CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Shares of Sumo Logic Inc. jumped more than 20% when they hit the stock market Thursday after the cloud-based machine data analytics firm raised at least $325.6 million in its initial public offering.

Sumo Logic had priced its IPO late Wednesday at $22 a share, above its initial price range of $17 to $21 a share, offering 14.8 million common stock shares at $22 per share.

The company, whose stock trades under the ticker symbol “SUMO,” also offered an additional 2.22 million shares as an option to its underwriters over the next 30 days. Those shares would be worth $48.8 million, which would bring the potential total up to $374.4 million.

The offering will leave Sumo Logic with about 98.7 million shares outstanding, giving the company a market value of about $2.2 billion. Shares closed up more than 22%, to $26.88 a share.

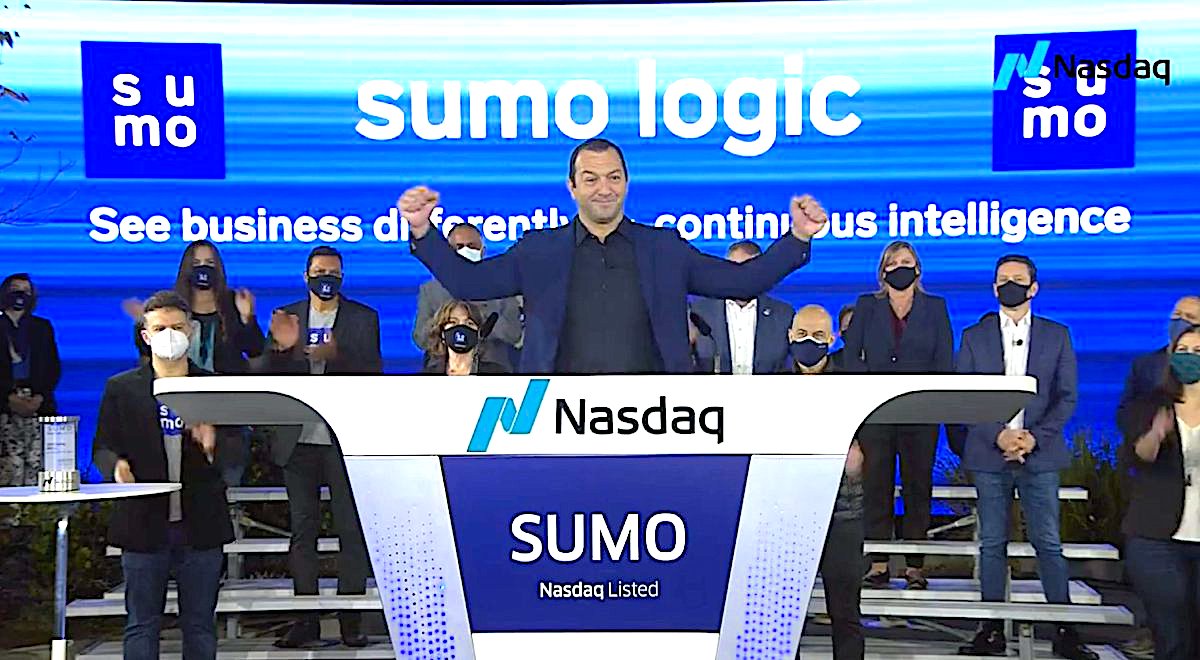

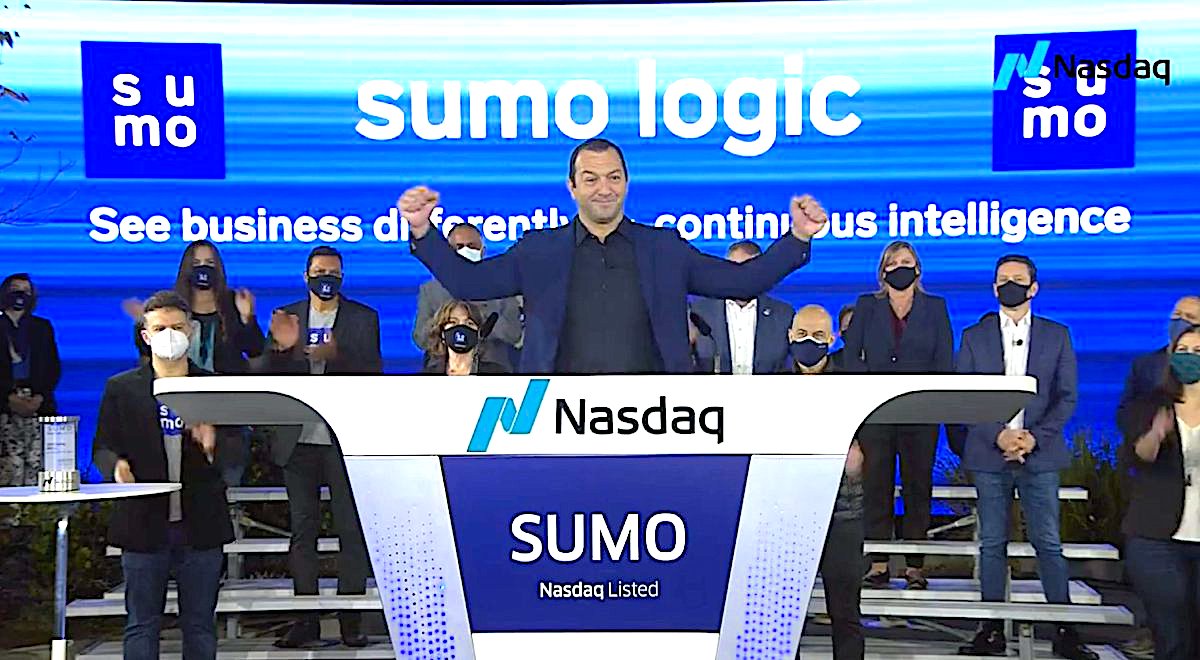

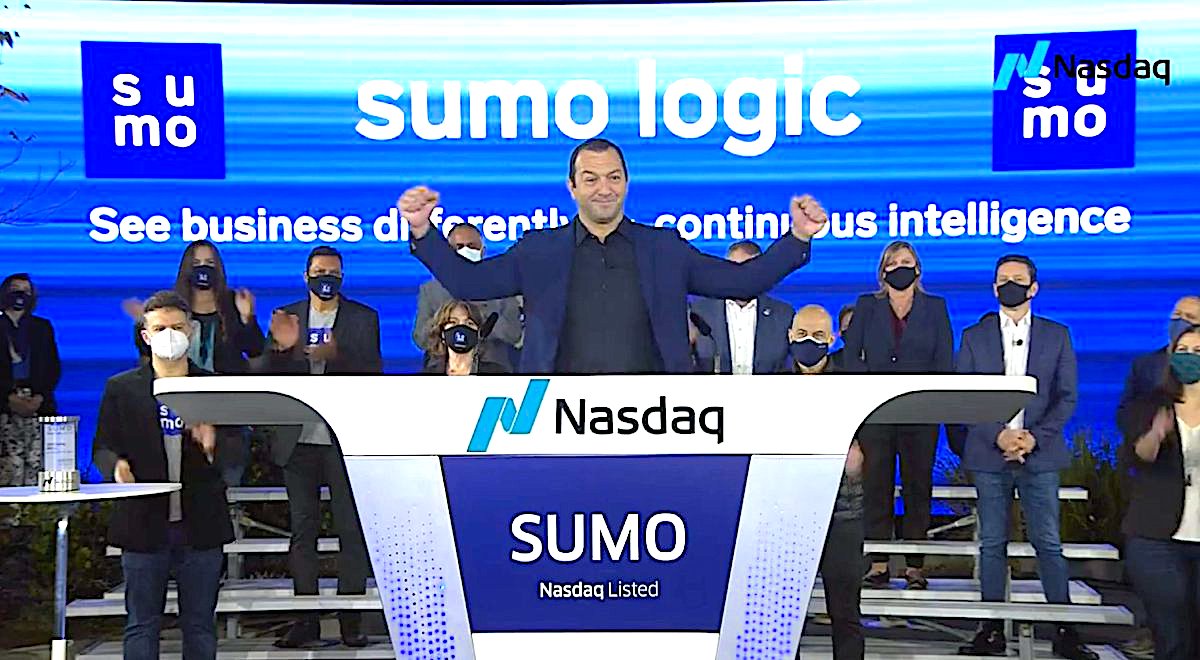

The company, which is led by Chief Executive Officer Ramin Sayar (pictured), sells a cloud analytics platform that provides insights into information technology infrastructure issues and cybersecurity threats. It provides services such as log management, Amazon Web Services monitoring, Azure management, Google Cloud Platform management, Kubernetes management, microservices monitoring and cloud security monitoring. The platform also lends itself to more business-oriented use cases such as customer analytics.

The pop wasn’t nearly as much as that of Snowflake Inc., whose shares more than doubled on their first day of trading Wednesday. Sumo Logic might be seen as a risky bet by some investors, since the company posted a loss of $92.1 million in its fiscal 2019 year, compared with a loss of $47.8 million the year before.

But although it hasn’t reached profitability yet, its revenue has increased by more than 50% in the same period, underlining its potential. And investors have been sanguine about money-losing but fast-growing tech companies, especially those in cloud computing.

The company will be hoping to lure Wall Street investors with the promise of good things to come. In its IPO filing, Sumo Logic estimated its total addressable market at around $49.3 billion, though it warned that it faces intense competition from companies that provide similar services.

Although Sumo’s platform can be adapted to a variety of uses, the company intends to stay focused on IT infrastructure and security for the foreseeable future, said Chief Technology Office and co-founder Christian Beedgen in an interview with SiliconANGLE. “We could spend all day preaching about business intelligence and analytics but by and large our discussions are about focusing on two use cases in IT: availability/performance and security,” he said.

The area of security information and event management has particularly strong potential because cloud computing has opened new vulnerabilities. “We believe the world needs a cloud SIEM. It doesn’t exist in the way we are imagining,” he said. “There’s a lot more to do in terms of tweaking SIEM to make it more cloud-native.”

One of Sumo Logic’s biggest rivals is the data analytics firm Splunk Inc., which was founded in 2003 and has a much bigger slice of the pie, pulling in around $1.93 billion in annual recurring revenue. Secure Octane founder Mahendra Ramsinghani wrote in VentureBeat Monday that Sumo Logic’s main advantage over Splunk is that its software-as-a-service platform was born in the cloud. Splunk, on the other hand, began life as an on-premises software offering, but it has spent the last few years slowly transitioning to a SaaS model, and that move is now accelerating.

In the company’s most recent, second-quarter earnings call, Splunk Chief Executive Doug Merritt revealed that its annual recurring revenue from SaaS subscriptions is growing at more than 50%, and that SaaS accounts for 53% of its total bookings. Splunk also has a big advantage in terms of integrations with third-party applications, Ramsinghani said.

Sumo’s cloud-native heritage continues to be a source of competitive strength, Beedgen said. “Our philosophy has always been that this problem has to be solved in a [software-as-a-service] fashion,” he said. That opinion was born of his nearly nine years at ArcSight Inc., a maker of logging tools that is now owned by Micro Focus International plc. “As successful as ArcSight was, we became a little disillusioned with the enterprise software delivery model,” he said. “We had a hard time writing code and throwing it over the wall, leaving the hard par to the customer.”

The cloud advantage is not lost on investors. It’s entering a stock market that has a voracious appetite for high-growth, cloud-based software firms, many of which have demonstrated strong growth during the coronavirus pandemic. The Nasdaq index, which is focused on publicly traded technology firms, is up more than 25% this year versus a 4.5% gain for the broader S&P 500.

A number of promising cloud software companies have gone public in recent days, most notably Snowflake Computing Inc., which saw its share price more than double in value to $245 per share on its first day of trading Wednesday, raising almost $4 billion and giving it a stunning valuation of $68 billion.

Also Wednesday, JFrog Ltd., which sells a cloud-based application development platform, saw its share price rocket on its first day of trading. The stock closed up 47%, to $64.79 per share, putting the company’s value at $5.7 billion.

Sumo Logic has said it plans to spend the proceeds of its IPO on acquisitions and further investments in technologies, with an eye to accelerating product innovation and expansion. The company’s strategy is to grow its business first in order to grab more of that almost $50 billion addressable market it’s fighting for, before trying to become profitable.

Sumo Logic has raised $340 million in venture capital, with its most recent $110 million funding round in May 2019 valuing it at just over $1 billion.

Additional reporting by Paul Gillin

THANK YOU