INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Micron Technology Inc. hosted a lively earnings call today, saying it expects demand for flash memory chips to remain high for the rest of the year even as the supply of other kinds of computer chips begins to meet customers’ needs.

It also announced the sale of a manufacturing plant in Lehi, Utah, where it had previously made 3D Xpoint chips in partnership with Intel Corp., as well as a big investment in some important, next-generation chipmaking machinery.

The company posted strong results. It reported a third-quarter profit before certain costs such as stock compensation of $1.88 per share on revenue of $7.42 billion, up from $5.44 billion in the same period one year ago. That was better than expected, with Wall Street analysts looking for earnings of just $1.72 per share on revenue of $7.32 billion.

“Micron set multiple market and product revenue records in our third quarter and achieved the largest sequential earnings improvement in our history,” said Micron Chief Executive Sanjay Mehrotra (pictured) said in a statement.

Micron specializes in two kinds of computer chip, namely dynamic random-access memory, which is used in personal computers and servers, and NAND flash memory chips for smaller devices such as smartphones and USB drives, for example. Those products have been in great demand since the onset of the COVID-19 pandemic, and prices have jumped much higher.

Sales of DRAM accounted for 73% of Micron’s revenue in the quarter, jumping by more than 50% from the same period last year. NAND revenue rose 9%.

The pandemic caused huge disruption to semiconductor supply chains last year, leaving many manufacturers that rely on them, such as carmakers, high and dry and their factories idled. Now, as components start to become more readily available, those manufacturers are filling both backlog orders and new ones too.

On a conference call with analysts, Mehrotra said that as the semiconductor shortages subside, demand for memory products is expected to remain high.

“As that semiconductor shortage gets alleviated over time, that actually is going to create more demand for memory and storage because every end application today, you know, whether it’s analog IC-related or memory, CPU cores-related, all of them actually require memory and storage,” Mehrotra said.

He explained further that customers are likely approaching their inventory considerations in a different manner from before, so as not to get caught short again. As a result, he said, the company is seeing strong growth across all of its key end markets, including personal computers, handsets, cloud and automotive.

He did note that the shortage of some other semiconductor components is weighing on demand in some areas. However, he said that demand would improve as some of those issues ease.

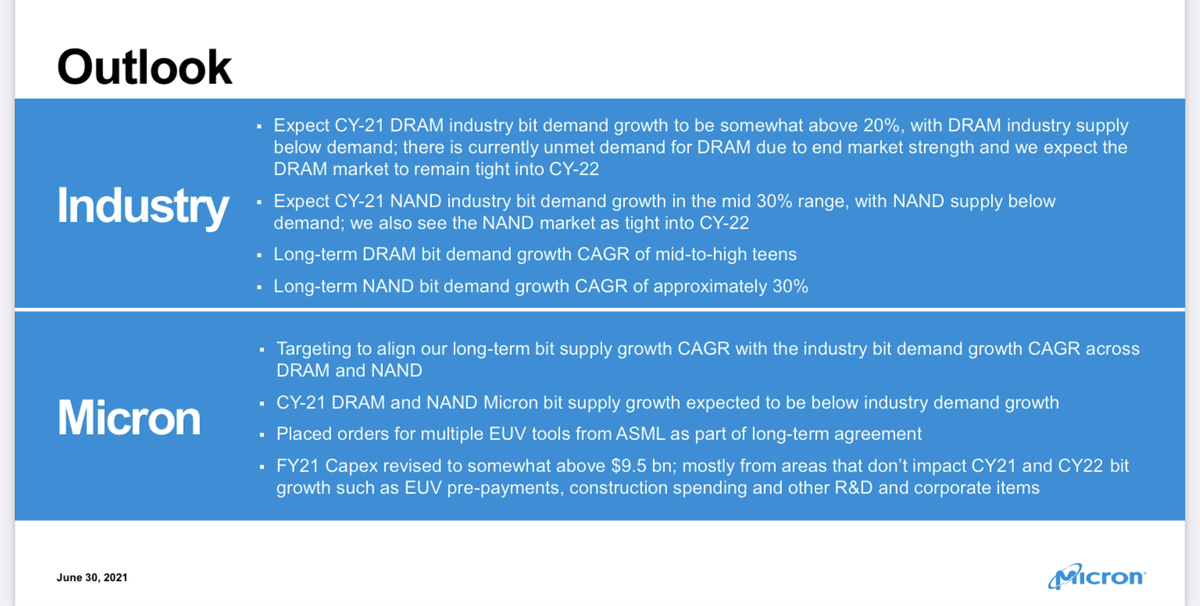

Mehrotra forecast that demand for DRAM will likely grow more than 20% this year, while NAND growth is expected to be about 35%.

Despite the optimistic outlook, Micron’s stock fell by almost 2.5% in after-hours trading as investors reacted to a big increase in spending the company has planned. Micron officials said the company’s capital expenditure for fiscal 2021 will rise above $9.5 billion because of pre-payments it will make on extreme ultraviolet lithography machinery that it intends to acquire from the Dutch firm ASML Holding N.V.

EUV is a cutting-edge chip manufacturing technology that’s needed to make more powerful next-generation semiconductors, but the machinery is not cheap. Officials told analysts on the call they can cost more than $100 million each.

Micron plans to start using the EUV machines in production by 2024, having stretched out its cheaper existing chipmaking processes for as long as possible, it said.

Chief Business Officer Sumit Sadana told Barron’s that as a result of the investment in the EUV machines, the company’s capital expenditure during fiscal 2022 will rise to the mid-30% range as a percentage of revenue, up from a previous forecast of the low 30% range.

To recoup some of that investment, Micron is planning to sell its Lehi manufacturing plant for around $1.5 billion to Texas Instruments Inc. Of that amount, $900 million will be in cash and $600 million will be from the value of tools it can sell to outsiders or move to its other factories, officials explained.

Sadana told Reuters in a separate interview that Micron was forced to take an impairment charge of $435 million because the $900 million in cash is below the book value of the factory. However, he said the facility was on track to generate a $500 million loss this year because it’s underutilized, so all in all it was a good bit of business, he said.

“Micron is getting the fundamentals right in a growing market,” analyst Patrick Moorhead of Moor Insights & Strategy told SiliconANGLE. “Memory and storage is core to the growth in IT and I believe the company is well-positioned to take advantage of that growth. It won’t be easy, though, as Samsung and Hynix are driving quickly.”

For the current quarter, Micron offered an encouraging forecast. It said it’s looking for $2.30 per share in earnings on $8.2 billion in revenue. That’s above Wall Street’s forecast of $2.18 per share in earnings and $7.9 billion in revenue.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.