INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Computer graphics chip maker Nvidia Corp. said Thursday its key data center business recorded its best-ever quarter, with revenue topping $1 billion for the first time.

That came as the company reported a first-quarter profit before certain costs such as stock compensation of $1.80 per share on revenue of $3.08 billion, up 39% from the same period a year ago.

The results were better than expected, with Wall Street having forecast a profit of $1.68 per share on revenue of $2.98 billion. Shares rose nearly 3% on Friday.

Nvidia is best known for its graphics processing units that are used to power games consoles and personal computers. And it continued to show solid growth in that area, with gaming revenue coming to $1.9 billion, up 25% from a year ago.

However, the company’s fastest-growing segment is its data center business, where its GPUs are used to perform compute-intensive tasks such as machine learning. The data center business reported revenue of $1.14 billion up 80% from a year ago.

The company also closed on its $6.9 billion acquisition of data center networking specialist Mellanox Technologies Ltd., which should help its data center business to grow further.

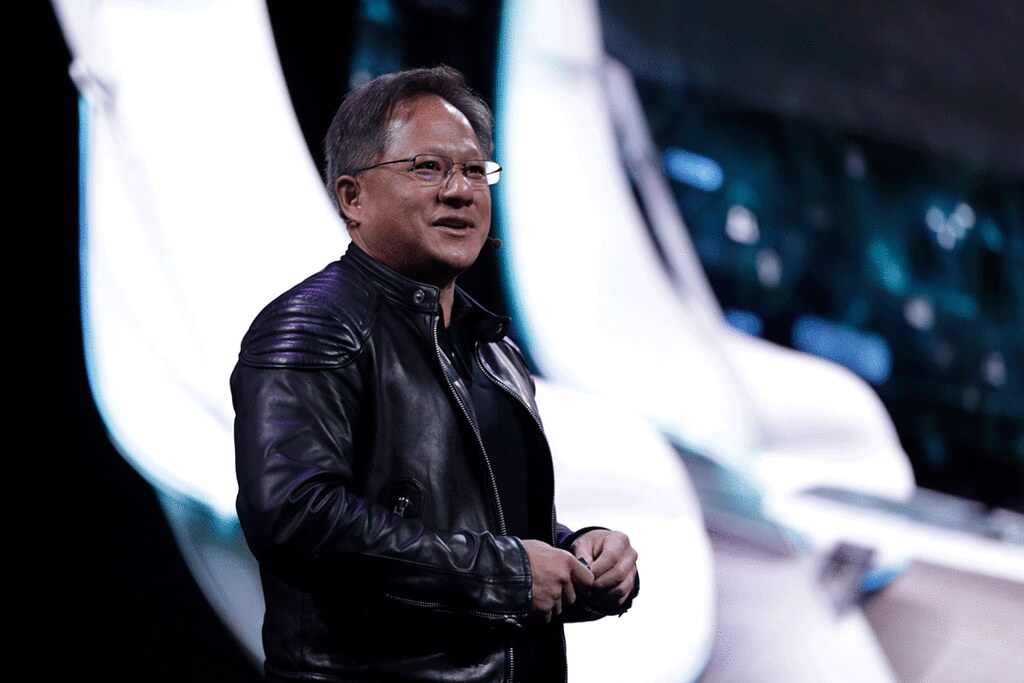

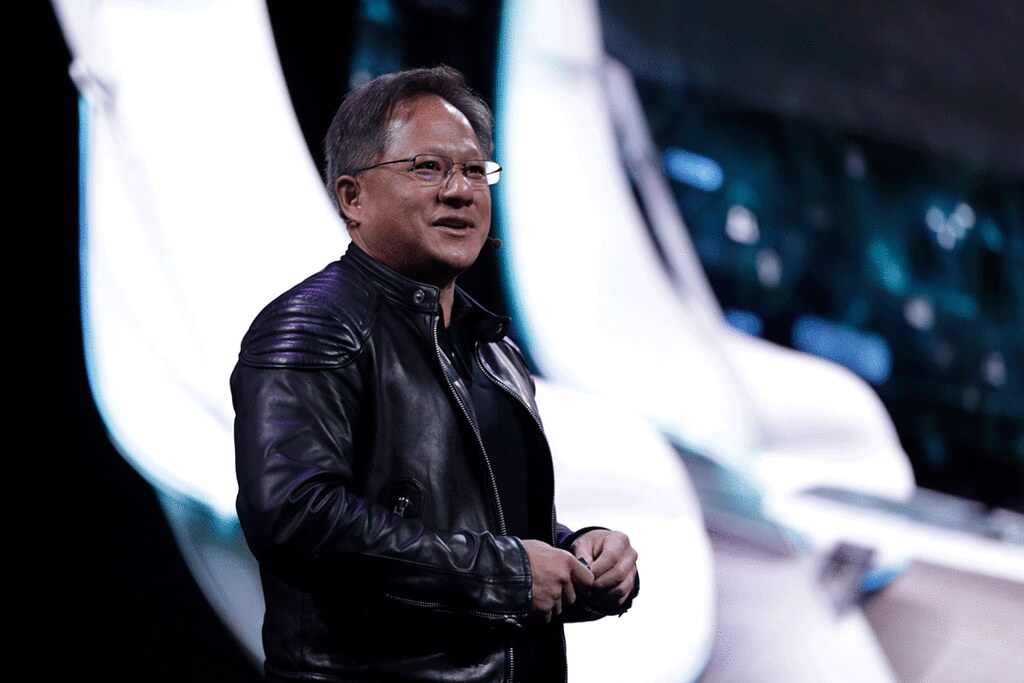

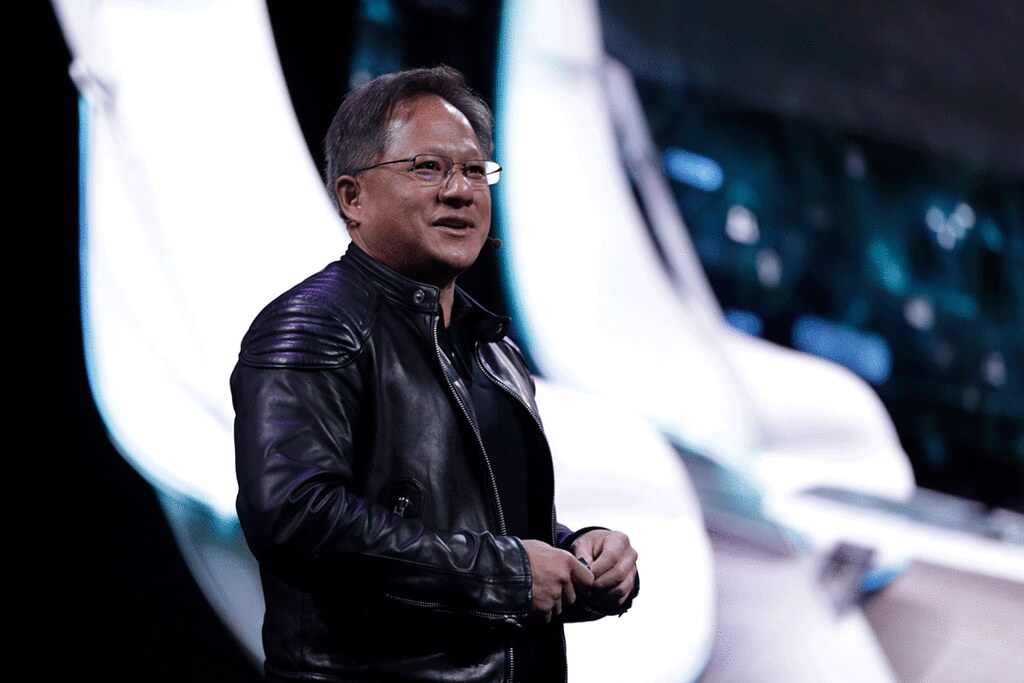

“Nvidia had an excellent quarter,” Nvidia Chief Executive Jensen Huang (pictured) said in a statement. “The acquisition of Mellanox expands our cloud and data center opportunity.”

Nvidia also announced the launch of a new, high-performance GPU for artificial intelligence training and inference workloads during the quarter. Based on its new Ampere architecture, the new A100 chip provides a 20-times performance boost over its predecessor and is expected to power many more artificial intelligence, data analytics, scientific computing and cloud graphics workloads.

“We raised the bar for AI computing with the launch and shipment of our Ampere GPU,” Huang said. “Nvidia is well-positioned to advance the most powerful technology forces of our time – cloud computing and AI.”

Elsewhere, the company reported Professional Visualization revenue of $307 million during the quarter, up 15% from a year ago. OEM and Other revenue came to $138 million, up 39%. The only disappointment was the company’s Automotive business, where revenue came to $115 million, down 7% from the same period last year.

“Nvidia had a phenomenal Q1 on the back of products that are in even more demand due to COVID-19 and solid execution,” said Patrick Moorhead, an analyst with Moor Insights & Strategies. “Every business except automotive was up, including data center, gaming and workstation. The A100 data center training/inference product appears to be off on a rocket-ship start, a very good sign. Gaming and workstation growth are directly tied to competitive products and the need to work, govern and attend school from home.”

Not everyone was so enthusiastic. Constellation Research Inc. principal analyst Holger Mueller pointed out that Nvidia could soon be facing some headwinds, as most of its key business units failed to show any growth compared to the previous quarter, most likely because of the COVID-19 pandemic.

“The bright star is Nvidia’s data center revenue, which is the only division that grew quarter over quarter,” Mueller said. “The chipmaker may soon be known as a data center vendor if this trends keep going. It’s a sign of ingenuity on the R&D side and the enterpreneurship on top.”

The company also found time to make a couple of smaller acquisitions in the quarter, buying data center networking firm Cumulus Networks Inc. for $129 million, as well as SwiftStack Inc., which sells an object data storage and management platform for data-intensive applications.

For the current quarter, Nvidia said it expects to see revenue of about $3.65 billion, which is well ahead of Wall Street’s forecast of $3.15 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.