INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Strong personal computer sales growth helped Dell Technologies Inc. to deliver a record second-quarter performance, the company said today.

Dell reported a profit before certain costs such as stock compensation of $2.24 per share on revenue of $26.12 billion, up 15% from a year ago. That was way better than expected, with Wall Street modeling a profit of just $2.03 per share on revenue of $25.53 billion.

Dell Vice Chairman and co-Chief Operating Officer Jeff Clarke said the company is well known for its unique ability to adjust and lean into growth opportunities, and this quarter’s results are evidence of that. “We’re innovating and helping customers grow with a focus on multicloud solutions and modern infrastructure delivered traditionally and as-a-service,” he said.

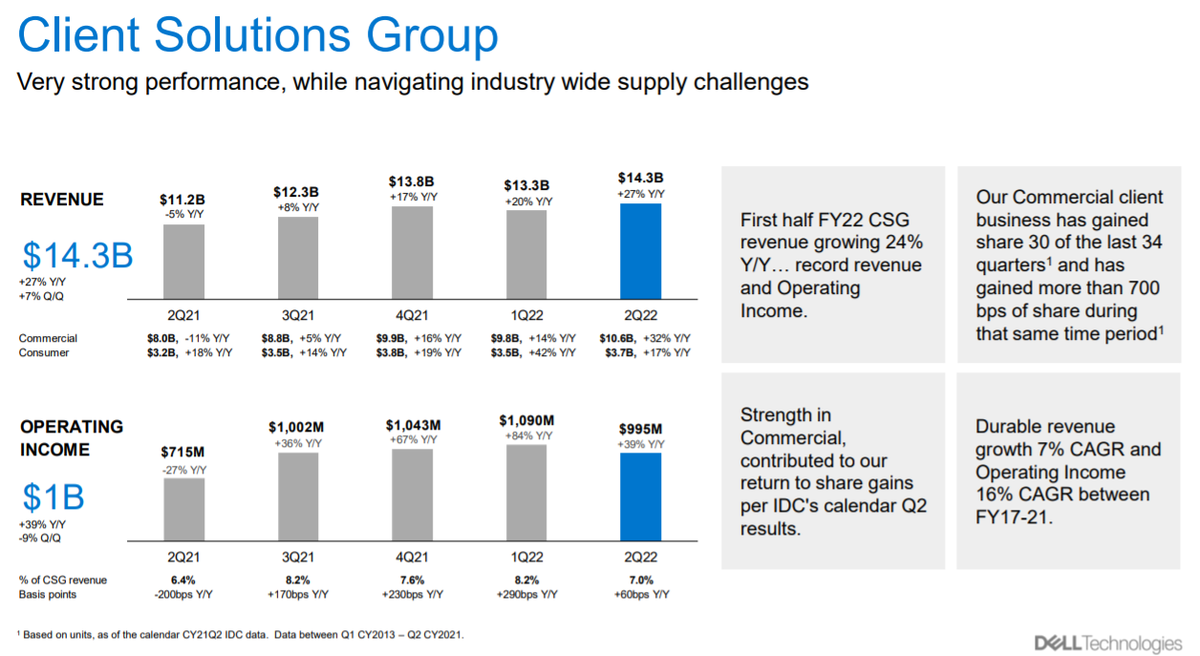

That may be so, but there’s no denying it was Dell’s Client Solutions Group, which accounts for the PCs it makes, that powered its results in the quarter. The company, which is led by founder and Chief Executive Officer Michael Dell (pictured), has seen business boom ever since the COVID-19 pandemic gripped the world, forcing people to work at home. Those people just can’t seem to get enough of the PCs, notebooks, laptops and other gear it sells that enable remote work.

The Client Solutions Group reported operating income of $995 million on sales of $14.3 billion in the quarter, up 27% from one year ago. Within that group, Commercial PC revenue was up 35% to $10.6 billion, while consumer sales jumped 17% to $3.7 billion.

Dell said it saw especially strong growth in its Latitude and Precision systems, while U.S. sales were up 17% in the quarter as the popularity of notebooks boomed.

Analyst Charles King of Pund-IT Inc. told SiliconANGLE that Dell is a great example of a company delivering the goods customers need today, while also positioning itself for opportunities and challenges that lie ahead.

“The continuing success of Dell’s client products, particularly its workplace-focused solutions, underscores its focus on helping business customers stay productive and effective despite the trials and tribulations of the past year and a half,” King said.

In a call with analysts, Clarke explained that Dell is benefiting from a new “do-anything-from-anywhere” economy that has driven strong information technology spending across multiple industries and customer sizes. “We’re leaning in to capture our share of the strong IT spending,” he said.

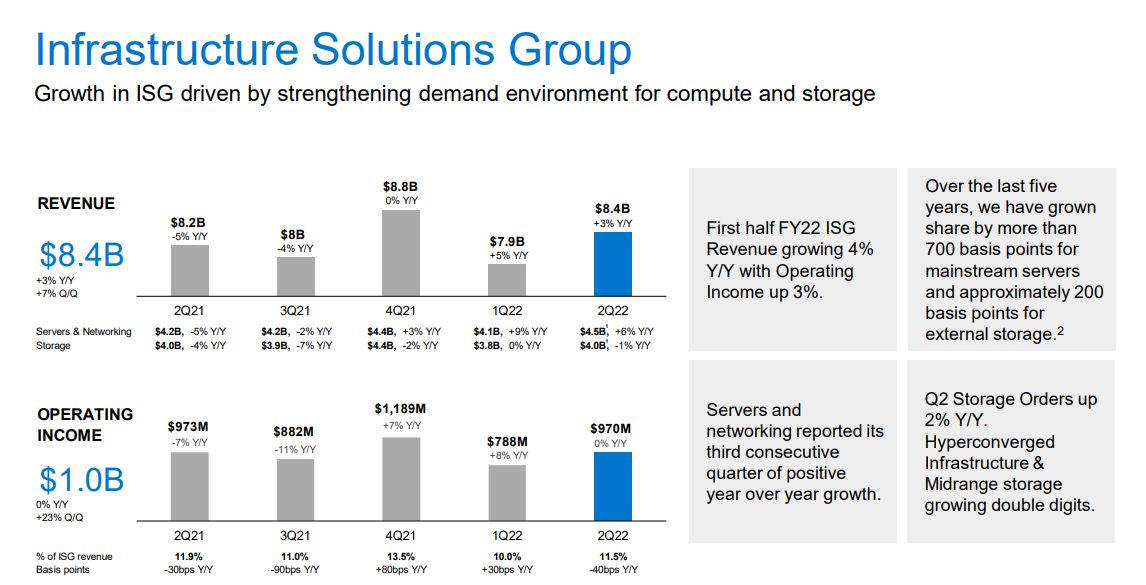

A big part of that strong IT spending also went to infrastructure, and Dell benefited from that too. The company’s other main business, the Infrastructure Solutions Group, saw revenue grow by 3% in what is traditionally a fairly slow quarter, to $8.4 billion. Operating profit for the unit came to $970 million.

Dell said it saw strong demand for multicloud gear, helping to boost server and networking revenue within that unit by 6%. Storage hardware sales fell 1%, however. Digging down, analysts did see a few highlights in the infrastructure business.

“The 34 percent growth in orders for Dell’s latest VXrail HCI solutions highlights how organizations are responding to the company’s ability to continually deliver innovative new And enhanced offerings,” King said.

Moor Insights & Strategy analyst Steve McDowell told SiliconANGLE Dell’s storage business remains healthy despite the sales drop. He cited 17% growth in Dell’s midrange storage business, which is higher than market rivals NetApp Inc. and Pure Storage Inc., plus the momentum of its PowerStore servers, where almost a quarter of customers were new.

“The drag on Dell’s storage business appears to be its high-end business, which is much more cyclical than midrange,” McDowell said. “It’s also recovering more slowly than the rest of the market.”

Perhaps the real highlight for the Infrastructure group was the launch of Dell’s new APEX as-a-service portfolio in the quarter, on which it’s pinning a lot of hopes for future growth.

The company is following the lead of industry rivals such as Hewlett Packard Enterprise Co., Cisco Systems Inc. and IBM Corp. that have already committed to subscription-based pricing and delivery, a model sometimes called composable infrastructure.

In that scenario, the provider installs and maintains computer, storage and networking equipment on customer sites or in colocation facilities and charges based on usage. Infrastructure providers are responding to customer demands to even out expenses by shifting from a variable capital expense model to one that treats technology as an operating expense.

King said strong quarter reflects the wisdom of its founder to grow the company into a leading purveyor of end-to-end business IT solutions. “It bodes well for the future with Dell’s new APEX services and offerings too,” he said.

During the quarter, Dell made a key executive hire, bringing in Chuck Whitten, a partner at management consultancy Bain & Co., as its new co-chief operating officer. Whitten will work alongside Clarke and report directly to Michael Dell, and analysts said the move could indicate Dell’s future succession plans

“In my opinion this is about long-term succession planning,” Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon, said at the time. “Dell is very thoughtful about succession planning and business resilience throughout the company, not just at the top — it’s that supply chain mentality.”

Dell was also given a big boost by VMware Inc., which reported solid second-quarter sales of $3.1 billion in the quarter, up 8% from a year ago.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.