CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Zuora Inc., a company that sells cloud subscription services to enterprises, delivered strong fourth-quarter earnings today, beating expectations on revenue and profit.

The company reported a loss before certain costs such as stock compensation of 2 cents per share on revenue of $79.3 million, up 13% from the same period a year ago. Wall Street had been looking at a wider loss of 5 cents per share on revenue of $76 million.

Zuora has now beaten expectations in four successive quarters. The company also reported full-year revenue rose 11% from a year ago, to $305.4 million. The company does, however, remain unprofitable, posting a net loss of $73.9 million for fiscal 2021.

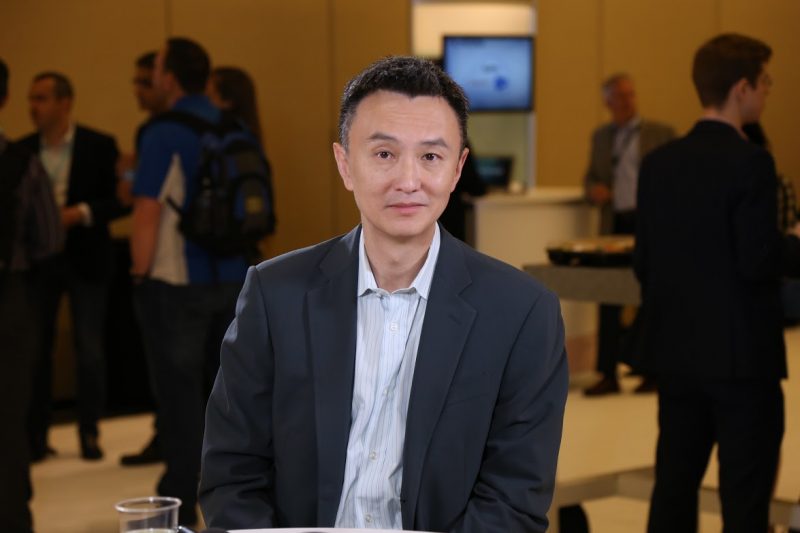

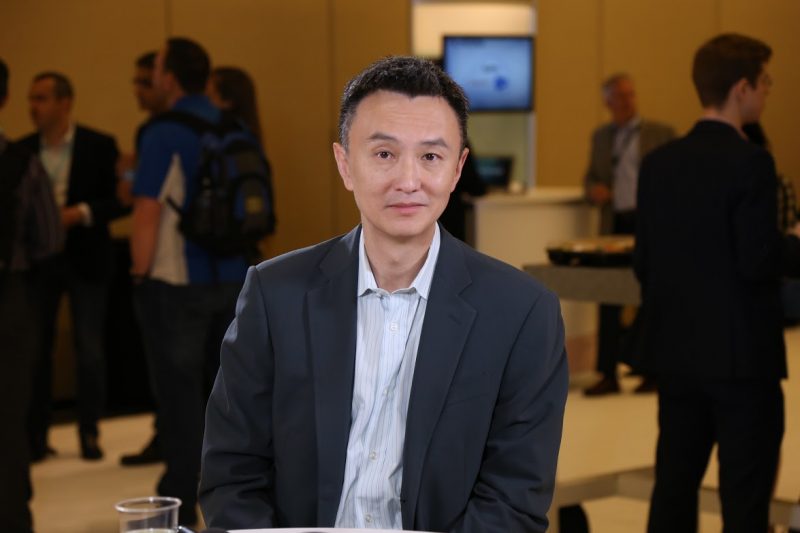

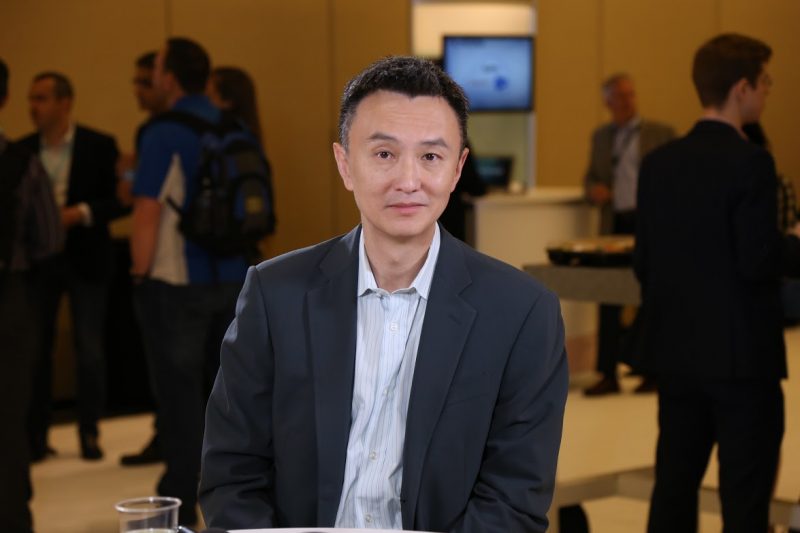

Nonetheless, Zuora Chief Executive Tien Tzuo (pictured) praised what he said was a “strong finish” to the year.

Zuora sells a software-as-a-service offering that’s used to automate businesses’ subscription order-to-cash operations in real time. In other words, what it does is help companies transition to subscription billing and then manage those payments on an ongoing basis.

Tzuo said its software and services are proving extremely popular as enterprises embrace what many believe is a much stronger business model. “Enterprises are coming to Zuora for our technology, expertise and partnerships, and we’re helping them win in the Subscription Economy,” Tzuo told investors.

Zuora’s continued growth was evident in its subscription revenue, which came to $65 million in the quarter, up 19% from one year ago. For the full year, its subscription revenue rose 17%, to $242.3 million.

The company is progressing well on the customer acquisition front too. During the quarter, it added 23 new customers with an annual contract value of more than $100,000, bringing its total to 676. That’s up 8% from a year ago. Meanwhile, the company’s billings platform saw total transaction volume in the quarter of $17 billion. That was up 30%.

Holger Mueller, an analyst with Constellation Research Inc., told SiliconANGLE that Zuora has grown well, all the more so since not all parts of the subscription economy have been doing as good.

“The vendor’s revenue gains are helping to outgrow its cost base, with Zuora reducing the loss it had for the last full year,” the analyst said. “That is encouraging to see, but there is more work to be done in 2021 for the executive team.”

Zuora’s guidance going forward was a little mixed. For the current quarter it said it sees revenue of $78 million to $80 million, in line with Wall Street’s forecast of revenue of $79 million. But for the full year, Zuora said, it’s looking for revenue of between $335 million and $337 million, ahead of the analyst consensus of $332.9 million, suggesting more rapid growth once the first quarter is out of the way.

Zuora’s stock was down 2% after the report, following nearly a 6% rise in the regular session.

THANK YOU