SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

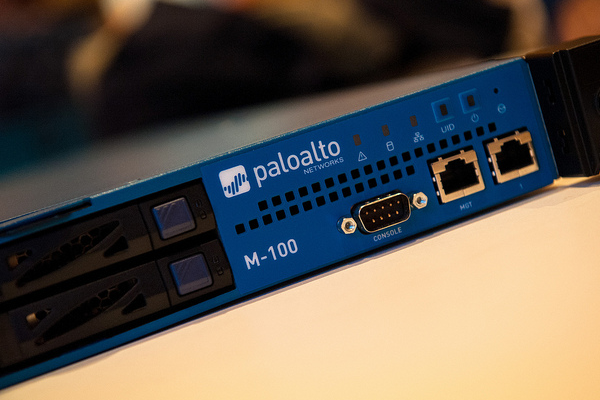

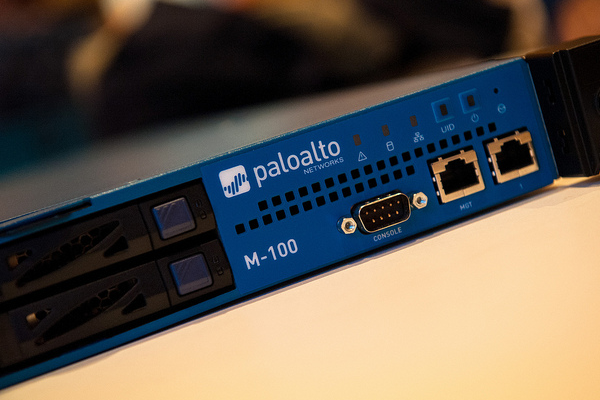

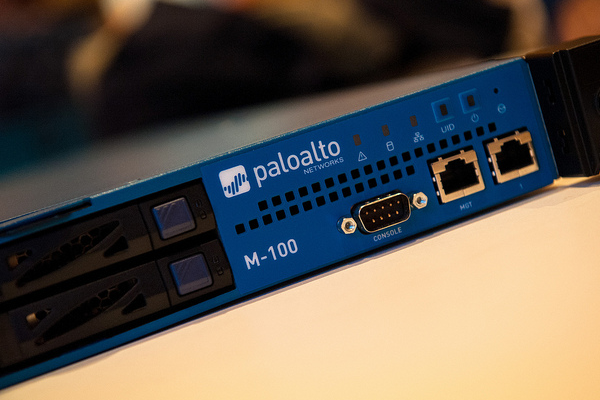

Palo Alto Networks Inc.’s acquisition spree continued today as the company announced plans to acquire Crypsis Group for $265 million on a day it delivered a strong quarterly earnings report.

Founded in 2015, Crypsis Group offers a range of cybersecurity products focused on fighting cybercrime. Pitched as being built on a shared vision of a more secure digital world, the company offers quality incident response, risk management and digital forensic services.

The company employees more than 150 security consultants who handle some of the most complex and significant cybersecurity incidents, responding to more than 1,300 security engagements per year. Crypsis currently has about 1,700 customers spanning the healthcare, financial services, retail, e-commerce and energy industries.

Crypsis’ services will be used to strengthen Palo Alto’s existing cybersecurity-focused Cortex XDR service. The integration of Crypsis’ security and consulting services is said to strengthen Cortex XDR’s ability to collect rich security telemetry, manage breaches and initiate rapid response actions.

The acquisition of Crypsis is the latest in a growing list for Palo Alto Networks. In the last 12 months, the company has acquired Zingbox Inc. for $75 million, cloud security startup Aporeto Inc. for $150 million and network management products maker CloudGenix Inc. for $420 million. Crypsis is Palo Alto’s 14th acquisition since 2014.

The news was delivered alongside Palo Alto’s earnings, which beat analysts’ predictions.

For the quarter ended July 31, Palo Alto reported revenue of $950.5 million, up from $805.9 million in the same quarter of 2019 on an adjusted profit of $1.48 per share. Analysts had been predicting $924 million and $1.39 per share.

Among the highlights for the quarter were future billings coming in at $1.39 billion, up 32% from a year ago whereas analysts had forecast $1.2 billion.

For the quarter ahead, Palo Alto said it expects revenue in the range of $915 million to $925 million with an adjusted profit of $1.32 to $1.35 per share.

In a post-earnings conference call, Chief Executive Officer Nikesh Arora said that not only was the company’s software business making up for the drop-off in its hardware business but the company was also continuing to shift its own operations to the cloud.

“We have significantly shrunk our data-center capacity, we basically shifted all of our own compute to Google Cloud or to AWS,” Arora said. “And when that happens, we’re not deploying more hardware in our data centers, we’re actually buying more cloud from the public cloud providers.”

Despite the company beating analysts’ predictions, shares dropped in after-hours trading a little under 3%.

THANK YOU