CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud computing has been the single most transformative force in information technology over the last decade. What will Cloud 2030 look like?

As we move deeper into the 2020s, we believe that cloud will become the underpinning of a ubiquitous, intelligent and autonomous resource that will disrupt the operational stacks of virtually every company in every industry.

This Breaking Analysis is a special report as part of SiliconANGLE’s and theCUBE’s coverage of Amazon Web Services Inc.’s virtual re:Invent conference starting Monday. In this post, we’ll put forth our scenario for the next decade of cloud evolution. In addition, we will share our latest market figures for the big three hyperscalers — AWS, Microsoft Corp. and Google LLC — and drill into the most recent data on AWS from Enterprise Technology Research’s October 2020 survey of more than 1,400 chief information officers and IT buyers.

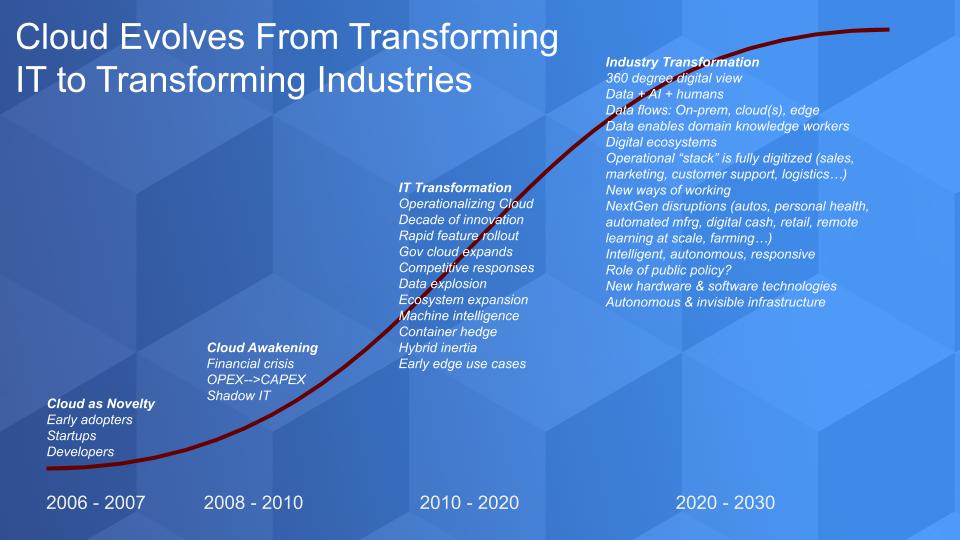

Where did we come from and where are we going? The graphic below shows our view of the critical inflection points that catalyzed cloud adoption, In the middle of the 2000s, the IT industry was recovering from the shock of the dot-com bubble and 9/11. CIOs were still licking their wounds from the narrative that IT doesn’t matter. In 2006, AWS launched its Simple Storage Service and later EC2, with little fanfare. But developers at startups and small businesses noticed and overnight, AWS turned the data center into an application programming interface.

Analysts like us saw the writing on the wall as CEO after CEO pooh-poohed Amazon’s entrance into their territory. They said things like, “yYou guys have all gone cloud-crazy… it’s all you want to talk about.” And “We’re doing just fine.” Many promised a cloud strategy that would allow them to defend their respective turf easily. We’d seen the industry in denial before with phrases like “PCs are toys” and “Unix is snake oil.”

The financial crisis was a boon for the cloud. Chief financial officers saw a way to conserve cash, shift capital expenditures to operating expenditures and avoid getting locked into long-term capital depreciation schedules or constrictive leases. We also saw shadow IT take hold and bleed into the 2010s in a big way.

That, of course, created problems for organizations, rightly concerned about security and rogue tech projects. CIOs were asked to clean up the crime scene and in doing so realized the inevitable – that they could transform their IT operational models, shift infrastructure management to more strategic initiatives and drop money to the bottom lines of their businesses.

The 2010s were an era of rapid innovation and a level of data explosion that we had not seen before. AWS led the charge with a torrent pace of innovation via feature rollouts. Virtually every industry, including the all-important public sector, got into the act, again led by AWS with the seminal Central Intelligence Agency deal. Google got in the game early but never took the enterprise business seriously until 2015 when it hired Diane Greene. But Microsoft saw the opportunity, leaned in and made remarkable strides in the second half of the decade by leveraging its massive software estate.

The 2010s also saw the rapid adoption of containers and an exit from the long AI winter, which along with the data explosion created new workloads began to go mainstream. During this decade we saw hybrid investments begin to show some promise as the ecosystem realized broadly that it had to play in the AWS sandbox or it would lose customers. And we saw the emergence of edge and “internet of things” use cases such as AWS’ Ground Station emerge.

The question is: What’s next?

Whereas the last decade was largely about shifting the heavy burden of IT infrastructure management to the cloud, in the coming decade, we see the emergence of a true digital revolution. Most people agree that COVID-19 has accelerated this shift by at least two to three years. We see all industries as ripe for disruption as they create a 360-degree view across their operational stack. Meaning sales, marketing, customer service, logistics and the like are unified such that the customer experience is unified.

We see data flows as unified as well where domain-specific knowledge workers are first-party citizens in the data pipeline, not subservient to hyperspecialized technology experts.

No industry is safe from this disruption and the pandemic has given us a glimpse of the future. Healthcare is going increasingly remote and becoming personalized. Machines are making more accurate diagnoses than humans in some cases. Manufacturing will see new levels of automation.

Digital cash, blockchain and new payment systems will challenge traditional banking norms. Retail has been completely disrupted in the last nine months. As has education. And we’re seeing the rise of Tesla Inc. as a possible harbinger to a day where owning and driving your own vehicle could become the exception rather than the norm. Farming, insurance… on and on…. Virtually every industry will be transformed as this intelligent, responsive, autonomous, hyperdistributed system provides services that are ubiquitous and largely invisible.

First, you may ask: “Is this even cloud that you’re talking about?” And that’s understandable. We would argue that the definition of cloud is evolving and expanding. Cloud has defined the consumption model for technology. You see cloudlike pricing models moving on-premises with initiatives such as Hewlett Packard Enterprise Co.’s GreenLake and now Dell Technologies Inc.’s APEX. Software-as-a-Service pricing is evolving and you see companies such as Snowflake Inc. and Datadog Inc. challenging traditional SaaS models with true cloud consumption pricing. We think this will become the norm.

As hybrid cloud emerges and pushes to the edge, the cloud becomes a hyperdistributed system with a deployment and programming model that becomes much more uniform and ubiquitous. So maybe this S-curve we’ve drawn needs an adjacent curve with a steeper vertical this decade. And perhaps the nomenclature evolves, but we believe that cloud will be the underpinning of whatever we call the future platform.

We also point out on the chart above that public policy will evolve to address privacy and industry power concerns and that will vary by region. So we don’t expect the big “techlash” to abate in the coming years.

And finally we definitely see alternative hardware and software models emerging as witnessed by Nvidia Corp. and Arm Holdings Ltd., data processing units from companies such as Fungible Inc., AWS and others, designing their own silicon for specific workloads, controlling their costs and reducing their reliance on Intel Corp.

So the bottom line is that we see programming models evolving from infrastructure-as-code to programmable digital businesses — where ecosystems power the next wave of data creation, data sharing and innovation.

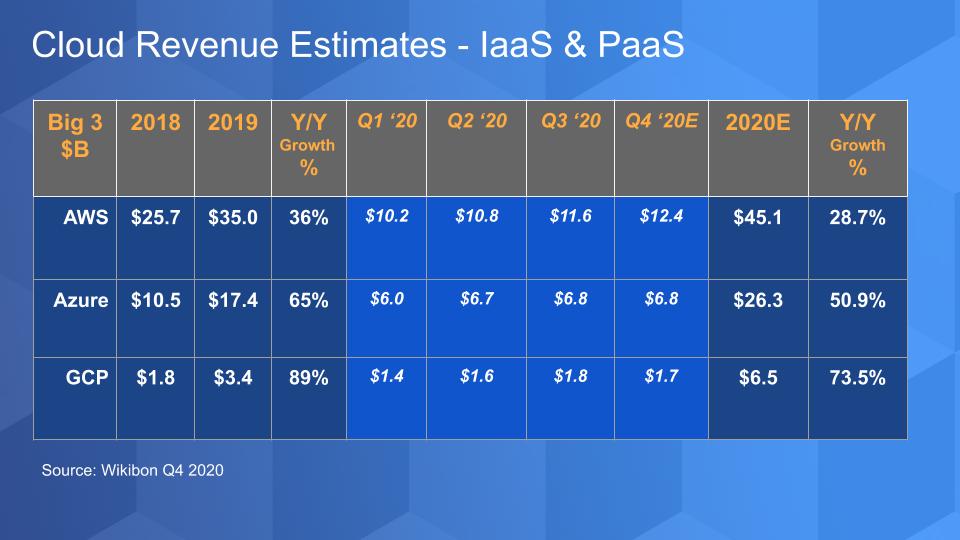

The chart below shows a just released update of our infrastructure-as-a-service and platform-as-a-service revenue for the big three cloud players, AWS, Azure and Google:

And you can see we’ve estimated fourth-quarter revenues or each player and the full-year 2020. Please remember our normal caveats on this data: AWS reports clean numbers, whereas Azure and GCP are estimates based on breadcrumbs each company tosses our way. We triangulate using our own surveys, ETR data and theCUBE network data. The following points are worth noting:

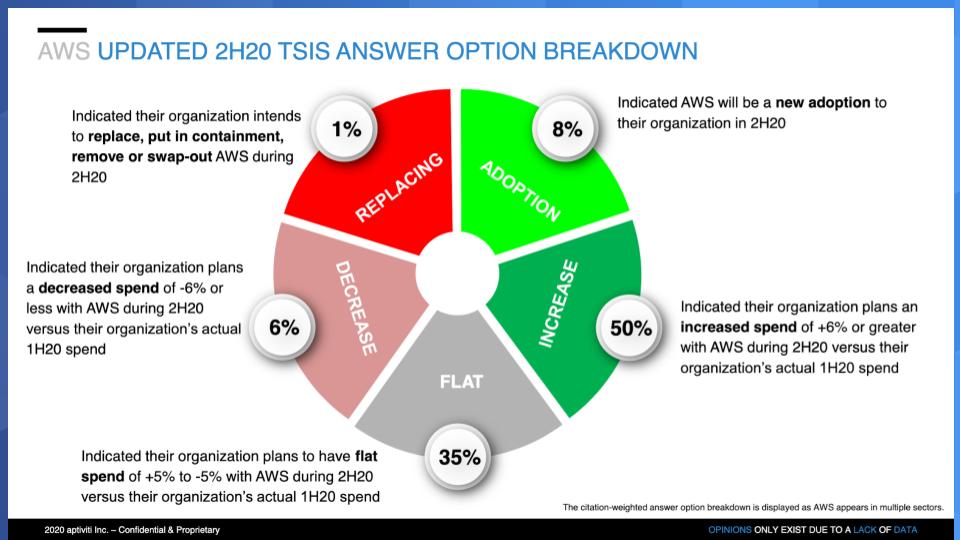

This wheel chart below shows how ETR calculates Net Score and its component parts:

Each quarter ETR gets responses from thousands of CIOs and IT buyers and asks them, “Are you spending more or less on a particular platform or vendor?” Net Score is derived by taking Adoption plus Increase and subtracting Decrease and Replacing – so subtracting the reds from the greens. Now, remember – AWS is a $45 billion company and it has a Net Score of 51%. So despite its exposure to virtually every industry, including hospitality and airlines and other hard-hit sectors, far more customers are spending more than less with AWS.

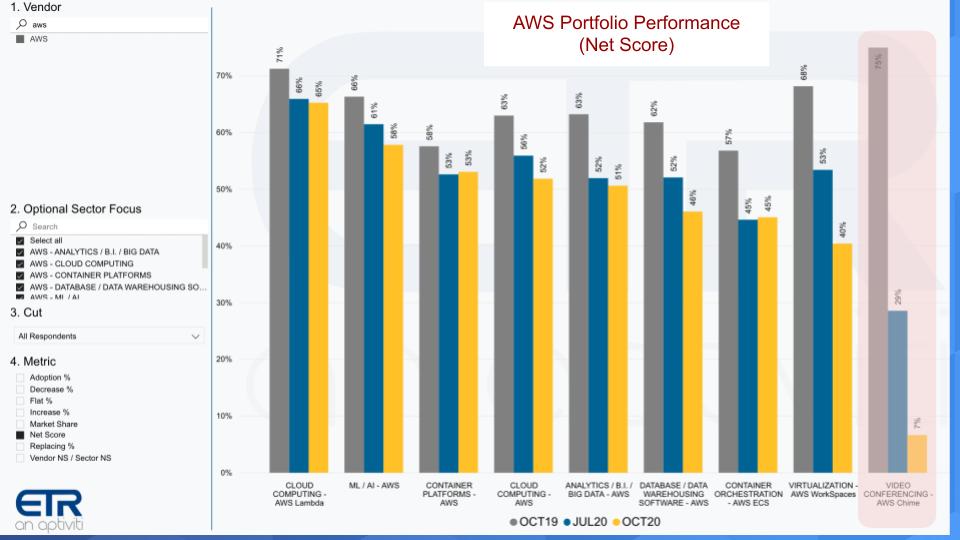

The chart below shows the Net Score across the AWS portfolio for three survey dates – last October (gray), this summer (blue) and the October 2020 survey (yellow):

Remember, Net Score is an indicator of spending momentum and, despite the deceleration as shown in the yellow, these are very elevated Net Scores. Only Chime videoconferencing is showing notable weakness in the AWS data set from the ETR survey, with an anemic 7% Net Score.

But every other sector has elevated spending scores. Starting with Lambda on the lefthand side, you can see a 65% Net Score. For context, very few companies have Net Scores that high. Snowflake and Kubernetes spending are two examples with higher Net Scores, but this is rarefied air space for AWS functions.

Similarly, you can see, artificial intelligence, containers, cloud overall and analytics all over 50% Net Score. Now, while database is still elevated with a 46% Net Score, it has come down from its highs as of late, perhaps because AWS has so many options in its own portfolio and the survey doesn’t have enough granularity. But there is competition as well.

On balance, this is a very strong portfolio from a spending momentum standpoint.

We find the data below to be very impressive. The chart shows the same portfolio view but isolates on the bright red portion of the wheel – that is, replacements:

Basically, very few defections show up for AWS in the ETR survey. Again, only Chime is a sore spot but everywhere else in the portfolio we’re seeing low single-digit replacements.

We’ve shown the chart below in previous Breaking Analysis segments. It plots Net Score or spending velocity on the vertical axis and Market Share, which measures pervasiveness in the data set, on the horizontal axis. And in the table portion – upper right corner, you can see the numbers that drive the positions of each company.

As you can see the data confirms what we know – this is a two horse race right now between AWS and Microsoft. Google is hanging out with the on-prem crowd, vying for relevance in the data center. We’ve talked extensively about how we would like to see Google evolve its business and rely less on appropriating data to serve ads…and focus more on cloud. There’s so much opportunity there.

But nonetheless, you see the so-called hybrid zone emerging. Hybrid is real. Customers want hybrid and AWS is going to have to learn how to support hybrid deployments with offerings like Outposts and others. But the data doesn’t lie. The foundation has been set for the 2020’s and AWS is very well positioned to maintain its leadership position.

The quotes below were pulled from several ETR VENN roundtables this year:

The compute bill. The first comment speaks to the cloud compute bill. It spikes and sometimes can be unpredictable.

AWS leadership. The second comment is from a CIO at a telco who says (we’ll paraphrase):

AWS is leading the pack and is No. 1 …and AWS will continue to be No. 1 by a wide margin.

Multicloud. The third quote is from a CTO at an S&P 500 organization who sees the importance of cloud independence as an architectural and strategic mandate. The central concern of this person is the software engineering pipeline. The strategy is clearly to go multicloud to avoid getting locked in and ensuring that developers can be productive, independent of the cloud platform — essentially separating the underlying infrastructure from software development.

We talked about how the cloud will evolve to become an even more hyperdistributed system that can sense, act and serve, providing sets of intelligent services on which digital businesses will be constructed and transformed.

We expect AWS to continue to lead in this buildout with its heritage of delivering innovations and features at a torrid pace.

We believe that ecosystems will become the mainspring of innovation in the coming decade and we feel that AWS has to embrace not only hybrid, but cross-cloud services. And it has to be careful not to push its ecosystem partners to competitors — it has to walk a fine line between competing and nurturing its partners. To date, its success has been a key to that balance as AWS has been able to, for the most part, call the shots. However, we shall see if competition and public policy attenuate its dominant position in this regard.

What will be fascinating to watch is how AWS behaves given its famed customer obsession — and how it decodes customer needs. As Steve Jobs famously said:

Some people say give the customers what they want, but that’s not my approach. Our job is to figure out what they’re going to want before they do. I think Henry Ford once said, ‘If I’d ask customers what they wanted, they would’ve told me a faster horse.’

Remember these episodes are all available as podcasts – please subscribe. We publish weekly on Wikibon.com and SiliconANGLE.com, so check that out and please do comment on the LinkedIn posts we publish. Don’t forget to check out ETR for all the survey data. Get in touch on twitter @dvellante or email david.vellante@siliconangle.com. And remember, Breaking Analysis posts, videos and podcasts are all available at the top link on the Wikibon.com home page.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.