CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Buying the dip has been an effective strategy since the market bottomed in early March last year.

The approach has been especially successful in tech and even more so for those tech names that: 1) were well-positioned for the forced march to digital – that is, remote work, online commerce, data-centric platforms and certain cybersecurity plays; and 2) already had the cloud figured out.

The question on investors’ minds is where to go from here. Should you avoid some of the highfliers that are richly valued with eye-popping multiples? Or should you continue to buy the dip? And if so, which companies that capitalized on the trends from last year will see permanent shifts in spending patterns that make them a solid long term play?

In this Breaking Analysis, we shine the spotlight on three companies that may be candidates for a buy-the-dip strategy over the next three to five years. To do so, it’s our pleasure to welcome Ivana Delevska, founder and chief investment officer of SPEAR Alpha, a new, research-centric exchange-traded fund focused on industrial technology. She is a longtime equity analyst with a background in both long and short investing.

Let’s start with some background on this new exchange-traded fund.

SPEAR is a newly launched female-led firm that does deep research into the supply chain to uncover underappreciated industrial tech firms in some pretty interesting and emerging sectors, as shown above.

SPEAR is a newly launched female-led firm that does deep research into the supply chain to uncover underappreciated industrial tech firms in some pretty interesting and emerging sectors, as shown above.

Comparisons to Cathie Wood’s Ark fund may be inevitable, but Delevska described the objectives and strategy of SPEAR as follows:

“My background is in industrial’s research and industrial technology investments. I’ve spent the past 15 years covering this space and what we’ve seen over the past five years is technology changes that are really driving fundamental shifts in industrial manufacturing processes. So whether this is 5G connectivity, innovation in the software stack, increasing compute speeds, all of these are major technological advancements that are impacting traditional manufacturers. So what we try to do is speak to these firms and assess who is at the leading and who is at the lagging end of this digital transformation. And we’re trying to determine what vendors they’re using, what processes they’re implementing, and that is how we generate most of our investment ideas.”

She also shared in this clip how SPEAR tries to understand deeply the digital supply chain of the companies that can create alpha.

Before we get into the case for these three companies, we want to give you some quick stats as a comparison. The chart below sets the context to give people a sense of relative size, growth and valuation:

For the revenue calculations, we simply took the most recent quarterly revenue for Coupa Software Inc., Snowflake Inc. and Zscaler Inc. and multiplied by four. We include ServiceNow Inc. in the table just for baseline reference because Bill McDermott, as we’ve reported, aspires to make ServiceNow the next great enterprise software company, which these companies all aspire to be in their own domain.

We show the market capitalization from Friday morning, Sept. 10, calculated a revenue run-rate multiple and we add the quarterly revenue growth. What this data does is give you a sense of three companies that are well on their way to $1 billion in annual revenue, and it underscores the relationship between revenue growth and valuation – Snowflake being the poster child for that dynamic.

The following comments on each company are noteworthy.

Starting with Coupa, the company just blew away its quarter, beating top-line consensus by 990 basis points.

Delevska made the following points on Coupa:

If you go back to that McKinsey graphic where the opportunities lie across the manufacturing enterprise, Coupa is really focused on business spend management so they’re really trying to help companies reduce their costs. They’re a leader in the space, they are unique in that they’re cloud-based so the feedback we’ve been hearing from our companies that use it, JetBlue uses it, Trane Technologies uses it. The feedback we’ve been hearing is that they love the ease of implementation so it’s very easy to adopt and it drives real savings for these companies. So we see in our DCF model, we see multiple years of this 30%, 40% growth, and that’s really driving our price target for Coupa.

Snowflake is a company we’ve followed extensively. We asked Delevska why she likes Snowflake as a buy the dip company. Her answer was based on her research of Snowflake customers:

Where we come in is more from understanding where our companies can use Snowflake and where Snowflake can add value. What we’ve been hearing from our companies is the challenge that they’re facing is that everybody’s moving to the cloud, but it’s not as simple as just send your data to the cloud and call AWS and they’re going to generate more revenue for you and solve your cost problems. Companies need to find tools that are easy to use, where they can apply their own domain expertise and just plug and play. Ansys is one of the companies. They found Snowflake to be an extremely useful tool in sales lead generation. And within sales, CRM systems have been around for a while and they’re really being implemented, but analyzing sales numbers is something that is new to this company.

Some of our companies don’t even know what their sales are even when they look back after the quarter is closed. So tools like this help companies do easy analytics and therefore drive revenue and cost savings. So we see a really big runway for Snowflake. I think the most misunderstood part about it is that people view it as just a data warehousing play.

As it pertains to Zscaler, not only does SPEAR like the security market, but its research suggests the spending levels within the customer base are not where they should be to provide adequate protection. Delevska believes that going forward, companies will need to spend more on cyber and Zscaler will benefit from that trend.

With Zscaler, we like the broader security space. And interestingly, our companies are not yet spending to the level that is commensurate with the increase in attack rates so we think this is a trend that is really going to accelerate as we go forward. My own board, 20% of the time on the last board meeting was spent on cybersecurity and this is a pretty simple operation that we’re running here, so you can imagine for a large enterprise with thousands of people all around the world needing to be on a single simple system. Zscaler really fits well here — very easy to implement, several of our industrial companies use it, Siemens uses it, GE uses it, and they’ve had great, great experience with it.

For a bit more context, let’s take a quick look at how these names have performed over the last year and what, if anything, that data tells us.

This chart above compares the past 12 months’ performance of our three target companies plotted with ServiceNow and the Nasdaq Composite.

Zscaler, which just announced a strong quarter, has outperformed the others. Snowflake has underperformed he NAS this year but is creeping back lately after a strong earnings report– even though the stock dropped after it beat earnings because the street wants the chief financial officer to guide higher than is perhaps prudent. Coupa has underperformed, relatively speaking. It absolutely destroyed consensus this week and the stock went up, but it has been off in tandem with the market this past week.

The first point Delevska makes regarding stock prices this year relates to how interest rate concerns have affected investor behavior. Specifically, investors look at future earnings of companies and run their models using a discounted cash flow or DCF calculation. In other words, they discount the value of future earnings based on an interest rate assumption. When interest rates are near zero, the value of those future cash flows is higher than when interest rates tick up.

So with fears of fed tightening and a higher interest rate environment, many of thee high-multiple stocks got hit. However, interest rates haven’t really moved much and that has played a factor in the recent performance improvements of some of these names. This is especially hard to parse given assumptions around COVID variants.

Delevska explains this dynamic in detail.

Let’s take a look at some spending data from our friends at Enterprise Technology Research.

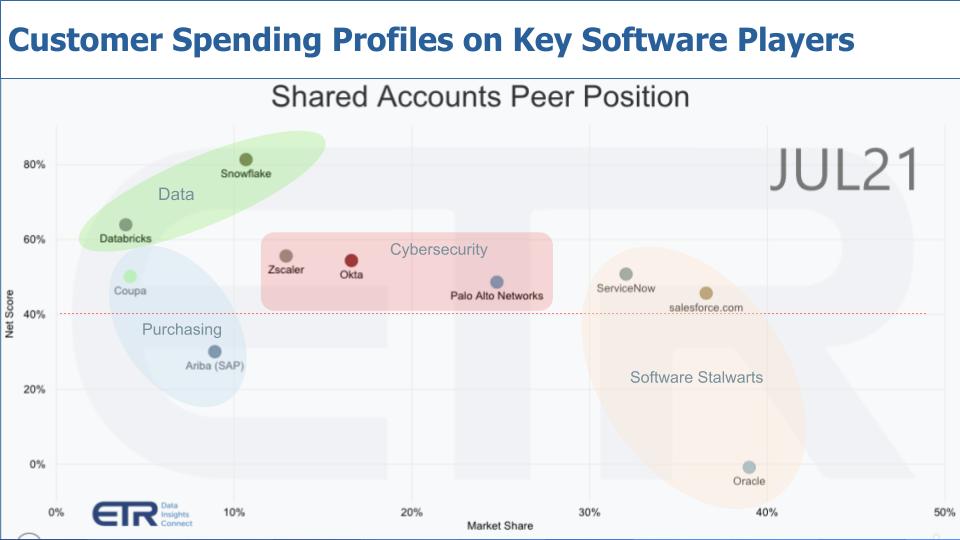

Above is a two-dimensional view that we often like to show. It’s based on a survey of between 1,000 and 1,500 chief information officers and technology buyers each quarter. This data is from the most recent July survey. The vertical axis shows Net Score, which is a measure of spending momentum. It tracks the net percentage of customers in the survey that are spending more on a particular vendor’s product or platform. In other words, it essentially subtracts the percentage of customers spending less from those spending more which yields a Net Score. The methodology ETR uses is more granular than that but basically that’s how it works.

The horizontal axis is Market Share or pervasiveness in the data set. It’s not revenue market share, rather it’s more like “mention” market share.

That red dotted line at the 40% mark on the vertical axis represents elevated scores. Subjectively, anything above that 40% line we consider notable.

And we’ve plotted our three “buy the dip” companies and included some of their competitors for context. You can see we added Salesforce.com Inc., ServiceNow and Oracle Corp. in that orange ellipse because they are some of the the bigger whales in the software business.

Let’s take these in alphabetical order. Starting with Coupa in the blue zone, you can see we plotted the company next to SAP SE’s Ariba, and you can see Coupa has stronger spending momentum but not as much presence in the market. To us this means opportunity for Coupa to gain share. And of course, Oracle has products in this market, but the Oracle dot includes all Oracle products, not just the procurement stuff.

Let’s look at the green ellipse – we called it the data zone here. We know we’re like a broken record on this program, but Snowflake has performed unbelievably well on the vertical axis for every quarter that ETR has captured enough N sample in its survey. Snowflake has held at or near the 80% Net Score mark consistently, which is unprecedented. Most often, the Net Score level is inversely proportional to the sample N in the survey. Not with Snowflake.

We’ve plotted Databricks Inc. in that zone. It has been expected that Databricks would IPO this year and late last month the company raised $1.6 billion in a private round. So it was either a strategy to delay the IPO or raise a bunch more cash and give late investors a low-risk bite at the apple pre-IPO, as we saw with Snowflake last year.

What we didn’t plot here are some of Snowflake’s biggest competitors who also happen to be their partners – most notably the big cloud players – all with their own database offerings: Amazon Web Services Inc., Microsoft Corp. and Google LLC. Snowflake has consistently outperformed these larger firms on the Net Score axis, while continuing to chip away at market share.

Finally there is Zscaler. We love Zscaler. We noted Zscaler as one to watch in 2019 and the company was put back on our four-star security firm list last spring. They joined our other favorites, CrowdStrike Holdings Inc. and Okta Inc. We said these three should be on your radar and continue to believe that. And as you see above we’ve plotted ZS with Okta and Palo Alto Networks Inc. another cybersecurity player that we’ve covered extensively and is on our four-star list. We are impressed with Okta as well and also have great respect for Palo Alto. You’ll note they each are over the 40% red line.

Zscaler has benefitted from the huge cloud migration trend, and we asked Delevska why she’s bullish on ZS.

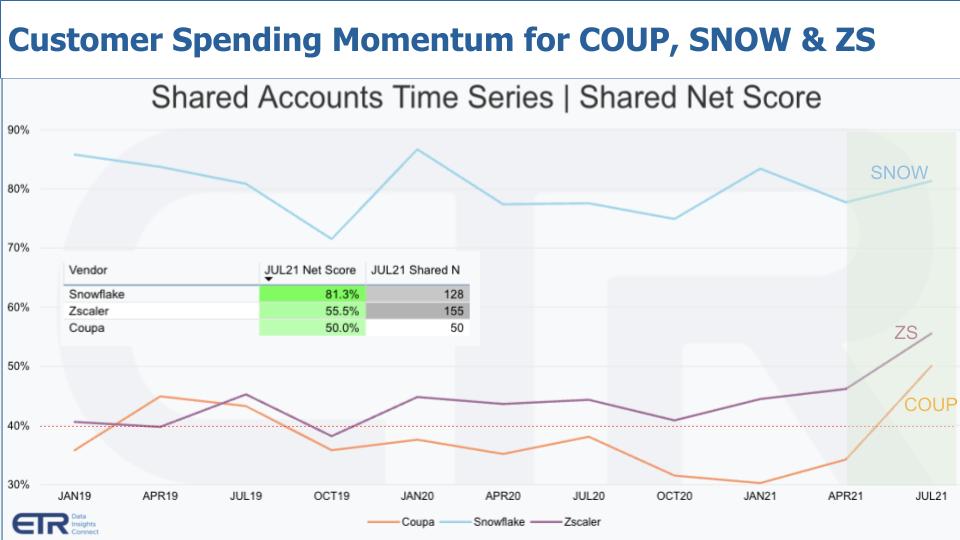

The chart below adds some depth and color to the Net Score discussion. It plots the Net Score and shows the progression since January 2019. The table on the insert shows the number of responses in the survey. All three of these companies have been getting more mentions over time, with Snowflake and Zscaler now both well over 100 N in the survey.

You can see how Snowflake is just incredible in terms of its ability to maintain that elevated score.

The other notable item here is you can see all three are coming out of the isolation economy with spending tailwinds and a nice uptick, shown in the most recent survey highlighted in green.

There are a lot of reasons to like these companies and we list many on this chart below:

Coupa has earnings momentum and management on the call cited strong end market demand. The stock has underperformed the Nasdaq this year. Snowflake and Zscaler also have momentum. Snowflake has an enormous total available market, though it was punished for not putting a hard number on it, which we found laughable. Snowflake’s TAM is everything data… so everything. Good luck putting a firm number on that, since it’s bigger than huge. And Zscaler similarly has a large TAM and is benefiing from the cloud migration trend.

All three companies have a modern tech stack in the cloud and really importantly, they have very high retention rates and low churn. We don’t show this in the data this week, but we’ve checked: They all have near-zero or zero defections from their respective platforms.

But… there are concerns.

Coupa’s management, despite the blowout quarter gave underwhelming guidance. The company has cited headwinds with the LLamasoft acquisition, specifically the migration to the Coupa cloud platform, as a challenging dynamic that will have to play out. Snowflake is priced to perfection because everyone expects CEO Frank Slootman and SFO Mike Scarpelli to surpass ServiceNow – which was a rocket ship. And it could be argued that all three are richly priced and overvalued.

The key to Ivana Delveska’s scenario is you look for opportunities where news (for example, the Cleveland Research note on Snowflake) drives the stock down and diverts from the balance of the market momentum. Then buy the dip with confidence. Watch earnings and talk to the ecosystem to determine if anything has fundamentally changed. The premise is: If the fundamentals remain strong and your thesis is holding up, then the strategy will pay off.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. As it pertains to SPEAR, there is no guarantee that SPEAR’s objectives will be achieved. For SPRX’s portfolio holdings, which are subject to change, and investment objectives, please read the prospectus and do your own research. You and only you are responsible for your investment decisions.

Good luck!

THANK YOU