CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Virtual events platform startup Hopin Ltd. said today it has raised $400 million in new funding to accelerate growth, scale up operations and strengthen its team and platform.

The Series C round was led by Andreessen Horowitz and General Catalyst and included IVP, Coatue, DFJ Growth, Northzone, Salesforce Ventures and Tiger Global. The investment values Hopin at $5.65 billion.

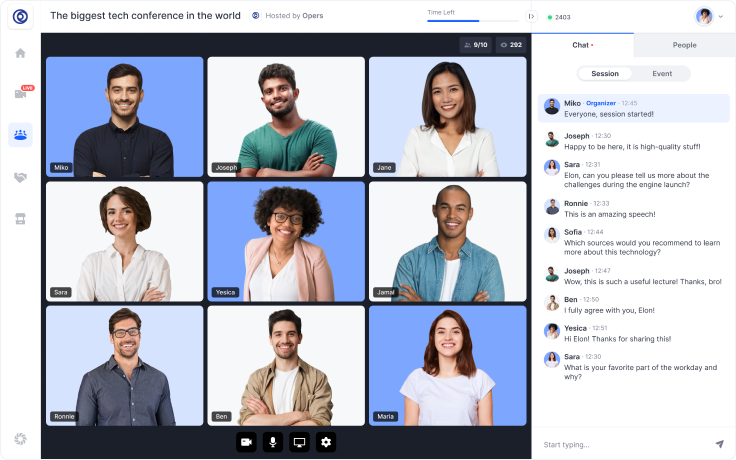

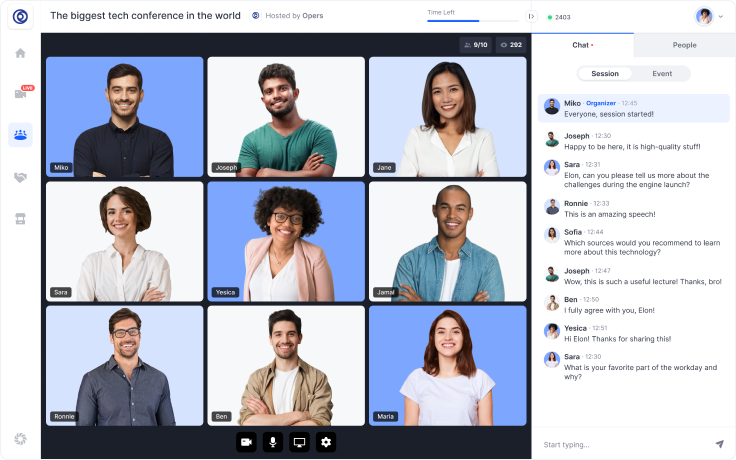

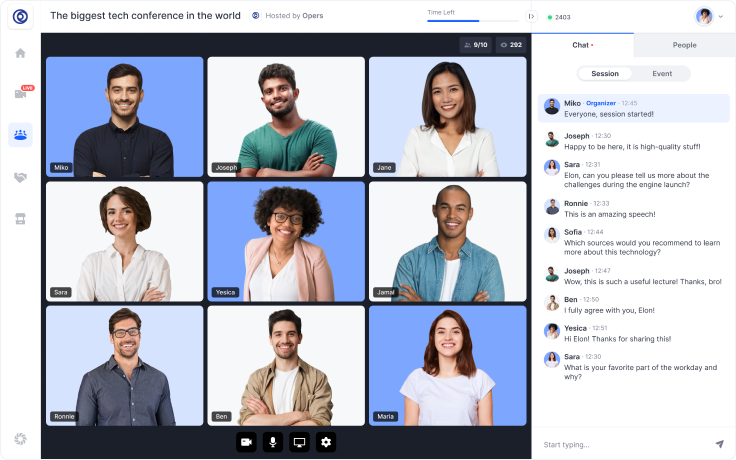

Founded in 2019, Hopin offers an all-in-one live online events platform designed to connect distributed communities. The company’s platform differs from most other videoconferencing services in that it’s designed from the ground up to provide support for conferences, including the management of stages, networking, breakout sessions, sponsors, tickets and analytics.

With the COVID-19 pandemic ongoing, Hopin has thrived and demand for virtual events has “exploded overnight” according to Hopin co-founder and Chief Executive Johnny Boufarhat. The company launched six months early in March and has gone from strength to strength since that time.

The user numbers are impressive, with more than 80,000 organizations now using Hopin, 3.6 million video content creators using StreamYard, the company’s live streaming platform, and millions attending and viewing events hosted by Hopin each month. The company has grown over the last 12 months from zero revenue to $70 million in annual recurring revenue.

It comes as no surprise that Hopin’s rapid growth has also resulted in interest from investors, though the intensity of that interest is striking. In the last year, Hopin has raised $565 million in venture capital funding, including a $40 million round in June and $125 million in November, the latter on a valuation of $2 billion. New clients since the funding in November include HP Inc., American Express Co., Poshmark Inc. and the Financial Times.

Hopin intends to expand into related businesses. StreamYard for example was acquire by Hopin for $250 million in January while the company acquired mobile app Topi for an undisclosed sum in December.

“We’re now trying to expand into a multiproduct company, with the greater mission of being the company that drives accessibility around the workplace,” Boufarhat told CNBC.

With such rapid growth also comes the possibility of a future initial public offering or even a merger with a special-purpose acquisition company. Speaking to TechCrunch, Boufarhat said that he receives regular outreach from SPACs, but at this time he plans to have Hopin operationally IPO-ready next year, meaning a possible IPO in 2022 or 2023.

THANK YOU