SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

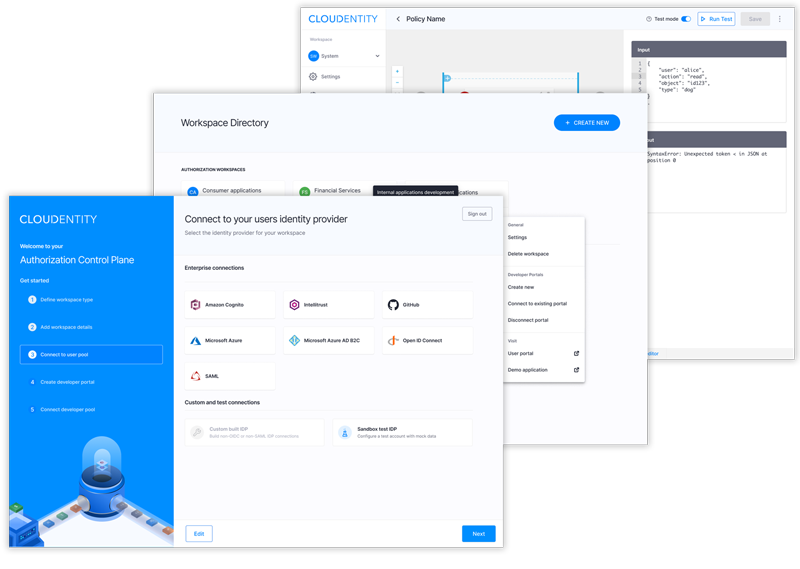

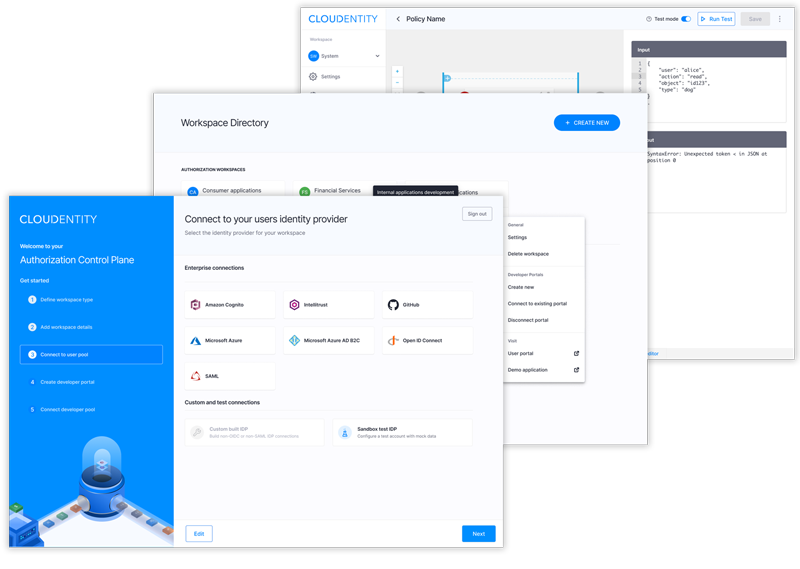

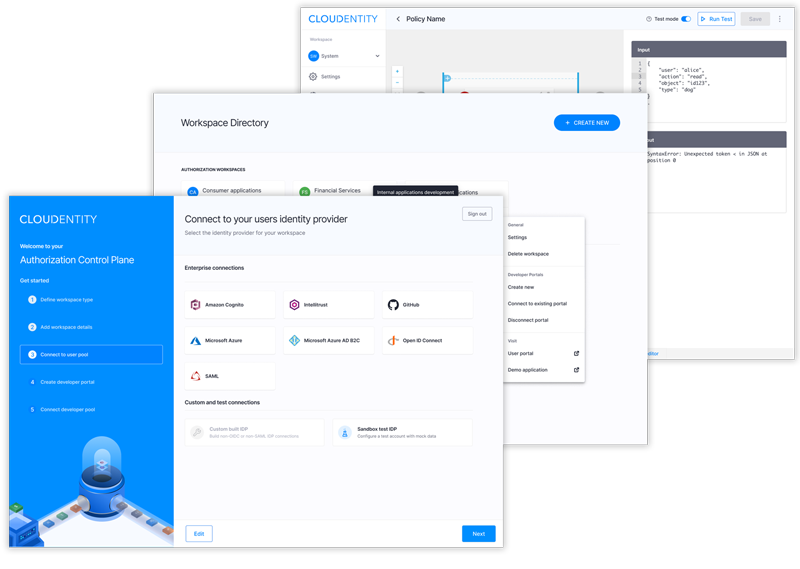

Identity-aware authorization and application security solutions provider Cloudentity Inc. has announced a new partnership with application programming interface integrations platform provider Axway Software SA to deliver zero-trust authorization for open banking services.

Open banking services are the use of APIs to enable third-party developers to build applications and services around a financial institution. The gist of the idea is to deliver greater financial transparency options for account holders ranging from open data to private data.

Levering Cloudentity’s dynamic authorization automated governance and machine learning

technology, the integrated solution automates the onboarding of APIs and cloud services on the Amplify platform.

With the partnership, APIs and services are protected with fine-grained progressive consent and pre-built open banking consent flows, providing pre-configured dynamic access control policies that meet the specific needs of open banking standards around the world. Those standards include the European Union Payment Services Directive, U.K. Open Banking, Australia’s Consumer Data Standards and the Financial Data Exchange.

The integrated solution is said to also automate the protection of APIs and cloud services on the Amplify platform to deliver on the promise of secure open banking with dynamic authorization. That includes security and privacy guardrails that reduce development costs for building consent flows by up to 85%.

“Getting consent right is one of the most challenging aspects of creating a comprehensive open banking solution,” Vince Padua, chief technology and innovation officer at Axway, said in a statement. “By partnering with Cloudentity and leveraging their financial-grade API-compliant authorization control plane, we can hide the complexity of consent and identity in our Amplify platform. This lets our customers use the consent provider of their choice and focus on building great open banking APIs.”

Founded in 2011, Cloudentity has raised $13 million in venture capital funding, according to Crunchbase. Investors include ForgePoint Capital and WestWave Capital.

THANK YOU