INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Computer graphics chipmaker Nvidia Corp. pulled out all the stops as it delivered strong fiscal fourth-quarter financial results today, posting record revenue in its main Data Center and Gaming business segments.

The strong gains ensured that Nvidia topped Wall Street’s expectations by a wide margin. The company posted a profit before certain costs of $3.10 per share on revenue of $5 billion, versus analysts’ forecast of a $2.81-per-share profit on $4.82 billion in revenue.

For the full year, Nvidia reported a profit of $10 per share on record annual revenue of $16.68 billion, up 53% from a year ago.

The company’s stock fell about 2% in after-hours trading, but shares had risen about 2.5%, to $579.96 a share, in the regular session on a relatively strong day for the overall market.

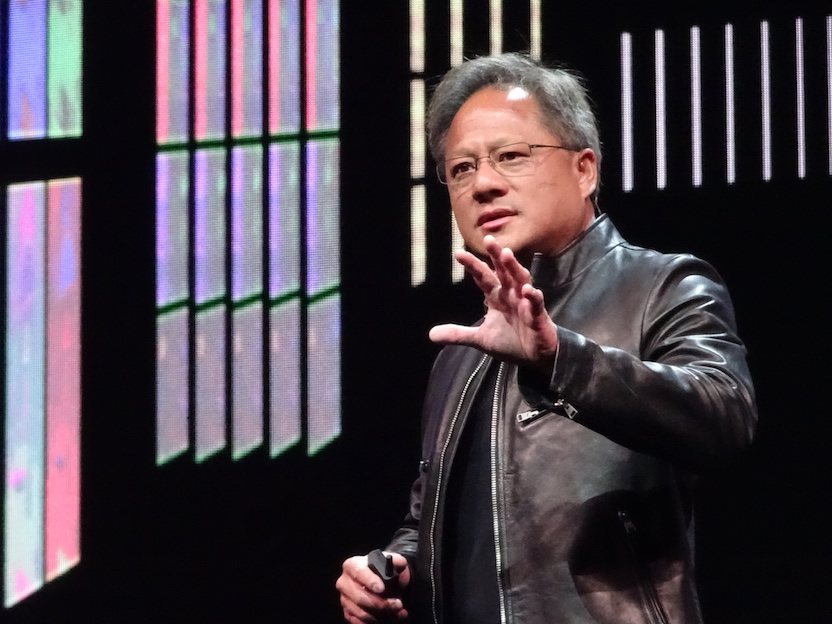

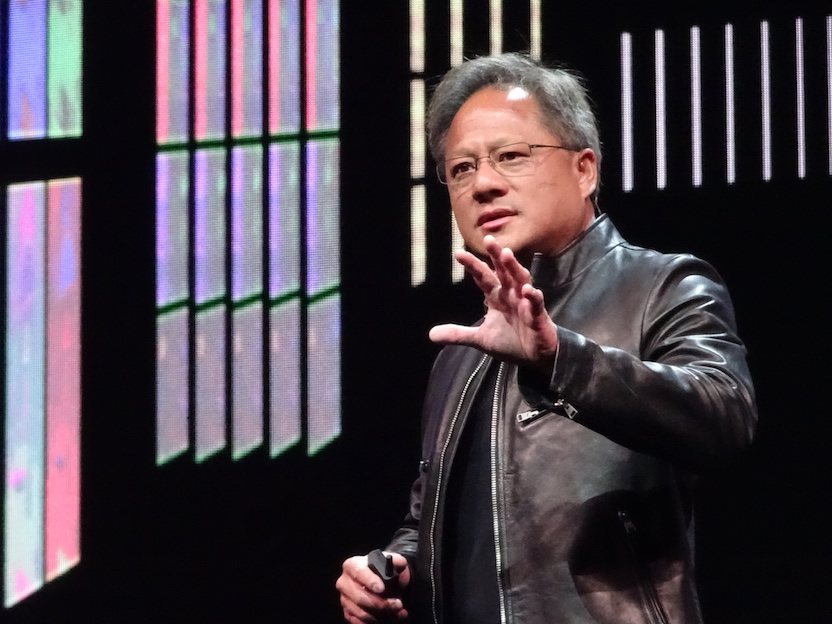

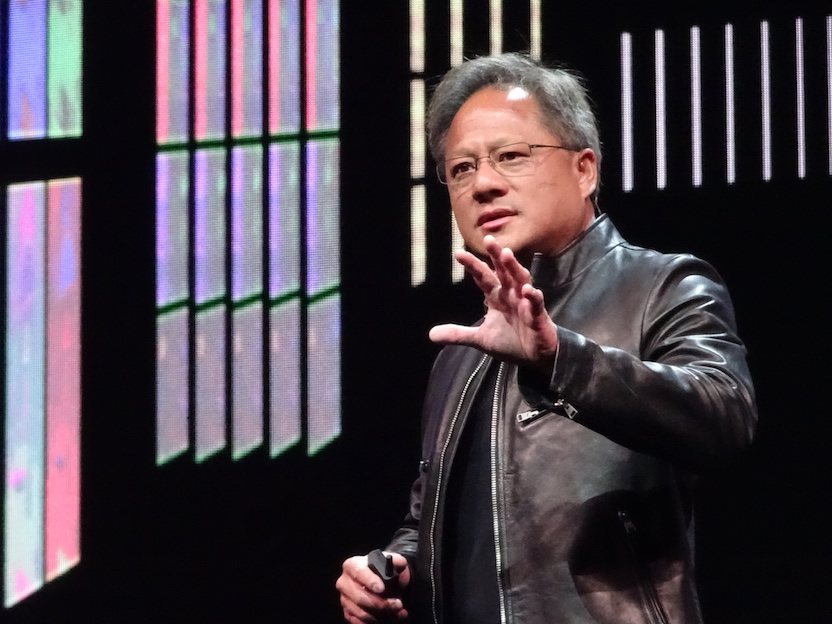

Nvidia Chief Executive Jensen Huang (pictured) said 2020 was a “breakout year” for the company’s computing platforms. “Our pioneering work in accelerated computing has led to gaming becoming the world’s most popular entertainment, to supercomputing being democratized for all researchers, and to AI emerging as the most important force in technology,” he said.

Nvidia’s numbers prove that Jensen’s comments are not hollow. Its data center business, which sells GPUs for artificial intelligence and supercomputing workloads, posted record quarterly revenue of $1.9 billion, up 97% from a year ago. Full-year revenue jumped 124%, to $6.7 billion.

The data center business was driven by strong sales of Nvidia’s most advanced A100 series GPUs that were launched in May. During the quarter, Nvidia began selling its first batch of OEM data center servers loaded with those chips, while its DGX A100 systems added support for Google LLC’s Anthos hybrid cloud service on bare-metal servers.

“Our A100 universal AI data center GPUs are ramping strongly across cloud-service providers and vertical industries,” Huang said in his statement. “Thousands of companies across the world are applying NVIDIA AI to create cloud-connected products with AI services that will transform the world’s largest industries. We are seeing the smartphone moment for every industry.”

Huang explained in a conference call with analysts that the “smartphone moment” refers to the opportunity to change the way industries can interact with customers. The idea, he said, is that instead of selling something just once, whether that’s a medical device or a tractor or a lawn mower, companies can now “sell something and then provide a service on top of it,” just like they do with smartphones.

“In the future all of these industries, whether medical imaging or lawn mowers, you’re going to have data centers hosting your products, just like CSPs,” Huang added.

Nvidia’s gaming division did even better this quarter, with record revenue of $2.5 billion, up 67% from a year ago. For the full year, it recorded sales of $7.76 billion, up 41%. Demand was driven by sales of new games consoles such as the PlayStation 5 and Xbox Series X, and also Nvidia’s biggest-ever laptop launch of more than 70 new devices for gamers and creators powered by its new GeForce RTX 30 Series GPUs.

Huang said demand for the GeForce RTX 30 Series GPUs was “incredible” during the quarter. “Nvidia RTX has started a major upgrade cycle as gamers jump to ray tracing, DLSS and AI,” he said.

The only disappointment was Nvidia’s smaller Professional Visualization and Automotive businesses. Revenue in the first came to $307 million, down 7%, while the second reported sales of $145 million, down 11%.

“Nvidia had a very good Q4 and drove record revenue driven by large increases in gaming and datacenter, essentially a repeat of last quarter,” said Moor Insights & Strategy analyst Patrick Moorhead. “In gaming, Nvidia is taking advantage of more people staying home, gaming and with a very competitive 300 Series product line. As I predicted last quarter, major game titles dropping, like the new ‘Call of Duty Black Ops Cold War,’ drove upgrades.”

Constellation Research Inc.’s Holger Mueller said Nvidia was firing on all cylinders and that passing $20 billion in annual revenue based on its run rate means it’s now a member of “the super league of IT suppliers.”

“There is no reason t0 think that Nvidia will not be able to keep up that trend in 2021, as the pandemic fuels both data center growth and gaming growth,” Mueller said. “The task now for Nvidia executives is to manage that growth successfully, making sure it finds new customers and grows its existing customers.”

Huang also provided an update on Nvidia’s proposed $40 billion acquisition of the British chip designer Arm Ltd., saying the company was making “good progress” and that the deal will “create enormous new opportunities for the entire ecosystem” when it goes through. The acquisition has met some resistance. The U.K.’s antitrust watchdog said in January it will investigate the deal and rival chipmaker Qualcomm Inc. voiced its opposition, but most analysts believe that it will ultimately be given the go-ahead.

In the meantime, Nvidia is confidently forecasting that its hot streak will continue, saying it expects revenue of $5.3 billion in the first quarter, well ahead of Wall Street’s forecast of $4.51 billion.

THANK YOU