CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

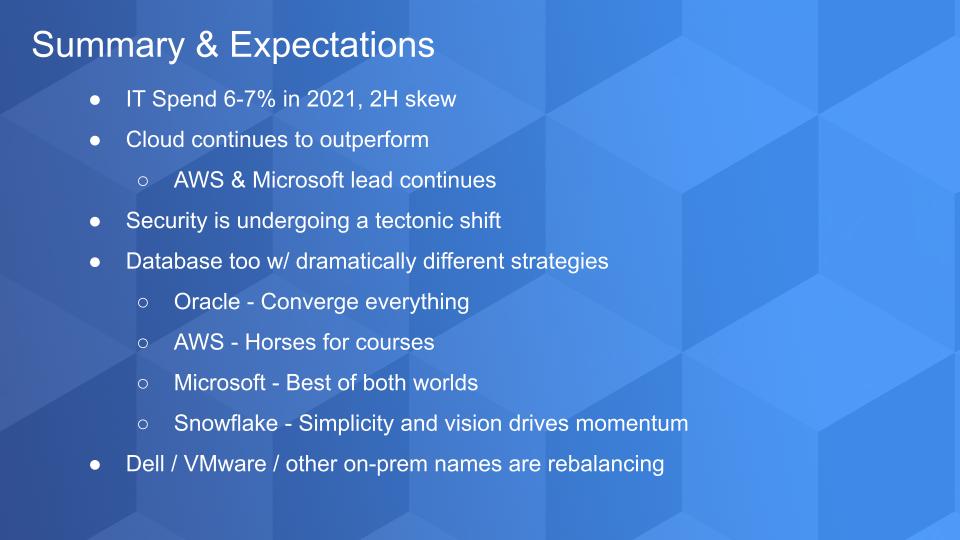

Tech spending is about to roar back.

Following a 4% to 5% contraction in 2020, we expect a 6% to 7% increase in 2021 technology spending. We see four key drivers for that growth:

1) Continued fine-tuning of and investment in digital strategies, such as cloud, security, artificial intelligence, data and automation;

2) Application modernization initiatives, such as containers;

3) Steady remote workforce infrastructure investment; and

4) Pent-up demand for data center infrastructure such as servers, storage and networking on-premises.

The major risk to this scenario remains the pace of reopening. However, even if there are speed bumps to the vaccine rollout and herd immunity, we believe tech spending will grow at least 2 points faster than gross domestic product in 2021, currently forecast at 4.1%.

In this Breaking Analysis, we will update you on our latest macro view of the market and share Enterprise Technology Research data in the following key sectors that we’ve been watching: Cloud (with a particular drill-down on Microsoft Corp. and Amazon Web Services Inc.), security, database and Dell Technologies Inc. and VMware Inc. as a proxy for the data center.

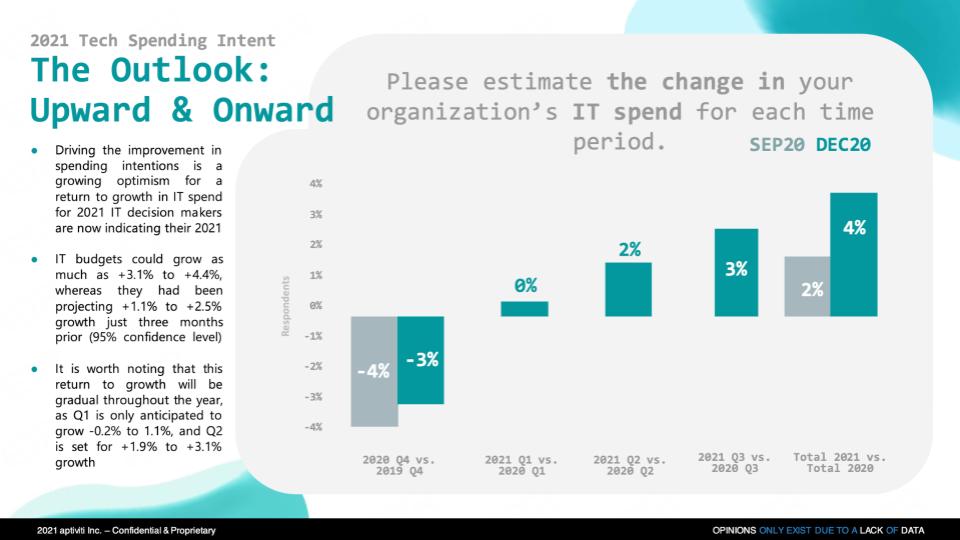

The chart above shows the latest survey data from ETR, comparing the December survey results with the year earlier data. Consistent with our earlier reporting we see a “swoosh recovery” with a slow first half and accelerating in the third and fourth quarter.

We believe chief information officers are being prudently conservative. Although ETR is forecasting 3.1% to 4.4% growth, our 6% to 7% projection is higher, factoring tech spend outside the visibility of CIOs and traditional information technology buyers, meaning line-of-business and edge initiatives. In addition, with GDP currently forecast at 4.1%, we expect tech spending to outperform in the 6% to 7% range.

Notably, the sanguine spending expectations are back-loaded, but we believe organizations will continue to benefit from productivity increases and a high comfort level with remote-work protocols. In other words, we expect digital businesses will continue to thrive, those businesses in transition will increase productivity and those that have been operating at reduced capacity during the pandemic will slowly come back in 2021.

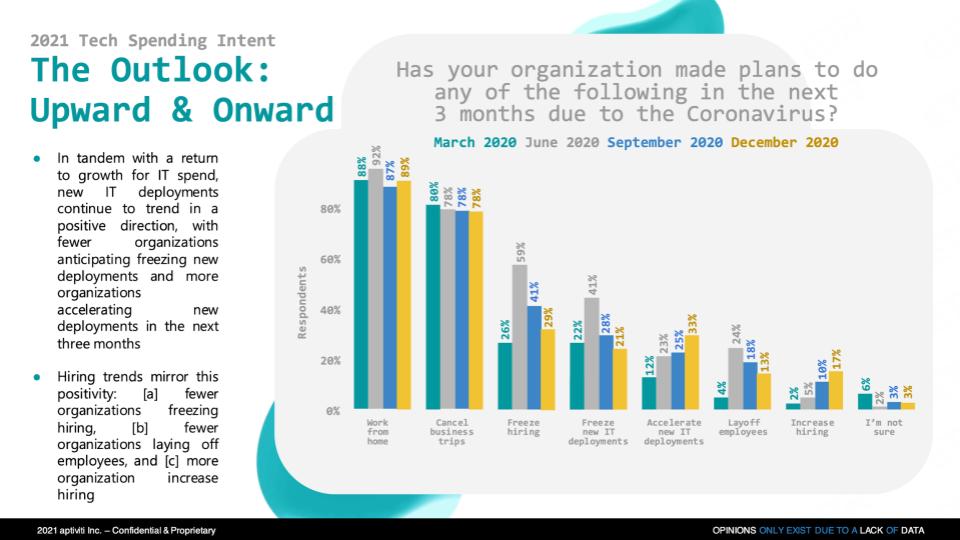

The chart below shows the current survey data from ETR on strategies organizations have deployed to deal with COVID.

You can see, no change in work from home. No change in business travel. But hiring freezes and freezing new deployments continue to trend down. New IT deployments continue their uptick and layoffs continue to moderate. Hiring is also up. All good signs.

Importantly, our spending forecast of 6% to 7% assumes a certain percentage of workers returning to the office in the second half of the year. We believe the current high percentage of employees twho work from home will moderate by the second half to around 35%, which represents a doubling of the historical average. And that large percentage will necessitate continued work-from-home infrastructure spend. At the same time, we believe it will drive spending at headquarters.

The caveat to this scenario is that lots of companies are downsizing corporate headquarters, so that could weigh on this dual investment scenario. But generally, with the easy compare and these tailwinds, we expect solid growth this year, thus our increased forecast.

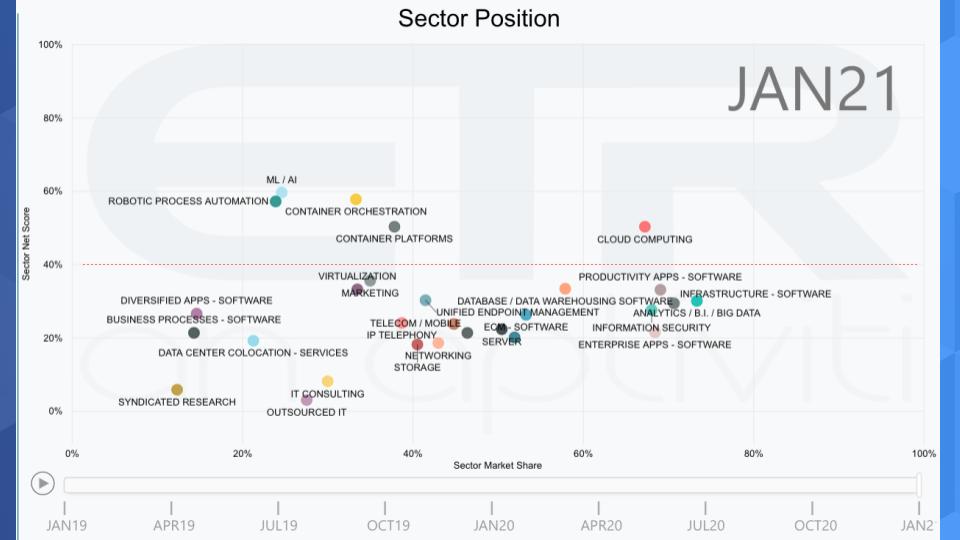

The chart below plots the spending data from ETR by sector. The vertical axis measures Net Score or spending velocity, while the horizontal axis measures Market Share or pervasiveness. Note the red dotted line at 40% Net Score underscores the elevated levels of these sectors.

These are the same sectors that have led through the pandemic and are foundations for digital business transformation. We expect they will continue to lead in 2021.

Cloud is the most impressive and stands out because it demonstrates not only spending momentum but a large presence in the data set. Cloud is becoming ubiquitous and spending intentions remain elevated.

One additional point, which highlights a taxonomical nuance in the ETR data: Generally, the four sectors highlighted don’t suffer from the Innovator’s Dilemma syndrome. In other words, these segments of the market within the ETR data set generally drive incremental revenue and are “stealing” from other sectors.

For example, the vendors in the cloud category don’t have a component of their business that is in free-fall decline, which has to be managed and offset by a growth line of business. Large, established vendors in on-prem networking, for example, do have that problem, and that will naturally depress the Net Scores within that sector.

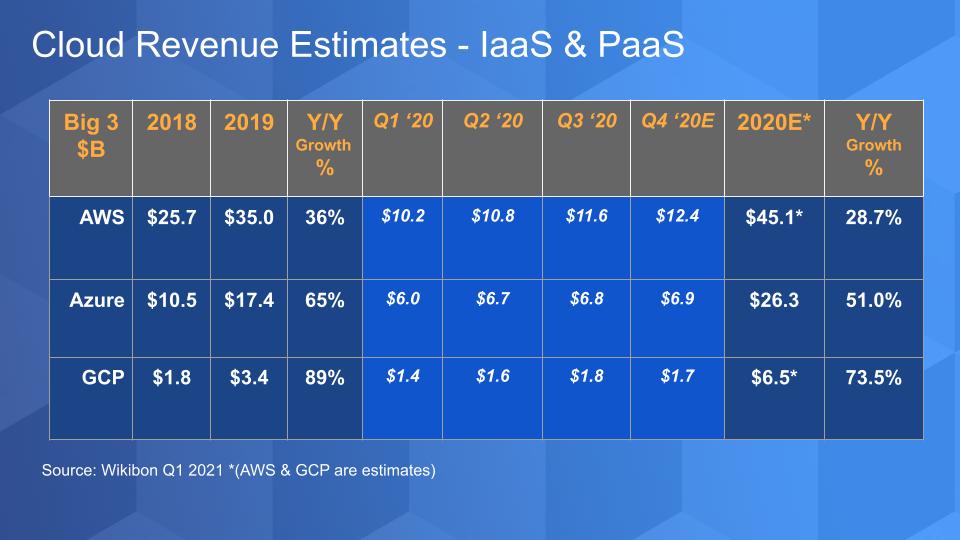

Microsoft reported earnings in mid-January and the chart below updates our forecast for the company’s infrastructure-as-a-service revenue for the year. We have not as of yet made any changes to our AWS or Google LLC data for 2020.

We had forecast Microsoft Azure’s fourth-quarter revenue at $6.8 billion, a 46% growth rate relative to fourth-quarter 2019. Azure’s reported growth was 48% and we’ve updated our figures accordingly to $6.9 billion for the quarter. The change for the year was immaterial. Note that Microsoft does not report Azure IaaS revenue figures, only growth rates relative to its overall cloud categories.

Amazon and Google report earnings in early February and as always we’re watching closely to see if Microsoft’s accelerating growth rate is a harbinger of market forces that are also benefitting AWS and Google to a similar degree, or if there are other factors in Microsoft’s business model allowing it to take even greater advantage of the cloud’s tailwinds. Our expectation is the former, that is AWS and possibly Google, will outperform our expectations.

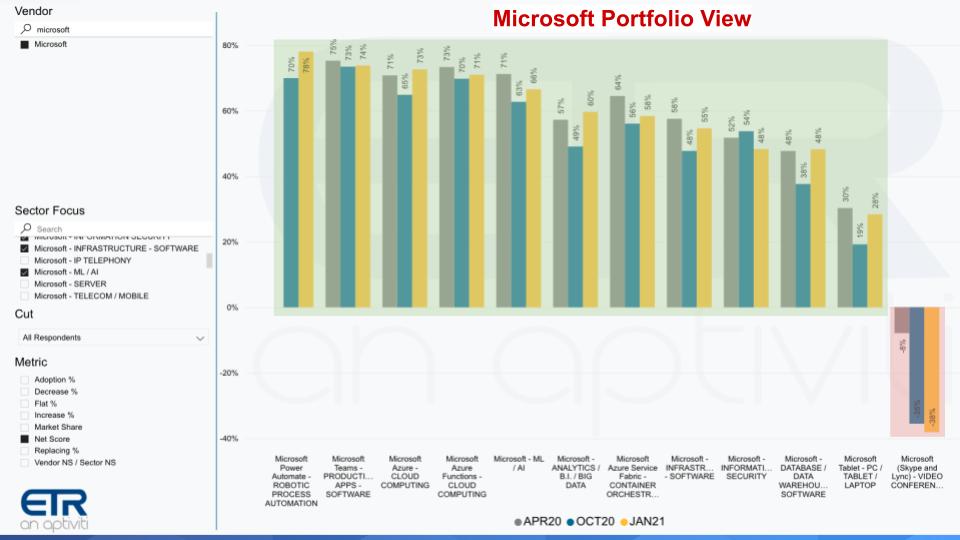

The graphic below shows ETRs survey data for Net Score, or spending momentum, across selected parts of Microsoft’s portfolio.

Virtually every of sector of Microsoft’s portfolio shows forward momentum and is in the green relative to last quarter’s survey. Power Automate (robotic process automation), Teams with off-the-chart demand, Azure, serverless, AI, analytics, containers — all with over 60% Net Scores. Skype is the only dog and Microsoft is doing a great job of transitioning its customers to Teams there.

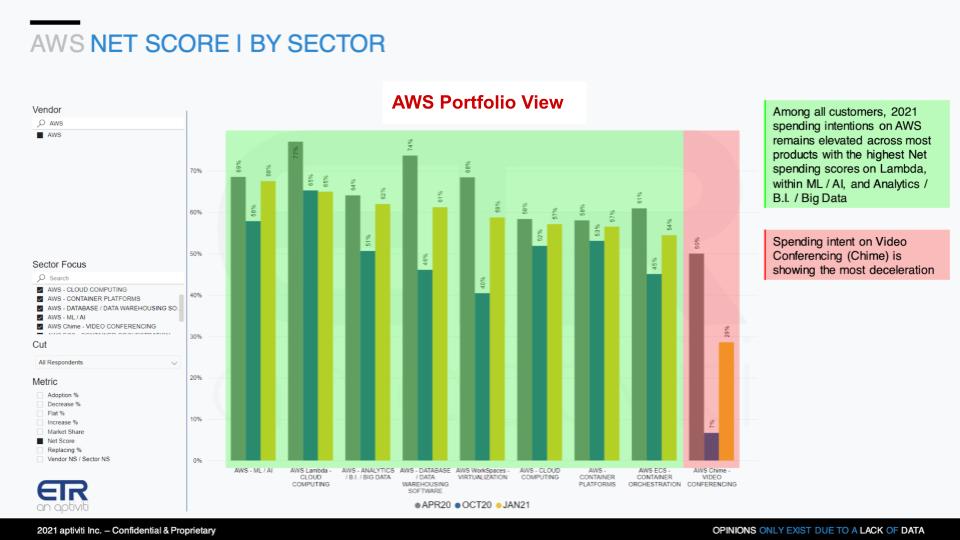

AWS Net Scores are not quite as high as Microsoft’s, but virtually all of its sectors are well into the 50% Net Scores or above.

Only Chime videoconferencing lags the pack and, despite its better showing than October, without a Teams-like refresh, we don’t see Chime competing for a top spot along with Zoom, Teams and Cisco Webex.

Nonetheless, AWS shows across-the-board strength, which is impressive for a $45 billion cloud company.

Security is a sector we’ve highlighted for several quarters and it’s undergoing massive change. Security is always on the radar, emphasized as a priority with the work-from-home pivot and the recent government hack.

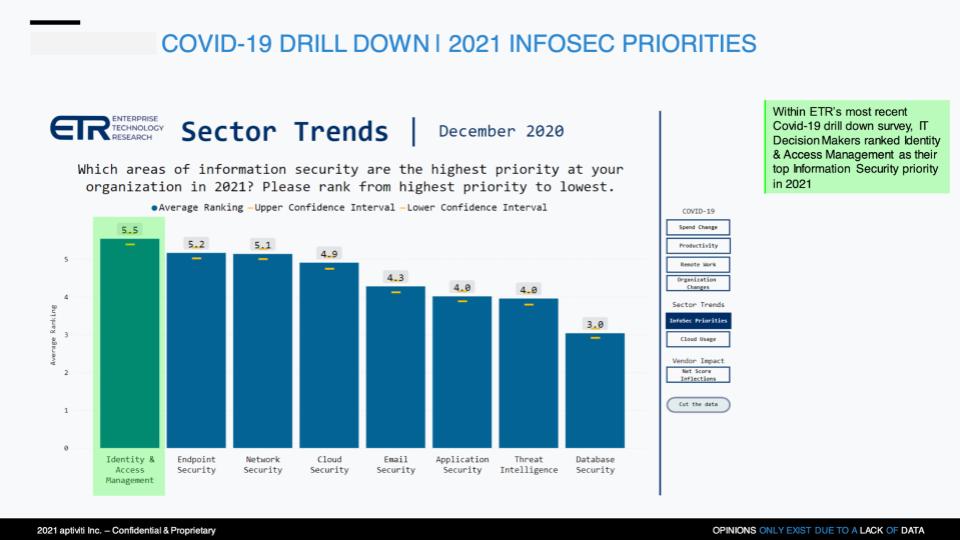

The chart above ranks CIO and chief information security officer priorities for security and here you see identity access management stands out. So this bodes well for the likes of Okta Inc. and SailPoint Technologies Inc. Endpoint security ranks highly – good news for CrowdStrike Holdings Inc., ForeScout Technologies Inc. and Carbon Black (acquired by VMware). Network security is up there – it’s kind of all network security – but Cisco, Palo Alto Networks Inc. and Fortinet Inc. and their security portfolios are benefiting. And cloud security is helping the likes of Microsoft, Amazon and Zscaler Inc. as well.

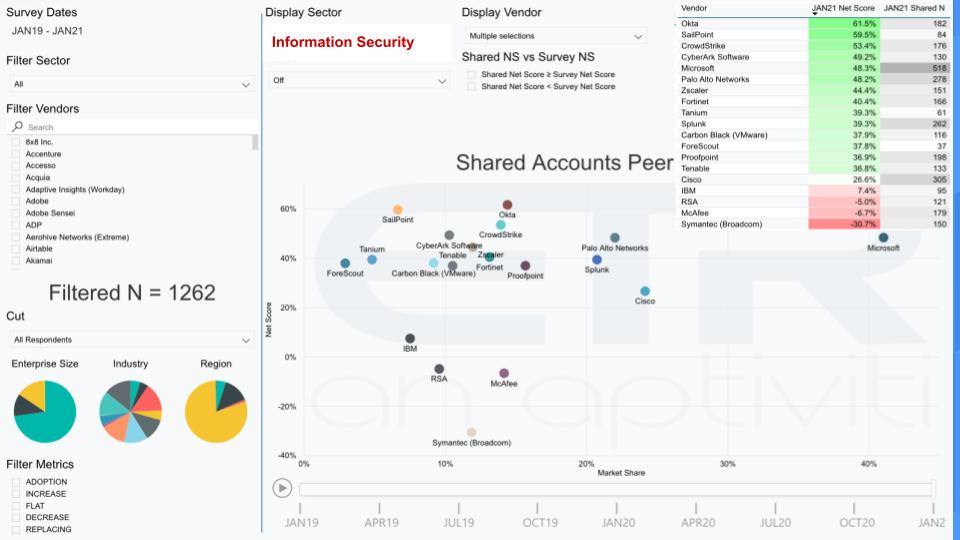

The chart below shows Net Score, or spending momentum, on the vertical axis and Market Share on the horizontal. Okta maintains its Net Score lead, with SailPoint and CrowdStrike looming large. Microsoft is impressive because of its dual threat of a large presence in the market and strong spending momentum.

For context we’ve included some of the legacy names such as RSA, McAfee and Symantec. They’re in the red, meaning more customers are spending less or defecting than are spending more or adding. IBM Corp. is also in the danger zone, although its Net Score is a small positive.

But the rest of the security pack we show is solidly in the green. Security remains a priority for CIOs and CISOs. It’s a fragmented market with lots of viable players.

However, the security market is undergoing a major change with the shift to cloud and remote work. It has been a boon for some of the specialists that we’ve highlighted, but established players with large portfolios are managing well in the transition, notably Palo Alto Networks, Cisco and Fortinet continue to have high mindshare with CISOs.

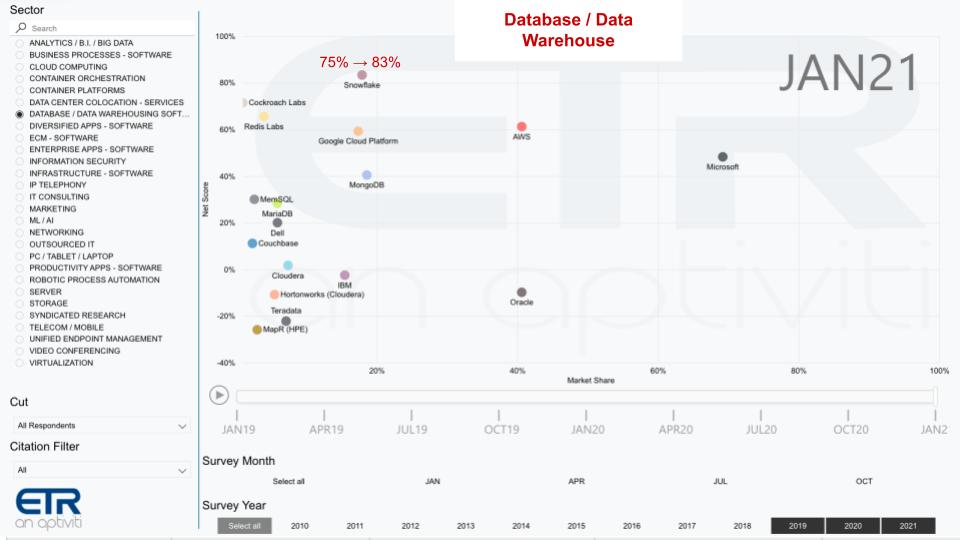

Below is the latest survey data showing the same XY view for the Database/Data Warehousing sector.

The first thing that calls for attention is Snowflake Inc. We’ve been reporting on the company for years now and sharing ETR data for a year or so. The company continues to impress with spending momentum or Net Score increasing from 75% last quarter to 83% in this latest survey. This is unbelievable because historically these numbers are not sustainable.

Snowflake’s Net Score has increased from 75% to 83%. It’s not common to see such an acceleration on an already elevated Net Score.

AWS is the other big call-out. Here’s a company that has become a database powerhouse and, from a standing start, has become a leader in the market. Google’s momentum also stands out, especially with its technical prowess. And of course Microsoft is notable – again given its presence in the market combined with strong momentum.

The database market is seeing dramatically different strategies. Amazon is pursuing a strategy of the right tool for the right job. It offers many different data stores with specialized databases for different use cases: Aurora for transactions, RedShift for analytics. DynamoDB for key value store, Neptune for graph database and databases for document workloads and time series and so forth. It’s a very granular portfolio.

Oracle Corp. is at the other end of the spectrum. It, along with many others, is converging capabilities into a sort of “mono-database.”

Microsoft’s world largely revolves around Azure SQL, although it does offer other options. But the big difference between Microsoft and AWS is AWS’ approach is to maximize granularity and technical flexibility with fine-grained access to primitives and APIs. Microsoft, with Synapse for example, is willing to build abstraction layers as a means of simplifying analytics experiences.

AWS’ approach favors optionality as the market changes. Microsoft’s philosophy favors abstracting complexity, which adds overhead, but simplifies.

Snowflake, for its part is building a data cloud on top of AWS, Google and Azure — another example of adding value by abstracting away the underlying infrastructure complexity. It seems to be working well for Snowflake, at a smaller overall revenue base than some of its larger competitors, but its growth is eye-popping.

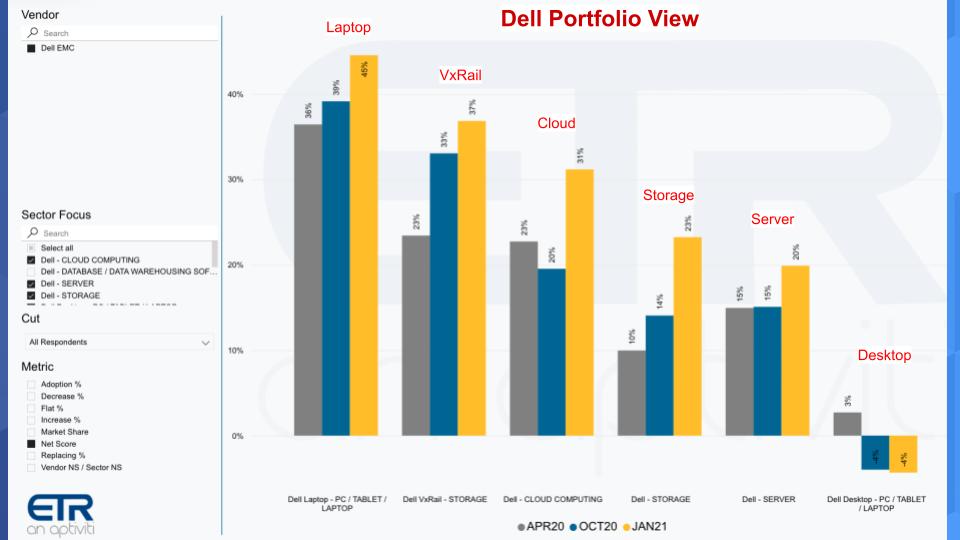

Let’s have a look at Dell and VMware as proxies for traditional markets with large installed bases on-premises.

The chart above shows Dell’s Net Scores across select parts of its portfolio. It’s a nice picture for Dell. Everything but desktop is showing forward momentum relative to previous quarterly surveys. Laptops continue to benefit from the remote-worker trend and have been a cash flow drive for Dell.

Dell’s cloud, which comprises a number of infrastructure components along with professional services, shows strength. Meanwhile, both storage and server momentum seem to be picking up and have relatively easy comparisons from 2020 for Dell. These two sectors have been lagging, but this data supports our pent-up demand premise for on-prem infrastructure. We’ll see if the survey translates into revenue growth for Dell.

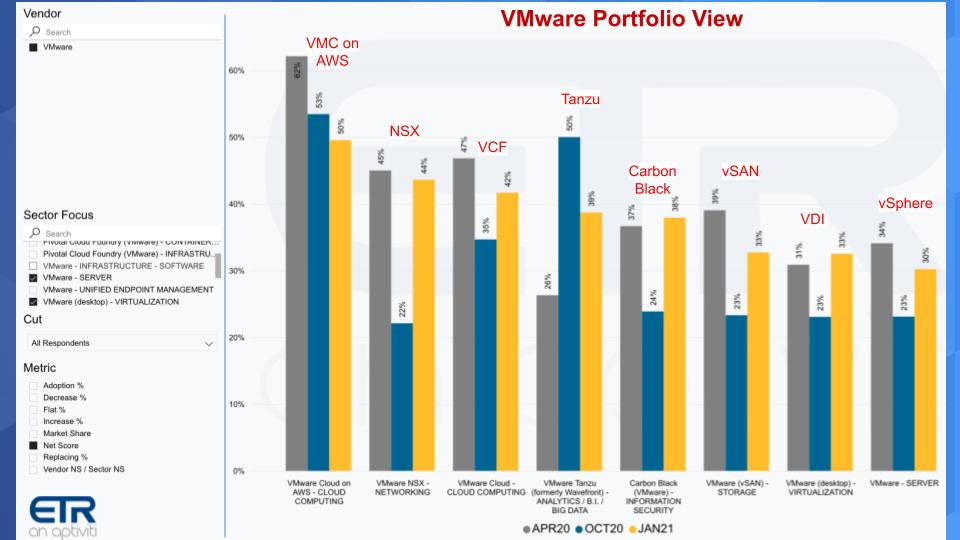

The picture below for VMware is generally solid. VMware Cloud on AWS, while moderating, is coming down from high spending momentum. NSX is bouncing back in the survey, VMware’s on-prem cloud with VCF is strong. Tanzu is a bit surprising because containers are very strong overall and we’d like to see better spending momentum there. Carbon Black benefits from the security tailwind. Core infrastructure looks good – vSAN, vSphere and VDI.

The big thing we’re watching for VMware is, of course, who will be the next CEO. Will Zane Rowe, acting CEO and recent chief financial officer get the job? Will it go to Chief Operating Officer Sanjay Poonen? The choice will say much about the direction of the company in our view. Succeeding Pat Gelsinger and the track record he built will be no small feat.

This summer we expect Dell to spin out VMware, restructure both VMware and Dell’s balance sheet and set a new era in motion. That financial transaction might call for a CEO with the financial background to navigate such a move. But certainly Poonen has been a loyal soldier and has performed exceptionally well in his executive roles. There’s little doubt he’s ready for the role and has earned it. No offense to Rowe, by the way — he’s an outstanding executive too.

But the big question for Dell and VMware is: What will the future of these two companies look like? They still have to get through paying down the debt so they can truly double down on an innovation agenda from an R&D perspective. Research and development is the lifeblood of a tech company and there are so many opportunities across clouds and at the edge. But these will require organic investment as well as strong mergers and acquisitions in our view. VMware has been an active acquirer, but imagine what it can do without the constant cash donations it has been forced to make to support Dell’s transformation.

We’re watching these factors closely and see significant upside for VMware and Dell if and when they collectively can get past the perpetual balance sheet gymnastics.

We see tech spend growth coming in as high as 7% this year, powered by cloud, AI, automation, application modernization and a new work paradigm that will force increased investment in digital initiatives. Think of this as a hybrid world that requires investment in not only in both cloud and on-prem, but in remote worker infrastructure that will continue to drive productivity and competitive advantage.

But cloud is the big winner and AWS and Microsoft are in the top division of the cloud bracket.

Security markets are really shifting and we continue to like the momentum of companies in identity, endpoint and cloud security– especially the pure plays such as Crowdstrike, Okta, SailPoint and Zscaler. But CISOs tell us they want to work with the big names too, because they trust them. That bodes well for Palo Alto Networks and Cisco, which have the resources to withstand these market shifts, and Fortinet, which has done well transitioning to cloud and serving mid-markets. We’ll do a deeper drill-down on security soon and update you on others trends and companies in the space.

The database world continues to heat up, thanks to cloud databases, especially Snowflake and its data cloud vision and its emphasis on simplicity. We’re seeing lots of different ways to skin a cat and though there’s disruption, we believe Oracle’s position is solid in its mission critical stronghold, while AWS and Microsoft continue to be the convenient choice for many customers. But there’s lots of innovation going on in databases beyond these names and we’ll update you on that soon as well.

Lastly, it’s quite notable how well some of the legacy names have navigated through the COVID-19 pandemic. Sure, they’re not rocketing like many of the work-from-home stocks, but they’ve been able thus far to survive and, in the example of Dell and VMware, the portfolio diversity has been a blessing. Cisco Systems Inc. and Hewlett Packard Enterprise Co. similarly we think have better days ahead as they manage through these transitions.

The bottom line is the first half of 2021 seems to be shaping up as we expected. Momentum for the strongest digital plays and low interest rates are helping large established companies hang in there with strong balance sheets and large customer bases.

What will be really interesting is to see what happens coming out of the pandemic. Will the rich get richer? Yes, we think so. But we see the legacy players adjusting their business models, embracing changes in the market and steadily moving forward.

And we see at least a dozen new players hitting the radar that could become leaders in the coming decade and we’ll be highlighting many in future episodes.

Remember these episodes are all available as podcasts wherever you listen. Ways to get in touch: Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts. Check out ETR for the survey data.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.