BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Data analytics company Palantir Technologies Inc. saw its stock close up more than 11% in regular trading thanks to solid second-quarter results, a string of new customer deals and strong guidance for the next three months.

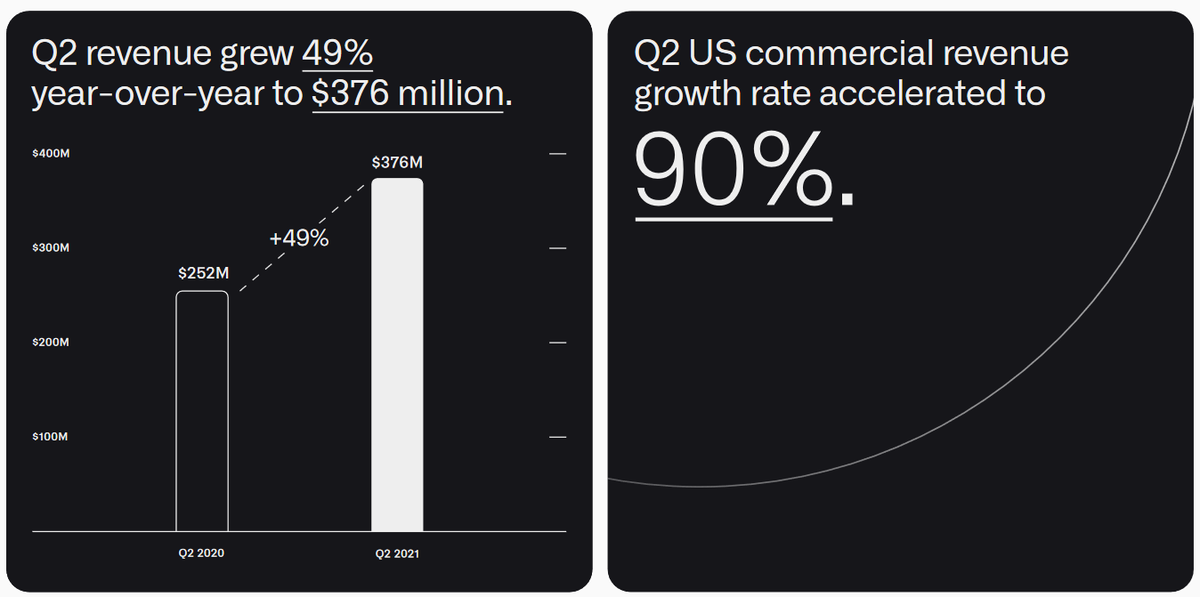

The company reported a profit before certain costs such as stock compensation of 4 cents per share on revenue of $376 million, up 49% from a year ago. That revenue growth was exactly the same as what it recorded in the first quarter.

Wall Street had been looking for a profit of 4 cents per share too, though it had targeted lower revenue of $352.3 million.

Palantir Chief Financial Officer David Glazer told Barron’s in a post-earnings interview that the company delivered a “very strong quarter,” noting that its commercial customer count increased to 169, up from 139 at the start of the year.

Palantir was founded back in 2003 by well-known technology investor Peter Thiel, along with Joe Lonsdale and its Chief Executive Officer Alex Karp (pictured). It sells data analytics software and services, primarily to government agencies, including the Defense Department, the U.S. Food and Drug Administration and several intelligence agencies.

Despite its strong ties to the U.S. and other governments, of late Palantir has been looking to diversify into the commercial sector. Last month, for example, it launched a subscription-based version of its data gathering and analytics technologies, targeted at startups. Today it said it has already signed up a number of customers for that offering in industries such as healthcare, financial technology, robotics and software.

Palantir said its U.S. commercial revenue jumped 90% from a year ago, and up 28% overall, to $144 million. Its commercial customer count rose 32% from the previous quarter, and it said it’s on track to double its commercial customer base by the year’s end.

Meanwhile, it’s not standing still in the government segment either. The company reported government revenue jumped 66%, to $232 million. During the quarter it signed a number of new deals, with the U.S. Army, Air Force and Coast Guard, plus a renewed deal with the Department of Health and Human Services, which uses Palantir’s tools to track vaccine distribution and administration across the U.S.

The Centers for Disease Control and Prevention also renewed its contract, worth $7.4 million a year, in June.

Palantir said it closed a total of 62 deals worth $1 million or more during the quarter. Of those, it said, 30 are contracts of $5 million or more, and 21 are worth $10 million or more.

Palantir also reported that its total contract value booked rose 175% from a year ago, to $925 million.

Holger Mueller, an analyst with Constellation Research Inc., told SiliconANGLE that Palantir is growing fast as its data analytics tools are in big demand from both its traditional government base, and increasingly in the private sector too.

“It’s good for Palantir that its private sector customers are growing more as this gives the company much-needed balance,” Mueller said. “But the management will need to keep an eye on costs too, as these are growing faster than its revenues. The fact its general and administrative costs are eclipsing its research and development and sales and marketing expenses is also not a good sign. The company will need to rectify this if it’s to keep its investor’s confidence.”

During the quarter Palantir attracted quite a bit of attention for its investments in special-purpose acquisition companies. SPACs, also called blank-check companies, serve as a vehicle that raises money in order to buy privately-held firms through a reverse merger and take it public.

Kevin Kawasaki, Palantir’s head of business development, told CNBC in an interview that less than 1% of the company’s second-quarter revenue was tied to those investments, in response to a question that asked if the company was trying to buy revenue through those deals.

“These are companies that we think we will be working with for a very long time,” Kawasaki said. “Further, we think that using our product is going to help them win.”

Palantir also seems to be on a winning track. For the next quarter, it said it’s expecting revenue of $385 million, which is ahead of Wall Street’s forecast of $376.4 million in sales.

In the longer term, Palantir said that it expects to see annual revenue growth of 30% or more from now through to the end of 2025.

THANK YOU