CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Error monitoring software-as-a-service startup Rollbar Inc. today said it has raised $11 million in new funding to double headcount across all divisions in its offices in the U.S., Spain and Hungary.

The Series B round was led by Runa Capital and included Long Light Capital, Blossom Street Ventures, Cota Capital, Bain Capital and Patagonia Capital. As part of the deal, Dmitry Galperin from Runa Capital is being appointed to Rollbar’s board.

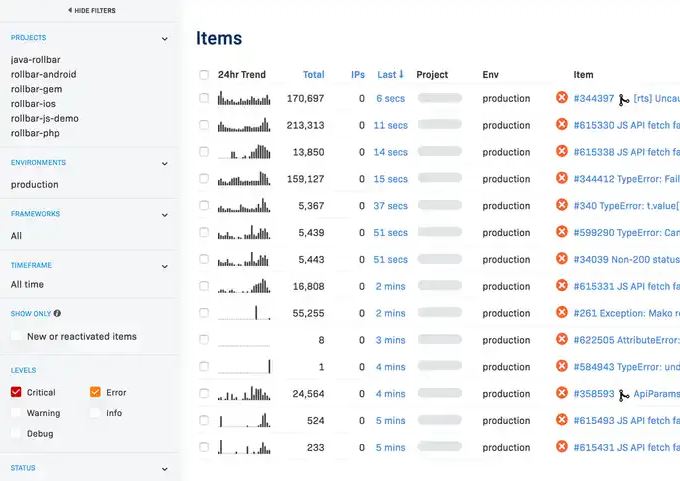

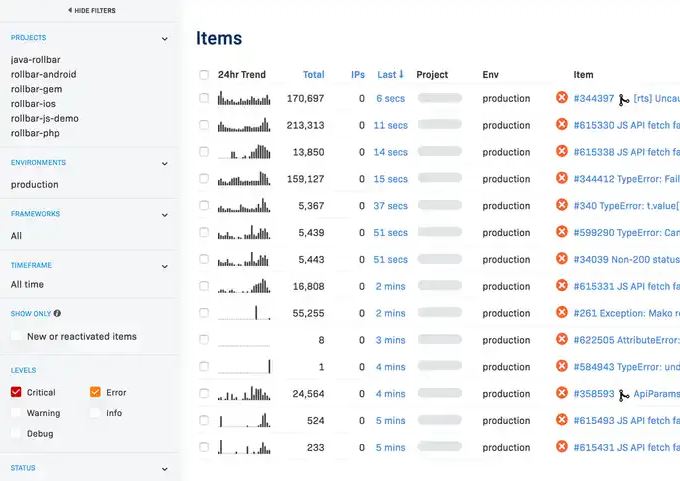

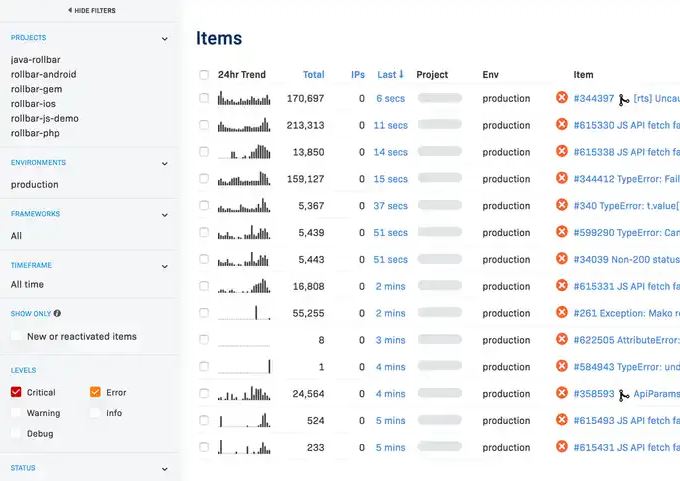

Founded in 2012, Rollbar offers a platform that allows developers to monitor and debug errors in software. The company claims that its solution allows developers to deploy better software faster, with solutions that identify, prioritize and resolve coding errors while working alongside existing tools.

By automating error monitoring and triage, Rollbar says, its solution allows developers to fix errors in a matter of minutes and to build software quickly and painlessly. The solution offers developers a real-time feed with instant alerts of errors, fingerprinting to improve signal-to-noise ratio, proactive triggering that includes the ability to assign owners to errors and create tickets, strong security with encryption as standard, and root-cause analysis.

“Traditional monitoring doesn’t give developers what they need to understand and respond to massive amounts of machine data,” Brian Rue, co-founder and chief executive officer of Rollbar, said in a statement. “Developers need a better way to see where they’re going.”

Rollbar claims more than 100,000 developers are using its software across 4,000 companies. Notable customers include Twilio Inc., Branch Metrics Inc., Salesforce.com Inc., Twitch, Uber Technologies Inc., Kayak and Instacart Inc.

“Rollbar lets cloud-native teams find and fix errors in code faster, and has recently made impressive inroads to help enterprise customers iterate throughout the software development lifecycle,” new Rollbar board member Galperin noted.

Including the new funding, Rollbar has raised $18.5 million to date. Previous investors include Silicon Valley Bank, Signature Ventures and Resolute Ventures.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.