APPS

APPS

APPS

APPS

APPS

APPS

Consolidation in the technology business is expected to reach new highs in 2022, according to a report by Gartner Inc.

The analyst firm said economic uncertainty resulting from the COVID-19 pandemic is the driving force of this consolidation, compelling enterprises to make some “tough decisions” about whether to merge or acquire other organizations.

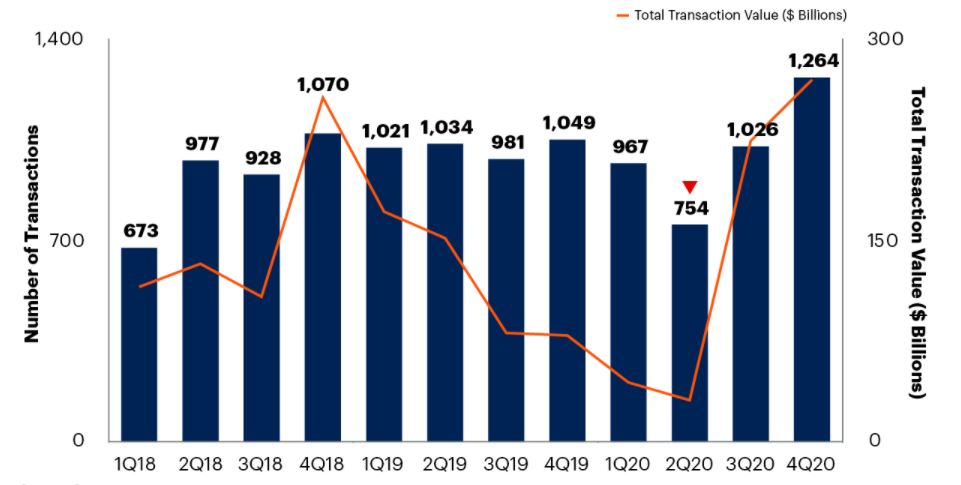

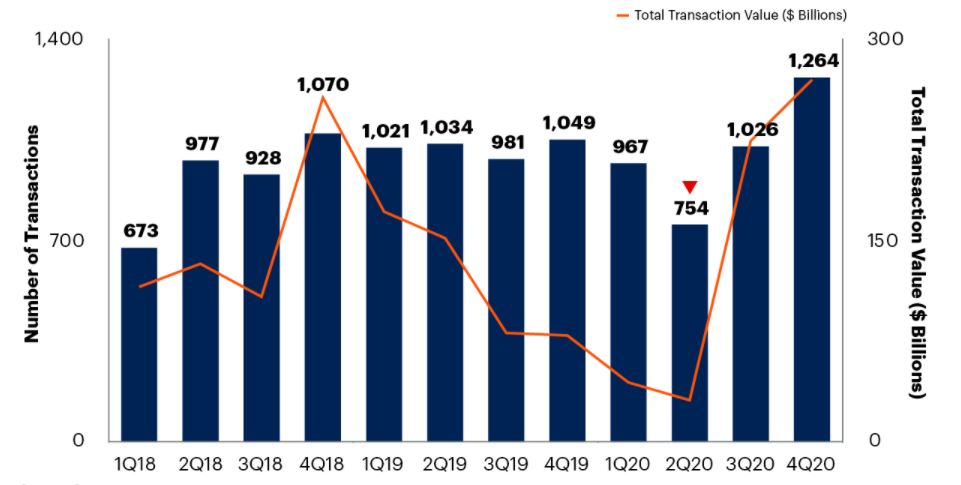

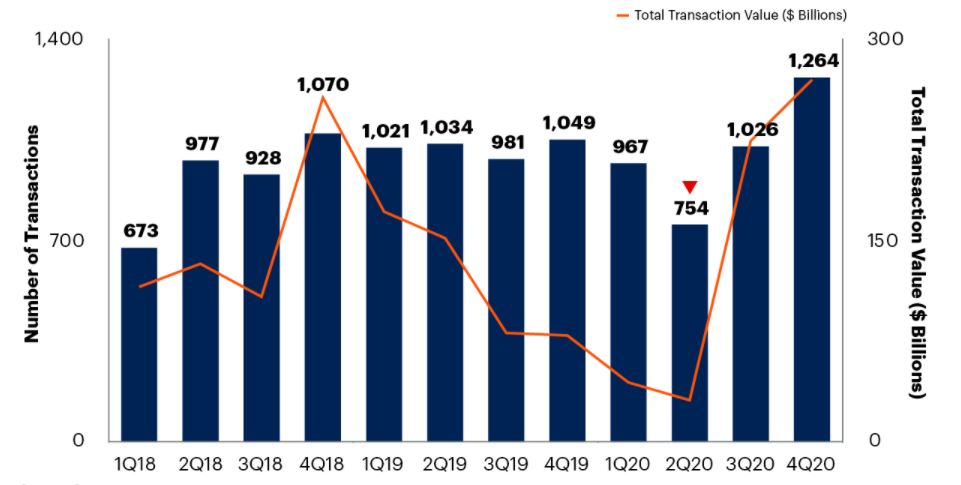

The report found M&A activity in the tech industry has been rising fast over the last year, and that by the end of 2022 the total transaction volume of such deals will surpass a previous record high set in 2018.

“Market conditions for deal making will continue to improve as volatility stemming from COVID-19 subsides,” Gartner Senior Research Director Max Azaham said. “Tech CEOs pursuing acquisitions should anticipate increased competition for targets and take steps to gain advantages over other acquirers to earn seller acceptance.”

When the pandemic first emerged, technology M&A activity fell sharply, hitting its lowest level for two years in the second quarter of 2020. But activity rebounded quickly and by the fourth quarter it had risen to levels not seen since 2018, as organizations moved to strengthen their businesses by acquiring communications, services and software providers.

More than half of all acquisitions in the technology space last year were made by financial services companies, particularly private equity firms, Gartner said.

Acquisitions of communications services providers jumped by 93% in the second half of 2020. That’s probably not a surprise, as communications has become of vital importance over the last year as more people work remotely instead of face-to-face. Acquisitions of service providers were up 30% in the fourth quarter of last year. Software acquisitions meanwhile, represented more than half of all acquisitions in 2020.

Gartner added that consolidation among organizations with a high degree of overlap also increased noticeably in the second half of 2020, by 65% in the services market and by 40% in the software market. It said this trend suggests chief executives must be prepared for a competitive landscape where key rivals merge, especially in the service provider market.

“Instead of making acquisitions or being acquired, tech CEOs will start to consider partnerships and ecosystems to level the playing field against larger companies resulting from consolidation in their markets,” Azaham said.

Acquiring companies, Gartner warned, will need to consider carefully the implications of what merging means for end users and ensure that customer experience remains a high priority throughout the acquisition process. It said customers expect minimal service disruption and transparent communications on products, pricing and support changes, if any occur. If that doesn’t happen, those customers may well take their business elsewhere.

“Without empathy and a deep understanding of what motivates the existing customer base, organizations risk acquiring a customer base that will churn following deal closure,” Azaham said.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.