SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Palo Alto Networks Inc. posted impressive revenue growth today, easily beating Wall Street’s fiscal fourth-quarter forecasts and causing its stock to surge in extended trading.

The company reported a profit before certain costs such as stock compensation of $1.60 per share on revenue of $1.2 billion, up 28% from a year ago and besting revenue growth of 24% in the previous quarter.

Wall Street had been looking for a adjusted profit of just $1.43 per share on revenue of $1.17 billion. The company also reported net operating income of $161.9 million in the quarter. For the full year, Palo Alto’s revenue grew 25%, to $4.3 billion.

Palo Alto Networks sells an enterprise cybersecurity platform that includes both hardware and software products designed to secure networks, clouds, endpoints and other information technology infrastructure.

The company has been a rising star for some time, and was named as one of four “four-star security vendors” by Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon, in a report earlier this year.

Palo Alto Chairman and Chief Executive Nikesh Arora (pictured) said the strong quarterly performance was the culmination of solid execution on the company’s strategy, which molded product innovation, platform integration, business model transformation and investments in its go-to-market organization.

“In particular we saw notable strength in large customer transactions with strategic commitments across our Strata, Prisma and Cortex platforms,” Arora said.

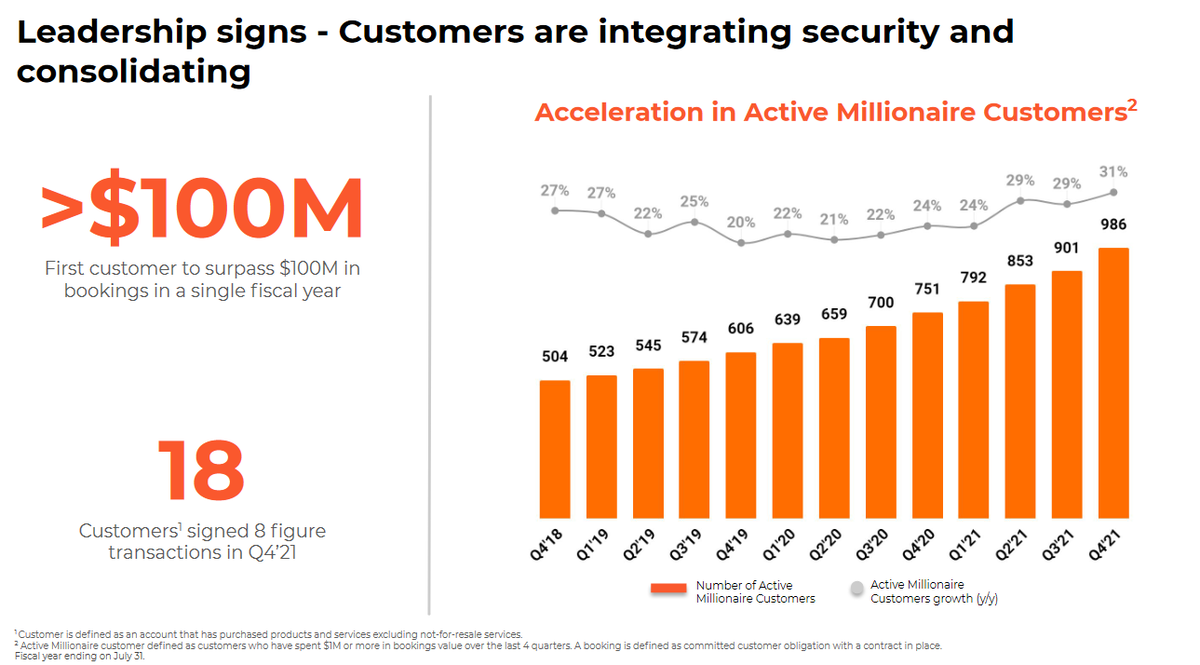

The company reported fourth-quarter billings growth of 34% year-over-year to $1.9 billion, while its fiscal 2021 billings rose 27%, to $5.5 billion. Meanwhile, deferred revenue grew by 32% from a year ago, to $5 billion, and remaining performance obligations jumped 36%, to $5.9 billion.

Investors appeared thrilled by all the positive numbers, as the company’s stock rose more than 10% in after-hours trading.

Holger Mueller, an analyst with Constellation Research Inc., told SiliconANGLE that Palo Alto is really firing on all cylinders.

“Field by the post-pandemic demands for secure networks and cybersecurity, Palo Alto is well on track to break the $5 billion dollar revenue milestone in its next financial year,” Mueller said. “The challenge for its management will be to better manage its costs and tax losses, which almost doubled in the last fiscal year. They’ll need to rein these expenses in because growth can’t just come at any price.”

Palo Alto may already be thinking along those lines. In a call with analysts, Arora said Palo Alto Networks is raising prices of its hardware products in the low single digits to compensate for supply chain challenges that have led to increased component costs. Still, the CEO said these price hikes did not appear to be deterring customers.

“On the high end of our hardware strategy, we’re beginning to start seeing refreshes,” he said. “This has been a trend which had been subdued. People were holding back. We realize the pandemic has eased up as companies are starting to come back to work.”

Arora also spoke of the opportunity he sees from the cloud adoption that’s taking place across almost every industry. He said the company can try to take advantage of this and expand its margins by optimizing its own use of cloud resources.

Customers’ concerns over the threat of ransomware present further opportunities, Arora said. He noted in the analyst call that ransom demands grew during the first half of 2021, adding that Palo Alto now has 300 ransomware readiness engagements in the pipeline that present further business opportunities.

All of those opportunities add up to what could be another earnings beat in the near future. Palo Alto Networks offered first-quarter revenue guidance of between $1.19 billion and $1.21 billion, ahead of Wall Street’s forecast of $1.15 billion.

For its full fiscal 2022 year, Palo Alto sees revenue of between $5.275 billion and $5.325 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.