CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Earlier this week, the U.S. Department of Justice, along with attorneys general from 11 states, filed a long-expected antitrust lawsuit accusing Google LLC of being a monopoly gatekeeper for the internet. Of course Google will fight the lawsuit, but in our view, the company must make bigger moves to diversify its business — and the answer is a massive pivot to the cloud and edge computing.

In this Breaking Analysis we will to two things: 1) We’ll review the history (according to my reading) of monopolistic power in the computer industry; and 2) we’ll look into the latest Enterprise Technology Research data and make the case that Google’s response to the DOJ’s suit should be to double or triple its focus on cloud and edge computing – a multitrillion-dollar opportunity.

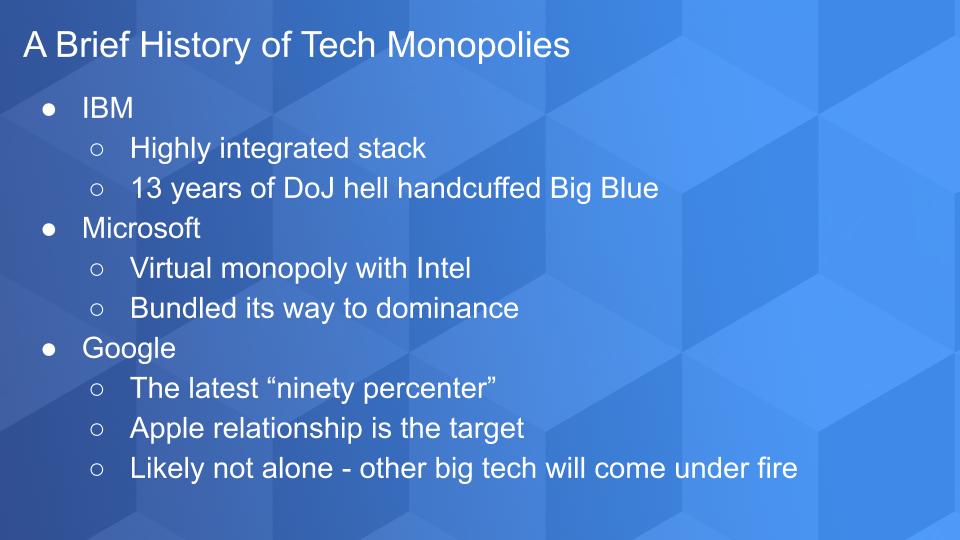

In 1969, the U.S. government filed an antitrust lawsuit against IBM Corp.. At the height of its power, IBM generated about 50% of the revenue and two-thirds of the profits for the entire computer industry. IBM’s monopoly, on a relative basis, far exceeded that of the virtual Wintel monopoly that defined the 1990s.

IBM had 90% of the mainframe market and controlled the protocols to a very vertically integrated mainframe stack comprising semiconductors, operating systems, tools and compatible peripherals such as terminals, storage and printers. The government’s lawsuit dragged on for 13 years before it was withdrawn in 1982, but it took a toll on IBM. To placate the government, IBM made concessions such as allowing mainframe plug-compatible competitors access to its code and limiting the bundling of application software in fear of more government pressure.

The biggest mistake IBM made coming out of antitrust was holding onto its mainframe past. We saw this in the way it tried to recover from the mistake of handing its monopoly over to Microsoft and Intel by keeping OS/2 and giving Microsoft Windows, thinking that the personal computer could be vertically integrated like the mainframe.

Microsoft Corp.’s monopoly power was earned in the 1980s and carried into the 1990s. In 1998, the DOJ filed a lawsuit against Microsoft alleging that the company was illegally thwarting competition, which I argued at the time it was. As it happens, this is the same year that Google was started.

In the early days of the PC, Microsoft was not a dominant player in desktop software. Lotus 123, WordPerfect and Harvard Presentation Graphics were discrete products that competed effectively in the market. In 1987, Microsoft paid $14 million for PowerPoint and then in 1990 launched Office, which bundled spreadsheets, word processing and presentation into a single suite, priced far more attractively than alternative point products.

In 1995, Microsoft launched Internet Explorer and began bundling its browser into Windows for free. Windows had a 90% market share. Netscape was the browser leader and a high-flying tech company. The company’s management at the time pooh-poohed Microsoft’s bundling, saying it wasn’t concerned because it was moving up the stack into business software. It later changed that position after realizing the damage Microsoft’s bundling would do to its business, but it was too late.

In similar moves of ineptness, Lotus refused to support Windows at its launch and instead wrote software to support the DEC VAX – a minicomputer that you probably never heard of. Novell Inc., a leader in networking software at the time – anyone remember Netware? – responded to Microsoft’s moves to bundle network services into its OSes by going on a disastrous buying spree, acquiring WordPerfect, QuattroPro (a spreadsheet) and a Unix OS.

The difference between Microsoft and IBM is that Microsoft didn’t build PC hardware, rather it partnered with Intel to create a virtual monopoly. The similarities between IBM and Microsoft, however, were that it fought the DOJ hard and made similar mistakes as IBM by holding on to its PC software legacy, until the company finally pivoted to the cloud under the leadership of Satya Nadella.

Google has 90% of the internet search market. There’s that magic 90% number again. IBM couldn’t argue that consumers weren’t hurt by its tactics– they were, since IBM was gouging mainframe customers because it could. Microsoft, on the other hand, could argue that consumers were benefiting from lower prices because Microsoft bombed the market.

Google’s attorneys are doing what often happens in these cases. First they’re arguing that the government’s case is “deeply flawed.” Second, they’re saying the government’s actions will cause higher prices because they’ll have to raise prices on mobile software and hardware (hmm, sounds like a threat). And of course it’s making the case that many of its services are free.

What’s different from Microsoft is Microsoft was bundling IE, a product that was largely considered inferior when it first came out. But because of the convenience, most users didn’t bother switching. Google, on the other hand, has a superior search engine and earned its rightful place at the top by having a far better product than Yahoo, Excite, Infoseek and even AltaVista – which all wanted to build portals rather than a clean user experience with some nonintrusive ads on the side. Boy, has that changed, hasn’t it?

Regardless, what’s similar in this case with Microsoft is the DOJ is arguing that Google and Apple Inc. are teaming up with each other to dominate the market and create a monopoly. Estimates are that Google pays Apple between $8 billion and $11 billion annually to have its search engine embedded like a tick into Safari and Siri. That’s about one-third of Google’s profits going to Apple. And it’s obviously worth it because according to the government’s lawsuit, Apple originated search accounts for 50% of Google’s search volume. Incredible.

Does the government have a case here? We’re not qualified to give a firm opinion on this, but let’s say this: Even in the case of IBM, where the DOJ eventually dropped the lawsuit, if the U.S. government wants to get you, it usually takes more than a pound of flesh.

However, the DOJ did not suggest any specific remedies and the Sherman Act on which the suit is based is open to wide interpretation, so we’ll see.

What we are suggesting is that Google should not hug too tightly to its search and advertising past. Yes, Google gives us amazing free services, but it has every incentive to appropriate our data. And there are innovators out there right now trying to develop answers to that problem with blockchain and other technologies that can give power back to the users.

So if we’re arguing that Google shouldn’t, like the other great tech monopolies, hang its hat too tightly onto the past, what should Google do?

Let us first say that Google understandably promotes G Suite quite heavily as part of its cloud computing story. We get that, but it’s time to move on and aggressively push the areas that matter in cloud: core infrastructure, database, machine intelligence, containers and the edge. Not to say Google isn’t doing this, but these are the areas of greatest growth potential. And the ETR data shows it.

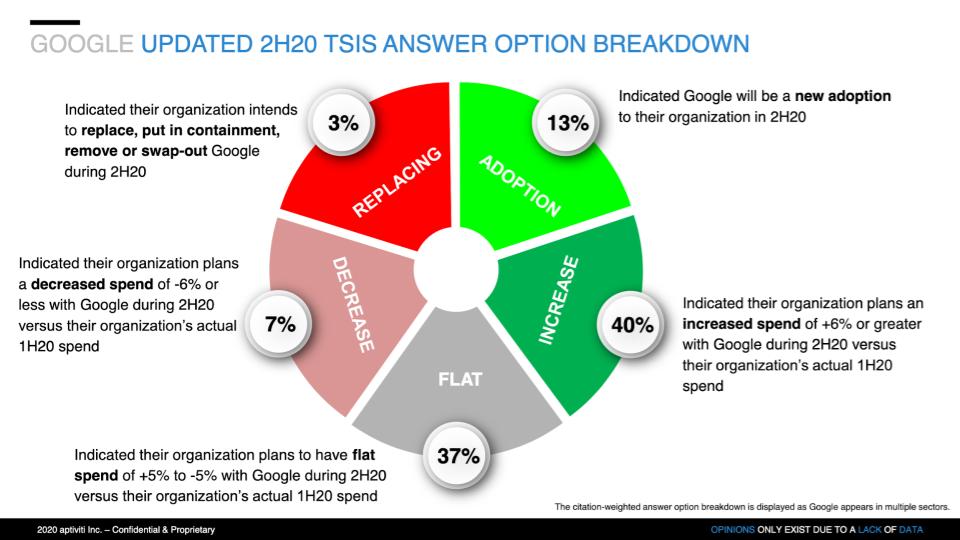

Let’s start with one of our favorite graphics which shows the breakdown of survey respondents used to derive Net Score.

Net Score is ETR’s quarterly measurement of spending velocity. Here we show the breakdown for Google Cloud. The lime green is new adoptions, the forest green is the percentage of customers increasing spending more than 5%, the gray is flat, the pinkish is a decrease of 6% or more and the bright red is replacing or swapping out the platform. Subtract the reds from the greens and you get a Net Score of 43%, which is not off the charts but it’s good and compares quite favorably with most companies.

But it doesn’t compare so favorably with Amazon Web Services Inc. (51%) and Microsoft (49%). Both AWS and Microsoft’s red scores are in the single digits whereas Google’s is at 10%. Look, all three are down since January thanks to COVID-19, but AWS and Microsoft are much larger than Google and we’d like to see stronger across-the-board scores from Google.

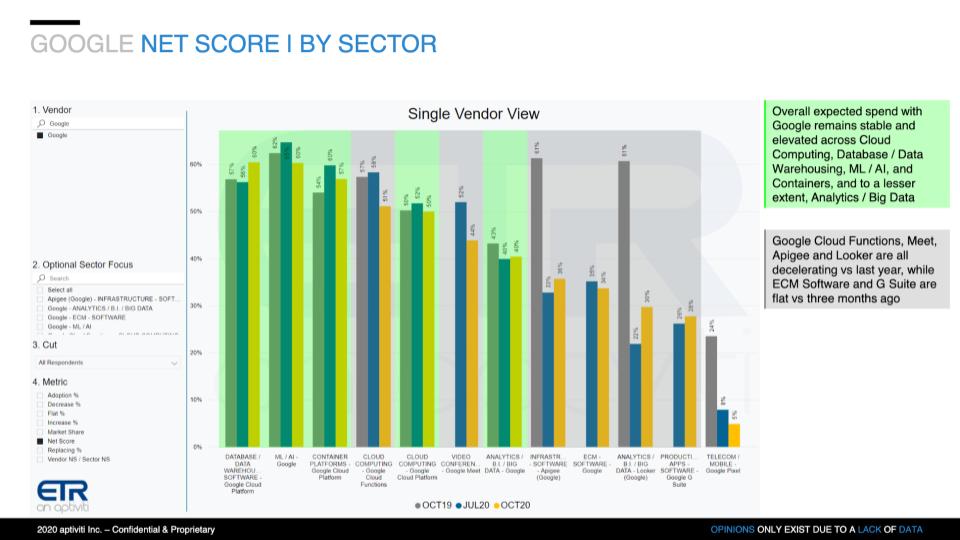

Take a look at the chart below. It’s a breakdown of Google’s Net Scores over three surveys snapshots. We skip January in this view to provide year-to-year context for October. Look at the all-important database category. We’ve been watching this closely, particularly with Snowflake Inc.’s momentum because BigQuery is generally considered the other true cloud-native database and we have a lot of respect for what Google is doing in this area.

Look at the areas of strength, highlighted in the green. Machine learning where Google is a leader in artificial intelligence. In containers, Kubernetes was an open-source gift to the industry and a linchpin of Google’s cloud and multicloud strategy.

Google Cloud is strong overall, but we were surprised to see some deceleration in Google Cloud Functions at a 51% Net Score. AWS Lambda and Microsoft Azure Functions are showing in the mid- to high 60s for Net Score. But Net Score is still elevated for Google.

We’re not that worried about steep declines in Apigee and Looker because after an acquisition, things get spread around the taxonomy, so don’t be too concerned about that. But as we said earlier, G Suite is just not that compelling relative to the opportunity in the other areas.

We won’t expose the data here, but Google Cloud is showing good strength across almost all industries and sectors with the exception of consulting and small business, which is understandable. But it’s also showing also a notable deceleration in healthcare, which is a bit of a concern.

The comments below are from an ETR VENN roundtable.

The first comment comes from an architect who says that it’s an advantage that Google is not entrenched in the enterprise. I’m not sure we agree, but we do take stock in what this person is saying about Microsoft trying to lure people away from AWS. And this person is right that Google essentially exposed its internal cloud to the world and has a ways to go. That’s why we don’t agree with the first sentiment – we feel Google still hasn’t figured out the enterprise.

The second comment underscores a point that we made earlier about BigQuery. Customers really like the out-of-the-box machine learning capabilities. It’s compelling.

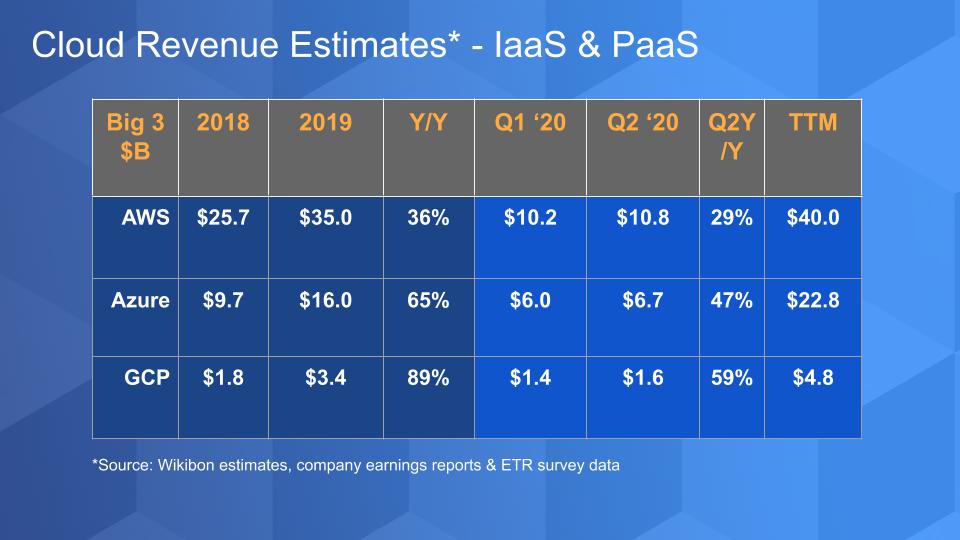

We’ll update this chart once the companies report earnings, but here’s our most recent take on the Big Three cloud vendors’ market performance that we’ve shared before:

The key points here is our data and the ETR data reflect Google’s comments in its earnings statements that GCP is growing much faster than its overall cloud business, which includes things that are not apples-to-apples comparisons with AWS and Azure. Remember, AWS is the only company that provides clear data on its cloud business, whereas the others will make comments but not share the data explicitly, so these are estimates based on those comments, survey data and our own intelligence.

As the one practitioner said, Google has a long ways to go because it is one-eighth the size of AWS and about one-fifth of the size of Azure. And although it’s growing faster, at this size we feel its growth should be even higher, though COVID is clearly a factor here, so we have to take that into consideration.

Google spends a lot on research and development. These are quick estimates but we’ll give you some context for the following companies’ R&D spend:

So Google for sure spends on innovation. And we’re not including capital spending in any of these numbers. The hyperscale cloud guys spend tons on CAPEX building data centers. So we’re not saying Google is “cheaping out” – it’s not.

It also has plenty of cash on its balance sheet at around $120 billion, so we can’t criticize its roughly $9 billion in stock buybacks the way we often point fingers at what we consider IBM’s overly Wall Street-friendly use of cash. But we’ll say this: Jeff Hammerbacher, whom I spoke with on theCUBE in the early part of last decade at Hadoop World, said, “The best minds of my generation are spending their time trying to figure out how to get people to click on ads.” And that’s where much of Google’s R&D budget goes. Again, we’re not saying that Google doesn’t spend on cloud computing – it does.

But here’s a prediction: The post-cookie apocalypse is coming. Yes, Google is banning cookies on Chrome in a couple of years. Apple’s iOS 14 makes you opt in to find out everything about you. This is why it’s such a threat to Google.

The days when Google was able to be the keeper of all our data and to house it and do whatever it likes with that data ended with Europe’s General Data Protection Regulation. That was just the beginning of the end. This decade is going to see massive changes in public policy that will directly affect Google and other consumer-facing technology companies.

So the premise is that Google needs to step up its game in enterprise cloud — much more than it’s doing today. And we like what Thomas Kurian is doing. But Google is undervalued relative to some of the other big tech names. We think it should tell Wall Street that its future is in enterprise cloud and edge computing and it’s going to take a hit to its profitability, and go big in those areas.

We would suggest four things for Google to do:

We expect Google will say, “We agree, that’s exactly what we’re doing.” We’re skeptical. We think Google sees the cloud as a tiny piece of its business. In our view, Google must do what Satya Nadella did and completely pivot to the new opportunity. Make cloud and the edge your mission. Bite the bullet with Wall Street and go dominate a multitrillion-dollar industry.

Remember these episodes are all available as podcasts, so please subscribe. We publish weekly on Wikibon.com and SiliconANGLE.com so check that out and please do comment on the LinkedIn posts we publish. Don’t forget to check out ETR for all the survey data. Get in touch on twitter @dvellante or email david.vellante@siliconangle.com. And remember, Breaking Analysis posts, videos and podcasts are all available at the top link on the Wikibon.com home page.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.