CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Microsoft Corp. Chief Executive Satya Nadella sees a different future for cloud computing over the coming decade.

In his Microsoft Ignite keynote this past week, Nadella (pictured) laid out the five attributes that will define the cloud in the next 10 years. His vision is a cloud platform that is decentralized, ubiquitous, intelligent, sensing and trusted. It’s one that actually titillates the senses and levels the playing field between consumers and creators by placing tools in the hands of more people around the world.

In this Breaking Analysis, we’ll review the highlights of Nadella’s Ignite keynote, share our thoughts on what it means for the future of cloud specifically and tech generally, provide a more tactical view of Microsoft and compare its performance within the Enterprise Technology Research data set.

Nadella made the statement that we have reached peak centralization today — that we are witnessing radical changes in computing architecture from the materials used to semiconductors and software that will serve a new frontier forming at the edge. He envisions a world where there will be more sovereignty and decentralized control.

We couldn’t agree more. The cloud universe is expanding and the lines are blurring between what’s being done on-premises, across public clouds and the cloud experience will extend everywhere, with data flowing through a hyper de-centralized system.

To us, data sovereignty means that whatever the local laws are, the system will have the intelligence to govern privacy, data provenance and corporate edicts. Ambient intelligence is a field of research that leverages pervasive sensor networks and artificial intelligence to respond to and anticipate humans’ needs and actions, as well as those of machines. Nadella sees a future where “business logic will move from being code that is written to code that is learned from data.” He imagines a sort of autodidactic system as fundamental to tackling big problems like personalized medicine or climate change.

Nadella said there will increasingly be a balance between consumption and creation. Essentially he’s predicting that creation will be democratized and his vision is to put tools in the hands of people to allow them to tip the scales toward knowledge workers, front line employees, students, everyone – creating content, applications, code and more. Power to the people! And underneath this vision are new forms of silicon, operating systems and entirely transformative digital experiences.

Picking up on the accelerated themes of remote work, Nadella emphasized that the future must accommodate flexibility in how, when and where people work. He sees a new model of productivity emerging, not necessarily defined by corporate revenue per employee (for example) but by the economic advantages that become accessible to everyone through better access to technology, collaboration tools, education and healthy lifestyles– all enabled by this ubiquitous cloud.

Nadella said ethical principles must govern the design, development and deployment of AI. The system must be secure by design with zero trust built in to protect business assets and personal privacy.

This was a big vision that connects the dots between bits and atoms, and sets up Microsoft to extend its reach well beyond office productivity tools and cloud infrastructure. He cited the Microsoft cloud as the underpinning of its future and specifically called out Teams, 365, HoloLens 2 and the announcement of Microsoft Mesh, a new mixed-reality platform.

Nadella said Mesh will do for virtual reality what Xbox live did for gaming – take the experience from single-person to multiperson. Holographic images with no screens empowering advances in medicine, science, technology and social interactions.

Although Nadella avoided naming the competition directly, one statement stood out to us:

To us this was a direct shot at Amazon Web Services Inc., Google LLC and Apple Inc. How so? And what does it tell us?

In his book “Seeing Digital,” author David Moschella said Silicon Valley, broadly defined, has a dual disruption agenda. What does that mean? Not only are large tech companies disrupting horizontal layers of the tech stack – compute, storage, networking, database, security, applications and so forth… but they’re also disrupting industry norms. For example, Amazon in media, grocery, logistics, Google and Amazon in healthcare, Google and Apple in automobiles, all three in fintech. And it’s likely this is just the beginning.

But Nadella’s posture suggests that Microsoft, for now at least, is content being mostly a horizontal technology provider. There are some examples where you could argue that Microsoft lives in some gray areas – as a games developer, for example, or as a software-as-a-service competitor. But these are more natural cohorts to technology than, say, Amazon’s retail business.

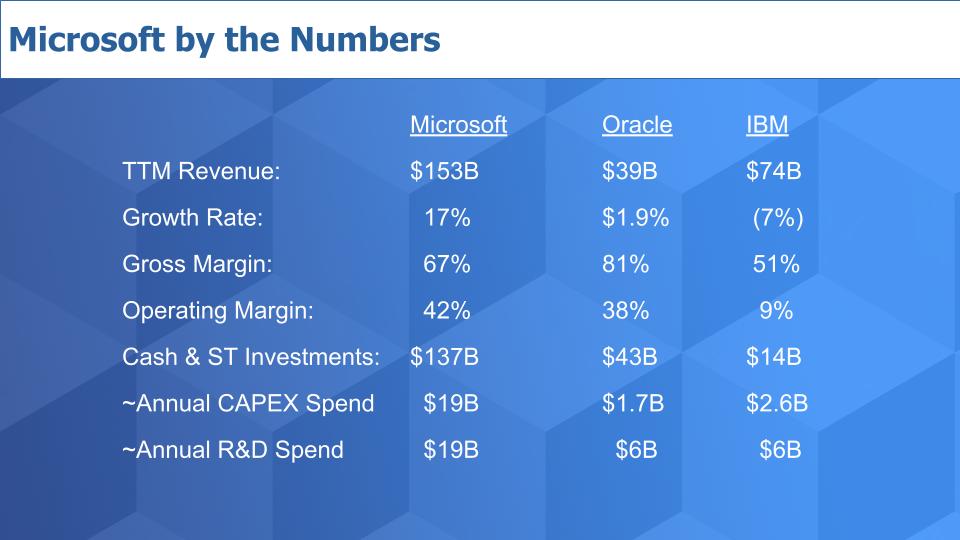

Here’s a financial snapshot of Microsoft compared to Oracle Corp., a highly profitable software company, and IBM Corp., an industry legend.

The first two things that jump right out are Microsoft’s size and growth rate. Microsoft is double IBM’s revenue and nearly four times that of Oracle, and yet it’s growing in the mid-teens. Compared that to the low single digits for Oracle, and IBM continues to shrink so it can, ostensibly, finally grow consistently again.

Microsoft’s gross margin model is pulled down by its hardware businesses, but its operating margins are unbelievable. Meanwhile, the cash on its balance sheet is immense – much larger than Oracle’s, which has a very healthy cash hoard and certainly dwarfs that of IBM, a company that had to take on lots of debt to acquire Red Hat and has a balance sheet that increasingly looks more like Dell’s than its historical self.

And look at the last two rows. Oracle and IBM, both owners of their own cloud, have been lapped by Microsoft in terms of capital spending and research and development investment. As it happens, IBM’s research and development spending in 2007, the year after AWS launched the modern era of cloud, was comparable to that of Microsoft.

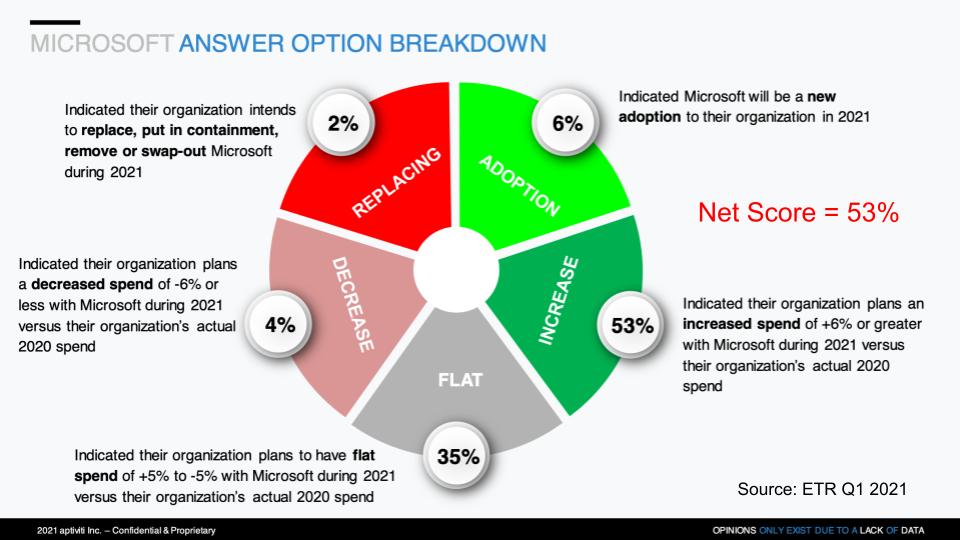

We’ll start by sharing a fundamental basis of the ETR methodology – the calculation of Net Score. Net Score is a measure of spending momentum and here’s how it’s derived. The chart below shows the components of Microsoft’s Net Score:

Net Score comprises five parts and represents the percentage of customers within the ETR survey with specific spending profiles. The lime green is new adoptions. The forest green is increased spend of 6% or more for 2021 relative to 2020. The gray is flat spend. The pinkish slice is spending declining by 6% or more and the bright red is replacements. Subtract the reds from the greens and you get Net Score.

As you can see, Microsoft’s Net Score is 53%, which is very high for a $150 billion company.

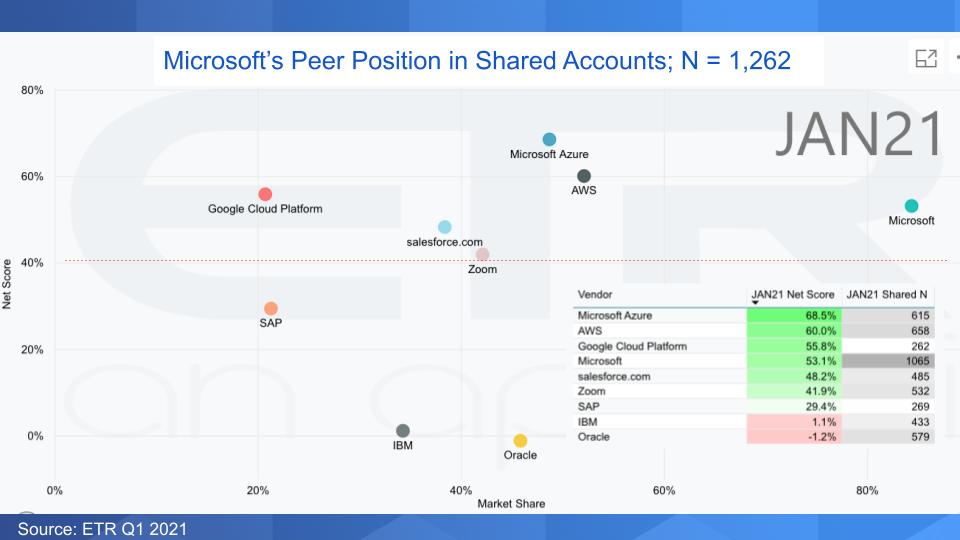

The chart below shows how Microsoft fares relative to its major peers. The vertical axis shows Net Score or spending velocity and the horizontal axis shows Market Share which measures pervasiveness in the survey. In the table insert you can see the vendors, sorted by Net Score and the Shared N column, which represents the number of shared accounts in the data set. On both dimensions, bigger is better.

Note the red line – that’s the 40% water mark which is our personal indicator of elevated Net Score. Anything above that in our view is really solid.

Microsoft – as usual – shows strength on both the X and Y axis. It shows well to the right in MarketShare with an overall Net Score of 53% on the Y axis. And then we added Azure specifically, which doesn’t have the presence of Microsoft overall, but is still prominent on the X-axis with a Net Score approaching 70% on the Y axis– amazingly strong for such a large platform.

AWS, not surprisingly, is very prominent on the horizontal axis with a highly elevated 60% Net Score on the vertical dimension. Meanwhile, Zoom Video Communications Inc., Salesforce.com Inc. and Google Cloud are all above the 40% line showing solid momentum. Google, as we’ve reported, is well off the pace on the horizontal axis, and even though its Net Score is elevated, we’d like to see it even higher given its size relative to AWS and Azure.

SAP always impresses because it’s a large company with a Net Score hovering just under 30%.

And you can see IBM and Oracle. Now we’re showing here IBM and Oracle overall, so the whole kitchen sink, comparable to the Microsoft turquoise dot. So you can see why those two are valued much lower than Microsoft.

But Oracle has some momentum, as we reported. The Barron’s article on Feb. 19 declaring Oracle a cloud giant and its stock a buy — combined with some earnings upgrades, including one last week from Raimo Lenschow of Barclays — have catapulted the stock to an all-time high and a valuation over $200 billion.

IBM, unfortunately, is a different story, as we’ve discussed extensively in previous Breaking Analysis segments. CEO Arvind Krishna has a lot of work to do to get this national treasure back to its prominent self.

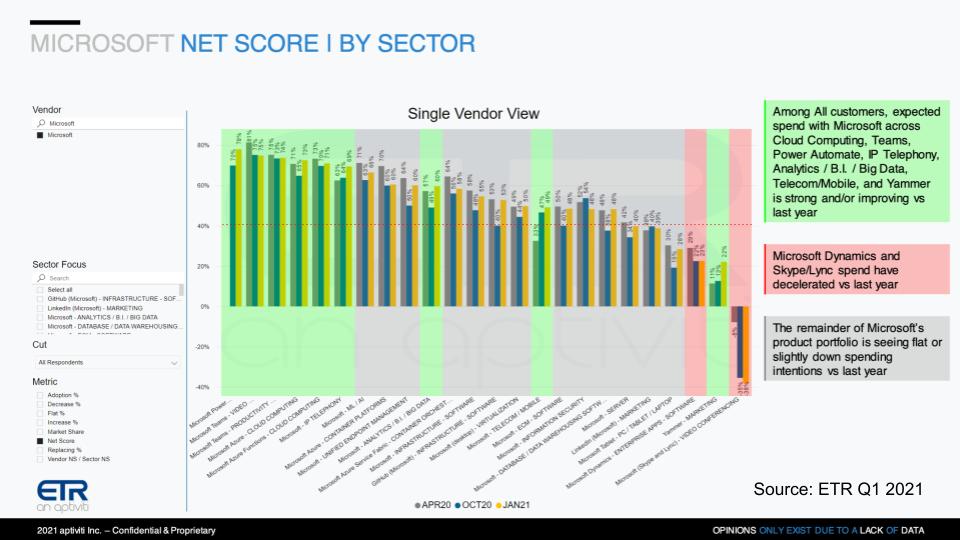

The graphic below shows Microsoft’s Net Score across its product lines within the ETR taxonomy.

And you can see it’s the company is pretty much killing it across the board. Microsoft plays in almost every sector and you can see the 40% red line and how many of its offerings are above that line. The yellow bar is the most recent survey and though there’s quite a bit of gray (meaning flat spend) relative to 2020, we’re talking about some very tough compares in 2020.

And yet there’s still a huge chunk of the portfolio in the green – meaning spending momentum is actually up from last year in some of Microsoft’s most important sectors like cloud and Teams and analytics. Only Skype and Microsoft Dynamics really lag. So it’s nice story there in our view.

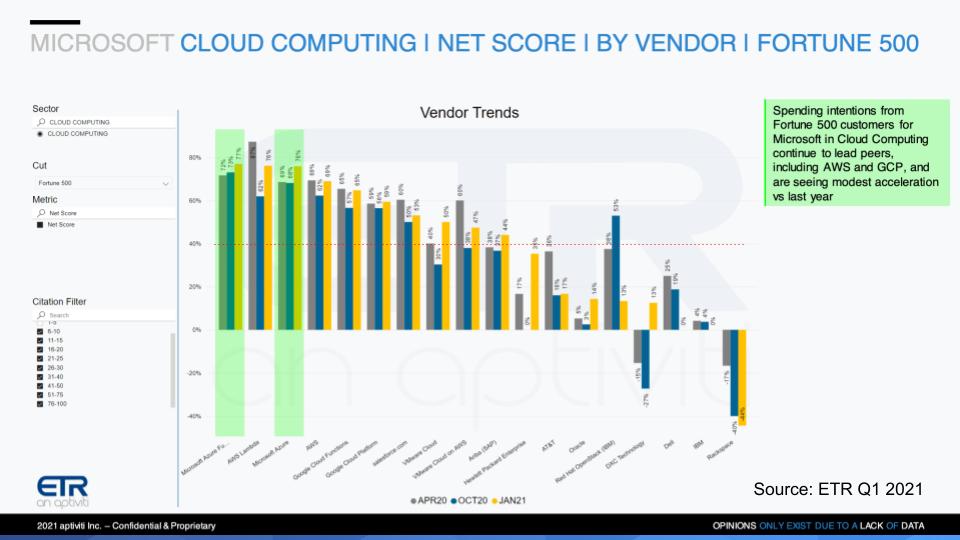

Nadella basically said that Microsoft’s future will be built on top of its cloud and looking at the picture below it’s pretty encouraging for the company.

The chart above shows Net Score spending momentum inside Fortune 500 customer– a key bellwether sector in the ETR data set.

And you can see Azure and Azure functions well above the 40% red line and extremely well positioned relative to AWS and GCP, which also show elevated Net Scores. Importantly, the yellow bar tells us that compared to previous surveys, Microsoft’s cloud business is actually gaining momentum in this all-important sector.

Other notable call-outs on this chart are VMware Inc. cloud, which is its on-premises/hybrid cloud offering, VMware Cloud Foundation, and VMware Cloud on AWS, which is reportedly doing well but off from its momentum highs of last spring.

You can see Oracle jumped up – indicating cloud momentum but still well below the performance of the largest cloud players. The IBM Cloud appears to be a non-factor in the survey and, as we’ve previously stated, we’d like to see IBM recalibrate the financials for its cloud business and come up with a reporting framework that better represents the prevailing mental model of cloud computing. A cleaner number, in our view, would allow IBM to build on the Red Hat momentum and better communicate its progress.

We’re not sure how much weight to put on the Hewlett Packard Enterprise Co. boosted performance. It looks significant but only 17 data points are represented in this segment of the survey of the Fortune 500. But 17 Fortune 500 companies is not terrible, and HPE’s Net Score in that sector is more than double its cloud Net Score overall – so that’s positive.

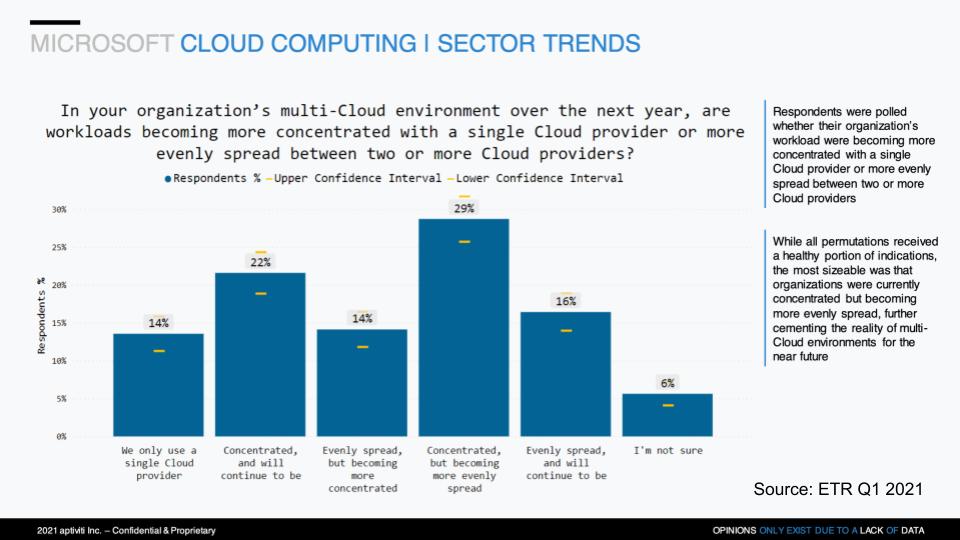

The chart below simply asks customers about cloud adoption currently and within the next 12 months.

The survey asked customers to describe their cloud provider usage and strategy. You can see that only 14% of the survey respondents have exclusively a monocloud strategy. But add in an additional 22% that are predominantly single-cloud and you now have more than a third of the customer base gravitating toward monocloud. Another 14% say they’re concentrating cloud providers more narrowly.

On the flip side, a big group, 29%, are moving toward multicloud. And if you add in the additional 16% who say they are and will continue to be evenly spread, 45% of the survey is solidly headed in that direction.

The picture above is mixed. What’s the takeaway? Well, we think AWS CEO Andy Jassy is right when he says that while many customers use more than one cloud they tend to have a primary provider and have something like a 70/30 or 80/20 split between primary and secondary clouds.

We think, however, this could change but only to the extent that the vendor community is adding value on top of the existing hyperscale clouds. What we’re saying is that there is a real opportunity to create value on top of the cloud infrastructure being built out by AWS, Google and Microsoft. Instead of fearing cloud, the vendor community should be embrace it: Create a layer on top, abstract away the underlying complexities associated with cloud native and building value on top.

Snowflake Inc.’s Data Cloud vision is right on in our view. We can envision virtually every layer of the stack following suit. Even within database there are opportunities to identify more granular segments across clouds. For example, despite Snowflake’s early multicloud lead, you’re seeing competitive firms such as Teradata Corp. begin to architect a system across clouds that can query data warehouses from distributed locations as part of what they refer to as a data fabric.

Sound like Snowflake’s (or better yet, Zhamak Deghani’s) data mesh? Sure, but Teradata’s vision emphasizes capabilities that Snowflake’s doesn’t – for example, the ability to do complex joins across clouds. And we can see plenty of market for both companies.

And why shouldn’t a similar vision extend from on-premises, across clouds to the edge for data protection, security, governance, hybrid compute, analytics, federated applications…. It’s potentially a total market worth more than a trillion dollars. but the hyperscale providers are likely too busy worrying about their own walled gardens to start pursuing it.

So Dell Technologies Inc., HPE, VMware, Cisco Systems inc., Palo Alto Networks Inc., Fortinet Inc., Zscaler Inc., Cohesity Inc., Veeam Inc. and hundreds of other tech companies – including IBM and Oracle too — they all should extend their thanks to AWS, Google and Microsoft for spending all that money to build out great infrastructure you can tap… and go build.

Many vendors will say, “We’re already doing this.” K, maybe you’re working on it. We’ll be observing the ratio of real versus slideware. Because today the denominator is much larger than the numerator. When the ratio hits 1X we’ll know this is real.

Remember these episodes are all available as podcasts wherever you listen, email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, on inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU