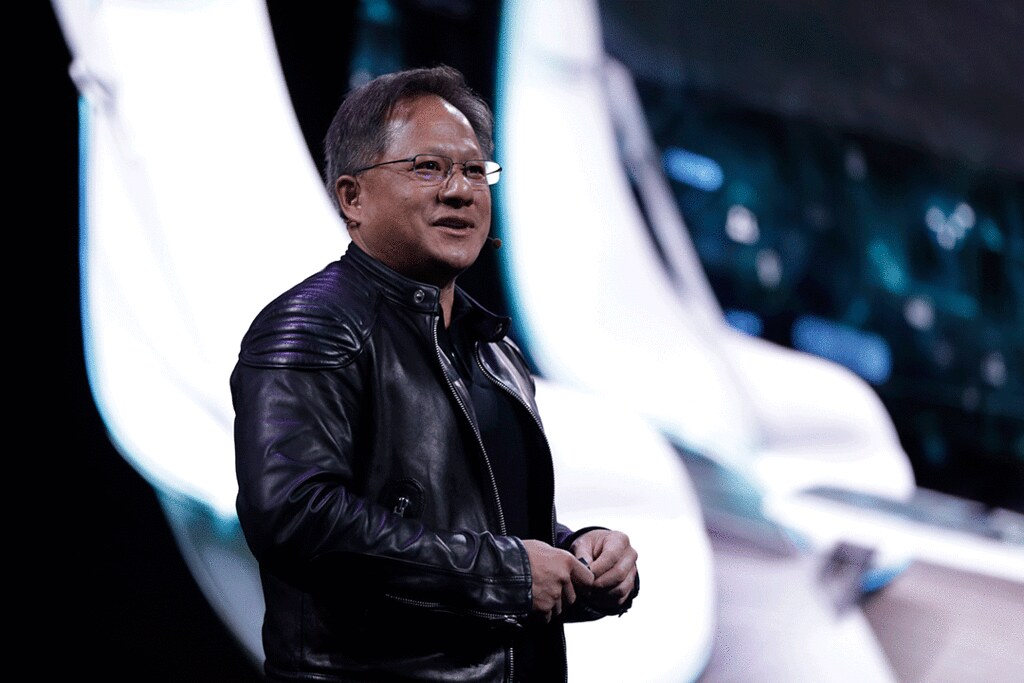

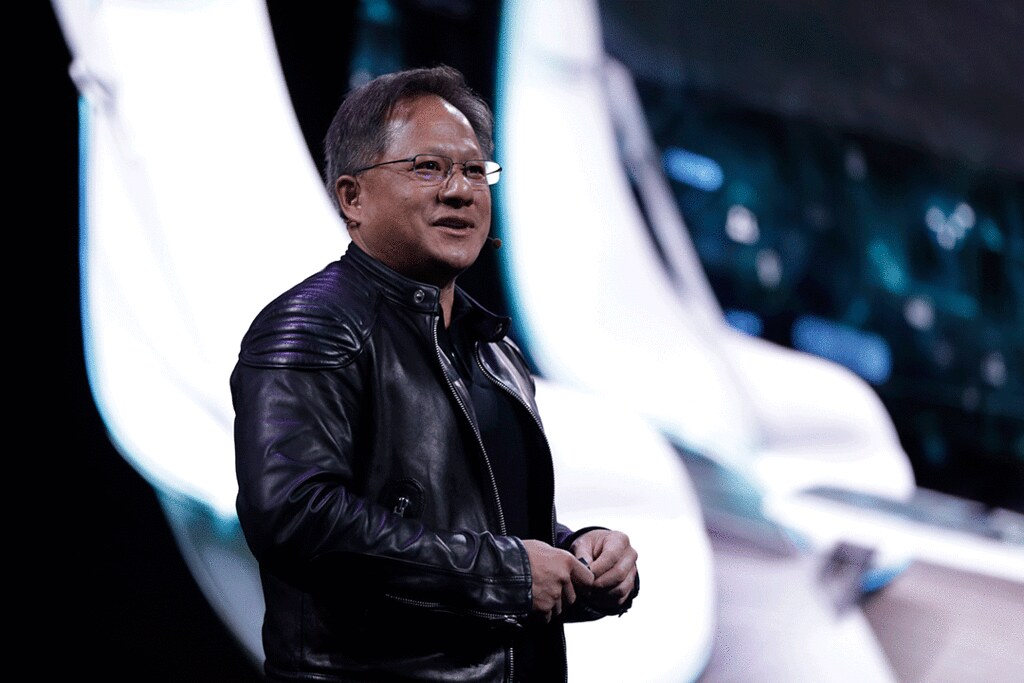

Jensen Huang (pictured), Nvidia’s founder and chief executive officer, said in a conference call that much of the data center growth was driven by rising sales of graphics processing units for artificial intelligence workloads. He called out four specific subsets of AI that are benefiting the company, including recommendation, which is a more personalized version of search; inference, where systems apply rules to databases to garner more insights; public cloud and vertical industries; and edge AI, where AI processing is done on the device instead in the cloud.

“Nvidia AI is enabling breakthroughs in language understanding, conversational AI and recommendation engines ― the core algorithms that power the internet today,” Huang said in a statement. “And new Nvidia computing applications in 5G, genomics, robotics and autonomous vehicles enable us to continue important work that has great impact.”

Analyst Holger Mueller of Constellation Research Inc. said Nvidia the data center is a critical business for Nvidia and that it’s making excellent progress.

“Having its chips in Amazon Outposts allows Nvidia to participate in the growing trend of delivering a cross deployment of workloads on compute platforms that span public, hybrid and private clouds,” Mueller said. “The supercomputer partnership with Azure is another feather in its cap this quarter. Going forward Nvidia will have to do more of the same to ensure it remains a relevant vendor, catering to the portability needs of enterprises for their AI-powered next-generation applications.”

Nvidia’s full-year picture was a little different. The company reported a profit of $4.52 per share on revenue of $10.9 billion, down 7% from a year ago. That was lower than Wall Street’s expectations, with analysts having forecast full-year earnings of $5.58 per share on lower revenue of $10.78 billion.

Still, investors seemed to be happy enough with the fourth-quarter gains alone, pushing up Nvidia’s stock almost 5% in after-hours trading.

Most likely, investors are also betting on the company’s improving prospects going forward. Although Nvidia lowered its guidance for the next quarter because of the cornonavirus wreaking havoc in China and elsewhere, its first-quarter revenue forecast of $3 billion still topped Wall Street’s $2.85 billion estimate.

“Nvidia had an incredible quarter with record revenue in many places,” said analyst Patrick Moorhead of Moor Insights & Strategy. “Key drivers were PC gaming driven by RTX and SUPER lines, datacenter driven by cloud giants with machine learning and even growth in professional visualization. I was a bit disappointed by the flat automotive number, but it makes sense given the end customer puts and takes. It was a great end to the fiscal year.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.