BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

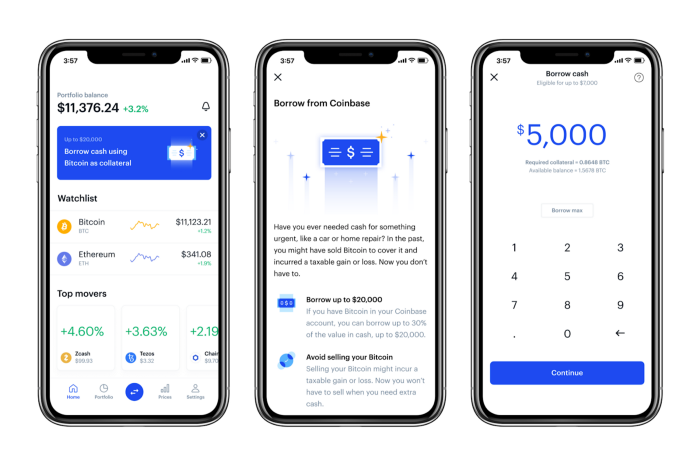

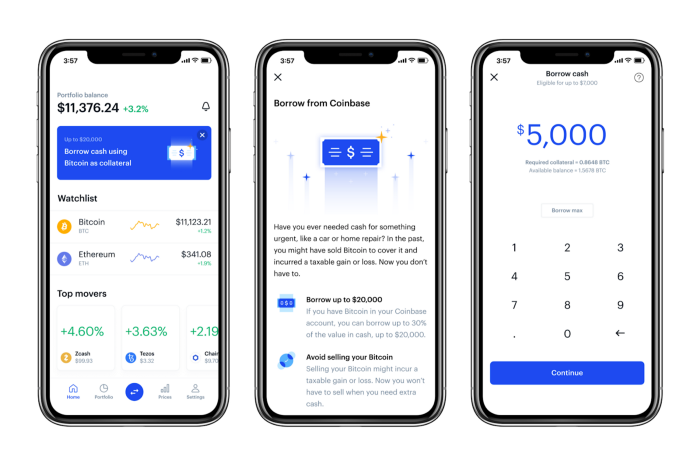

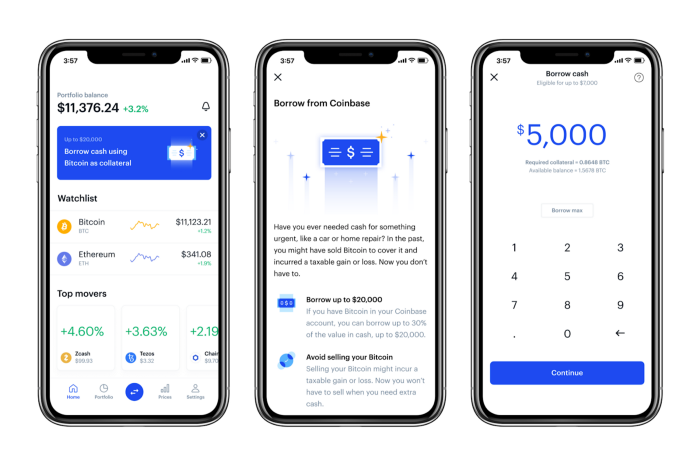

Cryptocurrency exchange Coinbase Inc. is entering the lending market with an option for some U.S. customers to borrow money against their bitcoin holdings.

The loans will allow customers to borrow as much as 30% in cash against their bitcoin holdings on the exchange, up to $20,000 per customer. Interest on the loans will be charged at 8% with terms of one year or less. Eligible customers will not need to fill out a long application or undergo credit checks and can sign up with a few taps to get cash within two to three days.

Coinbase is pitching the service as an alternative to traditional high-interest personal loans. “We hear from customers that they need cash for expenses like home renovations or car repairs, but they do not want to prematurely sell their crypto or take out high-interest loans that could come with 20%+ APR,” Coinbase Product Manager Thorsten Jaeckel said in a blog post today. “With portfolio-backed loans on Coinbase, customers can borrow cash quickly from their Coinbase accounts.”

According to Coindesk, Coinbase will not reinvest the collateral elsewhere and will keep the bitcoin at the exchange, unlike some crypto lenders that use the collateral for investment opportunities.

The service is currently available to customers in Alaska, Arkansas, Connecticut, Florida, Georgia, Illinois, Massachusetts, New Hampshire, New Jersey, North Carolina, Oregon, Texas, Virginia, Nebraska, Utah, Wisconsin and Wyoming, states in which Coinbase has a license to provide a lending service. The company is pursuing licenses in other states to expand the service in the future.

The announcement comes as speculation continues to mount that Coinbase is preparing for an initial public offering later this year or early next year. The first report came in July with further speculation in the last week.

The path Coinbase may take in going public remains open to speculation. Louis Lehot, founder of L2 Counsel, told Bloomberg Law Aug. 11 that given the company’s valuation, a direct listing makes more sense than a traditional public offering.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.