AI

AI

AI

AI

AI

AI

A self-styled “innovation intelligence” platform provider called PatSnap Ltd. is looking to capitalize on enterprises’ unquenchable thirst for artificial intelligence-powered analytics and insights after closing on a huge $300 million round of funding.

SoftBank Group Corp.’s Vision Fund 2 and Tencent Investment led the Series E round, which also saw the participation of existing investors CITIC Industrial Fund, Sequoia China, Shun Wei Capital, and Vertex Ventures. The round dwarfs all of PatSnap’s previous funding milestones, bringing its total amount raised to $351.6 million.

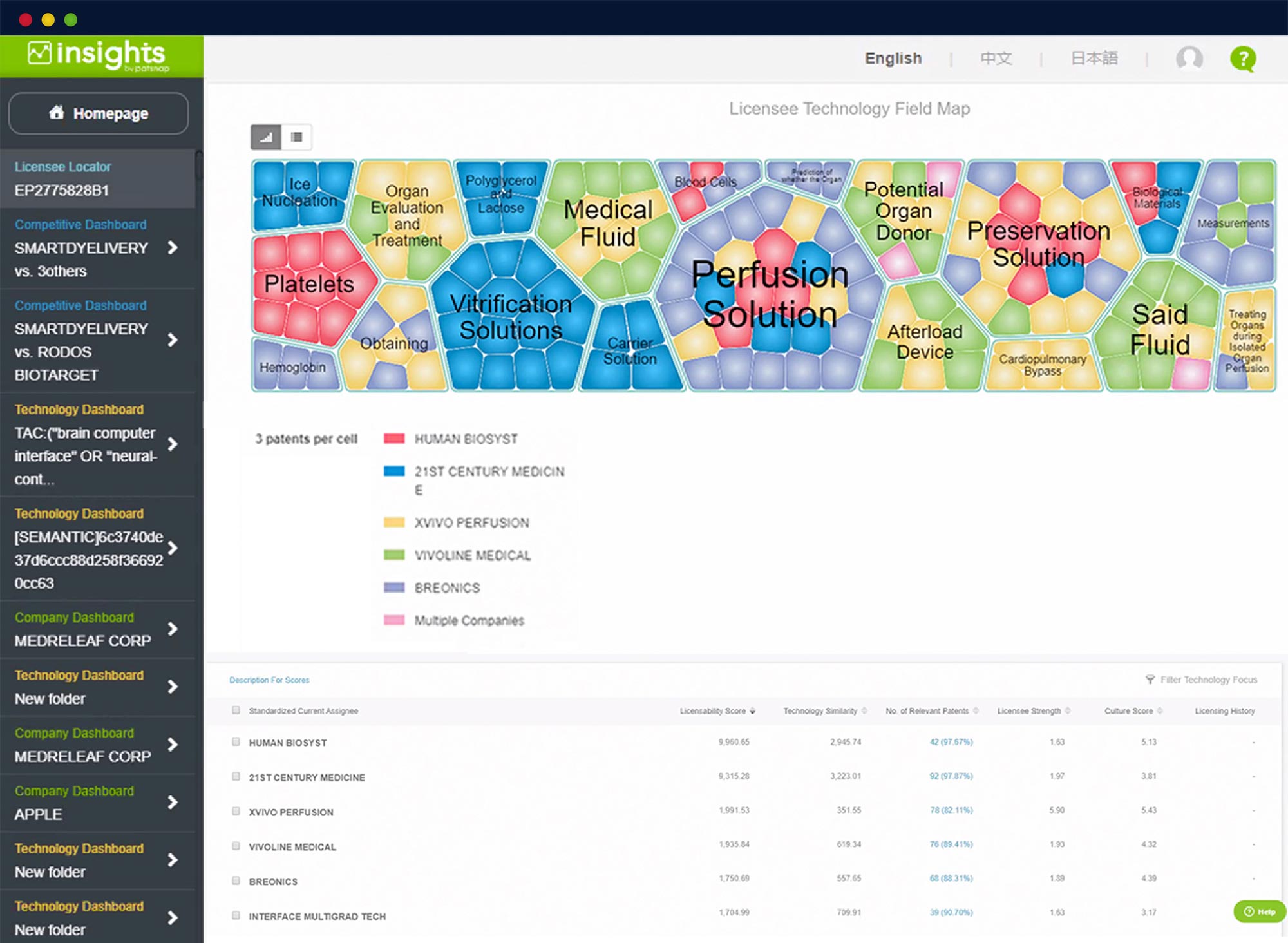

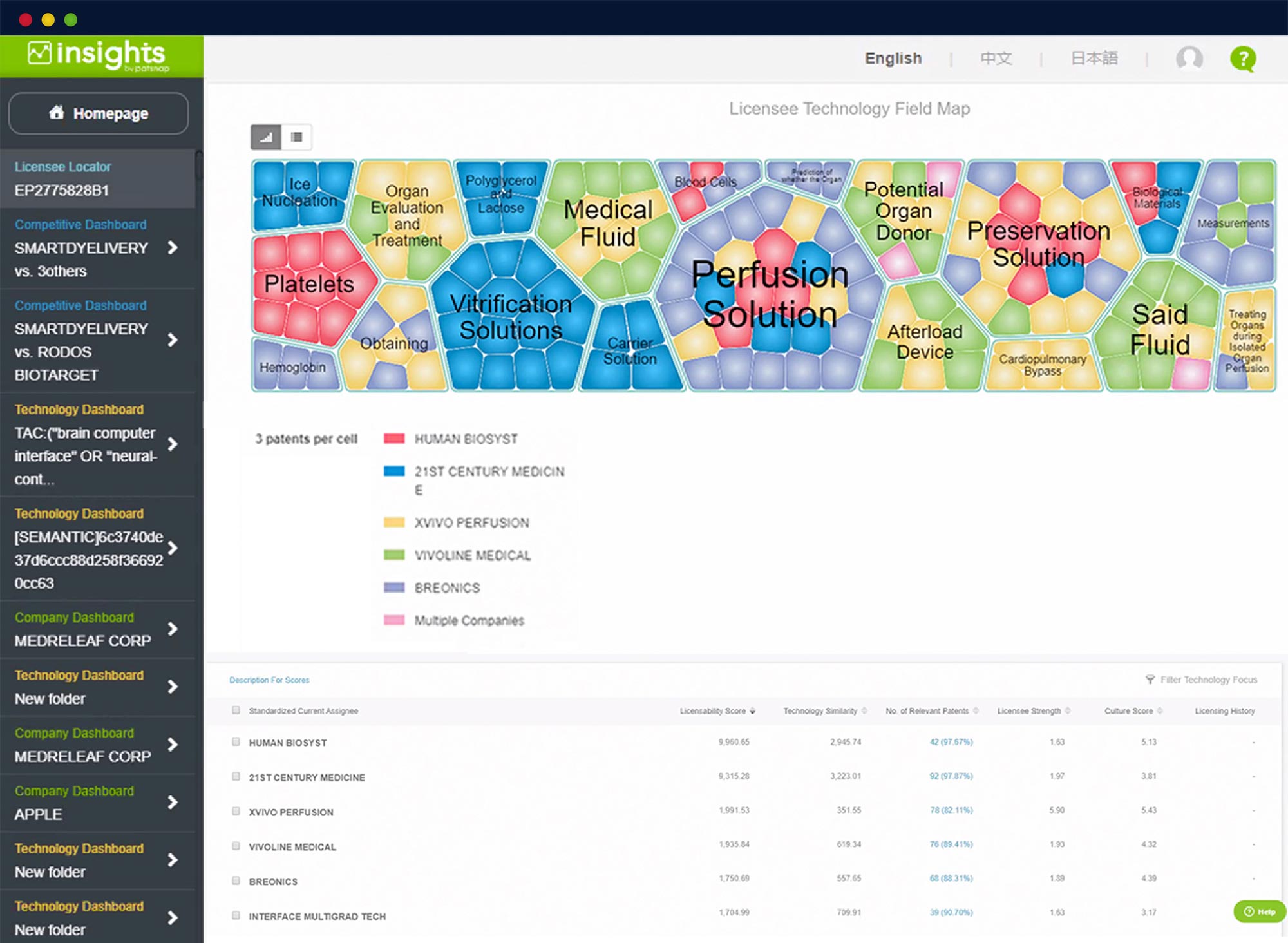

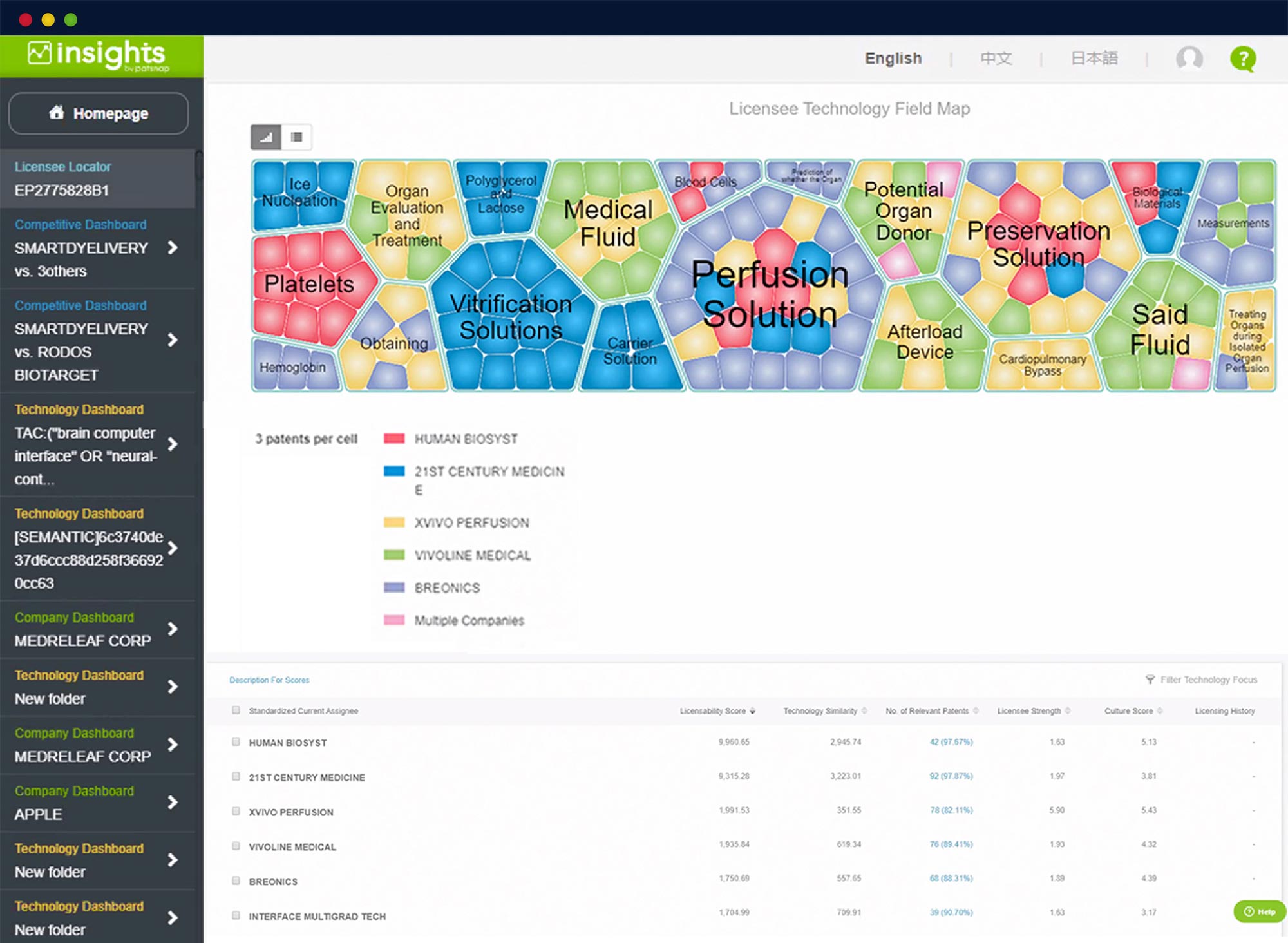

PatSnap’s products include an IP intelligence platform, which is an AI-powered directory of intellectual property that can be used by companies to aid their product research and manage IP portfolios. It also sells an R&D platform for research and development teams that aids product innovation by pulling data from thousands of different knowledge bases and other sources to help teams validate their ideas and forecast market trends.

The company offers a few industry-specific tools too, including PatSnap Bio and PatSnap Chemical, which are aimed at aiding innovation in the biotech and chemical research sectors.

PatSnap argues that its intelligence tools can enable companies to secure a much better return on their R&D investments. It cites research that suggests global firms will spend more than $2.4 trillion on R&D in 2021 alone.

But it also argues that money is not always well-spent, citing more data that points to a 65% drop in R&D productivity in the last year. PatSnap said in the past year, it has helped its customers to accelerate time to insight when dealing with unstructured data by 12 times, leading to a three-times increase in successful product launches.

“We believe AI is radically changing industries and PatSnap is a technology leader using AI to enable companies to innovate faster using IP data and R&D analytics,” said Eric Chen, managing partner of SoftBank Investment Advisers.

Analyst Holger Mueller of Constellation Research Inc. told SiliconANGLE that in today’s knowledge-based society, most intellectual property is protected with patents, and these are consequently a key consideration for many enterprises.

“Innovation without underlying patents can quickly backfire on enterprises if they’re not careful, as IP lawsuits can be expensive and licensing royalties can blow up cost models out of all proportion,” Mueller said. “So it’s good to see PatSnap using the capital markets to improve both its product and its go-to-market plans. We’ll soon see how much PatSnap is able to help companies make their innovations more commercially viable.”

PatSnap, which currently has more than 10,000 customers, said it will use today’s funding to accelerate its own product development and expand its sales presence across the globe while also investing in the growth and professional development of its 700-plus employees.

PatSnap founder and Chief Executive Jeffrey Tiong said he believes the backing from Softbank Vision Fund 2 and Tencent will help his company to nail its position as the industry standard in innovation intelligence. “Both have deep investment expertise with AI-led companies and proven track records supporting sustainable company growth,” Tiong said.

THANK YOU