INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Smartphone chip company Qualcomm Inc. is flying high today, its stock up more than 12% after posting fourth-quarter financial results that sailed past Wall Street’s expectations.

The company reported a profit before certain costs such as stock compensation of $1.45 per share on revenue of $6.5 billion, up 35% from the same quarter a year ago. Analysts had been looking for a profit of just $1.17 per share on revenue of $5.94 billion.

In a conference call, Qualcomm Chief Executive Steve Mollenkopf (pictured) said the results were boosted by a “partial quarter impact” from a large U.S. smartphone maker. That can only really be Apple Inc., and it’s worth noting that the new iPhone 12 is powered by one of Qualcomm’s latest 5G modem chips. Qualcomm has previously said that it’s well-placed to benefit from the rise of 5G networks and smartphones.

“Our fiscal fourth-quarter results demonstrate that our investments in 5G are coming to fruition and showing benefits in our licensing and product businesses,” Mollenkopf said in a prepared statement.

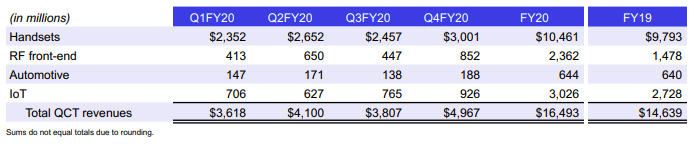

Qualcomm’s largest business unit, Qualcomm CDA Technologies, which sells mobile modem chips for smartphones as well as radio frequency chips, “internet of things” and automotive chips, reported revenue of $4.97 billion in the quarter, up 38% from a year ago. The company said handsets accounted for most of those sales, with revenue coming to $3 billion.

It also said MSM chip shipments came to 162 million in the quarter, but added this will be the last time it reports on those. That’s because the company is now breaking out revenue for each specific chip segment within the QCT business.

Qualcomm’s other business, Qualcomm Technology Licensing, which sells the rights to the company’s patents to third parties, pulled in revenue of $3.43 billion, a massive increase from the $1.2 billion it reported in the fourth quarter of 2019.

Charles King of Pund-IT Inc. told SiliconANGLE that Qualcomm’s strong performance shows what can happen when outward distractions such as its legal problems of the past are eliminated, and markets finally come around to a place where the company is entirely comfortable in 5G.

“Qualcomm has always been an IP-driven and driving machine but it has really stepped up its game during 2020,” King said. “Add in the fact that the hype around 5G is being supplemented with significant service rollouts that resonate with consumers and businesses’ need for robust mobile technologies, and it looks like Qualcomm is ready and well-positioned for the quarters ahead.”

That’s exactly what Qualcomm seems to believe too, as it provided strong guidance for its fiscal 2021 first quarter. The company said it’s expecting earnings of $1.95 to $2.15 per share, well ahead of Wall Street’s forecast of $1.68 per share. On the revenue side, Qualcomm said it forecasts $7.8 billion to $8.6 billion versus Wall Street’s forecast of $7.13 billion.

The company said it will benefit from what it expects to be “high-single-digit growth” in smartphone shipments next year, including 5G, 4G and 3G handsets.

Moor Insights & Strategy analyst Patrick Moorhead said Qualcomm delivered an incredible quarter and was equally impressive with its guidance.

“The company also broke out its ‘growth areas,’ giving investors a deeper understanding of its opportunities in radio frequency front-end, automotive and IoT,” Moorhead said. “In a big surprise, it appears that Qualcomm’s RFFE business is one of the largest, near Qorvo, Skyworks and Broadcom levels. Another shocker was that its automotive business is larger than Nvidia’s.

Moorhead added that Qualcomm is finally taking full advantage of its 5G and growth area investments and that’s likely to continue. “I don’t believe the full Apple impact has been baked in yet, which should be upside for the company,” he said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.