BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

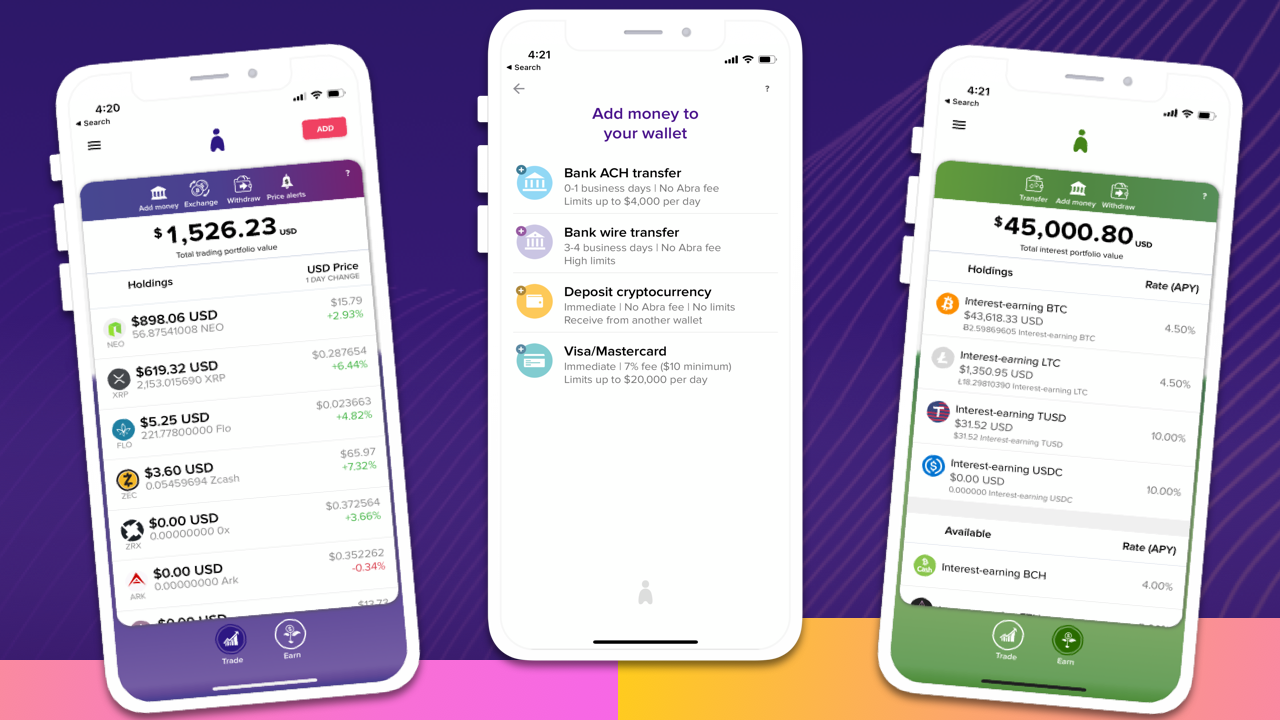

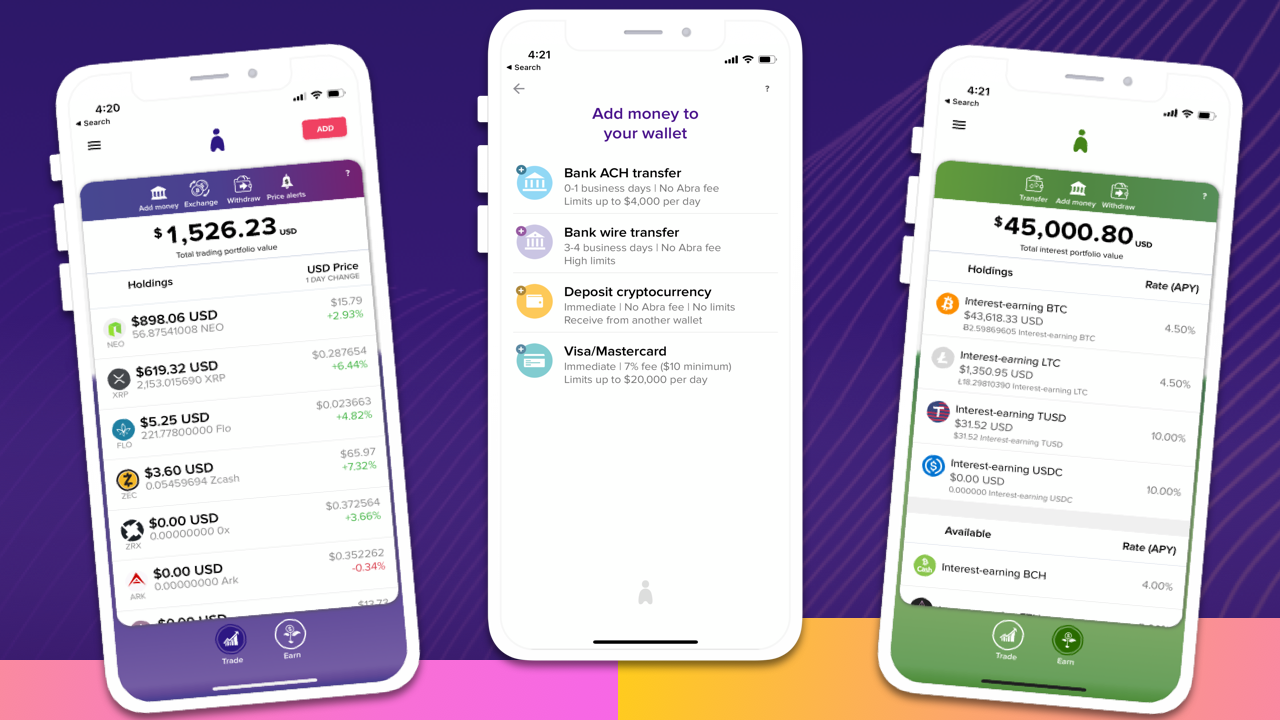

Crypto investment firm Abra Inc. today launched a new global cryptocurrency marketplace designed to enable consumers to compare prices and purchase more than 650 crypto assets from one place.

The company was founded in 2014 as a peer-to-peer blockchain remittance service but in later years shifted into offering both traditional cryptocurrency exchange services and the ability to invest cryptocurrency and earn interest. The new marketplace massively expands on the previous offering and is available in more than 150 countries.

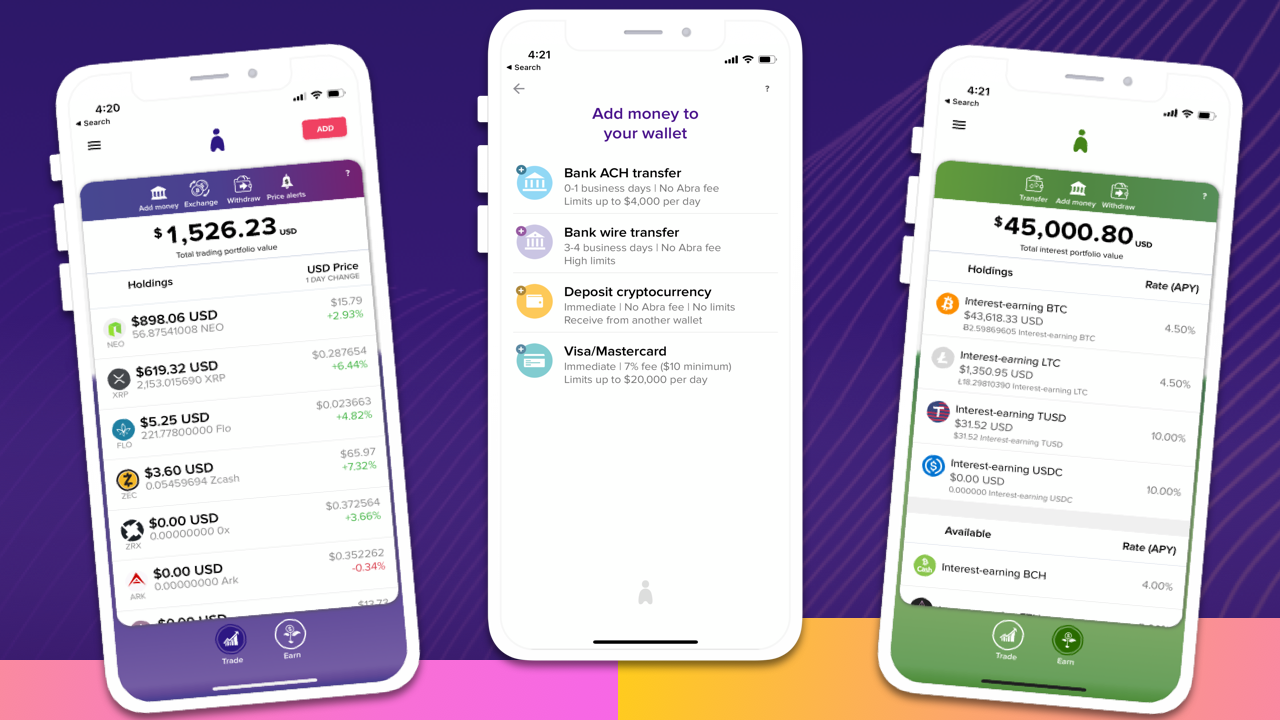

Large cryptocurrency marketplaces are not unique, but where Abra is attempting to differentiate itself is with support for wider range of payment methods, opening the door for more people to invest in cryptocurrency.

At launch, the new marketplace includes support for payments from Visa/Mastercard, Apple Pay, Google Pay, Samsung Pay, SEPA, FasterPay, iDEAL, Sofort-Klarna, Interac, POLi, PayID/OSKO, BPAY, Newsagent and Australia Post. The newly launched marketplace also offers a simple checkout experience using bank transfers in Australia, Canada, Europe, India and the U.K.

Abra’s cryptocurrency purchasing engine differs from other providers in that it aggregates the best prices from multiple partners and displays the options available to users based on their location and the payment method selected.

“We are on a mission to drive the mainstream adoption of cryptocurrencies, and with the launch of the crypto marketplace, we have taken it a step closer,” Abra Chief Executive Officer Bill Barhydt said in a statement. “Consumers can simply select the cryptocurrency they want to buy in their local currencies and check out using bank transfers, credit cards and retail cash points.”

Abra has run into trouble in the past. The company, along with its affiliate Plutus Technologies Philippines Corp. paid $300,000 to settle with the U.S. Securities and Exchange Commission and U.S. Commodity Futures Trading Commission in July for allegedly offering unregistered securities.

That said, the fine appears to have been a small blip for the company, which has ample support for investors. According to Crunchbase, Abra has raised $52.5 million in venture capital funding from American Express Ventures, RRE Ventures, Stellar Development Foundation, Kenetic, IGNIA, Chainfund Capital, Arbor Ventures, Nimble Ventures and Jungle Ventures.

THANK YOU